Investment In Amundi Dow Jones Industrial Average UCITS ETF: NAV Performance

Table of Contents

Factors Influencing Amundi DJIA ETF NAV Performance

The Amundi DJIA ETF's NAV performance is intrinsically linked to the underlying Dow Jones Industrial Average. The ETF aims to track the DJIA's performance closely, meaning that any movement in the index directly impacts the ETF's NAV. However, several other factors influence this relationship:

-

Dow Jones Industrial Average Performance: The primary driver of the Amundi DJIA ETF's NAV is the performance of the 30 constituent companies of the DJIA. A bull market, characterized by rising stock prices, will generally lead to an increase in the ETF's NAV, while a bear market will have the opposite effect.

-

Currency Fluctuations: Since this is a UCITS ETF, currency fluctuations between the Euro (or other applicable currency) and the US dollar can impact the NAV. If the US dollar strengthens against the Euro, the NAV, expressed in Euros, might decrease even if the DJIA remains stable or increases.

-

Expense Ratios and Management Fees: The ETF's expense ratio and management fees directly reduce the overall returns. These fees are deducted from the assets under management, which ultimately affects the NAV. A higher expense ratio will result in slower NAV growth compared to a lower-cost alternative.

-

Other Influencing Factors:

- Market Trends: Bull markets generally boost NAV, while bear markets depress it.

- Economic Indicators: Inflation, interest rates, and economic growth significantly influence the DJIA and thus the ETF's NAV.

- Geopolitical Events: Global events can cause market volatility, affecting the NAV.

- Sectoral Performance: The performance of specific sectors within the DJIA (e.g., technology, financials) also plays a role.

Analyzing Historical NAV Performance Data

Analyzing the historical NAV performance of the Amundi DJIA ETF provides valuable insights into its potential future behavior. While past performance is not indicative of future results, examining historical trends can illuminate risk and reward characteristics. (Insert chart/graph visualizing NAV performance over time here).

-

Data Visualization: A clear visual representation, such as a line graph displaying NAV over a specific period (e.g., the last 5 years), is essential for understanding the ETF's performance.

-

Key Performance Indicators (KPIs): Analyzing KPIs like annualized returns, standard deviation (measuring volatility), and Sharpe ratio (measuring risk-adjusted return) provides a quantitative assessment of the ETF's performance.

-

Benchmark Comparison: Comparing the ETF's performance to the Dow Jones Industrial Average itself, as well as other benchmark indices like the S&P 500, allows for relative performance assessment. This helps to understand whether the ETF effectively tracks its benchmark.

-

Market Events: Highlighting specific periods of growth or decline and connecting them to relevant market events (e.g., the COVID-19 pandemic, the 2008 financial crisis) offers context and helps in understanding market influences.

Risk Assessment and Investment Strategy

Investing in any ETF, including the Amundi DJIA ETF, involves inherent risks. Understanding these risks and how NAV performance helps manage them is vital:

-

Market Risk: The primary risk is the inherent volatility of the stock market. The DJIA, and consequently the ETF, can experience significant price fluctuations, impacting the NAV.

-

NAV Performance and Risk Management: By analyzing historical NAV data, investors can gauge the ETF's volatility and adjust their investment strategy accordingly. For instance, understanding periods of high volatility allows for more cautious investment approaches.

-

Investment Strategies:

- Risk Tolerance: Individual risk tolerance levels dictate appropriate investment strategies. Risk-averse investors might allocate a smaller portion of their portfolio to the ETF.

- Diversification: Diversifying investments across different asset classes reduces overall portfolio risk.

- Investment Horizon: Long-term investors are generally better positioned to weather market fluctuations than short-term investors.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, mitigating the risk of investing a lump sum at a market peak.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Understanding the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for making informed investment decisions. Analyzing historical data, considering influencing factors, and assessing inherent risks are vital steps in developing a sound investment strategy. Remember, while this article provides valuable insights, it's crucial to conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Start monitoring the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF to make informed investment choices and optimize your portfolio strategy. (Link to relevant resources about the ETF here).

Featured Posts

-

Woody Allen And Dylan Farrow Sean Penns Perspective On The Controversy

May 25, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Controversy

May 25, 2025 -

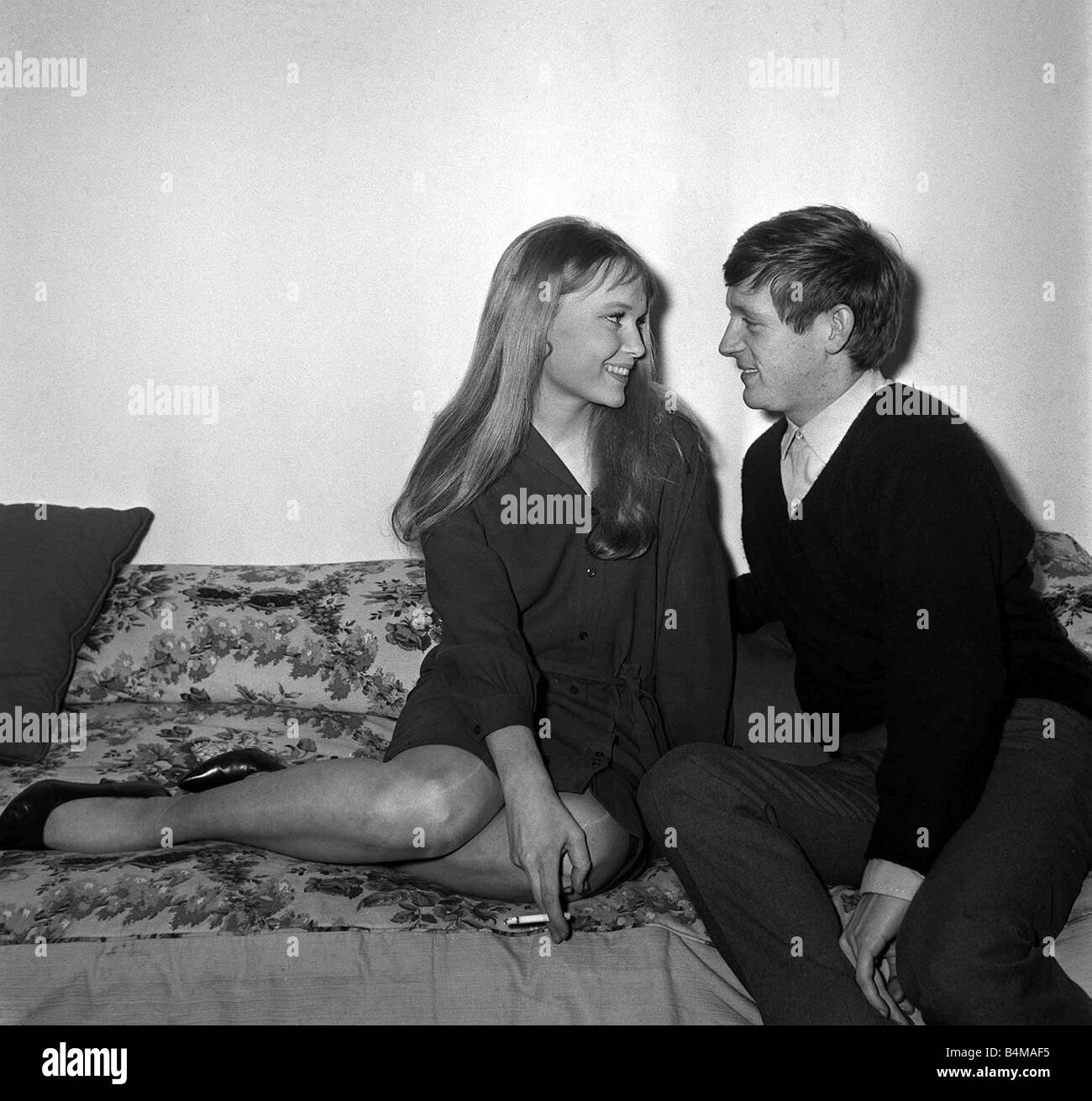

The Mia Farrow Sex Scene Michael Caines Unforgettable On Set Experience

May 25, 2025

The Mia Farrow Sex Scene Michael Caines Unforgettable On Set Experience

May 25, 2025 -

Actress Mia Farrows Urgent Message Is American Democracy On The Brink

May 25, 2025

Actress Mia Farrows Urgent Message Is American Democracy On The Brink

May 25, 2025 -

Bolee 600 Brakov Na Kharkovschine Za Mesyats Prichiny I Tendentsii

May 25, 2025

Bolee 600 Brakov Na Kharkovschine Za Mesyats Prichiny I Tendentsii

May 25, 2025 -

Le Pens Rally Underwhelms National Rallys Sunday Demonstration Analyzed

May 25, 2025

Le Pens Rally Underwhelms National Rallys Sunday Demonstration Analyzed

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025