Is BigBear.ai Stock A Buy Right Now? A Motley Fool Analysis

Table of Contents

Keywords: BigBear.ai stock, BigBear.ai investment, BigBear.ai analysis, BigBear.ai buy, BigBear.ai stock price, BigBear.ai future, artificial intelligence stock, AI stock, technology stock, Motley Fool analysis

The artificial intelligence (AI) sector is booming, and BigBear.ai is a company aiming to capitalize on this growth. But is BigBear.ai stock a buy right now? This Motley Fool-style analysis will examine the company's business model, financial performance, risks, and valuation to help you make an informed investment decision. We'll explore whether this AI stock presents a compelling opportunity or if investors should proceed with caution.

BigBear.ai's Business Model and Market Position

BigBear.ai provides AI-driven solutions for both national security and commercial clients. Their core business revolves around delivering advanced analytics, cybersecurity, and other AI-powered services to solve complex problems.

-

Target Markets: BigBear.ai focuses on two primary sectors:

- Government: They offer critical solutions to national security agencies, utilizing their AI expertise for intelligence analysis, threat detection, and mission support. This sector provides a stable, albeit potentially cyclical, revenue stream.

- Commercial: BigBear.ai also serves commercial clients across various industries, providing AI-powered analytics for decision-making, risk management, and operational efficiency. This segment offers higher growth potential but is also more competitive.

-

Key Offerings: Their offerings include:

- AI-powered analytics: Leveraging machine learning and deep learning algorithms to extract insights from large datasets.

- Cybersecurity solutions: Protecting sensitive data and infrastructure using AI-driven threat detection and response capabilities.

- Mission support: Providing AI-driven tools and support for various missions, particularly within the defense and intelligence communities.

-

Competitive Landscape: BigBear.ai faces competition from both established technology giants and smaller, specialized AI companies. While they possess expertise in certain niche areas, competition for government contracts can be fierce, and larger players have greater resources.

-

Market Share: Precise market share data is difficult to obtain for this specialized sector, but BigBear.ai is positioned as a key player within its chosen niche markets.

Financial Performance and Growth Prospects

Analyzing BigBear.ai's financial performance requires a careful review of their recent financial statements. While specific numbers fluctuate, certain trends provide valuable insight.

-

Revenue Growth: BigBear.ai has shown periods of both strong and moderate revenue growth. Examining the quarterly and annual reports reveals the trajectory and identifies factors driving growth (e.g., successful contract wins, expansion into new markets).

-

Profitability: Profitability is a key indicator of a company's financial health. Analyzing metrics like net income and operating margins is essential to understanding BigBear.ai's efficiency and ability to generate profits.

-

Key Financial Ratios: Investors should examine key ratios such as:

- P/E ratio: This helps gauge the stock's valuation relative to its earnings.

- Debt-to-equity ratio: This indicates the company's financial leverage and risk.

-

Cash Flow: Analyzing cash flow statements is crucial to assessing BigBear.ai's ability to fund its operations and growth initiatives. A strong positive cash flow is usually a positive sign.

-

Future Growth Projections: Based on current market trends and BigBear.ai's strategic plans, analysts provide growth forecasts which, while subject to change, provide estimates of future performance. This should be considered alongside the inherent uncertainty.

Risks and Challenges Facing BigBear.ai

Investing in BigBear.ai, like any stock, comes with inherent risks.

-

Competition: The AI market is fiercely competitive. BigBear.ai faces competition from established tech giants with far greater resources.

-

Economic Downturns: Government spending, a significant revenue source, can be affected by economic downturns. Reduced government budgets could impact contract awards.

-

Regulatory Risks: BigBear.ai operates in a regulated environment (particularly regarding national security contracts). Changes in regulations or compliance failures could significantly affect its operations.

-

Technological Disruption: The AI landscape is constantly evolving. New technologies or competitors could render BigBear.ai's current offerings obsolete.

Valuation and Investment Recommendation (Motley Fool Style)

Based on the analysis above, a comprehensive valuation of BigBear.ai requires a deep dive into its financials, future projections, and competitive landscape. This is beyond the scope of this concise analysis.

-

Recommendation: Due to the complex nature of its operations and the inherent risks, we cannot provide a definitive "buy," "sell," or "hold" recommendation without further in-depth research.

-

Upside/Downside: The potential upside lies in BigBear.ai's strong position within specific AI niche markets and potential for significant future growth. The downside stems from increased competition, economic downturns, and the risks inherent in the volatile AI technology sector.

-

Peer Comparison: A thorough comparative analysis against its competitors is necessary for a comprehensive valuation.

-

Entry/Exit Strategies: Any investment strategy must consider defined entry and exit points based on personal risk tolerance and market conditions.

Conclusion

This analysis has explored various aspects of BigBear.ai, examining its business model, financial performance, and inherent risks. While BigBear.ai operates in a high-growth sector with significant potential, the competitive landscape and associated risks require careful consideration. A definitive investment recommendation requires deeper, independent research and analysis.

Call to Action: Is BigBear.ai stock a buy for you? Conduct your own thorough due diligence before making any investment decisions. Remember to consult with a financial advisor before investing in BigBear.ai or any other stock. Learn more about BigBear.ai's performance and future prospects by researching their financial reports and industry news. Consider the potential of BigBear.ai and the AI stock market for your investment portfolio, but always invest responsibly.

Featured Posts

-

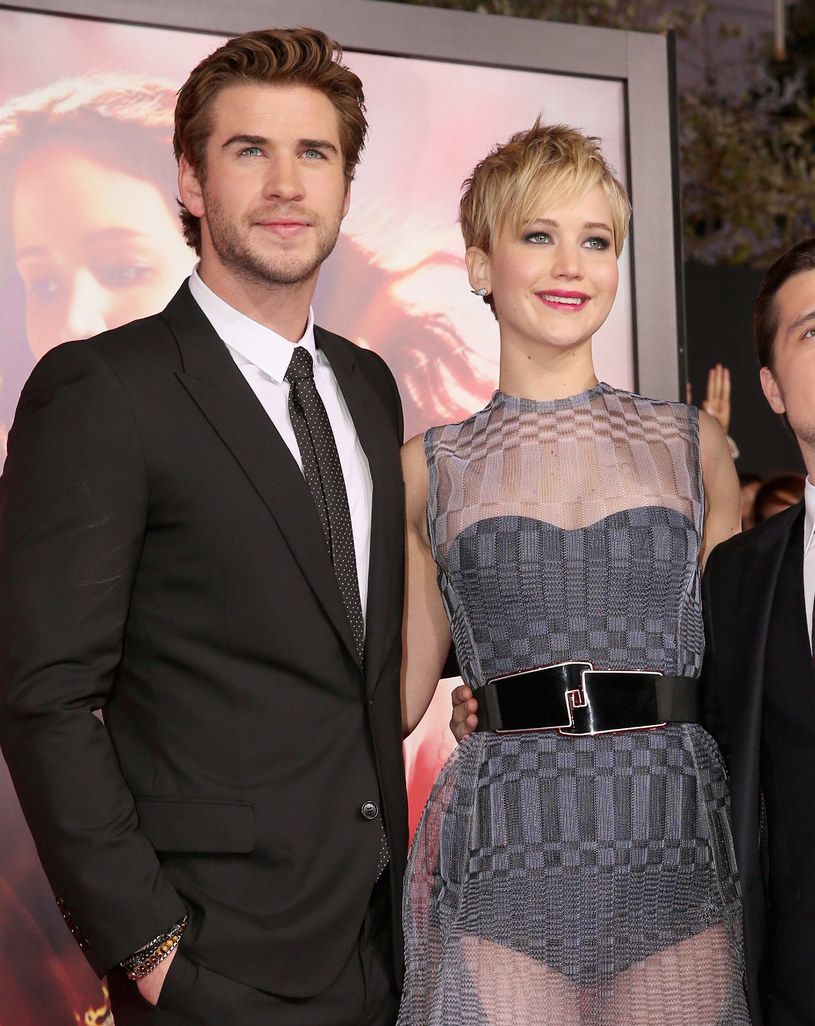

Jennifer Lawrence A Jej Nova Uloha Dvojnasobna Mama

May 20, 2025

Jennifer Lawrence A Jej Nova Uloha Dvojnasobna Mama

May 20, 2025 -

Historic Navy Corruption Case Former Second In Command Found Guilty

May 20, 2025

Historic Navy Corruption Case Former Second In Command Found Guilty

May 20, 2025 -

The Evolution Of Hercule Poirot In Agatha Christies Works

May 20, 2025

The Evolution Of Hercule Poirot In Agatha Christies Works

May 20, 2025 -

Politicko Sarajevo I Rusenje Daytonskog Sporazuma Tadi Ceva Analiza

May 20, 2025

Politicko Sarajevo I Rusenje Daytonskog Sporazuma Tadi Ceva Analiza

May 20, 2025 -

Collins Aerospace Confirms Job Cuts In Cedar Rapids

May 20, 2025

Collins Aerospace Confirms Job Cuts In Cedar Rapids

May 20, 2025

Latest Posts

-

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025 -

Gangsta Granny Activities To Enhance Reading Comprehension

May 20, 2025

Gangsta Granny Activities To Enhance Reading Comprehension

May 20, 2025 -

A Hitch In The Plans Matt Lucas And David Walliams Cliff Richard Musical

May 20, 2025

A Hitch In The Plans Matt Lucas And David Walliams Cliff Richard Musical

May 20, 2025 -

A Parents Guide To Discussing Gangsta Granny With Children

May 20, 2025

A Parents Guide To Discussing Gangsta Granny With Children

May 20, 2025 -

The Cliff Richard Musical Lucas And Walliams Encounter A Problem

May 20, 2025

The Cliff Richard Musical Lucas And Walliams Encounter A Problem

May 20, 2025