Investor Concerns About High Stock Market Valuations: BofA's Rebuttal

Table of Contents

BofA's Arguments Against Overvaluation Concerns

BofA's rebuttal to concerns about high stock market valuations rests on several key pillars. Their analysis suggests that current valuations are supported by strong fundamentals and a positive economic outlook, mitigating the risks associated with seemingly elevated price-to-earnings ratios.

Strong Corporate Earnings and Profitability

BofA's central argument hinges on the robustness of corporate earnings and profitability. They contend that healthy profit margins and consistent earnings growth justify the current market valuations, arguing that these figures outweigh concerns about seemingly high price-to-earnings (P/E) ratios.

- Examples of sectors showing strong earnings growth: BofA highlights sectors like technology, healthcare, and consumer staples as exhibiting particularly robust earnings growth, contributing significantly to overall market performance.

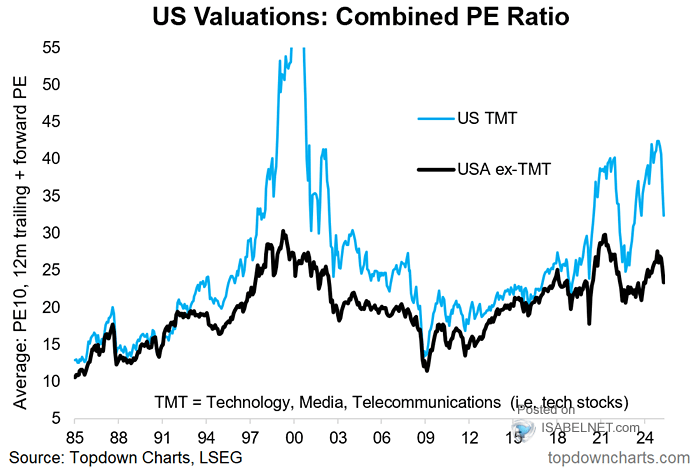

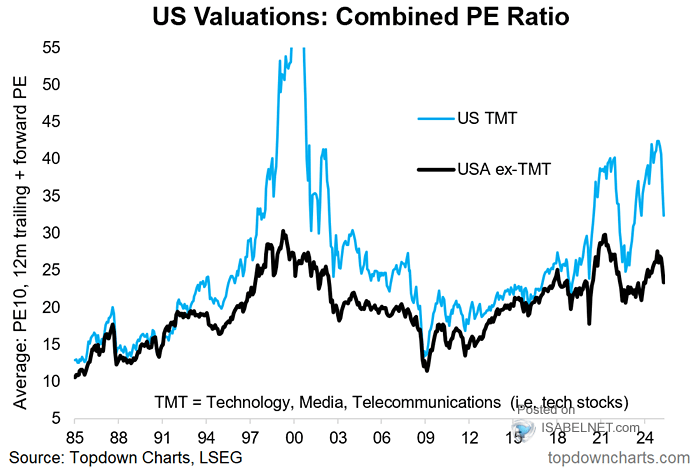

- Comparison of current P/E ratios to historical averages: While acknowledging the elevated P/E ratios in some sectors, BofA's analysis compares these figures to historical averages, arguing that while higher than some past periods, they are not unprecedented, particularly when considering the low interest rate environment.

- Factors contributing to strong corporate profits: BofA attributes strong corporate profits to a combination of factors, including increased productivity, technological advancements, and effective cost management strategies.

Positive Economic Outlook and Growth Projections

BofA paints a broadly optimistic picture of the global and US economic climate. Their projections for future economic growth, coupled with their assessment of key economic indicators, suggest sustained market strength, supporting their argument against overvaluation concerns.

- Key economic indicators supporting BofA's optimistic outlook: BofA points to indicators such as strong consumer spending, robust job growth, and continued business investment as evidence of a healthy and growing economy.

- Discussion of potential risks and mitigating factors: While acknowledging potential risks such as inflation and geopolitical uncertainty, BofA argues that these risks are manageable and already factored into their economic projections.

- Comparison of BofA's projections to other economic forecasts: BofA's analysis also incorporates a comparison of its projections to other leading economic forecasts, highlighting the relative consensus surrounding a positive, albeit cautious, economic outlook.

Low Interest Rates and Monetary Policy

Low interest rates play a crucial role in BofA's analysis. They argue that the prevailing low interest rate environment contributes significantly to higher stock valuations, as investors seek higher returns in the equity market.

- Impact of low interest rates on investor behavior and capital allocation: Low interest rates incentivize investors to move away from low-yielding bonds and into higher-growth equities, thereby driving up stock prices.

- Analysis of central bank policies and their potential influence on stock prices: BofA's analysis examines the role of central bank policies in maintaining low interest rates and its impact on stock market valuations.

- Discussion of potential future interest rate adjustments and their market implications: BofA acknowledges the potential for future interest rate adjustments but suggests that any gradual increases are likely to be managed in a way that minimizes negative impacts on the market.

Counterarguments and Critical Analysis of BofA's Rebuttal

While BofA presents a compelling case, a balanced assessment requires consideration of counterarguments and potential limitations in their analysis.

Potential Risks and Uncertainties

Despite the positive outlook painted by BofA, several factors could negatively impact the market and challenge their assessment of current valuations.

- Inflationary pressures and their potential effects on valuations: Rising inflation could erode corporate profit margins and trigger a reassessment of stock valuations.

- Geopolitical risks and their impact on market sentiment: Geopolitical instability, trade disputes, and unforeseen global events could negatively impact market sentiment and lead to a market correction.

- Potential for a correction or market downturn: The possibility of a market correction or even a more significant downturn cannot be dismissed, regardless of current positive economic indicators.

Limitations of BofA's Analysis

It's crucial to acknowledge potential biases and limitations within BofA's analysis.

- Critique of the methodology used in BofA's report: A detailed examination of the methodology employed in BofA's report could reveal potential shortcomings or assumptions that affect the validity of their conclusions.

- Discussion of any assumptions made in their analysis: Understanding the underlying assumptions made in BofA's analysis is crucial for assessing the robustness of their conclusions.

- Comparison to other analysts' perspectives and reports: Comparing BofA's analysis to the perspectives of other reputable analysts and research firms offers a more holistic view and identifies areas of consensus and divergence.

Conclusion: Investor Concerns About High Stock Market Valuations: A Balanced Perspective

BofA's analysis offers a compelling counterpoint to concerns about high stock market valuations, citing strong corporate earnings, positive economic projections, and the influence of low interest rates. However, acknowledging potential risks such as inflation, geopolitical uncertainty, and the inherent limitations of any economic forecast is equally important. Investors should approach the market with a balanced perspective, considering both the bullish arguments presented by BofA and the potential for unforeseen downturns. Thorough due diligence, including independent research and consideration of various market analyses, remains crucial before making any investment decisions. Therefore, continue your research into high stock market valuations and investor concerns; utilize resources like BofA's analysis alongside other reputable sources to develop a well-informed investment strategy. Understanding the nuances of stock market analysis is key to navigating the complexities of the market and making informed decisions regarding high stock market valuations.

Featured Posts

-

Us Tightens Visa Rules Amidst Social Media Censorship Debate

May 30, 2025

Us Tightens Visa Rules Amidst Social Media Censorship Debate

May 30, 2025 -

Kodiak Shellfish Industry Faces Double Blow From Harmful Algal Blooms

May 30, 2025

Kodiak Shellfish Industry Faces Double Blow From Harmful Algal Blooms

May 30, 2025 -

Optakt Til Danmark Portugal Kampanalyse Og Spilforudsigelser

May 30, 2025

Optakt Til Danmark Portugal Kampanalyse Og Spilforudsigelser

May 30, 2025 -

Alcaraz Vs Musetti Rolex Monte Carlo Masters 2025 Final Preview

May 30, 2025

Alcaraz Vs Musetti Rolex Monte Carlo Masters 2025 Final Preview

May 30, 2025 -

Red Tide Crisis Cape Cod Issues Emergency Warning

May 30, 2025

Red Tide Crisis Cape Cod Issues Emergency Warning

May 30, 2025