Investing In XRP: Weighing The Risks And Rewards After A 400% Jump.

Table of Contents

XRP's Recent Price Surge: Understanding the 400% Jump

The dramatic 400% increase in XRP's price hasn't been without cause. Several factors contributed to this significant rally. Understanding these drivers is crucial for assessing future potential.

-

Increased Institutional Interest: Several large financial institutions are increasingly exploring the use of XRP for cross-border payments, signaling growing acceptance and potentially driving demand.

-

Positive Legal Developments Concerning Ripple's Lawsuit: Positive developments in the ongoing legal battle between Ripple and the SEC have boosted investor confidence, reducing uncertainty surrounding XRP's regulatory future. While the case is not yet resolved, positive court rulings have fueled speculation.

-

Growing Adoption in Cross-Border Payments: XRP's speed and low transaction fees make it an attractive option for international remittances, a key driver of its adoption by payment providers and financial institutions. This increased usage directly impacts demand.

-

Speculative Trading and Market Hype: As with many cryptocurrencies, market hype and speculative trading play a significant role in price fluctuations. The recent surge can partly be attributed to increased trading activity driven by positive news and FOMO (fear of missing out).

-

Analysis of Trading Volume and Price Charts: Analyzing price charts and trading volume data reveals periods of high volatility alongside periods of relative stability. Understanding these patterns is key to predicting future price movements, though not guaranteed.

The Potential Rewards of Investing in XRP

Despite the risks, the potential rewards of XRP investment are significant, based on various factors:

-

High Growth Potential in the Cryptocurrency Market: The cryptocurrency market is still in its relatively early stages, and XRP, as a prominent player, has the potential for substantial future price appreciation. Many XRP price predictions anticipate further growth.

-

Use Cases in International Payments and Remittance: XRP's unique utility in facilitating fast and cheap cross-border transactions positions it for significant growth as international payments continue to evolve.

-

Potential for Wider Adoption by Banks and Financial Institutions: As more financial institutions explore blockchain technology and digital assets, the adoption of XRP for payment processing could lead to substantial price increases.

-

Technological Advantages Compared to Other Cryptocurrencies: The XRP Ledger is known for its speed, scalability, and energy efficiency, offering advantages over some of its competitors. This efficiency attracts both users and developers.

-

Community Support and Development Activity: A strong and active community surrounding XRP continues to develop and improve the platform, contributing to its long-term viability and appeal.

Analyzing XRP's Utility and Technology

XRP's utility extends beyond speculation. Its underlying technology and practical applications are key to its value proposition.

-

The XRP Ledger's Speed and Efficiency: The XRP Ledger boasts significantly faster transaction speeds and lower costs compared to many other blockchain networks.

-

Its Role in Facilitating Cross-Border Payments: XRP's design is specifically geared towards enabling seamless and cost-effective international payments, a major pain point in the current financial system.

-

Its Energy Efficiency Compared to Other Cryptocurrencies: Unlike some cryptocurrencies that require significant energy consumption, XRP utilizes a significantly more energy-efficient consensus mechanism.

-

Partnerships and Collaborations: Ripple, the company behind XRP, has forged partnerships with various financial institutions, furthering the adoption and utility of XRP in real-world applications.

The Risks Associated with XRP Investment

While the potential rewards are attractive, investing in XRP also carries substantial risks:

-

Regulatory Uncertainty Surrounding XRP and Ripple: The ongoing legal battle between Ripple and the SEC creates significant regulatory uncertainty, impacting investor confidence and price stability.

-

High Volatility and Potential for Significant Price Drops: XRP is highly volatile, and its price can experience dramatic swings in short periods, leading to substantial losses for investors.

-

Competition from Other Cryptocurrencies in the Payments Space: Several other cryptocurrencies are vying for a position in the cross-border payments market, increasing competition and potentially hindering XRP's growth.

-

Concentration of XRP Ownership and Potential for Manipulation: A significant portion of XRP is held by a relatively small number of entities, potentially making the market susceptible to manipulation.

-

Security Risks Associated with Digital Asset Storage: Storing XRP, like any cryptocurrency, involves security risks, and investors must take precautions to protect their assets from theft or loss.

Diversification and Risk Management Strategies for XRP Investors

Incorporating XRP into a broader investment strategy requires careful consideration of risk management techniques.

-

Importance of Diversification within a Cryptocurrency Portfolio: Don't put all your eggs in one basket. Diversify across various cryptocurrencies to mitigate risk.

-

Importance of Diversification Across Asset Classes: Diversify beyond cryptocurrencies into traditional assets like stocks, bonds, and real estate to further reduce risk exposure.

-

Strategies for Managing Risk, Such as Dollar-Cost Averaging and Stop-Loss Orders: Dollar-cost averaging (DCA) and stop-loss orders are effective tools to mitigate losses and manage volatility.

-

Importance of Conducting Thorough Research Before Investing: Always conduct thorough due diligence before investing in any cryptocurrency, including XRP.

-

Understanding Your Personal Risk Tolerance: Assess your personal risk tolerance before investing in any high-risk asset like XRP.

Conclusion

XRP presents a compelling investment opportunity with significant potential rewards, but it also carries substantial risks. The recent 400% price jump highlights both its volatile nature and its capacity for rapid growth. Understanding the underlying technology, the regulatory landscape, and the competitive environment is crucial before investing. Carefully weigh the risks and rewards before deciding whether investing in XRP aligns with your investment strategy and risk tolerance. Conduct thorough research and seek professional financial advice before making any investment decisions related to XRP or other cryptocurrencies. Remember, responsible investment in XRP requires understanding both its potential and its inherent volatility.

Featured Posts

-

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Kpss Sarti

May 08, 2025

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Kpss Sarti

May 08, 2025 -

Taiwan Dollars Surge A Necessary Economic Overhaul

May 08, 2025

Taiwan Dollars Surge A Necessary Economic Overhaul

May 08, 2025 -

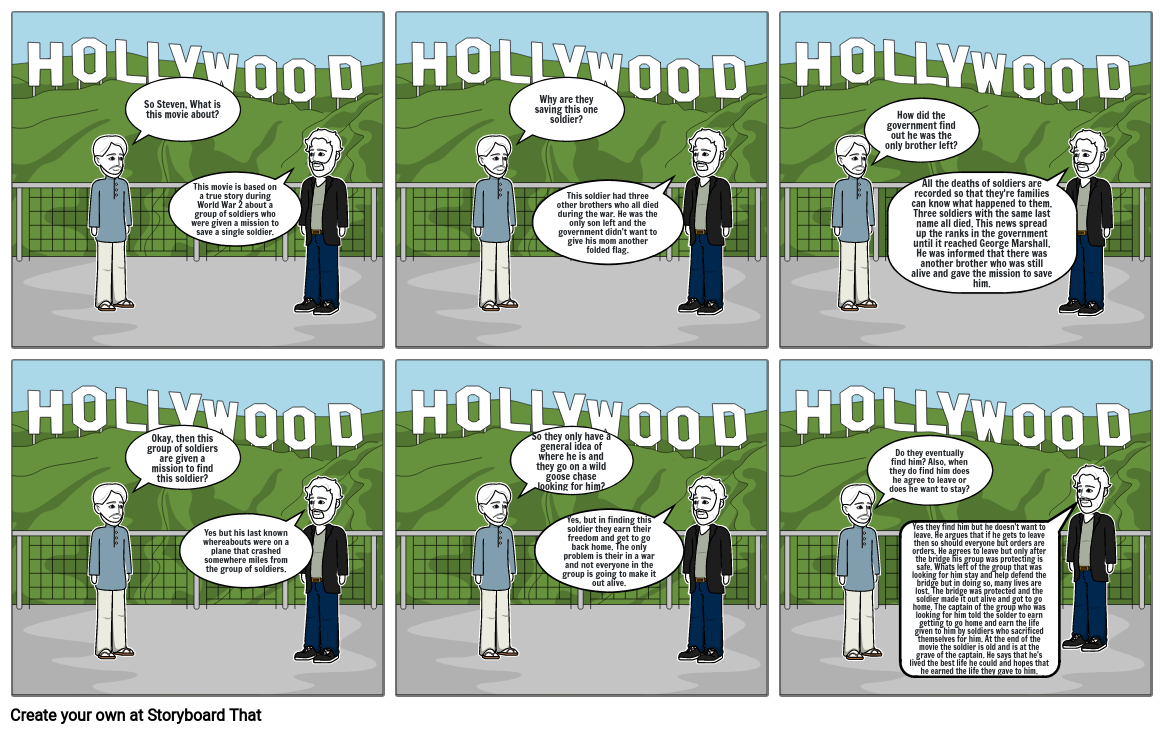

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025 -

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Hekim Disi Personel Alimi Basvuru Sartlari Ve Tarihleri

May 08, 2025

Saglik Bakanligi Personel Alimi Son Dakika 37 Bin Hekim Disi Personel Alimi Basvuru Sartlari Ve Tarihleri

May 08, 2025 -

Manitoba Snowfall Warning 10 20 Cm Expected Tuesday

May 08, 2025

Manitoba Snowfall Warning 10 20 Cm Expected Tuesday

May 08, 2025