Investor Flight To Safety: Gold And Cash ETFs Surge

Table of Contents

The Appeal of Gold ETFs as Safe Haven Assets

Gold has historically served as a safe haven asset during times of economic turmoil. Its inherent value and limited supply make it a reliable store of value when other assets falter. Gold ETFs offer investors a convenient and cost-effective way to gain exposure to gold without the complexities and risks associated with physical gold ownership, such as storage and security. This makes gold ETF investing accessible to a wider range of investors.

- Gold's value often rises during periods of inflation, acting as a hedge against currency devaluation. This is because inflation erodes the purchasing power of fiat currencies, while gold typically maintains or increases its value.

- Gold ETFs provide liquidity and transparency, allowing investors to easily buy and sell shares on major exchanges throughout the trading day. This contrasts sharply with the illiquidity of physical gold, which can take time to sell.

- Diversifying a portfolio with gold can reduce overall risk. Gold often shows a low correlation with other asset classes like stocks and bonds, meaning its price movements don't always mirror theirs. This lack of correlation provides valuable portfolio diversification and risk mitigation.

- Low correlation with other asset classes makes gold a valuable portfolio diversifier. During market downturns, when other investments lose value, gold can often hold its value or even appreciate, providing a buffer against overall portfolio losses. The gold price is influenced by various factors, including global economic conditions, investor sentiment, and industrial demand for the precious metal.

Cash ETFs: A Low-Risk, Liquid Option

Cash ETFs provide investors with access to highly liquid, low-risk investments, offering a safe haven during times of market volatility. These ETFs typically invest in short-term, high-quality debt securities, such as U.S. Treasury bills, providing a stable and secure investment option. They are often seen as a superior alternative to traditional money market funds due to increased transparency and regulatory oversight.

- Cash ETFs offer easy access to funds. Investors can quickly buy and sell shares, making them ideal for short-term needs or emergency funds. This contrasts with longer-term investments which may require time to liquidate.

- They are ideal for preserving capital during periods of uncertainty. Their low-risk profile makes them attractive to investors seeking to protect their principal rather than aiming for high returns.

- While returns may be modest, they offer stability and security, especially when compared to more volatile investments like stocks. Returns are generally tied to prevailing short-term interest rates.

- Suitable for short-term investment goals or emergency funds. Their liquidity and low risk make them a sensible choice for investors who need ready access to their funds.

Market Factors Driving the Investor Flight to Safety

Several factors contribute to the current investor flight to safety evident in the increased demand for gold and cash ETFs. These interconnected factors create a climate of uncertainty, prompting investors to seek the relative security of safe haven assets.

- High inflation erodes purchasing power, making gold and cash, which tend to hold their value during inflationary periods, more attractive. The current inflationary environment is a key driver of this trend.

- Recession fears prompt investors to seek stability and capital preservation. Concerns about an economic slowdown increase demand for assets that are less susceptible to market downturns.

- Geopolitical events create uncertainty and increase demand for safe haven assets. Global instability and uncertainty often lead investors to seek the perceived safety of gold and cash.

- Rising interest rates can impact the performance of other asset classes. Higher interest rates can negatively affect bond prices and stock valuations, making gold and cash relatively more appealing.

Analyzing the Long-Term Implications

While the current surge in gold and cash ETFs reflects a short-term response to market uncertainty, understanding the long-term implications is crucial for investors. The "flight to safety" is a temporary phenomenon; eventually, market conditions will likely change. However, a diversified portfolio incorporating a mix of asset classes, including growth assets alongside safe havens, remains essential for long-term growth and risk management. The allocation between these asset classes should be tailored to an individual investor's risk tolerance and investment timeframe.

Conclusion

The recent surge in gold and cash ETFs underscores a significant "investor flight to safety," driven by prevailing market uncertainty and fears related to inflation, recession, and geopolitical risks. The appeal of these assets as safe havens during times of economic turmoil is undeniable. While gold and cash ETFs offer a degree of security during uncertain times, a well-diversified investment strategy that balances risk and reward remains paramount for long-term success. Consider exploring the potential benefits of gold and cash ETFs as part of your overall investment strategy, but remember to consult a financial advisor before making significant investment decisions. Don't miss out on the opportunity to secure your portfolio with gold and cash ETFs in this volatile market.

Featured Posts

-

Portrait De Christelle Le Hir Presidente Du Directoire De La Vie Claire Et Du Synadis Bio

Apr 23, 2025

Portrait De Christelle Le Hir Presidente Du Directoire De La Vie Claire Et Du Synadis Bio

Apr 23, 2025 -

Allemagne Legislatives 2024 Derniers Preparatifs Et Enjeux

Apr 23, 2025

Allemagne Legislatives 2024 Derniers Preparatifs Et Enjeux

Apr 23, 2025 -

Cy Young Winners April Outing Nine Run Lead Didnt Dampen Strikeout Fury

Apr 23, 2025

Cy Young Winners April Outing Nine Run Lead Didnt Dampen Strikeout Fury

Apr 23, 2025 -

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025 -

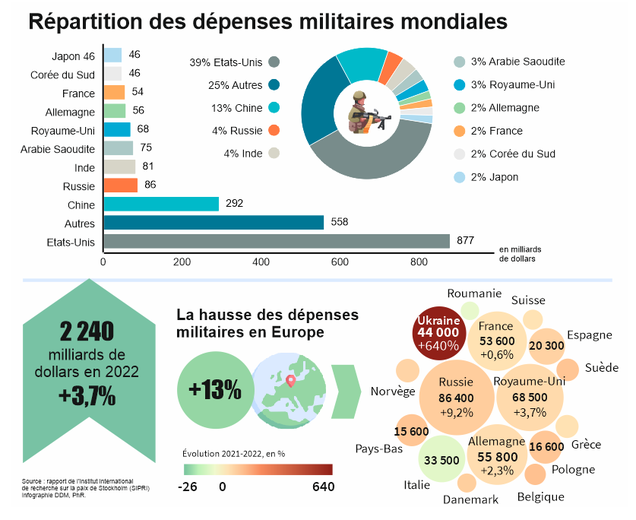

John Plassard Sur Les Depenses Militaires Usa Et Russie Face A Face

Apr 23, 2025

John Plassard Sur Les Depenses Militaires Usa Et Russie Face A Face

Apr 23, 2025