Is Gold A Safe Haven During Trade Wars? Record Rally Explained

Table of Contents

Gold's Historical Performance During Trade Wars

Throughout history, periods of heightened trade disputes have often coincided with increased gold prices. Examining these historical instances provides valuable context for understanding the current gold market.

-

Examples: The trade wars of the 1930s, marked by protectionist policies and global economic instability, saw a significant surge in gold prices. More recently, the escalating US-China trade tensions of 2018-2020 also correlated with a notable rise in gold's value. These examples suggest a potential relationship between trade uncertainty and increased demand for gold as a safe haven asset.

-

Charts and Graphs: [Insert relevant chart or graph visualizing historical gold price movements during periods of trade wars]. While correlation doesn't equal causation, these visuals help illustrate the historical tendency for gold to appreciate during times of trade conflict. It's crucial to note that other factors, discussed later, also play significant roles in shaping gold prices.

-

Influencing Factors: It's important to acknowledge that factors beyond trade wars influence gold prices. These include inflation, currency fluctuations, geopolitical instability, and changes in investor sentiment. Analyzing the interplay of these factors provides a more nuanced understanding of gold's price movements.

The Current Macroeconomic Environment and its Impact on Gold

The current global economic landscape presents a complex interplay of factors impacting gold's appeal as a safe haven.

-

Inflationary Pressures: High inflation erodes the purchasing power of fiat currencies, making gold, a non-yielding asset with intrinsic value, increasingly attractive. As investors seek to protect their wealth from inflation's effects, demand for gold tends to rise.

-

Negative Real Interest Rates: When real interest rates (nominal interest rates minus inflation) are negative, holding cash becomes less appealing. This incentivizes investors to seek alternative stores of value, such as gold, which offers a potential hedge against inflation and negative returns on cash.

-

Currency Devaluations: Currency fluctuations significantly impact gold prices, often expressed in US dollars. A weakening dollar, for example, can make gold more affordable for investors holding other currencies, increasing demand and driving up the price.

Investment Strategies for Utilizing Gold During Trade Wars

Incorporating gold into a diversified portfolio can offer a strategic way to mitigate risks associated with trade wars and broader economic uncertainty.

-

Investment Options: Investors can access gold exposure through various means, including:

- Physical Gold: Buying and storing physical gold bars or coins offers tangible ownership but involves storage and security considerations.

- Gold ETFs (Exchange-Traded Funds): Gold ETFs provide convenient and liquid access to gold without the need for physical storage.

- Gold Mining Stocks: Investing in companies involved in gold mining offers leveraged exposure to gold price movements but carries higher risk compared to direct gold investments.

-

Risk Assessment and Diversification: Gold should be considered as part of a broader diversification strategy, not as a sole investment. Its inclusion helps balance portfolio risk by potentially acting as a counterweight to other assets that might suffer during times of trade war uncertainty.

-

Investment Time Horizons: The suitability of gold as an investment depends heavily on your investment timeframe. For long-term investors, gold can offer a store of value, while short-term investors should be aware of the inherent volatility in gold prices.

Gold ETFs vs. Physical Gold: Which is Right for You?

Choosing between Gold ETFs and physical gold depends on individual circumstances and preferences.

-

Gold ETFs: Offer ease of trading, liquidity, and lower storage costs. However, they involve counterparty risk (the risk that the ETF issuer might default).

-

Physical Gold: Provides tangible ownership and is considered less susceptible to counterparty risk, but it necessitates secure storage and may involve higher costs. Tax implications also vary depending on your jurisdiction and investment method. Careful consideration is required to determine which approach best aligns with individual risk tolerance and financial objectives.

Beyond Trade Wars: Other Factors Affecting Gold Prices

While trade wars can significantly influence gold prices, other factors play a crucial role.

-

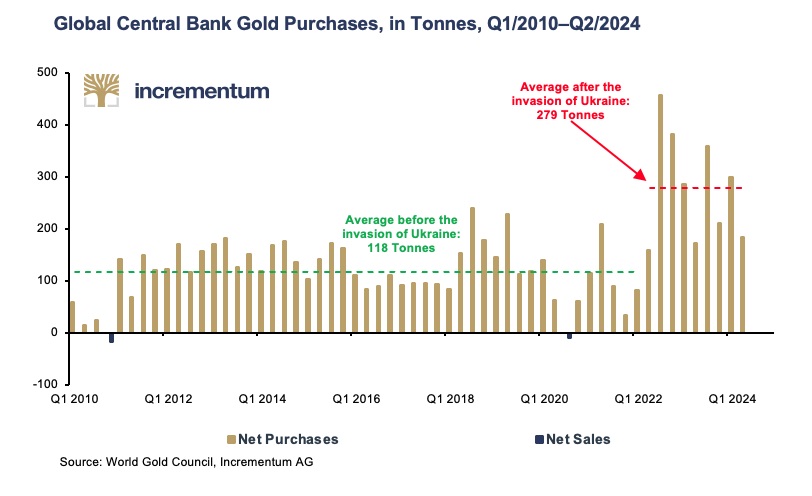

Geopolitical Risks: Geopolitical instability, such as wars or political upheavals, often drives investors towards safe haven assets like gold, boosting its demand.

-

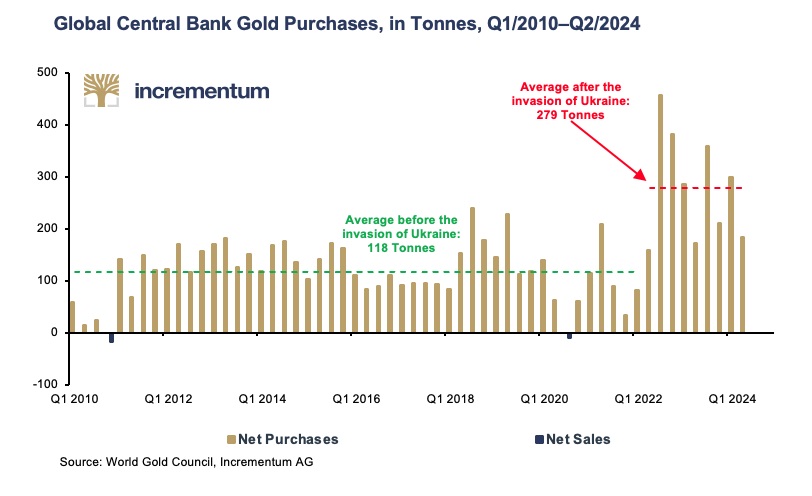

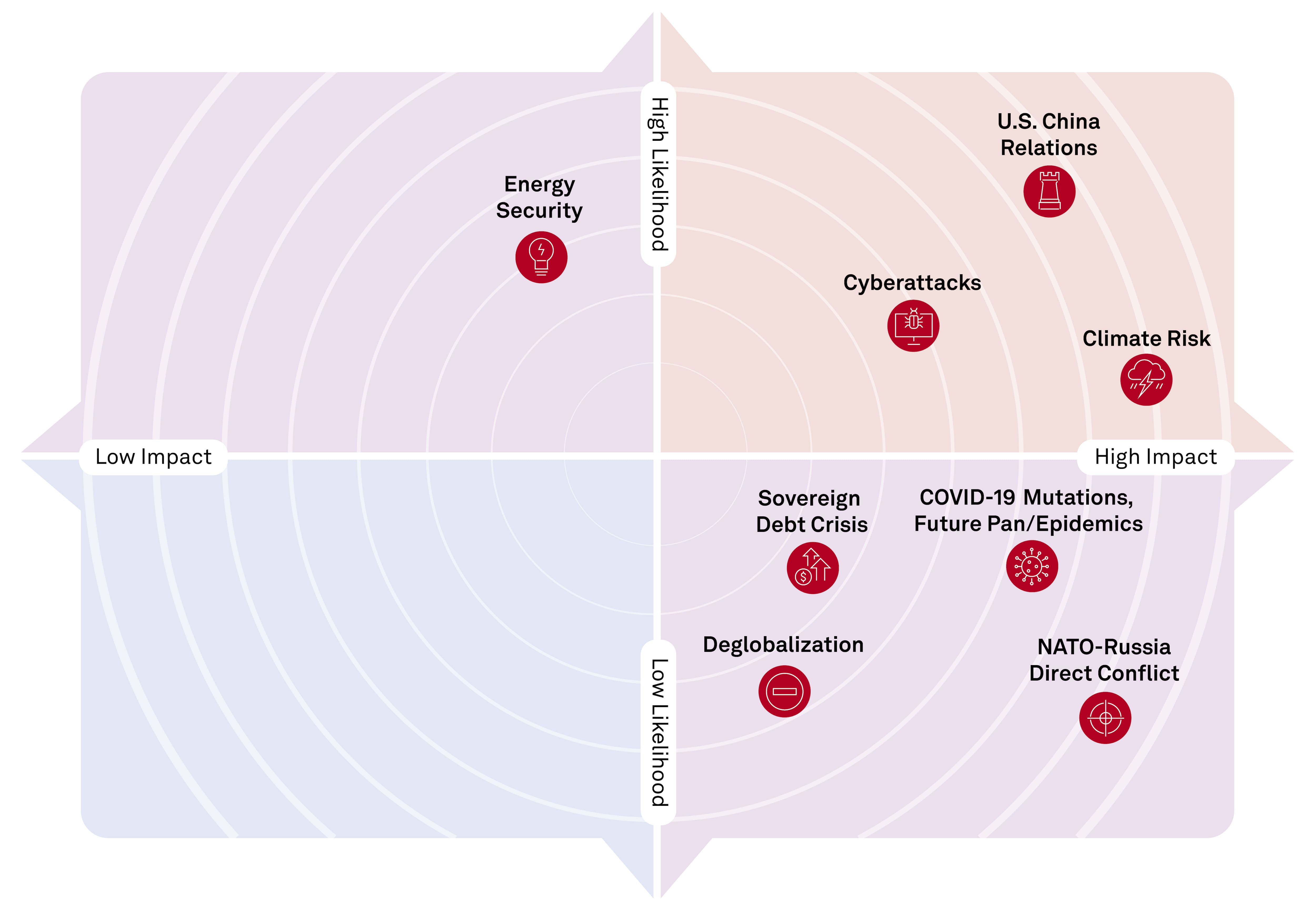

Central Bank Policies: Central banks' decisions regarding monetary policy, interest rates, and currency interventions can have a substantial impact on gold prices.

-

Investor Sentiment: Speculation and market sentiment can significantly influence gold price volatility. Periods of fear and uncertainty often lead to increased demand for gold.

Conclusion

Gold's role as a potential safe haven asset during periods of trade war uncertainty is supported by historical evidence and current macroeconomic conditions. However, it's crucial to remember that gold's price is influenced by numerous factors beyond trade tensions. While gold can act as a valuable component of a diversified portfolio, carefully assess your personal risk tolerance and investment goals before investing. Learn more about effective strategies for incorporating gold into your investment plan and navigate the complexities of trade war impacts on precious metals. Research gold investment options, including gold ETFs and physical gold, and make informed decisions about your portfolio's gold allocation. Understanding the nuances of gold investment during periods of economic uncertainty is key to building a resilient portfolio.

Featured Posts

-

After 127 Years Anchor Brewing Company Shuts Down

Apr 26, 2025

After 127 Years Anchor Brewing Company Shuts Down

Apr 26, 2025 -

Trumps Tariffs Ceo Warnings Highlight Economic Risks And Consumer Anxiety

Apr 26, 2025

Trumps Tariffs Ceo Warnings Highlight Economic Risks And Consumer Anxiety

Apr 26, 2025 -

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025 -

Exclusive Pentagon Chaos Shakes Pete Hegseth Amidst Polygraph Threats And Leaks

Apr 26, 2025

Exclusive Pentagon Chaos Shakes Pete Hegseth Amidst Polygraph Threats And Leaks

Apr 26, 2025 -

Open Ais Chat Gpt The Ftc Investigation And Future Of Ai Regulation

Apr 26, 2025

Open Ais Chat Gpt The Ftc Investigation And Future Of Ai Regulation

Apr 26, 2025

Latest Posts

-

Vaccine Study Review Hhs Selects Vaccine Skeptic David Geier

Apr 27, 2025

Vaccine Study Review Hhs Selects Vaccine Skeptic David Geier

Apr 27, 2025 -

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025 -

Discredited Misinformation Agent Hired For Cdc Vaccine Study

Apr 27, 2025

Discredited Misinformation Agent Hired For Cdc Vaccine Study

Apr 27, 2025 -

Cdc Vaccine Study Is A Discredited Agent Involved

Apr 27, 2025

Cdc Vaccine Study Is A Discredited Agent Involved

Apr 27, 2025 -

Cdcs New Vaccine Study Hire Concerns Over Misinformation Agent

Apr 27, 2025

Cdcs New Vaccine Study Hire Concerns Over Misinformation Agent

Apr 27, 2025