Investing In Uber's Autonomous Vehicle Future: ETF Opportunities

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's ambition in the autonomous vehicle market is significant. Their Advanced Technologies Group (ATG) has been a major player, investing heavily in research and development to create self-driving technology. This includes developing sophisticated software, sensor technology, and mapping capabilities crucial for autonomous driving. While Uber has faced challenges and setbacks, their commitment remains evident.

- Past and Present Efforts: Uber ATG's journey has involved extensive testing, data collection, and continuous refinement of their autonomous driving systems. They've experimented with various vehicle platforms and continuously improved their algorithms.

- Key Partnerships and Collaborations: Strategic collaborations with other technology companies and automakers have been key to Uber's strategy. These partnerships have facilitated access to expertise, resources, and technology.

- Significant Milestones and Challenges: Uber has achieved various milestones, such as completing millions of autonomous miles in testing. However, they've also faced challenges, including accidents and regulatory hurdles, demonstrating the complex nature of developing this technology.

- Impact on Uber's Business Model: Successful autonomous vehicle deployment could drastically alter Uber's business model, potentially reducing operational costs, increasing efficiency, and creating new revenue streams. This could translate into higher profitability and increased shareholder value.

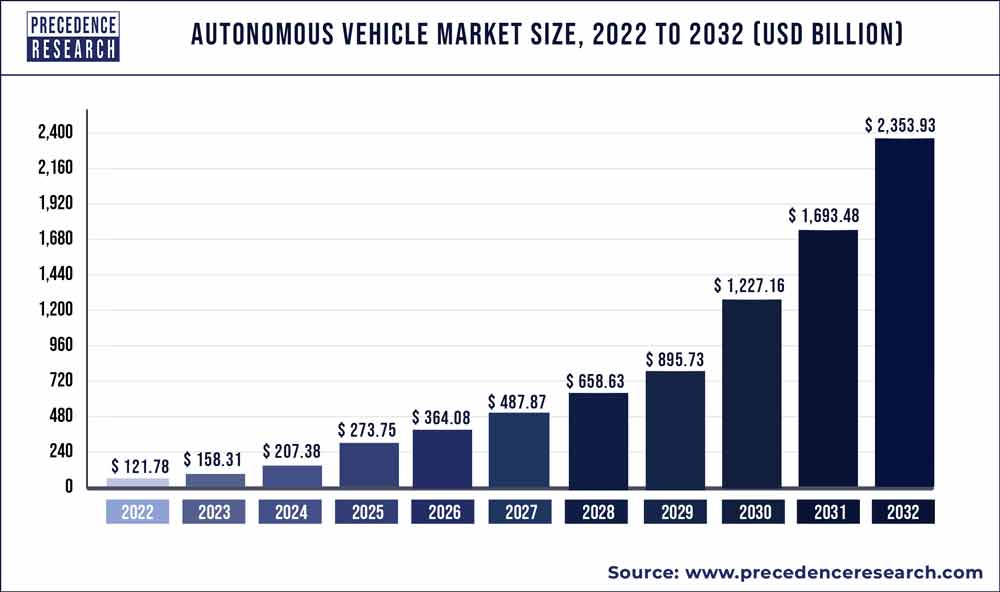

Identifying Relevant ETFs for Autonomous Vehicle Exposure

Several ETFs offer exposure to the autonomous vehicle sector, providing investors with diversified access to companies involved in various aspects of this technology. These can broadly be categorized into thematic ETFs focusing specifically on autonomous vehicles and broader technology ETFs with significant holdings in relevant companies.

- Specific ETF Examples: Investors should research ETFs like those focusing on robotics, artificial intelligence, or technology. Look for those with significant holdings in companies developing autonomous driving systems, sensor technology, mapping software, or related technologies. Carefully review the ETF prospectus for detailed holdings.

- ETF Methodology: ETFs use different methodologies to select their holdings. Some may focus on market capitalization, while others might use fundamental analysis or a combination of factors. Understanding the ETF's methodology is critical in evaluating its suitability for your investment goals.

- Fees and Expense Ratios: Compare the expense ratios of different ETFs to ensure you're getting the best value for your investment. Lower expense ratios can lead to higher returns over the long term.

- Indirect Uber Exposure: While there may not be a dedicated ETF directly focused on Uber's ATG, several ETFs hold companies that indirectly benefit from or contribute to Uber's autonomous vehicle efforts, such as suppliers of components or AI software.

Analyzing ETF Holdings for Uber-Related Investments

To determine the level of indirect exposure to Uber's autonomous vehicle initiatives within an ETF, you need to analyze its holdings.

- Accessing ETF Holdings Lists: Most ETF providers provide detailed lists of their holdings on their websites. You can typically find this information in the ETF's fact sheet or prospectus.

- Essential Components and Services: Look for companies that supply essential components or services to the autonomous vehicle industry. These may include lidar sensor manufacturers, AI chip developers, mapping companies, or high-precision GPS providers. Many of these are key suppliers to various players in the autonomous driving sector, including Uber.

- Indirect Exposure through Related Companies: Companies involved in mapping (e.g., high-definition mapping providers), sensor technology (e.g., lidar and radar manufacturers), or artificial intelligence (e.g., machine learning and computer vision specialists) often play crucial roles and can provide indirect exposure to Uber's ambitions.

Assessing Risk and Diversification

Investing in emerging technologies like autonomous vehicles involves inherent risks.

- Regulatory Uncertainties: The regulatory landscape surrounding autonomous vehicles is still evolving, creating uncertainty and potential delays in widespread adoption. Changes in regulations could significantly impact the success of companies in this sector.

- Technological Challenges: Developing fully reliable and safe autonomous driving technology is incredibly challenging. Technological hurdles, unforeseen problems, and potential delays could impact investment returns.

- Diversification: Diversifying your investments across different ETFs and asset classes is crucial to mitigate risk. Don't put all your eggs in one basket; spread your investments to reduce exposure to any single sector or company.

- Thorough Research: Always conduct thorough research before making any investment decisions. Understand the risks involved, the ETF's investment strategy, and the potential for both high returns and significant losses.

Conclusion

Investing in Uber's autonomous vehicle future via strategically selected ETFs presents a compelling opportunity for growth-oriented investors. While the sector carries inherent risks, careful analysis of ETF holdings and a well-diversified portfolio can help mitigate these risks. By understanding Uber's autonomous vehicle strategy and carefully selecting relevant ETFs, investors can participate in this transformative technological shift. Start your research today and explore the potential of Uber Autonomous Vehicle ETFs and similar investment options to build a portfolio for the future of transportation. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Tampoy Sto Mega Ola Osa Tha Doyme Sto Apopsino Epeisodio

May 19, 2025

Tampoy Sto Mega Ola Osa Tha Doyme Sto Apopsino Epeisodio

May 19, 2025 -

Eurovisions Voting System Jury And Public Combined

May 19, 2025

Eurovisions Voting System Jury And Public Combined

May 19, 2025 -

Ufc 313 A Complete Guide To This Weekends Fights Featuring Pereira Vs Ankalaev

May 19, 2025

Ufc 313 A Complete Guide To This Weekends Fights Featuring Pereira Vs Ankalaev

May 19, 2025 -

Mark Rylance Criticises Music Festivals Impact On London Parks

May 19, 2025

Mark Rylance Criticises Music Festivals Impact On London Parks

May 19, 2025 -

Nadal Y El Fallecimiento De Una Figura Clave Del Tenis

May 19, 2025

Nadal Y El Fallecimiento De Una Figura Clave Del Tenis

May 19, 2025