Is Homeownership In Canada Out Of Reach? The Role Of High Down Payments

Table of Contents

The Soaring Cost of Canadian Housing and its Impact on Down Payments

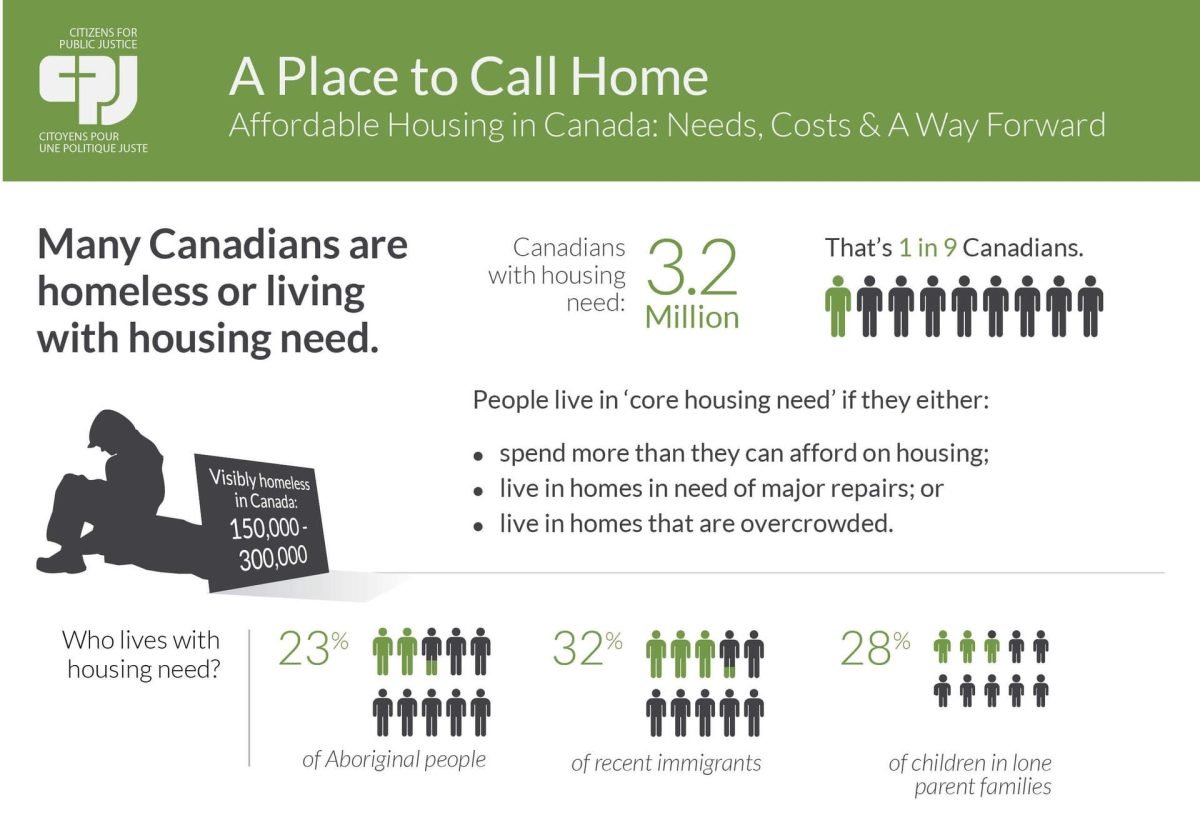

Canadian real estate has experienced a dramatic surge in prices in recent years, impacting affordability across the country. This unprecedented growth has widened the gap between average income and average home prices, making it incredibly difficult for many to save for a sufficient down payment.

- Average home price in Toronto vs. average income: In Toronto, for example, the average home price significantly surpasses the average annual income, requiring an extensive savings period to accumulate even a 5% down payment.

- Percentage increase in home prices over the last 5 years: Home prices in major Canadian cities have seen double-digit percentage increases over the past five years, exacerbating the down payment challenge.

- Comparison of home prices in different Canadian cities: While variations exist across provinces and cities, the trend of escalating home prices and the subsequent impact on required down payments remains a consistent national issue. Cities like Vancouver and Victoria consistently rank among the most expensive, demanding even higher down payments.

This escalating cost necessitates larger down payments, placing further strain on potential homebuyers.

The Minimum Down Payment Requirement and its Implications

The minimum down payment requirement in Canada depends on the purchase price of the home. For homes priced under $500,000, a 5% down payment is typically required. However, for homes priced between $500,000 and $1 million, the minimum down payment increases to 5% on the first $500,000 and 10% on the portion exceeding $500,000. This escalating percentage makes a substantial difference.

- Calculation showing the total down payment required for a $750,000 home: A $750,000 home would require a down payment of $50,000 (5% of $500,000) + $25,000 (10% of $250,000), totaling $75,000.

- Explanation of CMHC insurance and its added cost: The Canada Mortgage and Housing Corporation (CMHC) insurance is often mandatory for down payments below 20%, adding to the overall cost of homeownership. This insurance protects lenders against losses if borrowers default on their mortgage. The premium increases as the down payment decreases.

- Impact on savings timeline for first-time buyers: These requirements significantly extend the savings timeline for first-time homebuyers, who often face the additional challenge of juggling student loan debt, rent payments, and other financial obligations.

These stringent rules disproportionately impact first-time homebuyers already facing financial pressures.

Alternative Financing Options and Strategies to Overcome High Down Payments

While the challenge of high down payments is significant, several options and strategies can help potential homebuyers navigate this hurdle:

- Details of the First-Time Home Buyers' Incentive program eligibility criteria: The First-Time Home Buyers' Incentive program offers shared-equity mortgages, reducing the required down payment. However, eligibility criteria must be carefully considered.

- Advantages and disadvantages of family assistance: Receiving financial assistance from family members can be beneficial, but it’s crucial to clearly define the terms and arrangements to avoid future conflicts.

- Savings strategies to reach down payment goals faster: Implementing aggressive savings plans, budgeting meticulously, and exploring additional income streams can accelerate the process of accumulating the required down payment.

- Buying in less expensive markets or considering smaller properties: Exploring less expensive housing markets outside major urban centers or considering smaller properties can significantly reduce the required down payment.

These strategies offer viable pathways to homeownership despite the considerable financial commitment.

The Psychological Impact of High Down Payments on Potential Homebuyers

The sheer magnitude of high down payments can have a significant psychological impact on potential homebuyers.

- Impact of feeling priced out of the market: Many individuals feel disheartened and hopeless, believing that homeownership is unattainable due to escalating prices and substantial down payment requirements.

- Stress and anxiety related to saving for a large down payment: The pressure of saving a significant sum can lead to considerable stress and anxiety, affecting mental and emotional well-being.

- Strategies for maintaining financial hope and motivation: Maintaining a positive outlook, setting realistic financial goals, and seeking professional financial advice can significantly improve the chances of successful homeownership.

It's crucial to acknowledge and address the emotional toll of this financial challenge.

Conclusion: Navigating the Challenges of High Down Payments for Canadian Homeownership

The challenges posed by high down payments in the Canadian housing market are undeniable. Soaring home prices and stringent lending requirements create significant hurdles for many aspiring homeowners. However, the options outlined above—including government programs, family assistance, and strategic financial planning—provide potential pathways to success. Don't let high down payments discourage you from achieving the dream of Canadian homeownership. Explore the strategies outlined in this article and take the first step towards securing your future. Start planning your savings strategy and investigate the available options to lessen the burden of high down payments.

Featured Posts

-

The Countrys New Business Landscape A Comprehensive Map

May 10, 2025

The Countrys New Business Landscape A Comprehensive Map

May 10, 2025 -

Overstay Concerns Prompt Uk Visa Policy Changes For Nigerians And More

May 10, 2025

Overstay Concerns Prompt Uk Visa Policy Changes For Nigerians And More

May 10, 2025 -

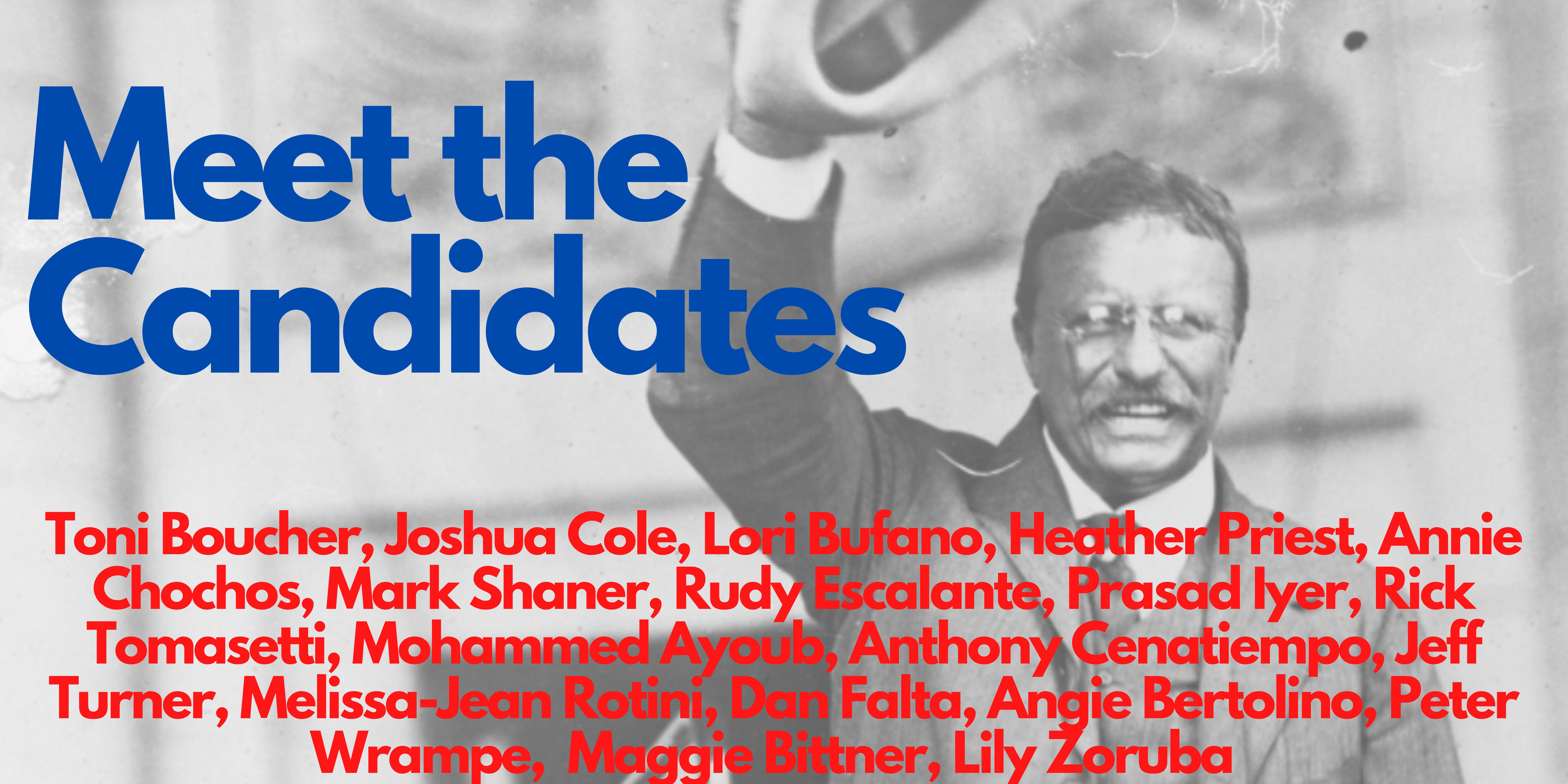

Your Guide To The Nl Federal Election Candidates

May 10, 2025

Your Guide To The Nl Federal Election Candidates

May 10, 2025 -

Dakota Dzhonson Sredi Nominantov Zolotoy Maliny Khudshie Filmy Goda

May 10, 2025

Dakota Dzhonson Sredi Nominantov Zolotoy Maliny Khudshie Filmy Goda

May 10, 2025 -

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025