Iron Ore Market Forecast: Considering The Impact Of China's Steel Production Reductions

Table of Contents

China's Steel Production Cuts: The Driving Force

China's steel industry is undergoing a dramatic transformation, driven primarily by two key factors: stricter environmental regulations and a slowdown in the real estate market. These intertwined forces are significantly impacting global iron ore demand.

Environmental Regulations and Their Impact

The Chinese government is intensifying its efforts to achieve carbon neutrality and reduce carbon emissions. This commitment translates into increasingly stringent environmental regulations for steel mills.

- New environmental regulations: Implementation of stricter emission limits and quotas for steel production.

- Stricter emission standards: Increased penalties for non-compliance with environmental regulations.

- Carbon neutrality targets: Aggressive targets for reducing carbon emissions across all industries, including steel.

- Penalties for non-compliance: Significant fines and production shutdowns for violating environmental laws.

These policies are forcing steel mills to either reduce production or invest heavily in cleaner technologies, directly impacting their iron ore consumption. The resulting decrease in demand ripples throughout the global iron ore market.

Real Estate Market Slowdown and its Ripple Effect

China's property sector, a major consumer of steel, is experiencing a significant downturn. This slowdown has a direct and substantial impact on steel demand.

- Reduced construction activity: Fewer new building projects translate to lower demand for steel rebar and other construction materials.

- Decreased demand for steel rebar: Rebar, a key component in reinforced concrete, accounts for a significant portion of steel consumption in construction.

- Impact on infrastructure projects: While government-led infrastructure projects continue, the overall pace has slowed, further reducing steel demand.

The interconnectedness between China's real estate market and its steel consumption is undeniable. A weaker real estate sector directly translates to lower steel demand, which in turn affects the price and demand for iron ore.

Global Iron Ore Supply and Demand Dynamics

The reduced demand from China necessitates a reassessment of global iron ore supply and demand dynamics. Major producers are adapting their strategies, while other regions are emerging as potential growth markets.

Major Iron Ore Producers and Their Response

Major iron ore producers, including BHP, Rio Tinto, and Vale, are responding to the decreased Chinese demand through various strategic initiatives.

- Production adjustments: Some producers are adjusting their production levels to align with reduced demand, avoiding a glut in the market.

- Diversification of markets: Producers are actively seeking new markets in other regions to mitigate the impact of reduced Chinese demand.

- Exploration of new opportunities: Investment in new projects and exploration activities in other resource-rich regions.

The financial performance and strategic decisions of these major players will heavily influence the iron ore market forecast in the coming years.

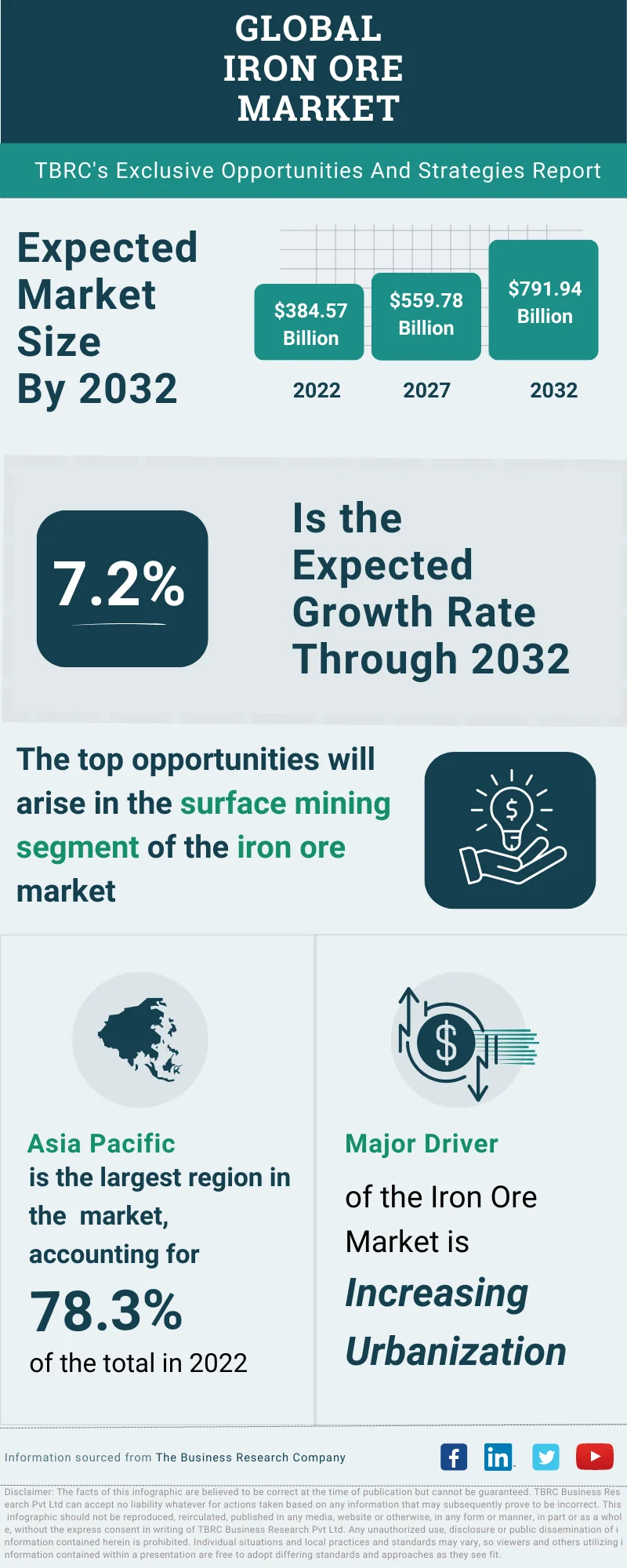

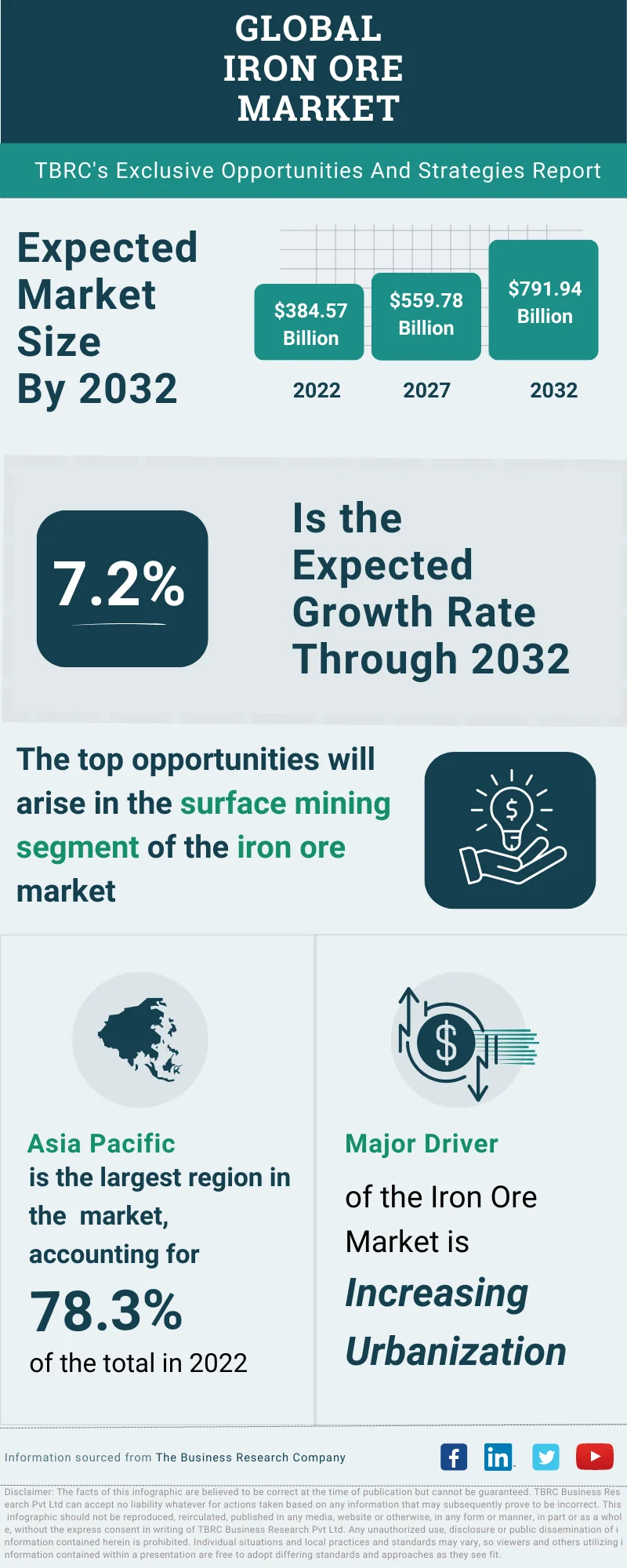

Alternative Markets and Demand Growth

While China remains a dominant player, the growth potential in other regions offers a glimmer of hope for the iron ore industry.

- Infrastructure development in emerging economies: India, Southeast Asia, and other developing countries are experiencing rapid infrastructure development, driving increased steel and iron ore demand.

- Rising steel consumption in developing countries: Industrialization and urbanization in developing nations lead to a steady rise in steel consumption, creating new opportunities for iron ore producers.

These emerging markets offer the potential to offset, at least partially, the decline in Chinese demand, but their growth rate and overall contribution to global demand remain key factors in shaping the iron ore market forecast.

Iron Ore Price Predictions and Market Volatility

Predicting iron ore prices with certainty is challenging due to the market’s inherent volatility. However, analyzing current trends provides insights into potential short-term and long-term scenarios.

Short-Term Price Outlook

The short-term price outlook for iron ore is likely to remain volatile, influenced by several factors.

- Forecasting price ranges based on different scenarios: Models incorporating varying levels of Chinese demand and global economic growth can provide a range of price forecasts.

- Impact of geopolitical events: Global political instability and trade disputes can significantly impact iron ore prices.

A balanced assessment of supply, demand, and external factors is crucial for navigating the short-term uncertainties.

Long-Term Market Trends and Sustainability

The long-term outlook for the iron ore market is intertwined with the global transition towards more sustainable steel production.

- Technological advancements in steel production: Innovations in steelmaking processes are aimed at reducing emissions and improving efficiency.

- Green steel initiatives: Government policies and industry initiatives are pushing for the adoption of greener steel production methods.

- The role of recycled steel: Increasing reliance on recycled steel can reduce the demand for iron ore in the long run.

The shift towards sustainable practices will fundamentally reshape the iron ore industry, requiring producers to adapt and innovate to maintain their competitiveness.

Conclusion

China's steel production reductions are undeniably reshaping the global iron ore market. The short-term outlook indicates volatility, driven by fluctuating Chinese demand and the responses of major producers. In the long term, the transition towards sustainable steel production will play a critical role in shaping future market dynamics. Understanding these shifting dynamics is crucial for navigating the complexities of this essential commodity market. Stay informed about the evolving iron ore market forecast and its potential implications for your business. Subscribe to our newsletter for the latest updates and analysis on the iron ore market and related commodities. Understanding the dynamics of the iron ore market is crucial for navigating this fluctuating landscape.

Featured Posts

-

Latest F1 News Alpine Bosss Warning For Doohan

May 09, 2025

Latest F1 News Alpine Bosss Warning For Doohan

May 09, 2025 -

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Matchups

May 09, 2025

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Matchups

May 09, 2025 -

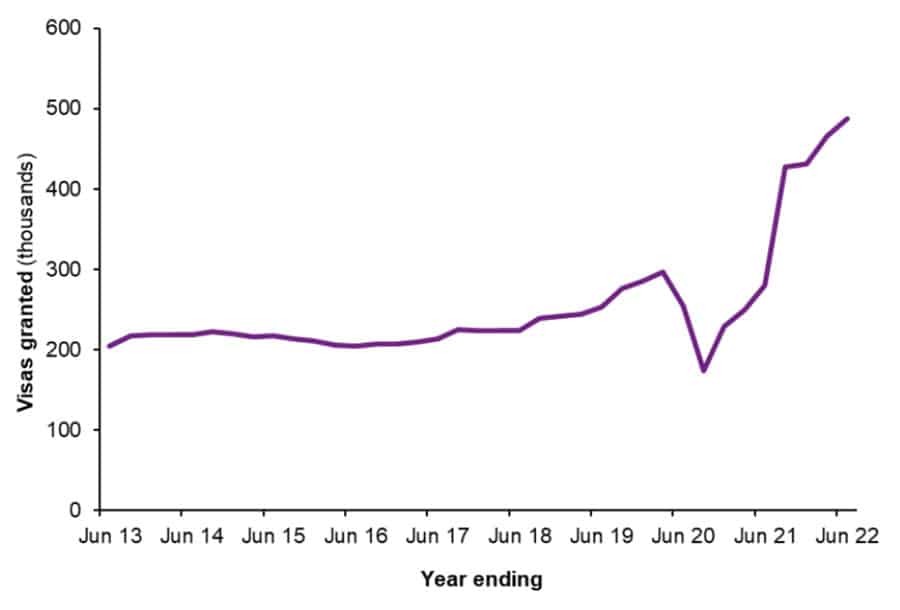

New Uk Visa Policy Impacts Applicants From Nigeria And Pakistan

May 09, 2025

New Uk Visa Policy Impacts Applicants From Nigeria And Pakistan

May 09, 2025 -

Bundesliga 2 Matchday 27 Overview Cologne Now Leads Hamburg

May 09, 2025

Bundesliga 2 Matchday 27 Overview Cologne Now Leads Hamburg

May 09, 2025 -

Deborah Taylor Appointed To Head Nottingham Attacks Inquiry

May 09, 2025

Deborah Taylor Appointed To Head Nottingham Attacks Inquiry

May 09, 2025