Investing In The Future: A Guide To The Country's Emerging Business Centers

Table of Contents

Identifying Promising Emerging Business Centers

Identifying the right emerging business centers for investment requires a thorough assessment of several key factors. Understanding these elements is crucial for maximizing returns and mitigating potential risks.

Key Factors to Consider:

- Economic Growth Indicators: A strong economy is fundamental. Look for robust GDP growth, consistent job creation, and significant foreign direct investment (FDI) inflows. These indicators signal a healthy and expanding market.

- Infrastructure Development: Well-developed infrastructure is essential for business operations. Assess the quality of transportation networks (roads, railways, airports), communication systems (internet access, telecommunications), and energy infrastructure (reliable power supply).

- Government Policies and Incentives: Supportive government policies can significantly influence investment decisions. Look for tax breaks, streamlined regulatory environments, and initiatives aimed at fostering business development and attracting foreign investment. Government stability is also a critical factor.

- Human Capital: A skilled and educated workforce is vital for a thriving business center. Analyze the availability of skilled labor, educational attainment levels, and training programs.

- Quality of Life: The quality of life significantly impacts the attractiveness of a location for businesses and employees. Consider factors such as housing affordability, healthcare access, educational opportunities, and overall safety and security.

Case Studies of Successful Emerging Business Centers:

-

City A: City A's success is attributed to its strategic location, substantial government investment in infrastructure, and a focus on developing its technology sector. [Link to relevant resource about City A's economic development]. This has attracted significant FDI and spurred job growth in tech-related industries.

-

City B: City B has experienced rapid growth in its renewable energy sector, driven by supportive government policies and a wealth of natural resources. [Link to relevant resource on City B's renewable energy initiatives]. This focus has attracted both domestic and international investment.

-

City C: City C's emphasis on education and skill development has created a highly skilled workforce, attracting manufacturing and high-tech companies. [Link to relevant resource showcasing City C's educational initiatives]. This focus on human capital is a key driver of its economic success.

-

Industries Thriving in These Centers:

- Technology (Software development, Fintech, AI)

- Manufacturing (Advanced manufacturing, automotive, aerospace)

- Renewable Energy (Solar, wind, biofuels)

- Logistics and Transportation

- Healthcare

Assessing Investment Risks and Opportunities

While emerging business centers present significant opportunities, investors must also carefully assess potential risks. A thorough understanding of these risks and implementing effective mitigation strategies is crucial for maximizing returns.

Identifying Potential Risks:

- Political and Economic Instability: Political instability or economic downturns can significantly impact investment returns. Thorough research into the political and economic climate is crucial.

- Infrastructure Limitations: Inadequate infrastructure can hinder business operations and increase costs.

- Competition from Established Business Centers: Competition from more established business centers can impact market share and profitability.

- Regulatory Uncertainty: Changes in regulations or unclear regulatory frameworks can create uncertainty and increase investment risks.

Mitigating Risks and Maximizing Returns:

-

Conduct Thorough Due Diligence: Carry out extensive research on the chosen business center, including its economic outlook, political stability, and regulatory environment.

-

Diversify Investments: Spread investments across multiple sectors and geographical locations to reduce exposure to specific risks.

-

Partner with Local Experts: Collaborate with local partners who possess in-depth knowledge of the market, regulations, and cultural nuances.

-

Develop a Long-Term Investment Strategy: Investing in emerging business centers requires a long-term perspective. Short-term fluctuations should be expected and accounted for.

-

Actionable Steps:

- Analyze market trends and forecasts.

- Evaluate potential competitors.

- Secure appropriate insurance coverage.

- Develop contingency plans.

Navigating the Investment Process in Emerging Business Centers

Successfully investing in emerging business centers requires a well-defined strategy and understanding of the investment process.

Finding Investment Opportunities:

- Government Agencies: Many government agencies provide information and support for foreign investors.

- Private Equity Firms: Private equity firms often specialize in investing in emerging markets.

- Networking Events: Attending industry conferences and networking events can help you connect with potential investment opportunities.

Due Diligence and Legal Considerations:

Thorough due diligence, including legal and financial assessments, is paramount before committing to any investment. Engage legal and financial professionals specializing in international investments.

Securing Financing and Funding:

Various financing options are available, including bank loans, equity financing, and venture capital. Explore options that align with your investment strategy and risk tolerance.

- Resources and Organizations:

- [Link to relevant government agency for foreign investment]

- [Link to relevant business development organization]

- [Link to relevant financial institutions specializing in emerging markets]

Investing in the Future: A Summary and Call to Action

Investing in emerging business centers presents significant opportunities for substantial returns, but it also involves inherent risks. Successful investment hinges on careful planning, thorough due diligence, and a long-term perspective. Understanding the key factors influencing economic growth, assessing potential risks, and navigating the investment process are crucial steps towards capitalizing on the potential of these dynamic locations. Remember to diversify your portfolio, partner with local experts, and maintain a long-term vision.

Don't miss out on the incredible potential of the country's emerging business centers. Start your research today and discover the investment opportunities that await. Begin exploring the many advantages of investing in these dynamic emerging business centers and build a strong foundation for your future financial success.

Featured Posts

-

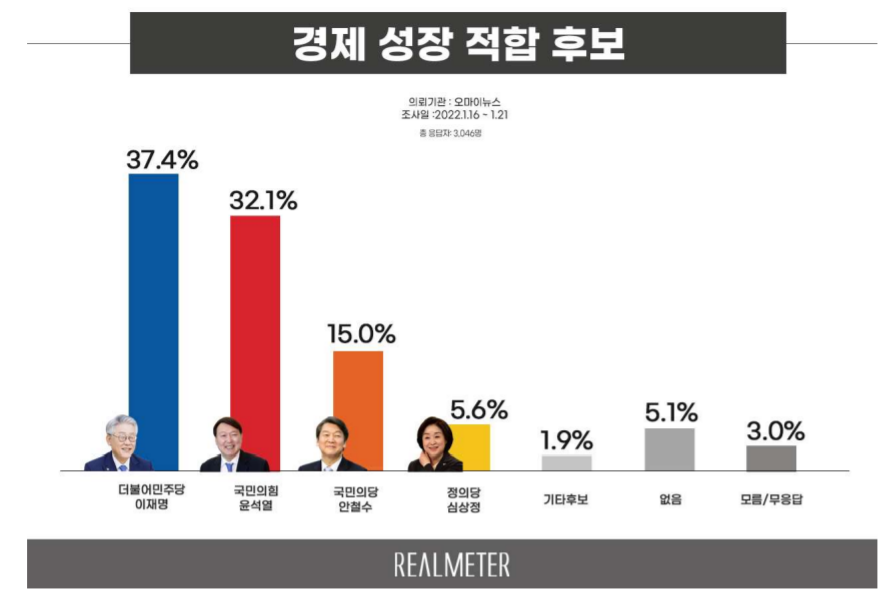

Understanding The South Korean Presidential Election Candidates Platforms And Predictions

May 28, 2025

Understanding The South Korean Presidential Election Candidates Platforms And Predictions

May 28, 2025 -

Man Utd Transfer News Is A 50m Player Leaving Old Trafford

May 28, 2025

Man Utd Transfer News Is A 50m Player Leaving Old Trafford

May 28, 2025 -

Impact Of Rent Regulation Changes On Tenants An Interest Groups Perspective

May 28, 2025

Impact Of Rent Regulation Changes On Tenants An Interest Groups Perspective

May 28, 2025 -

Score Free American Music Award Tickets On The Las Vegas Strip

May 28, 2025

Score Free American Music Award Tickets On The Las Vegas Strip

May 28, 2025 -

Unstoppable In Rome The Champions Journey Continues

May 28, 2025

Unstoppable In Rome The Champions Journey Continues

May 28, 2025

Latest Posts

-

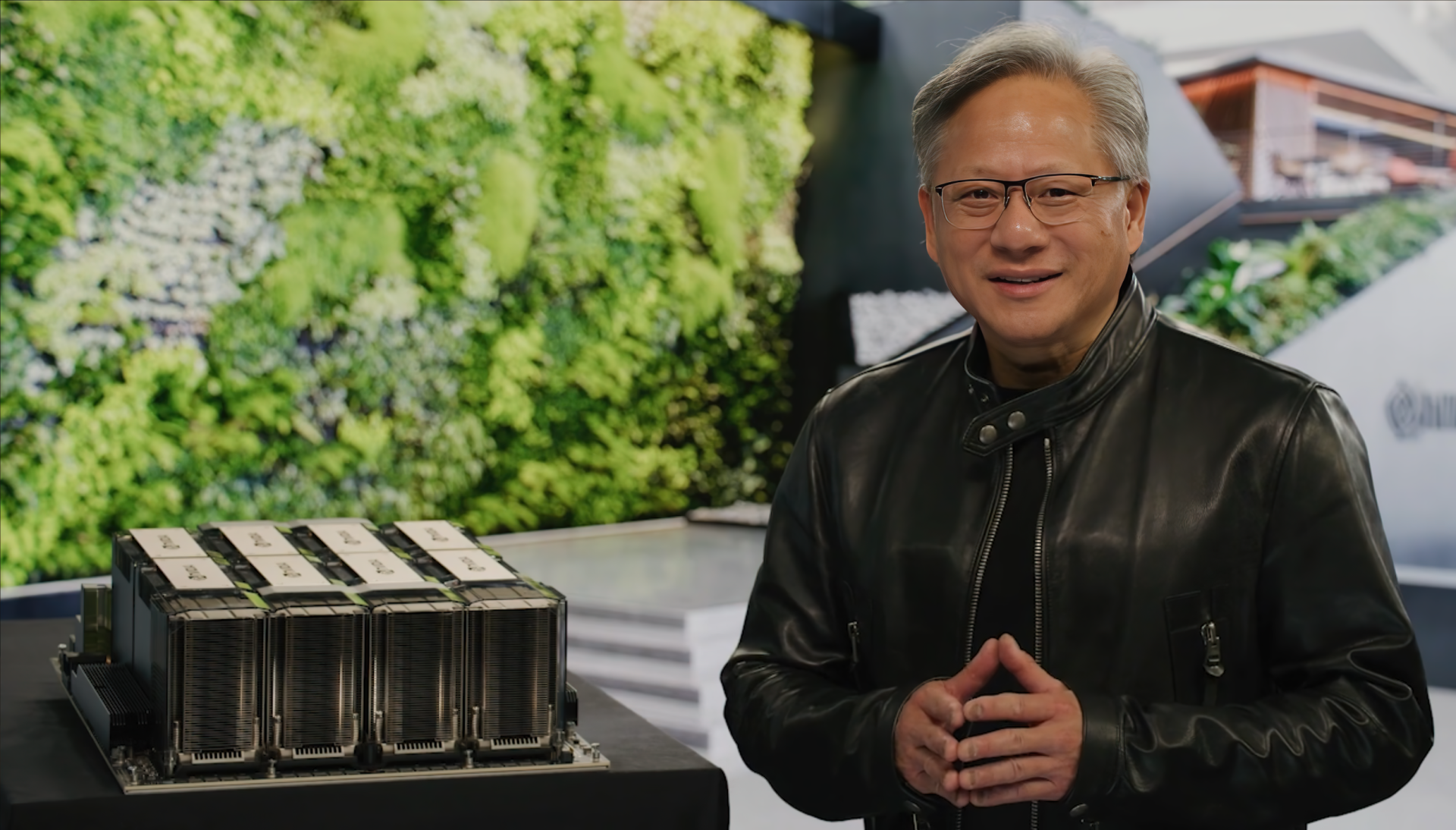

Nvidias Huang Chinese Ai Competitors Pose A Significant Threat

May 30, 2025

Nvidias Huang Chinese Ai Competitors Pose A Significant Threat

May 30, 2025 -

Navigate The Private Credit Boom 5 Crucial Dos And Don Ts

May 30, 2025

Navigate The Private Credit Boom 5 Crucial Dos And Don Ts

May 30, 2025 -

Untapped Potential Mapping New Business Hotspots Across The Country

May 30, 2025

Untapped Potential Mapping New Business Hotspots Across The Country

May 30, 2025 -

127 Years Of Brewing History Ends Anchor Brewing Companys Closure Announced

May 30, 2025

127 Years Of Brewing History Ends Anchor Brewing Companys Closure Announced

May 30, 2025 -

Chinas Ai Rise Nvidia Ceo Jensen Huang Sounds The Alarm

May 30, 2025

Chinas Ai Rise Nvidia Ceo Jensen Huang Sounds The Alarm

May 30, 2025