Is A Bond Market Crisis Imminent? Investor Awareness And Action

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The relationship between interest rates and bond prices is inversely proportional. This means that as interest rates rise, bond prices fall, and vice versa. This is because newly issued bonds offer higher yields, making existing lower-yielding bonds less attractive. Understanding this fundamental principle of bond valuation is crucial for navigating a period of rising interest rates.

The impact of rising rates on existing bond portfolios can be substantial. Higher rates increase the opportunity cost of holding lower-yielding bonds, reducing their attractiveness to investors. This can lead to capital losses for bondholders as the market value of their holdings declines.

- Higher rates reduce the value of existing lower-yielding bonds. A bond with a 2% coupon will look less appealing when new bonds are issued offering 4%.

- Increased borrowing costs for governments and corporations. Higher rates make it more expensive for governments and corporations to issue new debt, potentially impacting their financial stability.

- Potential for capital losses for bondholders. If interest rates rise significantly, investors holding bonds to maturity could experience losses if they need to sell their bonds before maturity.

Keywords: Interest rate risk, bond valuation, yield curve, Federal Reserve policy, interest rate hikes

Inflation's Erosive Effect on Bond Returns

Inflation significantly impacts bond returns. Inflation erodes the purchasing power of future interest payments and the principal repayment at maturity. When inflation rises faster than the bond's yield, the real return – the return adjusted for inflation – becomes negative. This means investors are effectively losing purchasing power, a crucial factor to consider for long-term investment strategies.

Persistent inflation also undermines investor confidence in bonds. Investors may seek higher-yielding alternatives to protect their purchasing power, leading to a decrease in demand for bonds and potentially further depressing prices.

- Inflation eats away at purchasing power. If inflation is 5% and your bond yields 3%, your real return is -2%.

- Real yields (adjusted for inflation) may be negative. Negative real yields mean you're losing money in terms of purchasing power.

- Investors seek higher-yielding alternatives. High inflation drives investors towards assets that offer better inflation protection, such as inflation-protected securities (TIPS) or real estate.

Keywords: Inflation risk, real interest rates, purchasing power, inflation-protected securities (TIPS), inflation hedge

Geopolitical Risks and Bond Market Volatility

Global events and uncertainties significantly impact the bond market. Geopolitical risks, such as wars, political instability, and economic sanctions, introduce uncertainty into the market. This uncertainty can lead to increased volatility and sharp price swings in bond markets.

Initially, investors may engage in a "flight to safety," seeking the perceived safety of government bonds, particularly those issued by countries considered politically stable. However, prolonged geopolitical tensions can undermine even the safest havens, leading to a broader market sell-off.

- War, political instability, and economic sanctions create uncertainty. These factors make it difficult to predict future economic conditions, impacting investor confidence.

- Investors may seek safe-haven assets like government bonds (initially). Government bonds from stable economies are often seen as a safe haven during times of crisis.

- Increased volatility can lead to sharp price swings. Geopolitical events can trigger sudden and substantial changes in bond prices.

Keywords: Geopolitical risk, flight to safety, sovereign debt, market volatility, global uncertainty

Assessing the Likelihood of a Bond Market Crisis

Several economic indicators can help assess the likelihood of a bond market crisis. Analyzing current economic data is vital. This includes reviewing credit ratings of major bond issuers (from agencies like Moody's, S&P, and Fitch), examining debt levels of governments and corporations, and considering the potential for contagion effects, where a crisis in one part of the market spreads to others.

Potential triggers for a crisis include a sharp increase in interest rates, a significant rise in inflation, a major geopolitical event, or a widespread loss of confidence in the creditworthiness of major bond issuers. The probability of these triggers varies, and it is essential to monitor these factors closely.

- Review credit ratings of major bond issuers. Downgrades in credit ratings signal increased risk and can trigger sell-offs.

- Analyze debt levels of governments and corporations. High levels of debt can increase vulnerability to economic shocks.

- Consider the potential for contagion effects. A crisis in one sector can quickly spread to others, leading to a broader market crash.

Keywords: Credit rating agencies, sovereign debt crisis, systemic risk, contagion effect, economic indicators

Strategies for Navigating a Potential Bond Market Crisis

Investors concerned about bond market risks should implement several strategies to mitigate potential losses and protect their investments. Proactive risk management is critical during uncertain times.

- Diversify your portfolio across asset classes. Don't put all your eggs in one basket. Diversify into stocks, real estate, commodities, etc., to reduce overall portfolio risk.

- Consider shorter-term bonds to reduce interest rate risk. Shorter-term bonds are less sensitive to interest rate changes.

- Invest in inflation-protected securities. TIPS (Treasury Inflation-Protected Securities) offer protection against inflation.

- Consult with a financial advisor. A financial advisor can help you develop a personalized investment strategy tailored to your risk tolerance and financial goals.

Keywords: Portfolio diversification, risk management, asset allocation, financial advisor, bond portfolio management

Conclusion

The possibility of a bond market crisis is a legitimate concern given the current economic climate. Rising interest rates, persistent inflation, and geopolitical uncertainty present significant challenges for bond investors. However, by understanding these risks and implementing appropriate strategies, investors can mitigate potential losses and protect their investments. Don't ignore the warning signs; take proactive steps to assess your bond holdings and adjust your portfolio accordingly. Proactive bond market risk management is crucial for navigating these uncertain times. Start planning your strategy today to mitigate potential risks associated with a bond market crisis.

Featured Posts

-

Jadwal Keberangkatan Km Lambelu Nunukan Makassar 4x Perjalanan Sampai 25 Juni 2025

May 28, 2025

Jadwal Keberangkatan Km Lambelu Nunukan Makassar 4x Perjalanan Sampai 25 Juni 2025

May 28, 2025 -

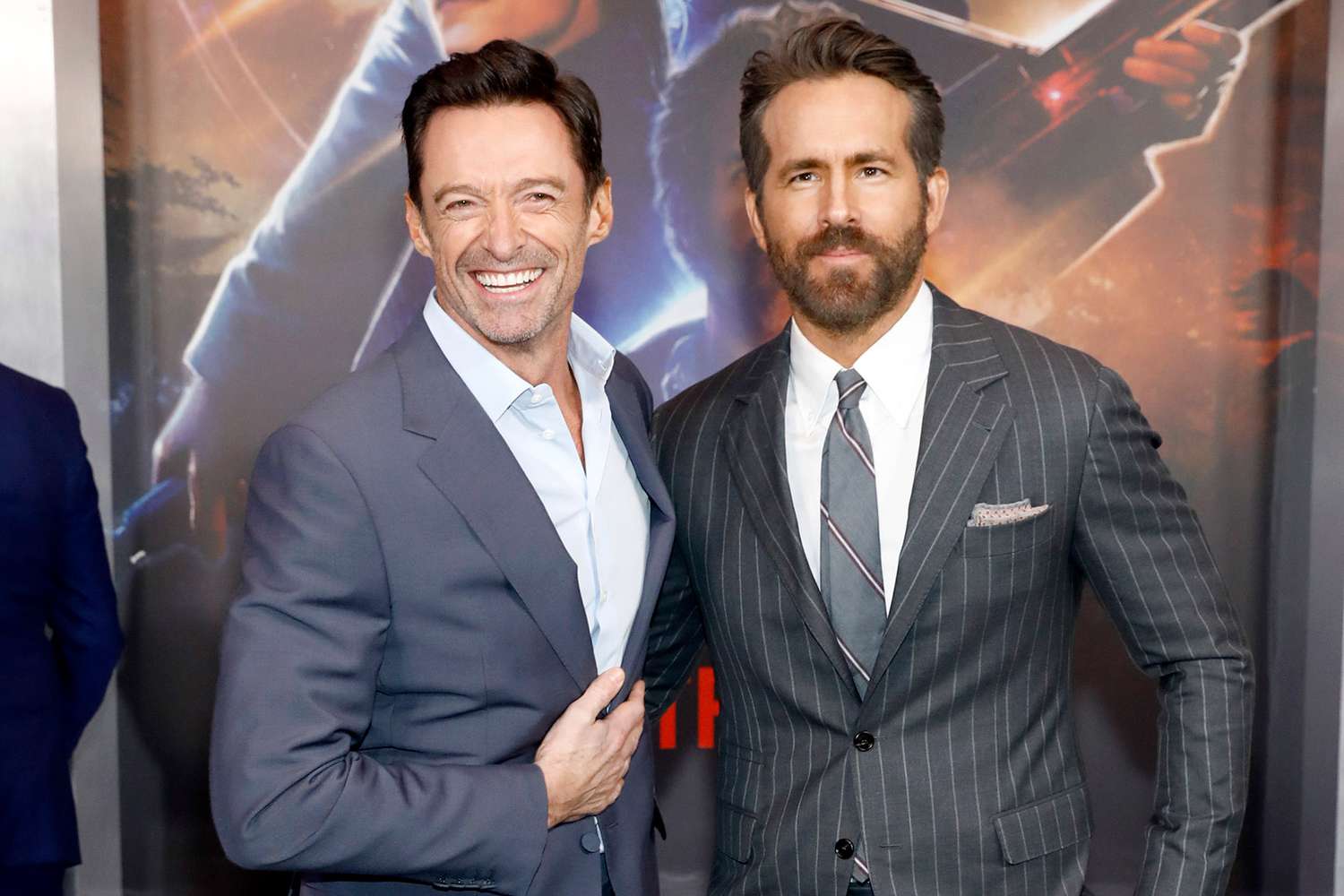

Hugh Jackman Shares His Gripe With Ryan Reynolds

May 28, 2025

Hugh Jackman Shares His Gripe With Ryan Reynolds

May 28, 2025 -

Lorde Stuns Fans At Unexpected Club Appearance

May 28, 2025

Lorde Stuns Fans At Unexpected Club Appearance

May 28, 2025 -

Hasselbaink Ten Ronaldo Ya Emeklilik Cagrisi 2026 Duenya Kupasi Nda Cristiano Nun Gerekli Olmadigi Tartismasi

May 28, 2025

Hasselbaink Ten Ronaldo Ya Emeklilik Cagrisi 2026 Duenya Kupasi Nda Cristiano Nun Gerekli Olmadigi Tartismasi

May 28, 2025 -

Al Nassr Ronaldo Ile 2 Yil Daha Anlasti

May 28, 2025

Al Nassr Ronaldo Ile 2 Yil Daha Anlasti

May 28, 2025

Latest Posts

-

Navigating The Pokemon Tcg Pocket Breakneck Expansion Release Frenzy

May 29, 2025

Navigating The Pokemon Tcg Pocket Breakneck Expansion Release Frenzy

May 29, 2025 -

Pocket Breakneck Expansion My Pokemon Tcg Anxiety

May 29, 2025

Pocket Breakneck Expansion My Pokemon Tcg Anxiety

May 29, 2025 -

Finding Shiny Pokemon Your Guide To Pokemon Tcg Pocket

May 29, 2025

Finding Shiny Pokemon Your Guide To Pokemon Tcg Pocket

May 29, 2025 -

Pokemon Tcg Pocket Breakneck Expansion Release Stress

May 29, 2025

Pokemon Tcg Pocket Breakneck Expansion Release Stress

May 29, 2025 -

Shiny Pokemon In Pokemon Tcg Pocket Rarity Methods And Tips

May 29, 2025

Shiny Pokemon In Pokemon Tcg Pocket Rarity Methods And Tips

May 29, 2025