Investor Sentiment And Market Timing: A Case Study Of Leveraged Semiconductor ETFs

Table of Contents

Understanding Investor Sentiment in the Semiconductor Sector

Gauging the prevailing mood in the semiconductor market is paramount for successful investing. Several indicators can provide valuable clues.

Gauging Market Sentiment:

-

News Sentiment Analysis: Analyzing news articles and financial publications for positive or negative mentions of semiconductor companies and the overall sector can reveal shifts in investor confidence. Positive news often correlates with rising stock prices, while negative news can trigger sell-offs. For example, announcements of new technological breakthroughs usually boost sentiment, whereas supply chain disruptions or geopolitical instability can dampen it.

-

Social Media Trends: Monitoring social media platforms like Twitter and Reddit for discussions and sentiment surrounding semiconductor stocks and related news can provide real-time insights into investor psychology. An increase in positive commentary might suggest growing optimism, while a surge in negative posts could indicate growing concerns.

-

Analyst Ratings: Following the recommendations and price targets of financial analysts specializing in the semiconductor industry offers a valuable professional perspective. Upgraded ratings generally signal positive sentiment, while downgrades often point to growing pessimism.

-

Investor Surveys: Regular surveys of investor sentiment conducted by financial institutions provide aggregated data on confidence levels. These surveys offer a broader perspective on investor expectations and overall market sentiment.

The Role of Macroeconomic Factors:

Broader economic conditions significantly influence investor sentiment towards the semiconductor industry.

-

Interest Rates: Higher interest rates increase borrowing costs, potentially impacting capital expenditures by semiconductor companies and reducing demand. This can negatively affect investor sentiment and stock prices.

-

Inflation: High inflation erodes purchasing power and can lead to reduced consumer spending on electronics, lowering demand for semiconductors and impacting investor confidence.

-

Geopolitical Events: Geopolitical instability, trade wars, and sanctions can disrupt supply chains, impacting semiconductor production and investor sentiment negatively. The recent US-China trade tensions serve as a prime example.

Leveraged ETFs and Their Amplified Volatility

Leveraged ETFs aim to deliver magnified returns – or losses – relative to the underlying index. However, their mechanics require careful consideration.

Mechanics of Leveraged ETFs:

-

Daily Reset: Leveraged ETFs reset their leverage daily. This means they aim to achieve a multiple of the daily return of the underlying index, not the total return over longer periods.

-

Volatility Decay: Due to the daily reset, prolonged periods of volatility can significantly erode returns, even if the underlying index eventually recovers.

-

Leverage: The leverage multiplier (e.g., 2x, 3x) determines the extent to which the ETF amplifies the daily performance of the underlying index. Higher leverage amplifies both gains and losses.

Risk Management Strategies for Leveraged Semiconductor ETFs:

Investors need robust risk management strategies to mitigate the amplified volatility of Leveraged Semiconductor ETFs:

-

Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes to reduce overall risk.

-

Stop-Loss Orders: Set stop-loss orders to automatically sell the ETF if it falls below a predetermined price, limiting potential losses.

-

Short-Term Trading Horizons: Given the risks associated with long-term holding, leveraged ETFs are often more suitable for shorter-term trading strategies.

Case Study Analysis: Market Timing with Leveraged Semiconductor ETFs

For this case study, we will analyze the performance of two leveraged semiconductor ETFs: SOXL (ProShares Ultra Semiconductor) and SMDD (Direxion Daily Semiconductor Bear 3X Shares). We chose these ETFs to illustrate both bullish and bearish leveraged strategies.

Selecting Specific ETFs:

SOXL is a 2x leveraged ETF tracking the performance of the ICE Semiconductor Index, representing a bullish bet on the semiconductor sector. SMDD, on the other hand, is a 3x leveraged ETF designed to profit from declines in the semiconductor sector.

Data Analysis and Performance Evaluation:

We analyzed the performance of SOXL and SMDD from January 1, 2020, to December 31, 2022. The analysis compared their returns to the iShares Semiconductor ETF (SOXX), a non-leveraged benchmark. Performance metrics included total return, Sharpe Ratio, and maximum drawdown.

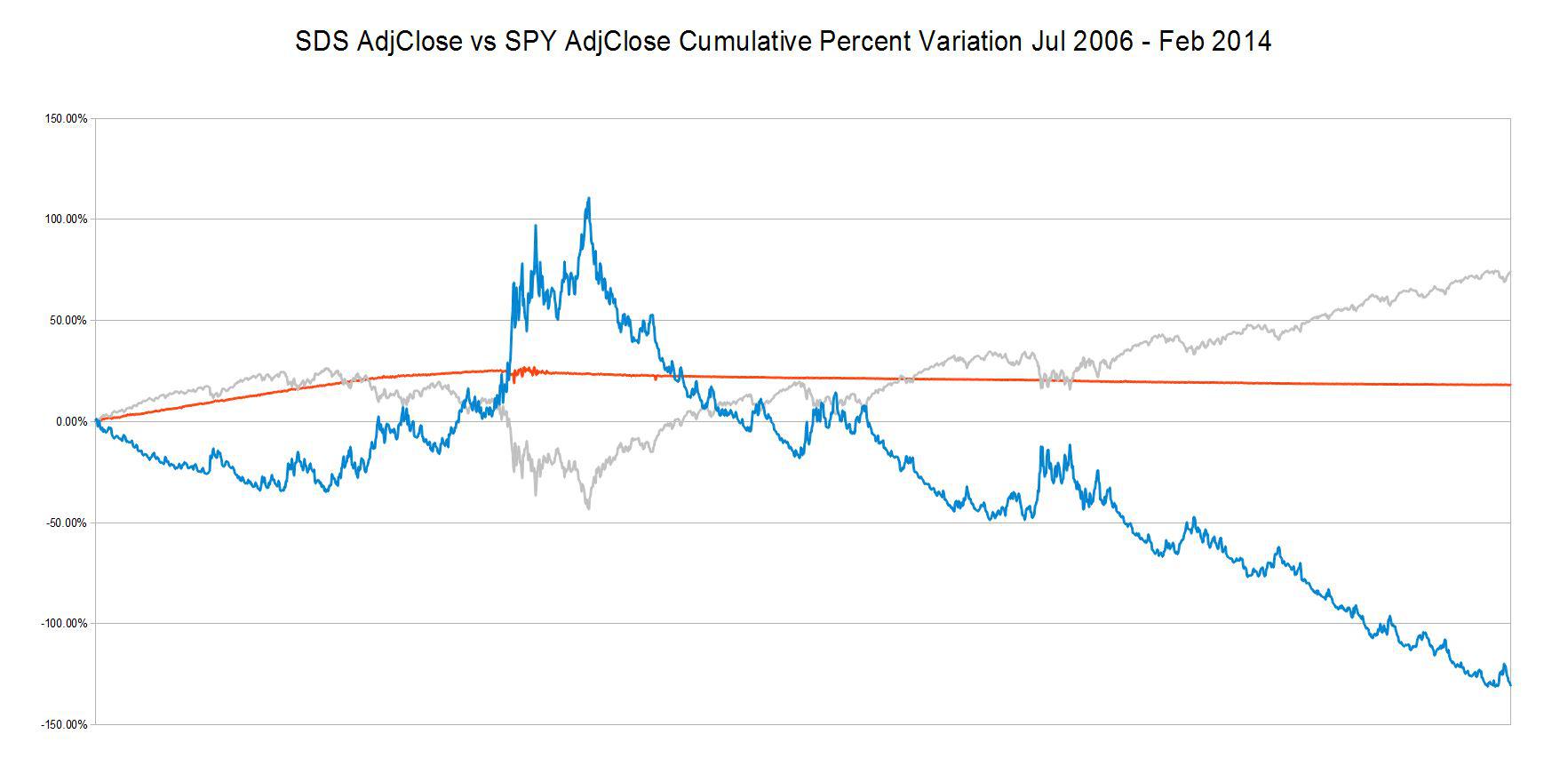

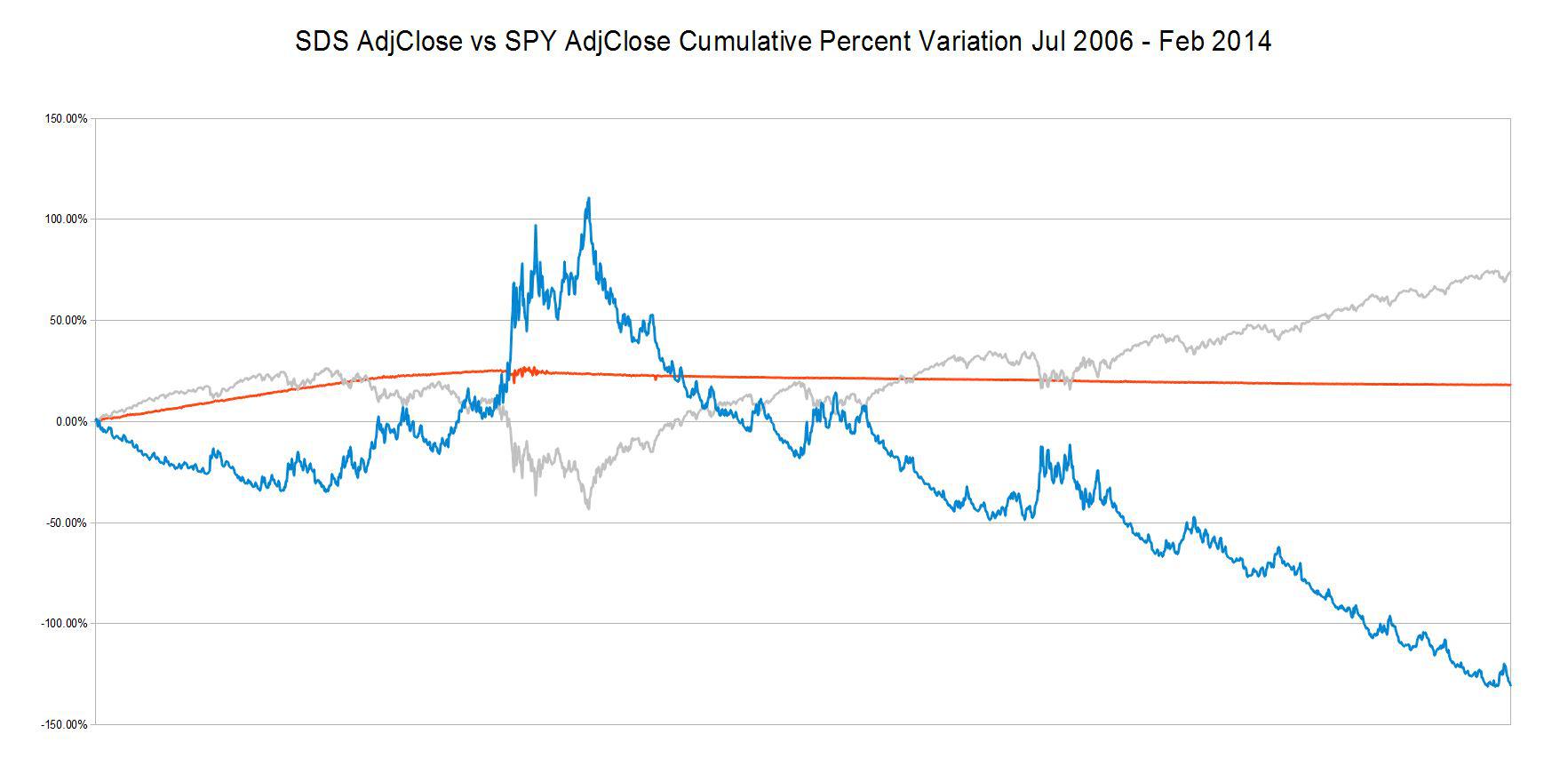

[Insert charts and graphs here illustrating the performance comparison, clearly labeled and indicating periods of high and low investor sentiment.]

Lessons Learned from the Case Study:

The case study highlighted the significant impact of market timing and investor sentiment on the performance of Leveraged Semiconductor ETFs. Periods of strong positive sentiment and rising semiconductor prices resulted in substantial gains for SOXL, while periods of negative sentiment led to significant losses. Similarly, SMDD performed well during periods of market downturn but underperformed when the semiconductor sector rallied. This emphasizes the importance of accurate sentiment analysis and well-defined trading strategies. Simply put, successfully utilizing leveraged semiconductor ETFs requires impeccable timing.

Conclusion

Investing in Leveraged Semiconductor ETFs presents both considerable opportunities and significant risks. Our case study underscores the critical role of understanding investor sentiment, macroeconomic factors, and the inherent volatility of leveraged products. Successful market timing with these ETFs requires sophisticated analysis and robust risk management. Before investing in leveraged semiconductor ETFs, conduct thorough research, carefully consider your risk tolerance, and perhaps consult with a financial advisor. Additional resources on ETF investing and risk management are readily available online. Remember, the key to success with leveraged semiconductor ETFs lies in informed decision-making and a clear understanding of the inherent challenges.

Featured Posts

-

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025 -

Edan Alexander Kidnapping Updates And Concerns

May 13, 2025

Edan Alexander Kidnapping Updates And Concerns

May 13, 2025 -

Fylm Zndgy Namh Ay Aywl Knywl Akhryn Akhbar Az Mdhakrat Ba Lywnardw Dy Kapryw W Adryn Brwdy

May 13, 2025

Fylm Zndgy Namh Ay Aywl Knywl Akhryn Akhbar Az Mdhakrat Ba Lywnardw Dy Kapryw W Adryn Brwdy

May 13, 2025 -

The New Workplace Reality Bosses Tough Talk And Employee Concerns

May 13, 2025

The New Workplace Reality Bosses Tough Talk And Employee Concerns

May 13, 2025 -

Lywnardw Dy Kapryw W Adryn Brwdy Ahtmal Hdwr Dr Fylm Jdyd Aywl Knywl

May 13, 2025

Lywnardw Dy Kapryw W Adryn Brwdy Ahtmal Hdwr Dr Fylm Jdyd Aywl Knywl

May 13, 2025

Latest Posts

-

The Low Box Office Returns Of Captain America Brave New World Reasons And Implications

May 14, 2025

The Low Box Office Returns Of Captain America Brave New World Reasons And Implications

May 14, 2025 -

Walmart Recall Check Your Pantry And Craft Supplies For Affected Products

May 14, 2025

Walmart Recall Check Your Pantry And Craft Supplies For Affected Products

May 14, 2025 -

Nationwide Recall Walmarts Igloo Coolers Risk Severe Finger Injuries

May 14, 2025

Nationwide Recall Walmarts Igloo Coolers Risk Severe Finger Injuries

May 14, 2025 -

Captain America Brave New World A Box Office Underperformer Compared To Other Mcu Films

May 14, 2025

Captain America Brave New World A Box Office Underperformer Compared To Other Mcu Films

May 14, 2025 -

Walmart Recalls Baby Products And Unstable Dressers

May 14, 2025

Walmart Recalls Baby Products And Unstable Dressers

May 14, 2025