Investor Guide: BofA's Take On Elevated Stock Market Valuations

Table of Contents

BofA's Current Market Outlook

BofA's current market outlook provides valuable context for understanding the implications of elevated stock market valuations. Their analysis considers several key macroeconomic factors, offering a comprehensive perspective on the potential trajectory of major market indices.

-

BofA's predicted trajectory for major indices: While specific predictions vary depending on the timeframe, BofA's recent reports often include forecasts for the S&P 500, Dow Jones Industrial Average, and other key benchmarks. These forecasts generally consider potential growth, economic slowdown scenarios, and the impact of interest rate changes. It's crucial to remember that these are forecasts, not guarantees.

-

Assessment of current economic indicators: BofA closely monitors key economic indicators, such as inflation rates, consumer confidence, unemployment figures, and GDP growth. Their analysis incorporates these indicators to assess the overall health of the economy and its potential impact on stock prices. Understanding the relationship between these indicators and market performance is vital for informed investing.

-

BofA's view on the sustainability of current valuation levels: BofA's analysts continuously evaluate whether current valuation levels are sustainable in the long term. They consider factors like earnings growth, interest rate environments, and geopolitical events to determine the likelihood of a market correction or continued growth. This assessment is critical for determining appropriate investment strategies.

-

Specific sectors identified as overvalued or undervalued: BofA often highlights specific sectors they believe are currently overvalued or undervalued. This sector-specific analysis allows investors to make more targeted decisions, potentially capitalizing on undervalued opportunities or mitigating risk in overvalued areas. Understanding these sector-specific assessments is crucial for effective portfolio management.

Understanding the Drivers of Elevated Valuations

Several factors contribute to the current high stock prices and elevated stock market valuations. Analyzing these drivers is crucial for comprehending the current market environment and making informed investment decisions.

-

Stock Valuation Metrics: Key valuation metrics, such as the Price-to-Earnings ratio (P/E), help assess whether stocks are trading at historically high or low multiples of their earnings. Currently, many market indices show elevated P/E ratios, indicating potentially high valuations.

-

Low Interest Rates and Quantitative Easing: Historically low interest rates and quantitative easing policies implemented by central banks have injected significant liquidity into the market, pushing up asset prices, including stocks. This easy monetary policy has played a significant role in fueling market growth and potentially contributing to high stock prices.

-

Impact of Corporate Earnings Growth: Strong corporate earnings growth can justify high valuations. However, if earnings growth fails to keep pace with rising stock prices, it can lead to a situation where valuations become unsustainable. Analyzing earnings reports and growth projections is essential in evaluating whether current valuations are justified.

-

Geopolitical Factors: Geopolitical events, such as trade wars, political instability, and global pandemics, can significantly impact market sentiment and valuations. These unpredictable factors often contribute to market volatility and influence investor behavior.

Strategies for Navigating High Valuations

Given BofA's insights on elevated stock market valuations, investors need to adopt appropriate strategies to navigate this market environment. A well-defined investment strategy is crucial for mitigating risk and potentially capitalizing on opportunities.

-

Risk Reduction Strategies: Diversification across asset classes (stocks, bonds, real estate, etc.) is a cornerstone of risk management. Investing in defensive stocks – companies less susceptible to economic downturns – can also help reduce portfolio volatility.

-

Opportunities in Undervalued Sectors: BofA's analysis may highlight specific sectors or stocks they consider undervalued. Identifying these potential opportunities can allow investors to capitalize on situations where the market may be mispricing assets.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is crucial in navigating market fluctuations. Short-term market movements should not dictate long-term investment strategies.

-

Value vs. Growth Investing: The choice between value investing (focusing on undervalued stocks) and growth investing (focusing on companies with high growth potential) depends on individual risk tolerance and market conditions. BofA's insights can inform this crucial decision.

Risk Mitigation and Portfolio Adjustments

Effective risk management is paramount during periods of elevated stock market valuations. Proactive adjustments to your investment portfolio can help mitigate potential losses and ensure your financial goals remain on track.

-

Assessing Risk Tolerance: Understanding your personal risk tolerance is crucial. Investors with lower risk tolerance may need to shift their portfolios towards more conservative investments.

-

Portfolio Rebalancing: Regularly rebalancing your portfolio – adjusting asset allocation to maintain your desired risk level – can help mitigate risk and capitalize on market opportunities.

-

Planning for Market Corrections: Preparing for potential market corrections or downturns is crucial. Having a plan in place to manage potential losses can minimize the impact of market volatility.

-

Seeking Professional Advice: Consulting a qualified financial advisor can provide personalized guidance on managing your investments during periods of high valuations and market uncertainty. Their expertise can help you tailor your investment strategy to your specific needs and risk profile.

Conclusion

BofA's analysis of elevated stock market valuations highlights the importance of informed decision-making. By understanding the drivers of high valuations, adopting appropriate investment strategies, and implementing effective risk management techniques, investors can navigate this challenging market environment more effectively. Remember, maintaining a long-term perspective, diversifying your portfolio, and potentially seeking professional financial advice are crucial steps in managing your investments during periods of uncertainty. Staying informed about elevated stock market valuations is crucial for successful investing. Use BofA's insights and this guide to develop a robust investment strategy that aligns with your risk tolerance and financial goals. Continue to monitor market trends and seek professional financial advice to refine your investment approach today!

Featured Posts

-

Turning Poop Into Profit An Ai Powered Podcast From Repetitive Documents

May 16, 2025

Turning Poop Into Profit An Ai Powered Podcast From Repetitive Documents

May 16, 2025 -

Chandler Simpsons Breakout Game Fuels Rays Padres Sweep

May 16, 2025

Chandler Simpsons Breakout Game Fuels Rays Padres Sweep

May 16, 2025 -

Tom Cruise And Ana De Armas A New Romance Blossoming In The Uk

May 16, 2025

Tom Cruise And Ana De Armas A New Romance Blossoming In The Uk

May 16, 2025 -

San Diego Padres Vs New York Yankees Prediction Can The Padres Win Seven In A Row

May 16, 2025

San Diego Padres Vs New York Yankees Prediction Can The Padres Win Seven In A Row

May 16, 2025 -

Hudson Bay Granted Court Approval For Extended Creditor Protection

May 16, 2025

Hudson Bay Granted Court Approval For Extended Creditor Protection

May 16, 2025

Latest Posts

-

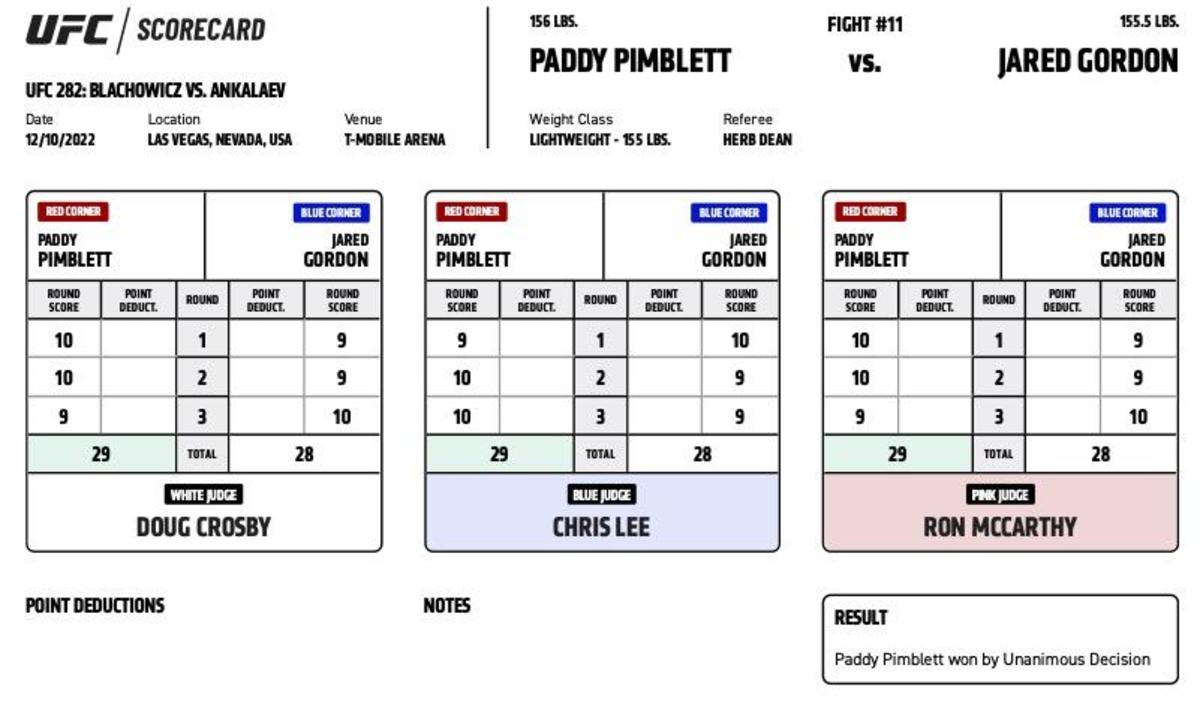

From Written Off To Title Contender Paddy Pimbletts Journey

May 16, 2025

From Written Off To Title Contender Paddy Pimbletts Journey

May 16, 2025 -

Gordon Ramsay Chandlers Ufc Loss To Pimblett No Surprise

May 16, 2025

Gordon Ramsay Chandlers Ufc Loss To Pimblett No Surprise

May 16, 2025 -

Will Paddy Pimblett Become Ufc Champion A Legends Prediction

May 16, 2025

Will Paddy Pimblett Become Ufc Champion A Legends Prediction

May 16, 2025 -

Paddy Pimblett From Underdog To Ufc Title Contender

May 16, 2025

Paddy Pimblett From Underdog To Ufc Title Contender

May 16, 2025 -

Paddy Pimbletts Ufc Title Shot A Legends Change Of Heart

May 16, 2025

Paddy Pimbletts Ufc Title Shot A Legends Change Of Heart

May 16, 2025