Is Norwegian Cruise Line (NCLH) Stock A Smart Hedge Fund Investment?

Table of Contents

Analyzing NCLH's Financial Performance and Future Projections

Recent Financial Results and Trends

Examining NCLH's recent financial performance is crucial for any potential investor. We need to look beyond headline numbers and dig into the details to understand the underlying health of the company.

- Quarterly Earnings: Analyze the trend of quarterly earnings reports to identify growth patterns or potential declines. Look for consistent profitability or periods of significant loss. Publicly available financial statements provide this data.

- Revenue Growth: Examine the growth in revenue over time. Is revenue consistently increasing, indicating strong demand, or is it stagnating or declining? This reflects the company's ability to attract passengers and generate income.

- Debt Levels: High debt levels can significantly impact a company's financial stability and risk profile. Analyzing NCLH's debt-to-equity ratio and overall debt burden helps gauge its financial leverage.

- Key Financial Ratios: Beyond simple revenue and profit figures, examine key ratios such as operating margin, net profit margin, and return on equity (ROE). These provide a more comprehensive picture of profitability and efficiency.

- Competitor Comparison: Comparing NCLH's performance against its main competitors, such as Royal Caribbean Cruises (RCL) and Carnival Corporation (CCL), helps gauge its relative strength and market position within the cruise industry.

Future Outlook and Industry Trends

Predicting future performance requires analyzing industry trends and considering various factors.

- Projected Cruise Industry Growth: Research the projections for the overall cruise industry's growth. Is the industry expected to continue its expansion, or are there headwinds that might slow down growth?

- Impacting Factors: Several factors can significantly affect NCLH's future performance:

- Fuel Prices: Fluctuations in fuel prices directly impact operational costs for cruise lines.

- Global Economic Conditions: Recessions and economic downturns can drastically reduce consumer spending on discretionary items like cruises.

- Consumer Confidence: Consumer confidence in travel, particularly international travel, is a significant factor.

- Strategic Initiatives: NCLH's strategic initiatives, such as fleet expansion plans, new itineraries, and marketing campaigns, can significantly impact its future profitability and growth.

Assessing the Risks Associated with Investing in NCLH Stock

Investing in NCLH stock, like any stock market investment, carries inherent risks.

Market Volatility and Economic Uncertainty

The stock market's inherent volatility is a significant risk factor.

- Macroeconomic Factors: Global economic conditions, interest rate changes, and geopolitical events can all significantly impact NCLH's stock price.

- Economic Downturns: During economic recessions, consumer discretionary spending, including cruise vacations, tends to decrease, negatively impacting NCLH's revenue and stock price.

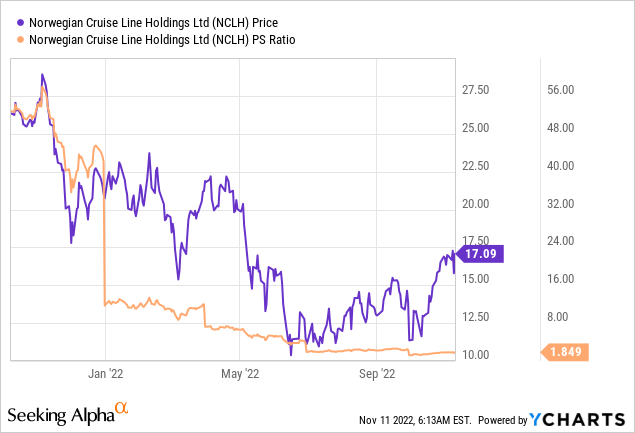

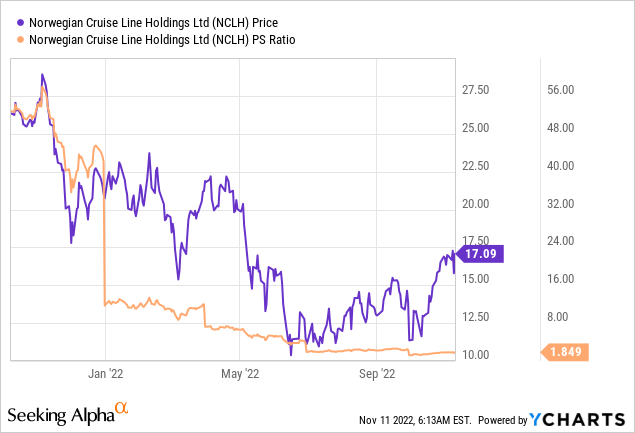

- Historical Volatility: Analyzing the historical volatility of NCLH stock helps assess the potential for future price swings and the associated risk.

Operational and Regulatory Risks

Operational and regulatory challenges pose further risks.

- Operational Challenges: Unexpected ship maintenance, crew management issues, and potential outbreaks of illness onboard can disrupt operations and damage the company's reputation.

- Environmental Regulations: Increasingly stringent environmental regulations and potential fines for non-compliance are significant risks.

- Geopolitical Instability: Geopolitical instability and travel advisories in key cruise destinations can drastically affect passenger bookings and profitability.

NCLH's Competitive Advantages and Potential for Growth

Despite the risks, NCLH possesses certain advantages.

Brand Recognition and Market Positioning

NCLH's brand recognition and market positioning are key strengths.

- Brand Strength: NCLH's brand recognition and reputation within the cruise market contribute to its ability to attract passengers.

- Innovative Offerings: NCLH's innovative offerings and unique selling propositions (USPs) differentiate it from competitors.

- Market Share: Analyzing NCLH's market share compared to its competitors provides insights into its competitive position within the industry.

Growth Opportunities and Expansion Plans

NCLH has several avenues for future growth.

- Fleet Expansion: Plans for fleet expansion and the introduction of new ships increase capacity and potentially revenue.

- Emerging Markets: Expansion into emerging markets presents significant growth opportunities.

- Digital Marketing and Loyalty Programs: Effective digital marketing and customer loyalty programs contribute to sustained revenue growth.

Evaluating NCLH as a Hedge Fund Investment Strategy

For hedge funds, the key is to evaluate NCLH within a broader investment context.

Diversification and Portfolio Allocation

NCLH's role in a diversified portfolio is paramount.

- Diversification: How does NCLH fit within a diversified investment portfolio? Does it provide adequate diversification or introduce undue risk?

- Risk-Reward Profile: Analyze the risk-reward profile of NCLH compared to other investment options within the portfolio.

- Alternative Strategies: Consider alternative investment strategies that could offer similar returns with potentially lower risk.

Hedge Fund Specific Considerations

Hedge funds may employ sophisticated strategies.

- Short-Selling: Assess the potential for short-selling NCLH stock based on market analysis and projections.

- Hedging Strategies: Explore hedging strategies to mitigate potential losses from market volatility.

- Arbitrage and other Techniques: Consider whether arbitrage opportunities or other sophisticated investment techniques are feasible.

Conclusion

This article analyzed the potential of Norwegian Cruise Line (NCLH) stock as a hedge fund investment. While NCLH presents opportunities for growth, particularly considering the industry's recovery, investors must carefully weigh the inherent financial risks and market volatility associated with the cruise industry and NCLH Stock. The company's financial performance, competitive position, and future outlook all need thorough assessment.

Call to Action: Before making any investment decisions regarding NCLH stock or other cruise ship stocks, thorough due diligence and a comprehensive understanding of the cruise industry and its inherent risks are absolutely essential. Conduct further research on NCLH investment strategies and other NCLH analysis resources to make an informed decision about whether NCLH stock aligns with your hedge fund's specific investment objectives and risk tolerance.

Featured Posts

-

Cau Chuyen Truyen Cam Hung Tien Linh Dai Su Tinh Nguyen Cua Binh Duong

Apr 30, 2025

Cau Chuyen Truyen Cam Hung Tien Linh Dai Su Tinh Nguyen Cua Binh Duong

Apr 30, 2025 -

Comprendre Le Document Amf Cp 2025 E1027752 D Arkema

Apr 30, 2025

Comprendre Le Document Amf Cp 2025 E1027752 D Arkema

Apr 30, 2025 -

Cavaliers Edge Blazers In Overtime Thriller Hunter Explodes For 32

Apr 30, 2025

Cavaliers Edge Blazers In Overtime Thriller Hunter Explodes For 32

Apr 30, 2025 -

Spd Nominates Lars Klingbeil For German Vice Chancellor And Finance Minister

Apr 30, 2025

Spd Nominates Lars Klingbeil For German Vice Chancellor And Finance Minister

Apr 30, 2025 -

Alteawn Yezz Slslt Mmyzth Dd Alshbab

Apr 30, 2025

Alteawn Yezz Slslt Mmyzth Dd Alshbab

Apr 30, 2025