Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Stance on Current Market Valuations

Bank of America's official stance on current market valuations is nuanced, acknowledging both the robust growth and inherent risks. While they don't outright declare a market bubble, they express caution, emphasizing the need for careful consideration and diversification.

- Specific quotes from BofA reports: BofA analysts have recently stated that while valuations are elevated compared to historical averages, current earnings growth and low interest rates offer some justification. However, they caution against complacency, warning that these factors are not guaranteed to persist.

- Indices and sectors: BofA's analysis frequently focuses on the S&P 500, paying close attention to the performance of technology stocks and other growth sectors, which have seen particularly significant increases in valuation. They also monitor key economic indicators like the Consumer Price Index (CPI) to gauge inflation risks.

- Economic forecasts: BofA's economic forecasts play a significant role in their valuation analysis. Their projections for future interest rate hikes, economic growth, and inflation directly influence their assessment of whether current valuations are sustainable in the long term.

Key Factors Driving High Stock Market Valuations (According to BofA)

BofA identifies several key factors contributing to the elevated stock market valuations:

- Low interest rates: Historically low interest rates have fueled investor risk appetite, encouraging capital flows into equities in search of higher returns. This has driven up demand and, consequently, prices.

- Strong corporate earnings: Several sectors, including technology and consumer staples, have reported strong earnings growth, supporting higher stock valuations. These robust earnings have bolstered investor confidence and fueled further investment.

- Government stimulus: Government stimulus packages, intended to mitigate the economic impact of the pandemic, have injected significant liquidity into the market, further boosting asset prices.

- Technological advancements: Innovation and technological advancements continue to drive growth in specific sectors, creating a positive feedback loop of increased investment and higher valuations for tech stocks and related companies.

BofA's Assessment of Risks Associated with High Valuations

Despite their relatively positive outlook, BofA acknowledges significant risks associated with the high valuations:

- Market correction: The potential for a market correction or even a more significant downturn is a significant risk. High valuations make the market more susceptible to sharp declines triggered by unexpected negative news or shifts in investor sentiment.

- Inflationary pressures: Rising inflation erodes the purchasing power of future earnings, impacting the present value of stocks. BofA carefully monitors inflation indicators to assess the risk of a significant inflationary surge.

- Geopolitical risks: Geopolitical uncertainties, such as international conflicts or trade disputes, can significantly impact market stability and investor confidence, potentially triggering a market sell-off.

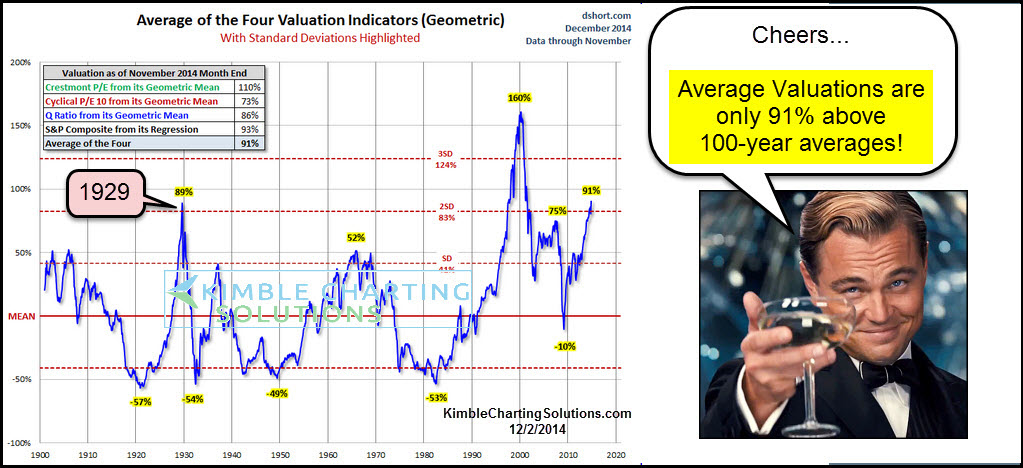

- Valuation multiples: BofA compares current valuation multiples (like the Price-to-Earnings ratio) to historical averages to gauge whether valuations are stretched. High multiples relative to historical norms often suggest a higher degree of risk.

BofA's Recommendations for Investors

BofA advocates a cautious yet opportunistic approach for investors in this environment:

- Diversification: BofA emphasizes the importance of diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Risk management: Investors should employ robust risk management techniques, including setting stop-loss orders and carefully managing their portfolio's exposure to specific sectors or asset classes.

- Sector rotation: BofA suggests considering sector rotation, shifting investments from overvalued sectors to potentially undervalued ones, based on their assessment of future growth prospects.

- Preferred asset classes: While acknowledging the attractiveness of certain growth sectors, BofA suggests careful evaluation of individual company fundamentals and valuations before making investment decisions, possibly favouring value stocks over growth stocks in some cases.

Alternative Perspectives on High Stock Market Valuations

It's important to acknowledge that not all analysts share BofA's perspective. Some financial institutions express more significant concerns about the potential for a market bubble and recommend a more defensive investment strategy.

- Contrasting predictions: Other financial institutions might highlight different risks or emphasize the potential for a steeper correction. Their analysis might lead to contrasting predictions regarding future market performance.

Conclusion: Addressing Investor Concerns About High Stock Market Valuations

Understanding investor concerns about high stock market valuations is crucial for navigating the current market. BofA's analysis highlights both the drivers of elevated valuations (low interest rates, strong earnings, government stimulus, and technological advancements) and the inherent risks (potential corrections, inflationary pressures, geopolitical risks, and high valuation multiples). Their recommendations emphasize diversification, risk management, and a careful assessment of individual investments. By considering BofA's analysis and conducting your own thorough research, you can make informed decisions and manage your portfolio effectively. Remember to consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Danse Avec Les Stars Le Jugement Severe D Ines Reg Un Traitement Different Pour Natasha St Pier

May 12, 2025

Danse Avec Les Stars Le Jugement Severe D Ines Reg Un Traitement Different Pour Natasha St Pier

May 12, 2025 -

Conor Mc Gregors Rare Photo With Adam Sandler A Happy Gilmore Shoutout

May 12, 2025

Conor Mc Gregors Rare Photo With Adam Sandler A Happy Gilmore Shoutout

May 12, 2025 -

The Rise Of Manon Fiorot A Single Loss Fueling A 12 Fight Winning Streak

May 12, 2025

The Rise Of Manon Fiorot A Single Loss Fueling A 12 Fight Winning Streak

May 12, 2025 -

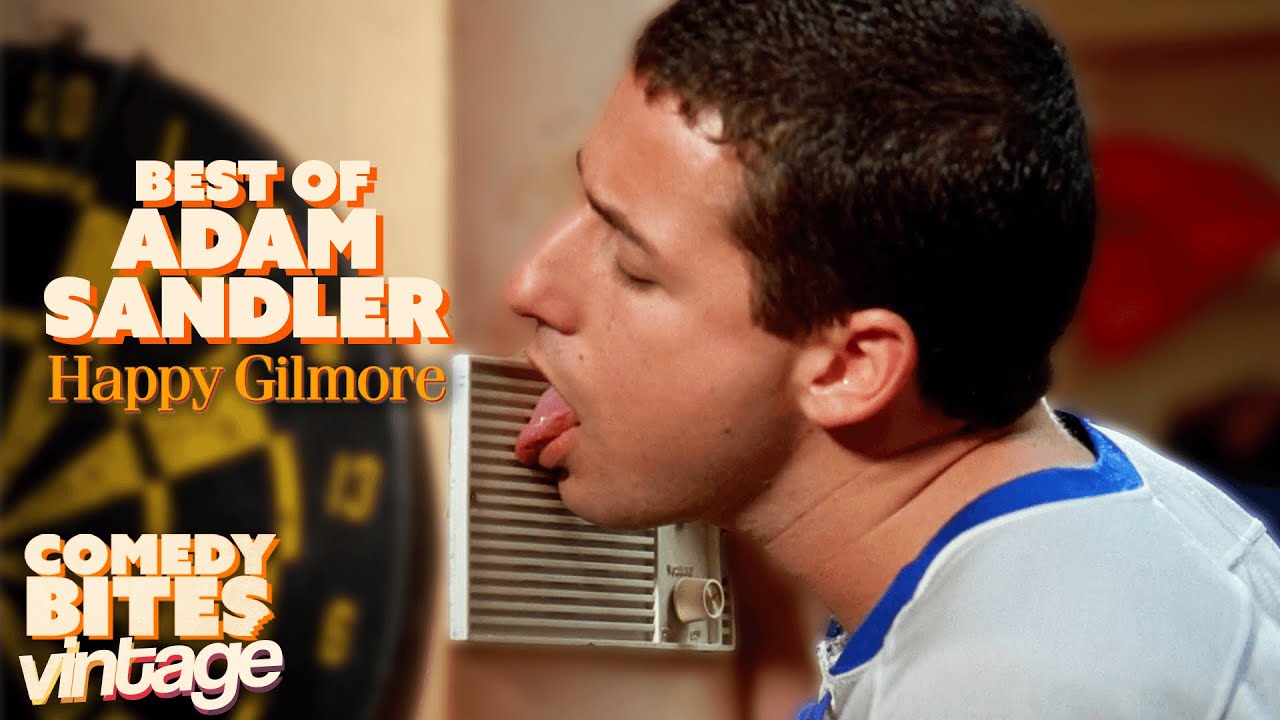

Como El Regalo De Uruguay Podria Beneficiar A Sus Exportaciones Ganaderas Con China

May 12, 2025

Como El Regalo De Uruguay Podria Beneficiar A Sus Exportaciones Ganaderas Con China

May 12, 2025 -

Zhang Weili Vs Valentina Shevchenko The Ufc 315 Possibility

May 12, 2025

Zhang Weili Vs Valentina Shevchenko The Ufc 315 Possibility

May 12, 2025

Latest Posts

-

Oregons Kelly Deja Blue A Tar Heels Ncaa Rematch Against Duke

May 13, 2025

Oregons Kelly Deja Blue A Tar Heels Ncaa Rematch Against Duke

May 13, 2025 -

Deja Kellys Game Winning Shot Leads Las Vegas Aces To Victory

May 13, 2025

Deja Kellys Game Winning Shot Leads Las Vegas Aces To Victory

May 13, 2025 -

Ncaa Tournament Deja Blue Kellys Return Against Duke

May 13, 2025

Ncaa Tournament Deja Blue Kellys Return Against Duke

May 13, 2025 -

Deja Blue In Oregon Kellys Ncaa Tournament Showdown Against Duke

May 13, 2025

Deja Blue In Oregon Kellys Ncaa Tournament Showdown Against Duke

May 13, 2025 -

Surprising Undrafted Rookie Competes For Roster Position

May 13, 2025

Surprising Undrafted Rookie Competes For Roster Position

May 13, 2025