Is Bitcoin's Rebound Just The Beginning? A Comprehensive Analysis

Table of Contents

Analyzing the Current Bitcoin Market

Factors Contributing to the Rebound

Several interconnected factors have contributed to Bitcoin's recent price resurgence. Understanding these elements is crucial to assessing the sustainability of Bitcoin's rebound.

-

Increased Institutional Investment: Major financial institutions, such as BlackRock and Fidelity, have increasingly embraced Bitcoin, offering investment products and expanding their cryptocurrency holdings. This influx of institutional capital provides a significant boost to Bitcoin's price and market stability. BlackRock's recent application for a spot Bitcoin ETF, for example, signifies a major shift in institutional sentiment.

-

Growing Adoption by Businesses and Governments: A growing number of businesses are accepting Bitcoin as a form of payment, while some governments are exploring the potential of cryptocurrencies for various applications. El Salvador's adoption of Bitcoin as legal tender, although controversial, highlights the growing acceptance of Bitcoin on a national level. This increased adoption fuels demand and contributes to Bitcoin's price appreciation.

-

Positive Regulatory Developments in Specific Regions: While regulatory clarity remains a work in progress globally, some regions are showing more positive signs towards cryptocurrency regulation. This fosters a more favorable environment for Bitcoin adoption and investment. More predictable regulatory frameworks can reduce uncertainty and encourage investment.

-

Technological Advancements in the Bitcoin Network: Improvements such as the Lightning Network are enhancing Bitcoin's scalability and transaction speed, addressing some of its previous limitations. These advancements make Bitcoin a more efficient and attractive payment option, contributing to increased adoption and price appreciation.

-

Macroeconomic Factors Influencing Investor Interest in Safe-Haven Assets: During periods of economic uncertainty and inflation, investors often seek safe-haven assets. Bitcoin, with its decentralized nature and limited supply, is increasingly viewed as a potential hedge against inflation, driving demand and price appreciation. Recent inflationary pressures have played a role in bolstering Bitcoin's value.

Technical Analysis of Bitcoin's Chart

Analyzing Bitcoin's price chart using technical indicators provides further insight into the strength and sustainability of the current rebound. Key indicators like moving averages (e.g., 50-day and 200-day MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify potential trend reversals and support/resistance levels. (Insert relevant chart/graph here showing key technical indicators). Currently, the [insert current technical analysis based on relevant indicators and chart patterns] suggests [insert interpretation of the technical analysis, e.g., a potential continuation of the upward trend or a possible correction].

Assessing the Long-Term Potential of Bitcoin

Bitcoin's Role as a Hedge Against Inflation

Bitcoin's limited supply of 21 million coins makes it inherently deflationary, contrasting with fiat currencies prone to inflation. This inherent scarcity contributes to its potential as a store of value and a hedge against inflation. Historical data comparing Bitcoin's performance against traditional assets during inflationary periods can help determine its effectiveness in this role.

The Future of Cryptocurrency Adoption

The future of Bitcoin's price is intrinsically linked to the wider adoption of cryptocurrencies. Increased usage in payments, investments, and decentralized finance (DeFi) applications will likely drive demand and price appreciation. The competitive landscape, with the emergence of altcoins, will also play a role, but Bitcoin's first-mover advantage and established network effect give it a strong position. The growth of DeFi and NFTs, while separate from Bitcoin itself, could indirectly influence its price by driving broader cryptocurrency adoption and interest.

Regulatory Landscape and Its Impact

The regulatory landscape surrounding Bitcoin is constantly evolving. While some jurisdictions are embracing cryptocurrencies, others are implementing stricter regulations. The impact of regulatory clarity or uncertainty on Bitcoin's price and adoption remains a key factor in its long-term potential. Favorable regulations could significantly boost investor confidence and adoption, while overly restrictive regulations could stifle growth.

Potential Risks and Challenges

While Bitcoin's rebound presents opportunities, investors must acknowledge potential risks and challenges.

Volatility and Price Fluctuations

Bitcoin is known for its significant price volatility. Sharp price swings can create both opportunities and risks for investors. Strategies like dollar-cost averaging and diversification can help mitigate the impact of volatility.

Security Concerns and Hacks

Security breaches and hacks remain a concern within the cryptocurrency space. While Bitcoin's blockchain technology is secure, exchanges and individual wallets can be vulnerable. Using secure hardware wallets and reputable exchanges is crucial to minimize security risks.

Environmental Concerns

Bitcoin's energy consumption has drawn criticism. The proof-of-work consensus mechanism requires significant energy. However, initiatives focusing on renewable energy sources and improved mining efficiency are addressing these concerns.

Conclusion

Is Bitcoin's rebound just the beginning? Our analysis suggests that while several factors support the continuation of Bitcoin's upward trajectory – institutional investment, increasing adoption, and potential inflation hedging – significant challenges remain, including volatility, security concerns, and environmental impact. Bitcoin's long-term potential hinges on navigating these challenges successfully and fostering a more stable and regulated environment. The current price action is promising, but careful consideration of both the upside and downside potential is crucial. Further research and careful consideration are essential before making any investment decisions. Stay informed about the latest developments in the Bitcoin market, analyzing both the technical indicators and fundamental factors influencing Bitcoin's price rebound, to make strategic choices regarding your investment portfolio.

Featured Posts

-

3 Month Warning From Dwp 355 000 Claimants At Risk Of Benefit Loss

May 08, 2025

3 Month Warning From Dwp 355 000 Claimants At Risk Of Benefit Loss

May 08, 2025 -

Analiza E Takimit Fitore Minimaliste E Psg Ne Pjesen E Pare

May 08, 2025

Analiza E Takimit Fitore Minimaliste E Psg Ne Pjesen E Pare

May 08, 2025 -

Sno Og Vanskelige Kjoreforhold I Sor Norge Viktig Informasjon For Fjellturister

May 08, 2025

Sno Og Vanskelige Kjoreforhold I Sor Norge Viktig Informasjon For Fjellturister

May 08, 2025 -

Scholar Rock Stocks Monday Drop Factors Contributing To The Decline

May 08, 2025

Scholar Rock Stocks Monday Drop Factors Contributing To The Decline

May 08, 2025 -

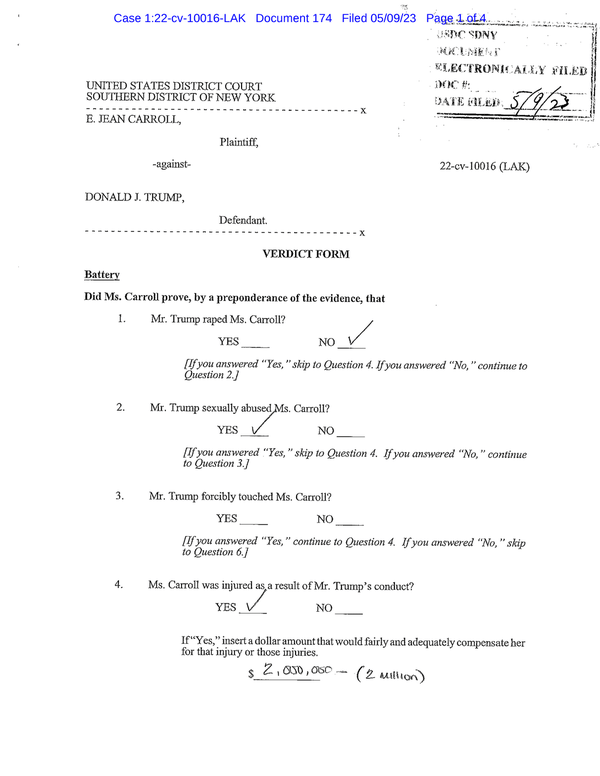

Soulja Boys Sexual Assault Lawsuit 6 Million Verdict

May 08, 2025

Soulja Boys Sexual Assault Lawsuit 6 Million Verdict

May 08, 2025