Investing In Palantir: Wall Street's View Before May 5th

Table of Contents

Palantir's Recent Performance and Growth Trajectory

Understanding Palantir's recent performance is crucial for assessing its investment potential. Analyzing key performance indicators (KPIs) reveals important trends. Keywords relevant to this section include Palantir revenue, Palantir growth, PLTR revenue growth, stock price performance, profitability, commercial revenue, and government contracts.

-

Revenue Growth: Recent quarterly and annual reports illustrate Palantir's revenue growth trajectory. Examining the percentage increase in revenue year-over-year provides a clear picture of the company's financial health and growth potential. Consistent revenue growth is a positive indicator for investors. Analyzing the breakdown between government contracts and commercial revenue offers insight into the diversity of Palantir's revenue streams. A healthy mix mitigates risk associated with over-reliance on a single sector.

-

Profitability Trends: Monitoring profitability metrics like gross margin and operating margin reveals the efficiency of Palantir's operations. Improving profitability suggests a positive trend in cost management and revenue generation. Investors look for consistent improvement in these metrics as a sign of long-term sustainability.

-

Key Performance Indicators (KPIs): Analyzing KPIs like customer acquisition cost (CAC) and customer lifetime value (CLTV) indicates the effectiveness of Palantir's sales and marketing efforts. A strong CLTV demonstrates customer loyalty and the long-term value of the company's offerings. Furthermore, monitoring the number of new contracts and their value provides insight into Palantir's market penetration and growth strategy.

(Include relevant charts and graphs here visually representing Palantir's performance data)

Analyst Ratings and Price Targets for PLTR Stock

Wall Street analysts offer valuable insights into Palantir's future prospects. This section analyzes analyst ratings and price targets to understand the prevailing sentiment among financial experts. Keywords here include Palantir stock price target, analyst ratings, buy rating, sell rating, hold rating, consensus price target, Wall Street analysts, and stock recommendations.

-

Average Price Target: The average price target set by leading analysts provides a consensus view on Palantir's future stock price. A higher average price target suggests stronger confidence in the company's potential.

-

Distribution of Ratings: Examining the distribution of buy, sell, and hold ratings reveals the range of opinions among analysts. A higher proportion of buy ratings signifies positive sentiment, while a higher proportion of sell ratings indicates caution.

-

Changes in Sentiment: Tracking any significant changes in analyst sentiment in the period leading up to the May 5th earnings report is crucial. This indicates whether analysts are becoming more or less optimistic about Palantir's prospects.

(Include a table summarizing analyst ratings and price targets from reputable sources here)

Key Factors Influencing Investor Sentiment

Several factors beyond Palantir's internal performance influence investor sentiment. This section examines macroeconomic conditions and competitive dynamics impacting PLTR stock. Keywords for this section include market conditions, geopolitical risks, competition, tech sector outlook, innovation, AI, and data analytics market.

-

Market Conditions: Broader market conditions such as interest rates and inflation significantly impact investor behavior. A rising interest rate environment, for instance, may lead to reduced investment in growth stocks like Palantir.

-

Geopolitical Risks: Geopolitical events can influence Palantir's government contracts, impacting revenue streams. Uncertainty in global affairs can create volatility in the stock price.

-

Competition: The competitive landscape in the data analytics market is crucial. Analyzing Palantir's position against competitors like AWS, Microsoft Azure, and Google Cloud helps assess its market share and growth potential.

-

Innovation and AI: Palantir's investment in AI and its potential applications are key drivers of investor interest. The company's ability to innovate and adapt to market trends is vital for its long-term success.

Risk Assessment for Investing in Palantir

Investing in Palantir carries inherent risks. This section highlights potential challenges investors should consider. Keywords include PLTR risk, investment risk, stock market volatility, valuation, financial risk, and market risk.

-

Market Volatility: Palantir's stock price is subject to market volatility. External factors can significantly influence the stock price regardless of the company's performance.

-

Valuation Concerns: Evaluating Palantir's valuation relative to its peers and its future growth prospects is essential. Overvaluation can lead to potential losses for investors.

-

Financial Risk: Analyzing Palantir's financial health, including its debt levels and cash flow, is crucial to assess its financial stability.

Conclusion

This article provided a comprehensive overview of Wall Street's perspective on Palantir before its May 5th earnings release. We examined Palantir’s recent performance, analyst predictions, market influences, and associated investment risks. The information presented offers a clearer picture of the investment landscape surrounding PLTR stock. Understanding these factors is essential for informed investment decisions.

Call to Action: Understanding Wall Street's view is crucial for any investor considering a position in Palantir. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions regarding Palantir stock (PLTR). Remember, investing in Palantir, or any stock, carries inherent risk.

Featured Posts

-

Nyt Strands Game 374 Hints And Solutions For March 12

May 09, 2025

Nyt Strands Game 374 Hints And Solutions For March 12

May 09, 2025 -

Analyzing Metas 168 Million Loss In The Whats App Spyware Case

May 09, 2025

Analyzing Metas 168 Million Loss In The Whats App Spyware Case

May 09, 2025 -

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025 -

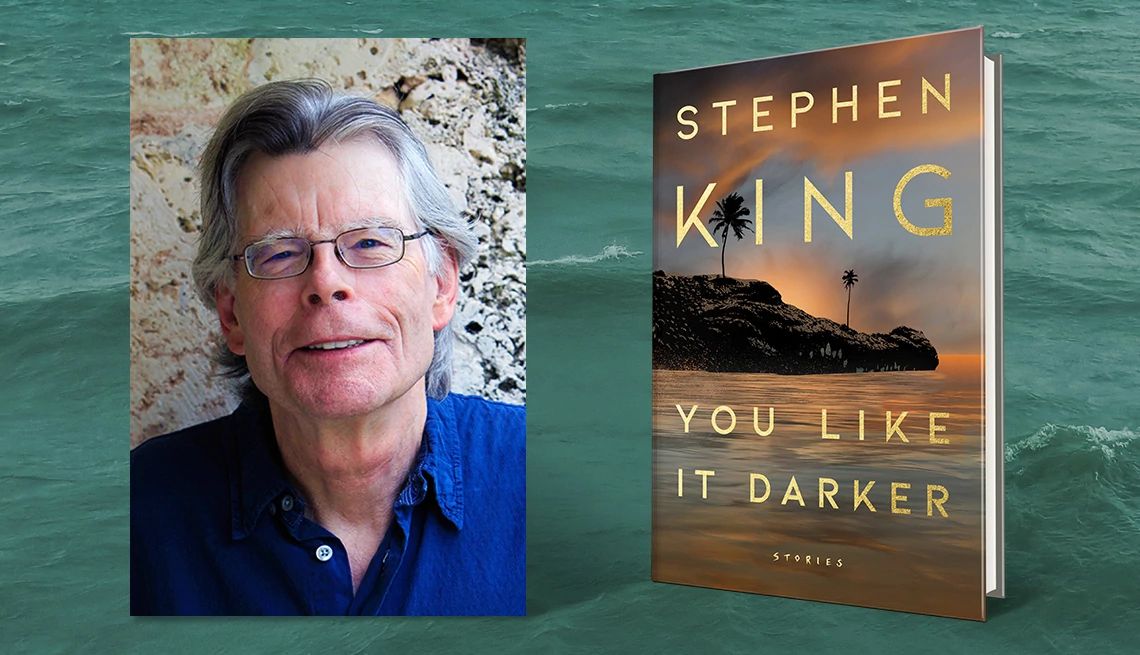

Stephen King 5 Books Every Fan Should Have Read

May 09, 2025

Stephen King 5 Books Every Fan Should Have Read

May 09, 2025 -

Young Thugs Uy Scuti Album Speculation And Anticipation Build

May 09, 2025

Young Thugs Uy Scuti Album Speculation And Anticipation Build

May 09, 2025