Investing In BigBear.ai: A Detailed Look

Table of Contents

Understanding BigBear.ai's Business Model

BigBear.ai provides AI-powered solutions primarily to government and commercial clients. Their core offerings focus on leveraging advanced data analytics and artificial intelligence to solve complex problems across various sectors. This BigBear.ai business model centers around providing cutting-edge technology to improve decision-making and operational efficiency.

- Focus on data analytics and artificial intelligence: BigBear.ai utilizes machine learning, deep learning, and other AI techniques to analyze vast datasets, providing actionable insights.

- Key markets served: Their primary clients are in the defense, intelligence, cybersecurity, and commercial sectors. This diversification reduces reliance on any single market segment.

- Key partnerships and collaborations: BigBear.ai actively seeks strategic partnerships to expand its reach and enhance its technological capabilities. These collaborations often involve technology providers and government agencies.

- Revenue model: BigBear.ai generates revenue primarily through contracts and subscriptions for its software and services. This recurring revenue stream offers some predictability and stability.

Analyzing BigBear.ai's Financial Performance

Assessing the financial health of BigBear.ai is essential for any potential BigBear.ai investment. While specific numbers fluctuate, analyzing key metrics provides a clearer picture. It's crucial to regularly review financial reports for up-to-date information.

- Yearly revenue growth trends: Analyzing year-over-year revenue growth demonstrates the company's ability to expand its client base and secure new contracts. Look for consistent, positive growth as a positive indicator.

- Profitability margins (gross and net): Gross and net profit margins indicate the efficiency of BigBear.ai's operations and pricing strategies. Higher margins generally suggest stronger profitability.

- Cash flow analysis: A strong cash flow is crucial for a company's long-term sustainability. Analyzing cash flow from operations, investing, and financing activities offers insight into the company's liquidity.

- Debt levels and their impact: High levels of debt can present significant financial risks. Assessing the debt-to-equity ratio and other debt metrics is crucial.

- Comparison to competitors: Comparing BigBear.ai's financial performance to its competitors provides context and helps gauge its relative strength in the market.

Assessing the Risks and Opportunities of Investing in BigBear.ai

Like any investment, BigBear.ai stock carries inherent risks and opportunities. Understanding these is vital for informed decision-making.

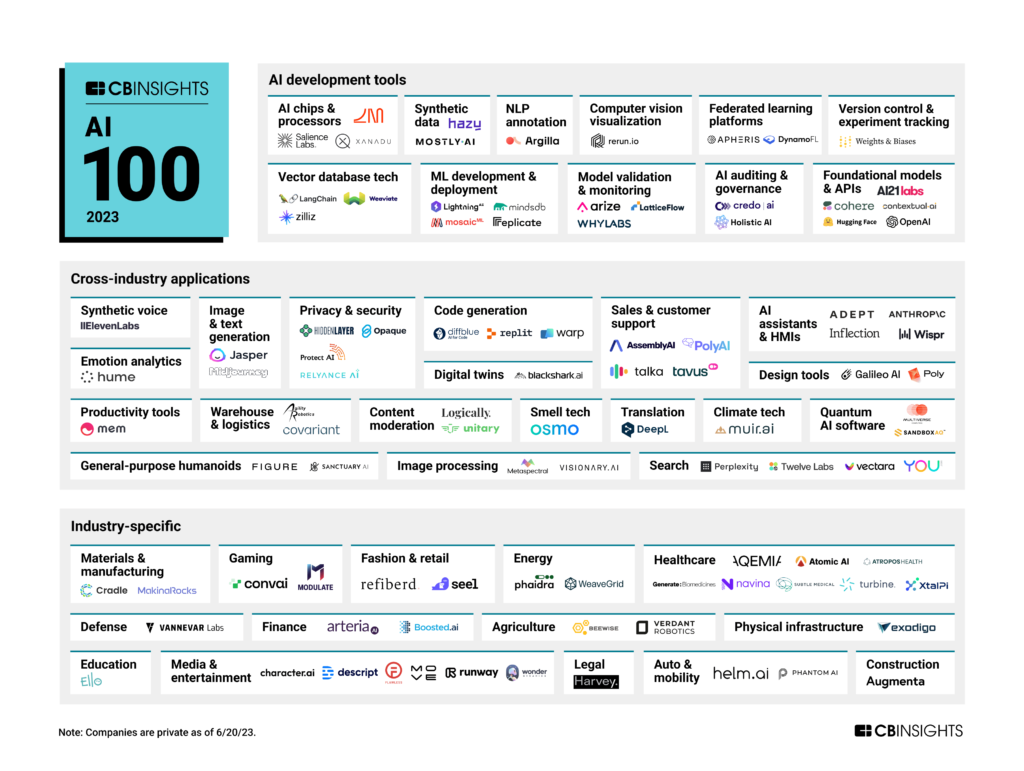

- Competitive landscape analysis: The AI and data analytics market is highly competitive. Understanding BigBear.ai's competitive advantages and disadvantages is crucial.

- Regulatory risks specific to the industry: Government regulations and policies can significantly impact companies in the defense and intelligence sectors.

- Technological advancements and their impact: The rapid pace of technological change poses both risks and opportunities. BigBear.ai needs to adapt and innovate to remain competitive.

- Growth potential in key markets: The expansion of AI adoption in various sectors presents substantial growth opportunities for BigBear.ai.

- Potential for disruptive innovation: BigBear.ai's ability to develop and deploy innovative AI solutions will be critical for its future success.

BigBear.ai Stock Valuation and Investment Strategies

Valuing BigBear.ai stock requires analyzing various financial metrics and considering different investment strategies.

- Current market capitalization: This represents the total market value of all outstanding shares.

- Price-to-earnings ratio (P/E): The P/E ratio compares the stock price to its earnings per share, indicating market sentiment and valuation.

- Price-to-sales ratio (P/S): The P/S ratio compares the stock price to its revenue per share, providing another measure of valuation.

- Potential future growth projections: Analyzing future growth projections, based on market trends and company performance, helps estimate potential returns.

- Long-term investment strategy recommendations: A long-term investment strategy may be more suitable for BigBear.ai given its growth potential.

- Risk management strategies: Diversification and setting stop-loss orders can help mitigate potential losses.

Comparing BigBear.ai to Competitors

Understanding BigBear.ai's position within the competitive landscape is essential. A comparative analysis with key players highlights its strengths and weaknesses.

- List of main competitors: Identifying and analyzing direct and indirect competitors provides crucial context.

- Comparison of market share: Assessing BigBear.ai's market share relative to its competitors reveals its relative strength and position.

- Comparison of revenue and profitability: Comparing revenue and profitability metrics provides insights into operational efficiency and market dominance.

- Competitive advantages of BigBear.ai: Identifying unique strengths, such as specialized technology or strategic partnerships, is crucial.

Conclusion

Investing in BigBear.ai presents both potential rewards and risks. The company operates in a rapidly growing market with significant opportunities for expansion. However, competition is fierce, and regulatory changes could impact its operations. Before making any BigBear.ai investment, a thorough understanding of its business model, financial performance, and competitive landscape is necessary. Remember that any BigBear.ai investment involves risk.

Before making any investment decisions regarding BigBear.ai stock, conduct thorough research and consult a financial advisor. Learn more about BigBear.ai investment opportunities by visiting their investor relations page. Remember, BigBear.ai investment involves inherent risks, and your decision should align with your risk tolerance and financial goals.

Featured Posts

-

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 21, 2025

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 21, 2025 -

New The Amazing World Of Gumball Teaser Trailer On Hulu Premiere Date Announced

May 21, 2025

New The Amazing World Of Gumball Teaser Trailer On Hulu Premiere Date Announced

May 21, 2025 -

Tottenham Loanee Leads Leeds Back To Championship Top

May 21, 2025

Tottenham Loanee Leads Leeds Back To Championship Top

May 21, 2025 -

Analysis Of D Wave Quantum Qbts Stock Reasons For The Recent Spike

May 21, 2025

Analysis Of D Wave Quantum Qbts Stock Reasons For The Recent Spike

May 21, 2025 -

Bbc Antiques Roadshow Couples Illegal National Treasure Trade Results In Prison Sentence

May 21, 2025

Bbc Antiques Roadshow Couples Illegal National Treasure Trade Results In Prison Sentence

May 21, 2025

Latest Posts

-

The World Of Vybz Kartel Sold Out Shows Dominate Brooklyn Ny

May 22, 2025

The World Of Vybz Kartel Sold Out Shows Dominate Brooklyn Ny

May 22, 2025 -

Vybz Kartel Sold Out New York Shows Prove Undying Popularity

May 22, 2025

Vybz Kartel Sold Out New York Shows Prove Undying Popularity

May 22, 2025 -

Brooklyn Roars Vybz Kartels Powerful Performances Sell Out

May 22, 2025

Brooklyn Roars Vybz Kartels Powerful Performances Sell Out

May 22, 2025 -

Dancehall Stars Trinidad Visit Restricted Vybz Kartel Sends Love

May 22, 2025

Dancehall Stars Trinidad Visit Restricted Vybz Kartel Sends Love

May 22, 2025 -

The Kartel Rum Culture Connection Insights From Stabroek News

May 22, 2025

The Kartel Rum Culture Connection Insights From Stabroek News

May 22, 2025