Investor Concerns About Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on Overvaluation

BofA Global Research's recent report paints a concerning picture of current stock market valuations. The analysis employs several key valuation metrics to assess the equity market's health, focusing primarily on price-to-earnings ratios (P/E) and price-to-sales ratios (P/S). These metrics compare a company's market capitalization to its earnings and revenue, respectively, providing a gauge of how expensively the market is pricing stocks.

- Elevated P/E Ratios: BofA's analysis reveals that P/E ratios across several key sectors, particularly technology and consumer discretionary, are significantly above historical averages. For instance, the tech sector's average P/E might be reported as 35, compared to a long-term average of around 20. This suggests that investors are paying a premium for these stocks.

- High Price-to-Sales Ratios: Similarly, P/S ratios also indicate elevated valuations in many sectors. These high ratios suggest that investors are betting heavily on future revenue growth, a bet that may not always materialize.

- Specific Overvalued Sectors: The report may identify specific stocks and sectors deemed significantly overvalued based on their valuation multiples. This could include companies with high growth potential but also considerable risk.

Identifying Potential Risks and Vulnerabilities

The high valuations highlighted by BofA's analysis present several potential risks for investors. These include:

- Market Correction Risk: Overvalued markets are inherently susceptible to corrections. A sudden shift in investor sentiment, triggered by economic news or unforeseen events, could lead to a sharp decline in stock prices.

- Increased Market Volatility: Even without a full-blown correction, high valuations often translate to increased market volatility. Investors should brace themselves for sharper price swings and potentially higher transaction costs.

- Impact of Interest Rate Hikes: Rising interest rates, often employed to combat inflation, tend to negatively impact stock valuations. Higher rates increase borrowing costs for companies, potentially slowing down earnings growth. This makes high-growth stocks, particularly those with high P/E ratios, more vulnerable.

- Inflationary Pressures: Persistent inflationary pressures erode the purchasing power of future earnings, impacting the attractiveness of high valuations. Investors need to factor this erosion into their valuation assessments.

BofA's Recommendations and Strategic Implications

Based on their analysis, BofA likely recommends a more cautious and strategic approach to investing. This might include:

- Portfolio Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate) and sectors can help mitigate risk. Reducing exposure to overvalued sectors is crucial.

- Risk Management Strategies: Investors may need to adjust their risk tolerance and employ strategies such as stop-loss orders to limit potential losses.

- Shift Towards Value Investing: BofA might suggest exploring value investing strategies, focusing on undervalued companies with strong fundamentals and a lower risk profile. This could involve seeking out companies with low P/E ratios and strong balance sheets.

- Tactical Asset Allocation: Adjusting asset allocation based on market conditions and economic forecasts is essential. This might involve shifting from growth stocks to more defensive stocks in a potentially overvalued market.

Alternative Perspectives and Counterarguments

While BofA's analysis highlights significant concerns, it's essential to acknowledge alternative perspectives. Some analysts might argue that:

- Strong Economic Growth Justifies High Valuations: Sustained economic growth and robust corporate earnings could justify the current high valuations.

- Future Earnings Growth Could Outpace Current Valuations: Projections of strong future earnings growth could support the current market prices.

- Market Sentiment Remains Positive: Strong market sentiment and continued investor confidence could sustain current valuations.

- Long-Term Investment Horizons: A long-term investment perspective might diminish the impact of short-term market fluctuations.

Conclusion

BofA's analysis underscores significant investor concerns regarding current stock market valuations. The potential risks associated with overvalued sectors, including market corrections and increased volatility, demand a cautious approach. Careful consideration of valuation metrics like P/E and P/S ratios, alongside a robust risk management strategy, is crucial. BofA's recommendations highlight the need for portfolio diversification and potentially a shift towards value investing. Conduct thorough research, consult with financial advisors, and develop a well-informed investment strategy to navigate the current market landscape. Proactively assessing stock market valuations and managing stock market valuation risk will be key to navigating the complexities of the current market.

Featured Posts

-

Understanding Papal Names History Significance And Predictions For The Future

May 06, 2025

Understanding Papal Names History Significance And Predictions For The Future

May 06, 2025 -

Thrifty Shopping High Quality On A Low Budget

May 06, 2025

Thrifty Shopping High Quality On A Low Budget

May 06, 2025 -

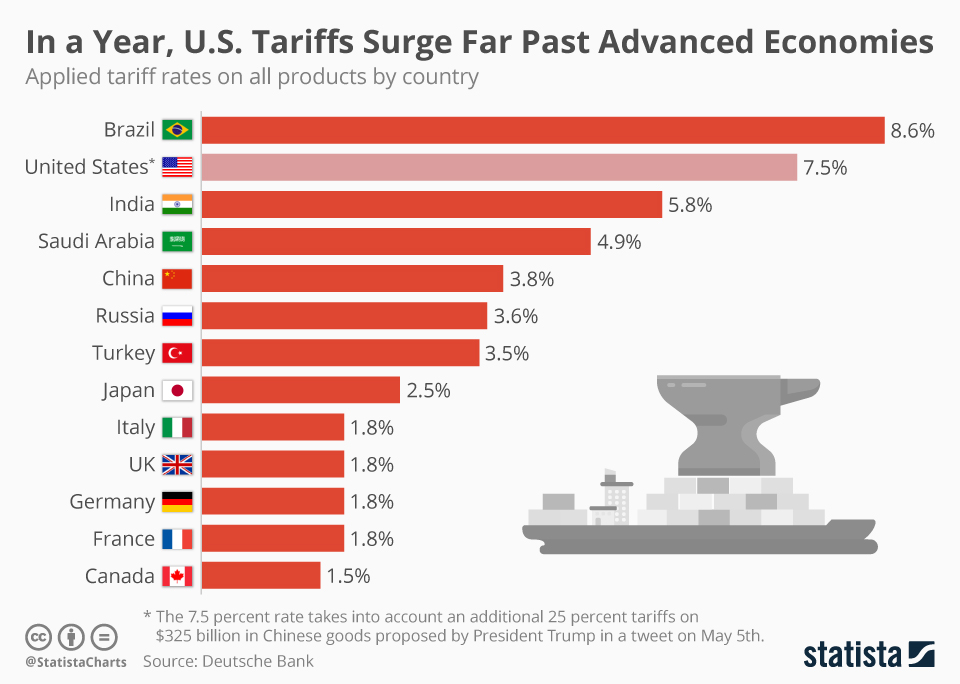

Trumps Tariffs A Boon For Some Us Manufacturers

May 06, 2025

Trumps Tariffs A Boon For Some Us Manufacturers

May 06, 2025 -

Chris Pratt Praises Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025

Chris Pratt Praises Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025 -

Patrick Schwarzenegger A Major Role In Luca Guadagninos Upcoming Project

May 06, 2025

Patrick Schwarzenegger A Major Role In Luca Guadagninos Upcoming Project

May 06, 2025

Latest Posts

-

Mindy Kalings Slim Figure Stuns Fans At Series Premiere

May 06, 2025

Mindy Kalings Slim Figure Stuns Fans At Series Premiere

May 06, 2025 -

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025 -

Mindy Kalings Dramatic Weight Loss Fans React To New Appearance

May 06, 2025

Mindy Kalings Dramatic Weight Loss Fans React To New Appearance

May 06, 2025 -

Analyzing The Best Female Characters From Mindy Kalings Shows

May 06, 2025

Analyzing The Best Female Characters From Mindy Kalings Shows

May 06, 2025 -

Mindy Kaling E Seu Relacionamento Conturbado A Verdade Sobre Seu Passado Com Ex De The Office

May 06, 2025

Mindy Kaling E Seu Relacionamento Conturbado A Verdade Sobre Seu Passado Com Ex De The Office

May 06, 2025