Investor Concerns Regarding Google's AI Development And Strategy

Table of Contents

Competition and Market Saturation in the AI Landscape

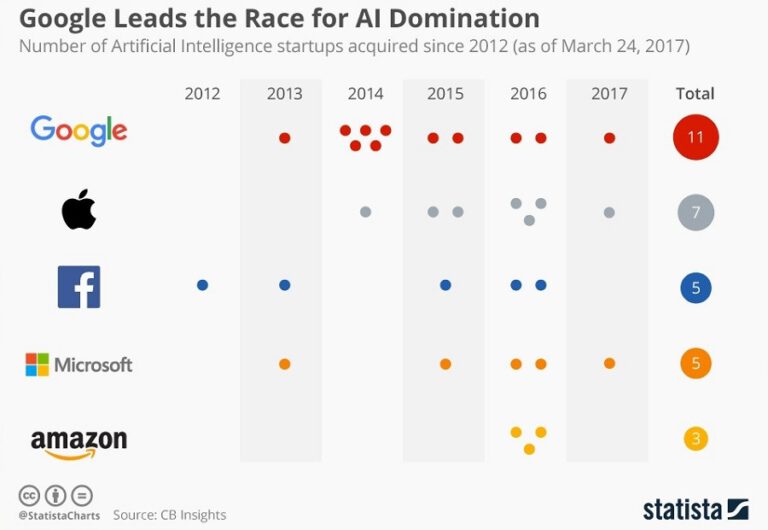

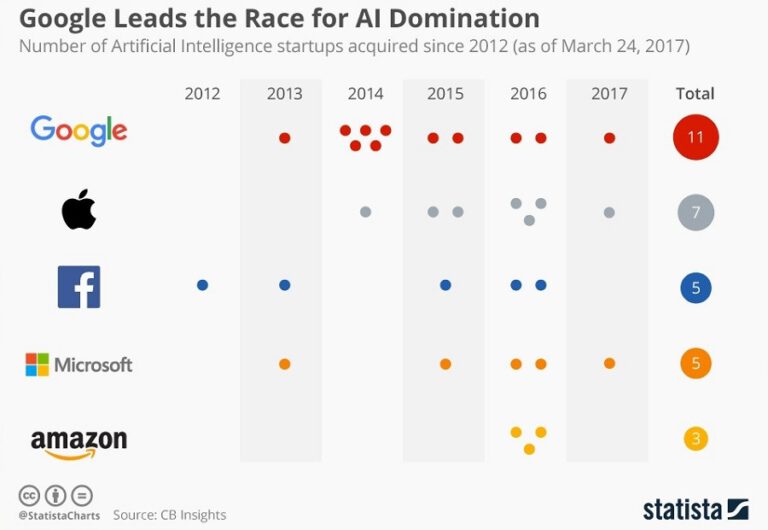

The AI market is fiercely competitive. Google faces stiff opposition from formidable players like OpenAI, Microsoft, and a growing cohort of ambitious startups. This intense rivalry raises concerns about Google's capacity to retain its competitive edge in this dynamic environment. The fear is that Google, despite its early advancements, might be losing ground.

- OpenAI's ChatGPT and its impact on search engine dominance: ChatGPT's impressive natural language processing capabilities pose a direct threat to Google's core search business. The potential for a paradigm shift in how users access information is a major source of investor concern.

- Microsoft's integration of AI into its products and services: Microsoft's aggressive integration of OpenAI's technology into its existing product ecosystem (Bing, Office 365, etc.) presents a significant challenge to Google's integrated services strategy. This synergy creates a potent competitor.

- The emergence of other powerful AI players and the potential for market fragmentation: The AI landscape is becoming increasingly crowded, with numerous companies developing specialized AI solutions. This fragmentation could dilute Google's market share and erode its revenue streams.

The potential for decreased market share and reduced revenue growth directly impacts Google's stock price and overall financial performance, leading to justifiable investor apprehension. Maintaining its competitive position requires significant and ongoing investment, adding pressure on profitability.

Ethical Concerns and Regulatory Risks Surrounding Google's AI

Beyond the competitive landscape, Google's AI ambitions face considerable ethical and regulatory hurdles. The potential for AI bias, the spread of misinformation, and the displacement of workers are all major concerns that could lead to significant financial repercussions.

- Concerns about AI bias and fairness in Google's algorithms: Bias in AI algorithms can lead to discriminatory outcomes, potentially resulting in legal challenges and reputational damage. This is a major risk for Google, especially given its wide-ranging influence.

- The potential for misuse of AI technology and the spread of misinformation: The ability of AI to generate realistic but false information poses a significant risk, potentially impacting public trust and leading to regulatory intervention.

- Upcoming regulations on AI development and deployment, and their potential costs: Governments worldwide are increasingly scrutinizing AI development, leading to the potential for costly regulations and compliance challenges.

The financial implications of potential lawsuits, regulatory fines, and reputational damage stemming from these ethical concerns are substantial, contributing significantly to investor anxiety surrounding Google's AI strategy.

The Financial Viability and ROI of Google's AI Investments

Google is investing heavily in AI research and development, but the return on investment (ROI) remains uncertain. Investors are naturally concerned about the substantial financial commitments involved and the potential for delayed or insufficient returns.

- High costs associated with AI research, development, and talent acquisition: Attracting and retaining top AI talent is an expensive endeavor, further increasing the financial burden on Google.

- Uncertainties regarding the market adoption and profitability of AI-powered products: The success of AI-driven products and services is not guaranteed, adding further risk to Google's substantial investments.

- The long-term nature of AI investment and the potential for delayed returns: The development and deployment of successful AI applications often require years of investment before generating substantial returns. This long-term horizon is a key source of investor uncertainty.

The potential for underwhelming returns on these massive investments could negatively impact Google's stock price and erode investor confidence, making this a critical area of concern.

Google's AI Strategy and its Long-Term Sustainability

Google's current AI strategy needs careful evaluation to determine its long-term viability and its effectiveness in addressing investor concerns.

- Assessment of Google’s current AI product portfolio and market penetration: Analyzing the success and market penetration of Google's existing AI products provides a critical assessment of its current strategy.

- Analysis of Google's approach to monetizing AI-driven technologies: A clear path to monetization is crucial for assuaging investor anxieties about the financial viability of Google's AI investments.

- Evaluation of Google's strategy for managing ethical and regulatory challenges: A robust strategy for addressing ethical concerns and navigating regulatory hurdles is paramount for long-term success and investor confidence.

Significant adjustments to Google's approach, focusing on improved product market fit, clear monetization strategies, and proactive ethical and regulatory compliance, might be necessary to alleviate investor apprehension and ensure the long-term sustainability of its AI endeavors.

Conclusion: Addressing Investor Concerns Regarding Google's AI Future

Investor concerns regarding Google's AI development and strategy are multifaceted, encompassing fierce competition, significant ethical considerations, substantial financial risks, and uncertainty surrounding the long-term sustainability of its approach. Addressing these concerns is crucial for maintaining investor confidence and securing Google's continued leadership in the AI market. Further research and in-depth analysis of Google's financial reports and public statements related to AI are essential for a more informed understanding of the challenges and opportunities that lie ahead. A proactive approach to addressing Investor Concerns Regarding Google's AI Development and Strategy is paramount for Google's future success.

Featured Posts

-

Remont Pivdennogo Mostu Khto Vikonuye Roboti Ta Skilki Koshtuye

May 22, 2025

Remont Pivdennogo Mostu Khto Vikonuye Roboti Ta Skilki Koshtuye

May 22, 2025 -

The Goldbergs Behind The Scenes Stories And Trivia

May 22, 2025

The Goldbergs Behind The Scenes Stories And Trivia

May 22, 2025 -

Marche Du Travail Des Cordistes A Nantes Analyse De La Croissance

May 22, 2025

Marche Du Travail Des Cordistes A Nantes Analyse De La Croissance

May 22, 2025 -

Abn Amro Marktontwikkelingen In De Occasionverkoop

May 22, 2025

Abn Amro Marktontwikkelingen In De Occasionverkoop

May 22, 2025 -

Half Dome Wins Abn Group Victoria Media Account

May 22, 2025

Half Dome Wins Abn Group Victoria Media Account

May 22, 2025

Latest Posts

-

Wildlife Rescue A Uw Documentary On The Pronghorns Winter Struggle And Recovery

May 22, 2025

Wildlife Rescue A Uw Documentary On The Pronghorns Winter Struggle And Recovery

May 22, 2025 -

Volunteer For Wyomings Guided Fishing Advisory Board

May 22, 2025

Volunteer For Wyomings Guided Fishing Advisory Board

May 22, 2025 -

New Documentary Highlights Pronghorn Survival After Harsh Winter

May 22, 2025

New Documentary Highlights Pronghorn Survival After Harsh Winter

May 22, 2025 -

Investigation Into Cwd At A Jackson Hole Elk Feedground

May 22, 2025

Investigation Into Cwd At A Jackson Hole Elk Feedground

May 22, 2025 -

Wyoming Wildlife Needs You Join The Guided Fishing Advisory Board

May 22, 2025

Wyoming Wildlife Needs You Join The Guided Fishing Advisory Board

May 22, 2025