Is BigBear.ai Holdings, Inc. (NYSE: BBAI) A Top Penny Stock To Watch?

Table of Contents

Understanding BigBear.ai's Business Model and Revenue Streams

BigBear.ai provides advanced AI solutions and data analytics services, primarily focused on government contracts but with a growing commercial presence. Their core offerings revolve around artificial intelligence, leveraging cutting-edge technologies to solve complex problems for their clients. This includes developing sophisticated algorithms for data analysis, predictive modeling, and decision support systems. Keywords like "artificial intelligence," "AI solutions," "data analytics," and "government contracts" are central to understanding their business model.

Revenue generation for BBAI comes from two main sources:

-

Government Contracts: A significant portion of BBAI's revenue stems from contracts with various government agencies. These contracts often involve large-scale projects requiring advanced AI capabilities for national security, defense, and intelligence applications. Analyzing the success rate of contract awards and their financial implications is crucial for assessing BBAI's future performance.

-

Commercial Clients: BigBear.ai is also expanding its reach into the commercial sector, offering AI-driven solutions to businesses across various industries. Success in this area will be vital for diversifying revenue streams and reducing dependence on government contracts.

Key Projects and Partnerships:

- Successful completion of Project X: This project resulted in a significant revenue increase and demonstrated BigBear.ai's ability to deliver complex AI solutions. Further details on such projects should be sought from official company releases.

- Partnership with Company Y: This collaboration expands BigBear.ai's market reach into the [Industry] sector, opening up new revenue opportunities. Understanding the nature of these partnerships and their potential impact is vital for evaluating the company's growth trajectory.

Analyzing BBAI's Financial Performance and Stock Volatility

Evaluating BBAI's financial health requires a close examination of its recent financial reports. Key metrics to consider include earnings per share (EPS), revenue growth, profitability (or lack thereof), and the debt-to-equity ratio. Analyzing these figures will offer a clearer picture of the company's financial strength and stability.

The stock's volatility is another crucial factor. BigBear.ai, like many penny stocks, experiences significant stock price fluctuations. Analyzing the market capitalization and trading volume will help understand the level of risk involved. Charts and graphs illustrating the stock's performance over time provide a visual representation of this volatility.

Key Financial Metrics and Implications:

- High debt levels: High debt may indicate increased financial risk and potential challenges in meeting future obligations. Investors should carefully consider the company's ability to manage its debt.

- Consistent revenue growth: Consistent revenue growth signals positive future prospects, but it's crucial to examine the sources of this growth and their sustainability.

Evaluating the Risks and Potential Rewards of Investing in BBAI

Penny stocks, including BBAI, are inherently risky investments. High volatility means the stock price can fluctuate dramatically in short periods, leading to significant potential losses. Due diligence is crucial; it's a speculative investment, not a guaranteed path to riches. Understanding the investment risk is paramount before considering any investment.

However, the potential rewards can be substantial. If BigBear.ai successfully executes its business plan and secures major contracts, the return on investment (ROI) could be significant. This makes it a potentially attractive prospect for investors with a high-risk tolerance and a long-term investment strategy.

Potential Risks and Rewards:

- Risk of dilution: Further share offerings could dilute existing shareholders' ownership and potentially lower the stock price.

- Potential for significant gains: Securing major government or commercial contracts could drive substantial revenue growth and significantly increase the stock price.

Comparing BBAI to Other Penny Stocks in the AI Sector

BigBear.ai operates in a competitive AI sector. Analyzing its competitive landscape, including key competitors and their respective market shares, is essential. Understanding BBAI's competitive advantage, if any, will help determine its long-term viability. Comparing BBAI's financial health, growth potential, and market performance to other penny stocks in the AI space using industry benchmarks will provide a better context for evaluating its investment potential.

(Insert table comparing key metrics – e.g., revenue growth, market capitalization, EPS – across several penny stocks in the AI sector.)

Conclusion: Is BigBear.ai (BBAI) Worth Your Attention as a Penny Stock?

BigBear.ai presents a compelling investment opportunity in the rapidly growing AI sector. However, the company's high growth potential is balanced by the inherent risks associated with penny stocks and its relatively high debt levels. Its dependence on government contracts also presents a level of uncertainty.

Based on this analysis, BBAI might be a top penny stock to watch for investors with a high-risk tolerance and a long-term perspective. However, it is not a guaranteed success. Before investing in BBAI or any other penny stock, conduct thorough due diligence. Research further, consult a financial advisor, and make informed investment decisions regarding penny stocks. Remember, the potential for significant gains is coupled with the potential for substantial losses. Always approach penny stock investments with caution.

Featured Posts

-

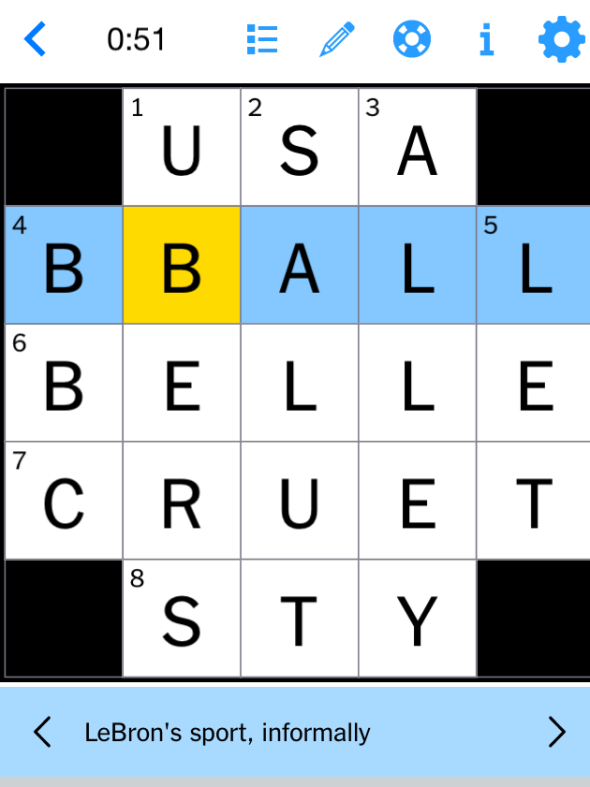

Nyt Mini Crossword Clues And Answers March 26 2025

May 21, 2025

Nyt Mini Crossword Clues And Answers March 26 2025

May 21, 2025 -

Assessing Giorgos Giakoumakis Market Value Ahead Of A Potential Mls Transfer

May 21, 2025

Assessing Giorgos Giakoumakis Market Value Ahead Of A Potential Mls Transfer

May 21, 2025 -

Giakoymakis I Los Antzeles Endiaferetai

May 21, 2025

Giakoymakis I Los Antzeles Endiaferetai

May 21, 2025 -

Occasionverkoop Abn Amro Impact Van De Toename In Autobezit

May 21, 2025

Occasionverkoop Abn Amro Impact Van De Toename In Autobezit

May 21, 2025 -

La Croissance De Nantes Et L Essor Du Metier De Cordistes

May 21, 2025

La Croissance De Nantes Et L Essor Du Metier De Cordistes

May 21, 2025

Latest Posts

-

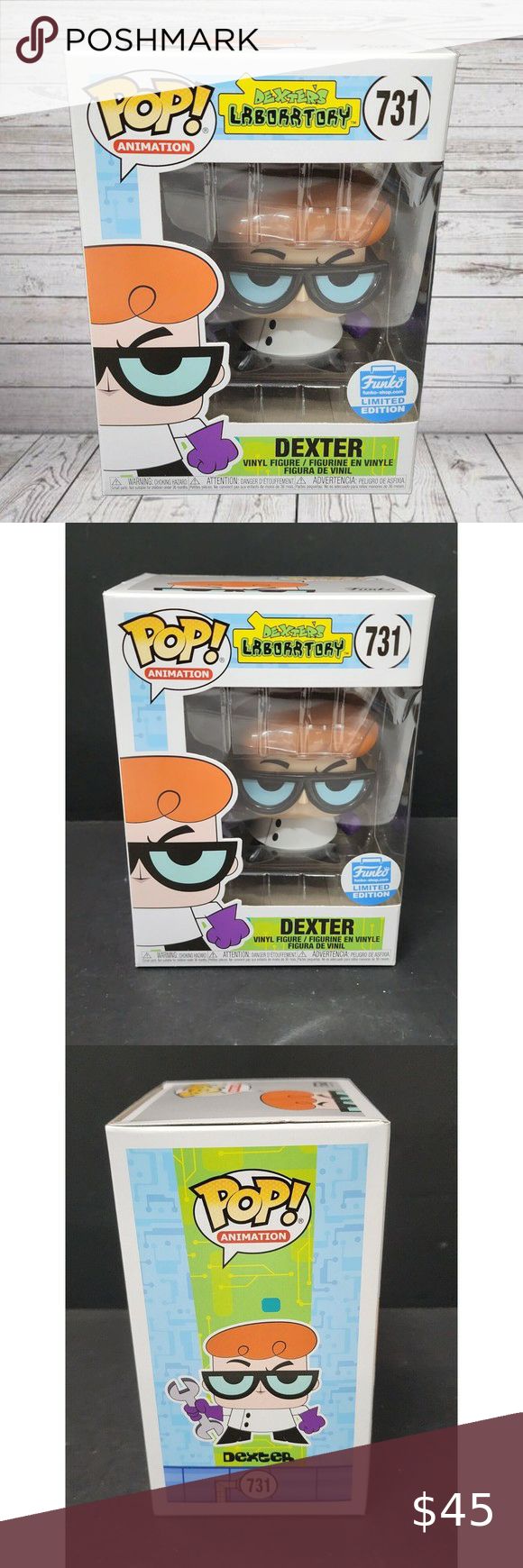

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025 -

Get Your Hands On The New Dexter Funko Pops

May 22, 2025

Get Your Hands On The New Dexter Funko Pops

May 22, 2025 -

Funko Pops The Dexter Collection Is Here

May 22, 2025

Funko Pops The Dexter Collection Is Here

May 22, 2025 -

Announcing The Dexter Funko Pop Line

May 22, 2025

Announcing The Dexter Funko Pop Line

May 22, 2025 -

Dexters Resurrection The Return Of Iconic Antagonists

May 22, 2025

Dexters Resurrection The Return Of Iconic Antagonists

May 22, 2025