Investing In BigBear.ai: A Comprehensive Guide

Table of Contents

Understanding BigBear.ai's Business Model and Revenue Streams

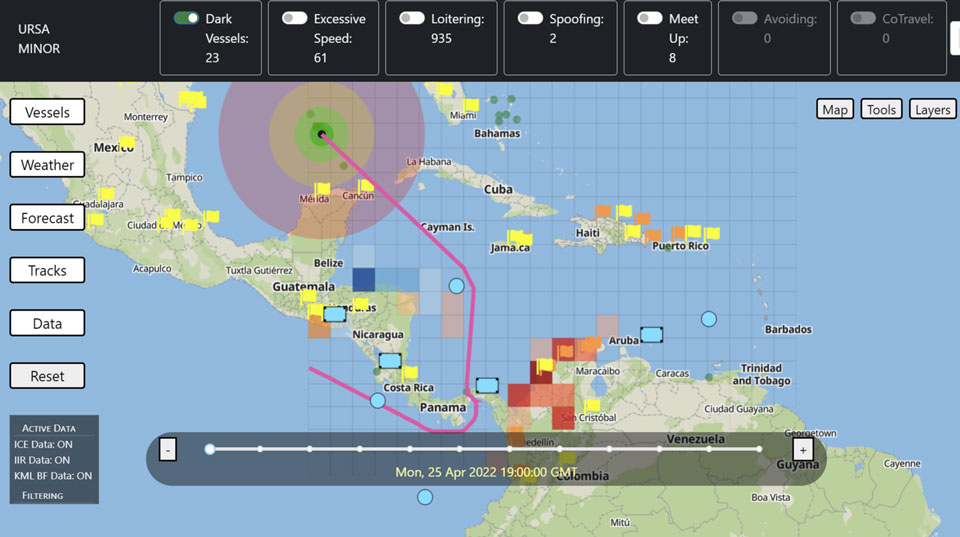

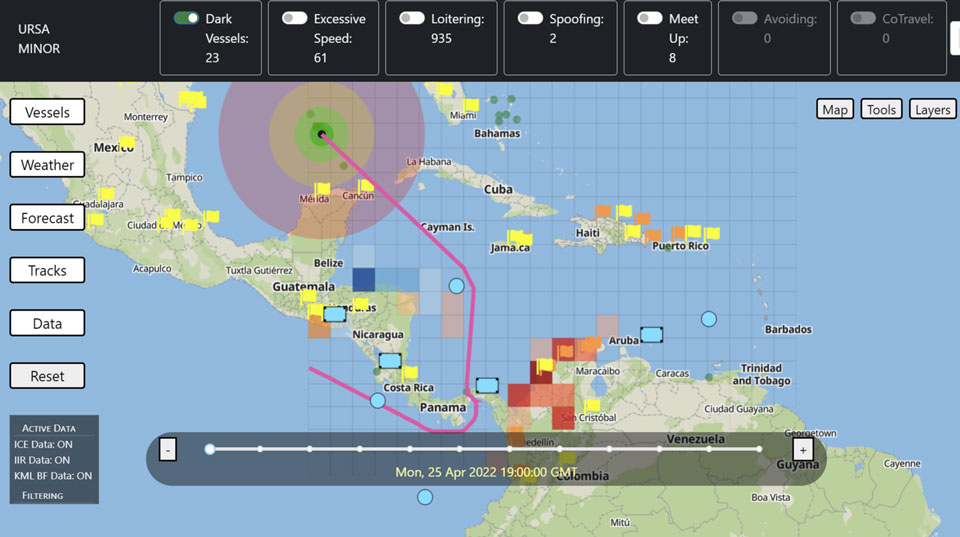

BigBear.ai's core business revolves around delivering advanced AI-powered solutions designed to solve complex problems for its clients. This encompasses a range of services, including data analytics, cybersecurity threat detection, and mission-critical decision support systems. Its revenue streams are diverse, driven by a mix of substantial government contracts and increasingly significant commercial sales. While precise financial breakdowns are subject to change and publicly available financial reports, a general understanding of their structure is essential for potential investors.

- Breakdown of revenue sources: A significant portion of BigBear.ai's revenue historically stems from government contracts, particularly within the defense and intelligence sectors. However, the company is actively expanding its commercial client base, diversifying its revenue streams and reducing reliance on any single source.

- Key clients or contracts: BigBear.ai boasts a portfolio of high-profile clients, both within the public and private sectors. While specific details might be confidential, the sheer volume and scale of their projects speak volumes about their market penetration.

- Growth projections and analysis: BigBear.ai's future growth is projected to be robust, fueled by the expanding demand for advanced AI and data analytics capabilities across multiple industries. Analysts often cite continued growth in government spending on national security and the increasing adoption of AI by commercial enterprises as key growth drivers. Careful examination of publicly available financial statements is crucial for informed assessment.

Analyzing BigBear.ai's Competitive Landscape and Market Position

BigBear.ai operates in a competitive landscape, vying with established players and emerging startups in the AI and data analytics market. Its key competitors include other large technology firms offering similar services, as well as specialized firms focusing on niche areas within AI and cybersecurity.

- List of key competitors and their market share: While precise market share figures can be difficult to obtain, analyzing competitor's offerings, client bases, and financial performance provides valuable context for understanding BigBear.ai’s standing.

- BigBear.ai’s unique selling propositions (USPs): BigBear.ai differentiates itself through its unique blend of advanced AI technologies, deep domain expertise (especially in national security), and a strong track record of successful project delivery.

- Market growth projections and BigBear.ai’s potential to capture market share: The overall market for AI and data analytics is experiencing exponential growth, presenting significant opportunities for BigBear.ai to expand its market share through strategic partnerships, innovative product development, and targeted acquisitions.

Evaluating the Risks and Rewards of Investing in BigBear.ai

Like any investment, investing in BigBear.ai carries both risks and rewards. A thorough understanding of these aspects is critical for informed decision-making.

- Specific financial risks: These could include factors like fluctuations in profitability, debt levels, and reliance on government contracts.

- Market-related risks: Broader market volatility, economic downturns, and changes in government spending policies all present potential challenges.

- Potential upside scenarios and return on investment (ROI): The potential rewards include substantial capital appreciation, driven by BigBear.ai's projected growth trajectory and its strategic position within rapidly expanding markets. However, ROI is inherently uncertain and depends on various factors.

BigBear.ai Stock Performance and Future Outlook

Analyzing BigBear.ai's stock performance requires reviewing historical data, considering current market trends, and evaluating the company's future growth prospects.

- Key indicators of stock performance: Examining key metrics such as the Price-to-Earnings (P/E) ratio, dividend yield (if applicable), and trading volume provides insights into investor sentiment and the stock’s performance relative to its peers.

- Factors influencing future stock price: New product launches, strategic partnerships, successful contract wins, and advancements in AI technology all significantly impact future stock performance.

- Analyst ratings and price targets: Consulting independent financial analysis and seeking expert opinions offers a balanced perspective on future prospects. However, it is crucial to remember that these are just predictions and not guarantees.

Conclusion: Making Informed Decisions on Investing in BigBear.ai

Investing in BigBear.ai necessitates a thorough understanding of its business model, competitive landscape, financial performance, and inherent risks. This guide has highlighted key factors to consider. Remember, conducting thorough due diligence is paramount. Before making any investment decisions, consult with a qualified financial advisor who can help you assess your risk tolerance and tailor an investment strategy aligned with your financial goals. For further research, refer to BigBear.ai's investor relations page and reputable financial news sources. Make informed decisions about investing in BigBear.ai based on your own individual circumstances.

Featured Posts

-

The Gretzky Trump Connection Impact On The Hockey Icons Image

May 20, 2025

The Gretzky Trump Connection Impact On The Hockey Icons Image

May 20, 2025 -

T Hanatos Apo Bullying I Sygklonistiki Istoria Toy Baggeli Giakoymaki

May 20, 2025

T Hanatos Apo Bullying I Sygklonistiki Istoria Toy Baggeli Giakoymaki

May 20, 2025 -

On This Love By Suki Waterhouse Lyrics Explained And Analyzed

May 20, 2025

On This Love By Suki Waterhouse Lyrics Explained And Analyzed

May 20, 2025 -

Projet D Adressage D Abidjan Explication Du Marquage Des Numeros De Batiments

May 20, 2025

Projet D Adressage D Abidjan Explication Du Marquage Des Numeros De Batiments

May 20, 2025 -

Clean Energys Growth Faces Unexpected Headwinds

May 20, 2025

Clean Energys Growth Faces Unexpected Headwinds

May 20, 2025

Latest Posts

-

Texas Lawmakers Consider Social Media Restrictions For Minors

May 20, 2025

Texas Lawmakers Consider Social Media Restrictions For Minors

May 20, 2025 -

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025 -

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025 -

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025