Is BBAI Stock Right For You? Evaluating The Penny Stock Investment

Table of Contents

Understanding BBAI Stock and its Business Model

BBAI, or BigBear.ai Holdings Inc., is a leading provider of artificial intelligence (AI) and big data analytics solutions. The company offers a range of products and services designed to help government and commercial clients solve complex problems using advanced data analysis techniques. BBAI operates within a rapidly growing industry, competing with other established players and emerging startups in the AI and big data analytics space. This competitive landscape necessitates a strong understanding of BBAI's unique value proposition and market differentiation.

- BBAI's key products and services: These include AI-powered solutions for geospatial intelligence, cybersecurity, and mission support, among others. They leverage advanced machine learning algorithms and cloud-based infrastructure to deliver actionable insights.

- Target market and customer base: BBAI primarily serves government agencies (defense, intelligence) and commercial clients requiring sophisticated data analytics capabilities. This diverse clientele base provides a degree of diversification in its revenue streams.

- Revenue streams and growth potential: BBAI's revenue is generated through contracts and subscriptions for its AI and big data solutions. The continued growth of the AI market presents significant growth potential for BBAI, although achieving profitability remains a key challenge for the company.

- Key partnerships and collaborations: Strategic alliances with technology providers and government agencies are vital for BBAI's success. These partnerships expand market reach and enhance its technology offerings.

Analyzing BBAI Stock Performance and Financial Health

BBAI stock, like many penny stocks, exhibits high volatility. Analyzing its historical stock price reveals periods of significant gains and losses, reflecting the inherent risk associated with such investments. Examining BBAI's financial statements is crucial for assessing its long-term viability.

Use reputable financial websites to access and analyze BBAI's financial data. Look for trends in:

- Recent stock price movements and volume: Track daily, weekly, and monthly price changes to understand the momentum. High trading volume can indicate increased investor interest, but also potentially increased volatility.

- Key financial ratios (e.g., P/E ratio, debt-to-equity ratio): These ratios help evaluate the company's profitability, leverage, and financial health. Compare these ratios to industry benchmarks to gauge BBAI's relative performance.

- Profitability and growth trends: Examine revenue growth, net income, and earnings per share (EPS) to assess the company's financial performance and growth trajectory. Sustained profitability is a crucial indicator of long-term success.

- Cash flow and liquidity position: Analyze BBAI's operating cash flow, free cash flow, and current ratio to understand its ability to meet its short-term and long-term financial obligations. Strong cash flow is essential for navigating challenging economic conditions. Consider including charts and graphs illustrating these key metrics for better visualization.

Assessing the Risks and Rewards of Investing in BBAI Stock

Investing in BBAI stock, or any penny stock, comes with significant risks.

- Volatility risk and potential for significant losses: BBAI's stock price is highly susceptible to market fluctuations, potentially leading to substantial losses.

- Liquidity risk and difficulty in buying/selling shares: Penny stocks often have low trading volume, making it challenging to buy or sell shares quickly without significantly impacting the price.

- Regulatory risks and potential legal challenges: As a publicly traded company, BBAI faces regulatory scrutiny, and any legal or regulatory issues could negatively impact its stock price.

- Upside potential and potential for substantial gains: Despite the risks, BBAI's position in the rapidly growing AI market offers substantial upside potential. Successful execution of its business strategy could lead to significant returns for investors.

Comparing BBAI Stock to Similar Investments

To assess BBAI's investment potential, compare it to other companies in the AI and big data analytics industry. Consider factors such as:

- Comparison of BBAI's valuation to competitors: Analyze BBAI's market capitalization, price-to-earnings ratio, and other valuation metrics relative to its competitors.

- Comparison of growth prospects and market share: Evaluate BBAI's growth potential compared to other players in the market, considering factors like market share, innovation, and competitive advantage.

- Analysis of risk profiles and potential returns: Compare the risk-reward profile of BBAI to its peers, considering factors like volatility, financial stability, and growth prospects. This comparative analysis will provide valuable context for your investment decision.

Diversification and Portfolio Management Strategies for BBAI

BBAI stock should be considered part of a well-diversified investment portfolio. Avoid over-allocating your capital to a single penny stock. A diversified portfolio mitigates risk. Consider allocating a small percentage of your investment portfolio to BBAI, depending on your risk tolerance and overall investment strategy. Risk management is crucial. Regularly review your investment portfolio and adjust your allocation as needed based on BBAI's performance and your risk tolerance.

Conclusion

This article provided a comprehensive analysis of BBAI stock, examining its business model, financial health, risks, and potential rewards. Investing in penny stocks like BBAI requires careful consideration and understanding of the inherent risks. Remember, BBAI stock's price can fluctuate dramatically.

Before making any investment decisions regarding BBAI stock, conduct thorough due diligence and seek professional financial advice. Remember, understanding the risks associated with BBAI stock is crucial to making informed investment decisions. Weigh the potential rewards against the inherent volatility of BBAI stock before investing.

Featured Posts

-

Clean Energys Growth Faces Unexpected Headwinds

May 20, 2025

Clean Energys Growth Faces Unexpected Headwinds

May 20, 2025 -

Jennifer Lawrence Stuns In Backless Dress After Welcoming Second Child

May 20, 2025

Jennifer Lawrence Stuns In Backless Dress After Welcoming Second Child

May 20, 2025 -

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takiminda

May 20, 2025

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takiminda

May 20, 2025 -

Increased Lng Demand In Taiwan Following Nuclear Shutdown

May 20, 2025

Increased Lng Demand In Taiwan Following Nuclear Shutdown

May 20, 2025 -

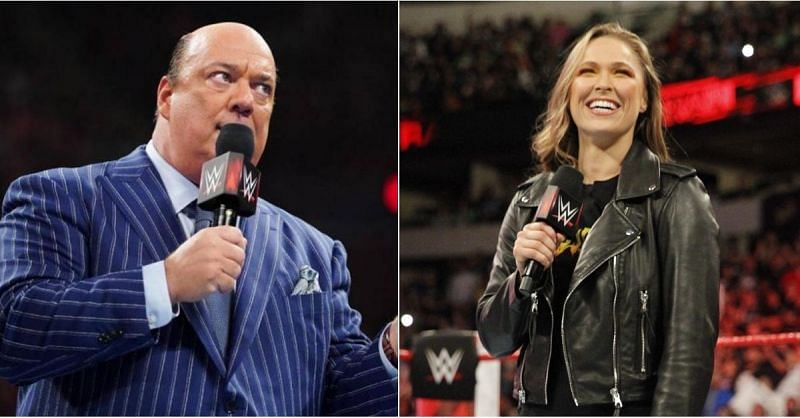

Wwe News Rousey Paul Uso And Big E Engagement Speculation

May 20, 2025

Wwe News Rousey Paul Uso And Big E Engagement Speculation

May 20, 2025

Latest Posts

-

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025 -

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025 -

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025 -

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025