Is NCLH The Top Cruise Stock Pick For Hedge Funds In 2024?

Table of Contents

NCLH's Financial Performance and Future Outlook

Recent Earnings and Revenue Growth

NCLH's recent financial reports offer a mixed bag. While revenue growth has been positive, showing a strong recovery from pandemic lows, profitability remains a challenge. Key performance indicators (KPIs) need careful scrutiny.

- Positive Indicators: Increased booking numbers for 2024 and beyond suggest strong consumer demand. Successful cost-cutting measures have improved operational efficiency in certain areas.

- Negative Indicators: High debt levels continue to be a concern, impacting profitability. Occupancy rates, while improving, haven't yet reached pre-pandemic levels consistently across all fleets.

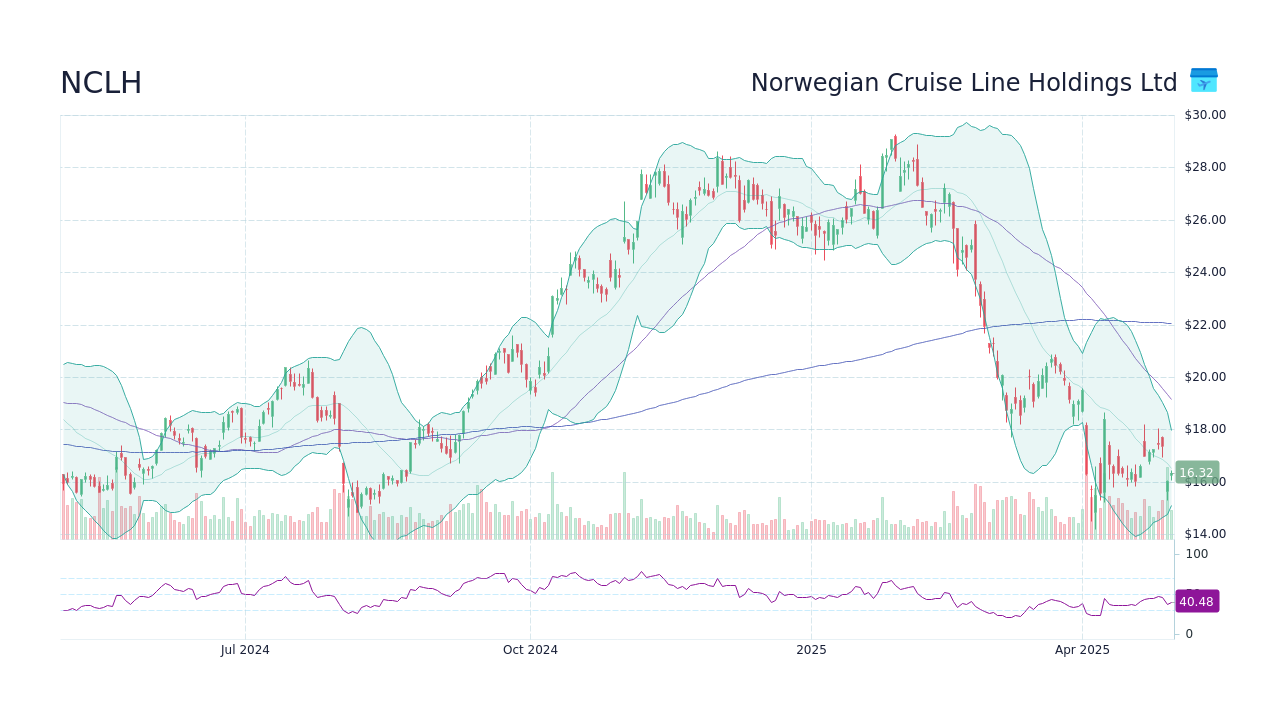

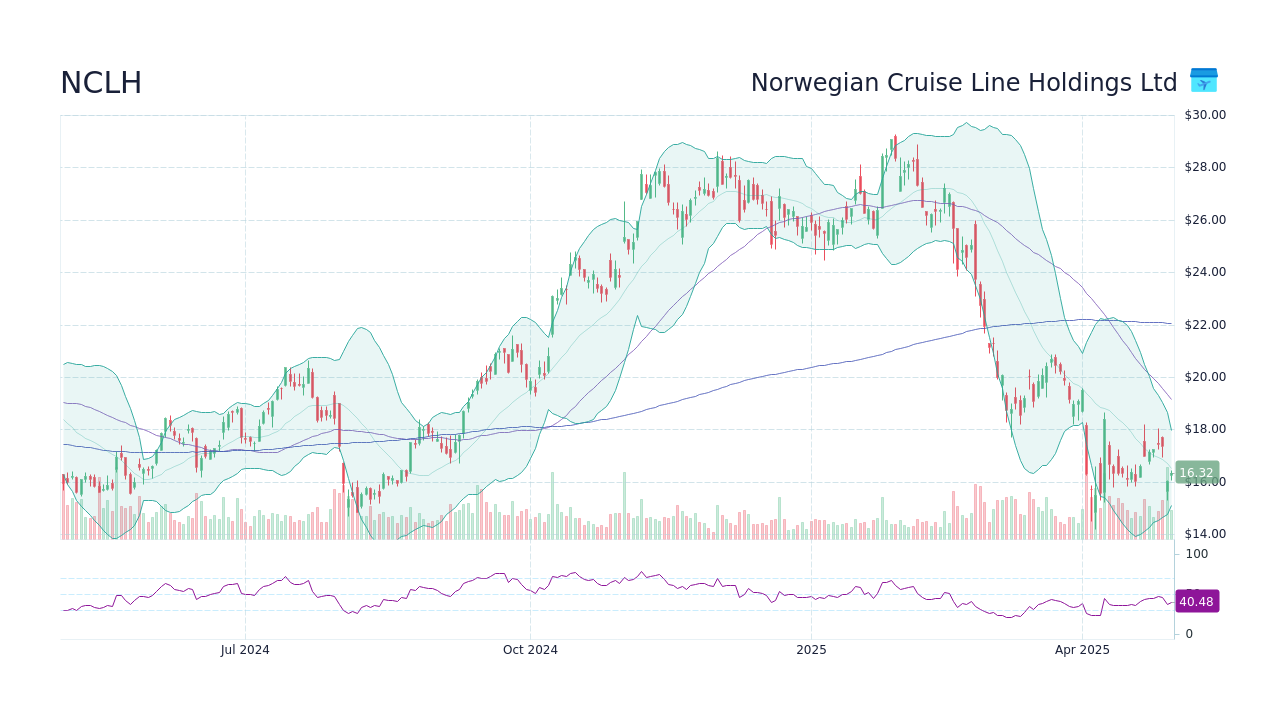

Analyzing NCLH stock performance requires a detailed look at quarterly earnings reports and comparing them to industry benchmarks and competitor performance, such as Carnival and Royal Caribbean. Careful consideration of NCLH cruise line financials is vital for any investor. Revenue projections for the next few years will be key to understanding its future growth potential.

Debt Levels and Liquidity

NCLH's high debt-to-equity ratio is a significant risk factor. While the company has taken steps to manage its debt, analysts remain concerned about its ability to service this debt effectively, particularly during periods of economic uncertainty.

- Debt-to-Equity Ratio: Monitoring this ratio is critical for understanding NCLH's financial leverage and risk profile.

- Credit Ratings: Credit rating agencies' assessments provide crucial insights into NCLH's creditworthiness and borrowing capacity.

- Cash Flow Analysis: A strong cash flow is crucial for debt repayment and overall financial stability. Examining NCLH's operating and free cash flow will provide valuable insights into its liquidity.

The assessment of NCLH debt and its impact on the company's financial stability requires thorough due diligence. Investors need to understand the potential risks associated with high leverage before considering an investment.

Fleet Modernization and Expansion Plans

NCLH's plans for fleet modernization and expansion are crucial for its future growth. The introduction of new, more efficient ships and renovations to existing vessels can significantly impact operational costs and passenger capacity.

- New Ship Launches: The timing and success of new ship launches will be key drivers of revenue growth.

- Renovations: Investing in renovations can improve the passenger experience and potentially command higher fares.

- Planned Itineraries: Attractive itineraries are crucial for attracting passengers and maximizing occupancy rates.

Understanding NCLH expansion plans and the success of its fleet modernization efforts is vital for assessing the long-term prospects of the company and its impact on NCLH stock performance.

Market Analysis and Competitive Landscape

Industry Trends and Recovery

The cruise industry is showing strong signs of recovery, with passenger numbers increasing significantly. However, the pace of recovery varies across different cruise lines.

- Passenger Numbers: Tracking passenger numbers across the industry provides valuable insights into the overall health of the sector.

- Booking Trends: Forward booking data offers clues about future demand and potential revenue growth.

- Competitor Analysis: Analyzing the performance of competitors like Carnival and Royal Caribbean is essential for understanding NCLH's market share and competitive position.

The cruise industry recovery is not uniform, and understanding NCLH's competitive advantage within this dynamic market is critical.

Hedge Fund Interest in the Cruise Sector

Hedge funds have shown renewed interest in the cruise sector, viewing it as a potential growth area. However, the level of investment in NCLH specifically varies.

- Specific Hedge Fund Holdings: Researching the holdings of major hedge funds reveals their assessment of NCLH's investment potential.

- Institutional Investors: Tracking the activities of institutional investors provides further insight into market sentiment regarding NCLH.

Analyzing hedge fund investments and institutional investor activity offers a valuable perspective on the market's overall confidence in NCLH.

Risks and Challenges Facing NCLH

Economic Uncertainty and Inflation

Economic uncertainty and inflationary pressures pose significant risks to NCLH's performance.

- Fuel Costs: Fluctuations in fuel prices directly impact operational costs.

- Consumer Spending: Economic downturns can reduce consumer discretionary spending, affecting travel budgets.

- Potential Travel Restrictions: Unexpected geopolitical events or health crises could lead to travel restrictions.

Understanding NCLH's vulnerability to macroeconomic factors is essential for assessing the risks associated with investing in the company.

Geopolitical Risks and Pandemic Concerns

Geopolitical instability and the potential for future pandemics remain key risks for the cruise industry.

- Geopolitical Risks: Political instability or armed conflicts in key cruise destinations can disrupt operations.

- Pandemic Preparedness: The cruise industry's ability to respond to future health crises is crucial for its resilience.

Assessing NCLH resilience to geopolitical risks and pandemic-related disruptions is critical for a comprehensive investment analysis.

Conclusion: Is NCLH a Top Cruise Stock Pick for Hedge Funds in 2024?

NCLH's recovery from the pandemic has been positive, but significant challenges remain. Strong revenue growth is countered by high debt levels and vulnerability to macroeconomic factors. While the cruise industry shows promise, NCLH's competitive landscape and susceptibility to unforeseen events necessitate cautious optimism. Whether it's a top cruise stock pick for hedge funds in 2024 depends on individual risk tolerance and investment strategy. While NCLH presents both opportunities and risks, understanding its financial performance and the broader cruise market is crucial before making an investment decision. Continue your research into NCLH cruise stock and its potential for growth in 2024.

Featured Posts

-

Six Nations 2025 Frances Rugby Renaissance

May 01, 2025

Six Nations 2025 Frances Rugby Renaissance

May 01, 2025 -

La Flaminia Sale Di Due Posizioni Analisi Della Rimonta

May 01, 2025

La Flaminia Sale Di Due Posizioni Analisi Della Rimonta

May 01, 2025 -

Mercedes Mone Pleads With Momo Watanabe For Tbs Championship Return

May 01, 2025

Mercedes Mone Pleads With Momo Watanabe For Tbs Championship Return

May 01, 2025 -

Jury Selection Underway In Charlotte Mothers Death Trial

May 01, 2025

Jury Selection Underway In Charlotte Mothers Death Trial

May 01, 2025 -

The Future Of French Rugby Six Nations 2025 And Beyond

May 01, 2025

The Future Of French Rugby Six Nations 2025 And Beyond

May 01, 2025