Is Palantir Stock A Buy In 2024? A 40% Growth Projection Analysis

Table of Contents

Palantir's Business Model and Growth Drivers

Palantir's success hinges on its unique data analytics platforms, Gotham and Foundry, serving both government and commercial clients. Understanding these growth drivers is crucial for any Palantir stock buy consideration.

Government Contracts and Their Impact

Government contracts form a significant portion of Palantir's revenue. Their stability offers a degree of predictability, a crucial factor in assessing a Palantir investment.

- Stability and Predictability: Long-term contracts with government agencies provide a consistent revenue stream, mitigating some of the inherent volatility of the tech sector.

- Potential Risks: Fluctuations in government spending, changes in political priorities, and the competitive bidding process for new contracts present potential risks.

- Contract Portfolio: Palantir boasts a diverse portfolio of government contracts across various agencies, reducing dependence on any single client. However, the exact details of the portfolio are not always publicly available, creating some opacity for potential investors.

Commercial Sector Expansion

While government contracts provide a solid foundation, Palantir's growth aspirations depend significantly on its success in the commercial market.

- Key Commercial Wins: Palantir has secured significant contracts with leading companies in various sectors, including healthcare and finance. The specifics of these wins often highlight the platform's versatility and ability to tackle complex data challenges.

- Growth Potential: The commercial sector offers substantial expansion potential, as more companies seek sophisticated data analytics solutions to improve operational efficiency and gain a competitive edge.

- Competition: Palantir faces stiff competition from established tech giants and emerging startups in the commercial data analytics market. This competition necessitates continuous innovation and adaptation.

Technological Innovation and Future Products

Palantir's commitment to R&D is a key factor driving its long-term growth potential and influencing whether a Palantir stock buy is worthwhile.

- New Product Launches: Palantir continually develops new features and products to enhance its platforms, attracting new clients and retaining existing ones. The success of these new offerings is crucial for future growth.

- AI Capabilities: Palantir is actively integrating artificial intelligence (AI) capabilities into its platforms, offering advanced data analysis and predictive modeling. This is a significant competitive advantage in an increasingly AI-driven world.

- Future Market Potential: Palantir's future product roadmap reflects a commitment to staying at the forefront of data analytics, a key determinant of future revenue and stock performance.

Analyzing the 40% Growth Projection: Realistic or Overly Optimistic?

The 40% growth projection for 2024 is ambitious. To assess its feasibility, a thorough analysis is crucial before any Palantir stock buy.

Evaluating the Assumptions

The 40% growth projection rests on several key assumptions:

- Continued success in securing government contracts. Failure to win new contracts could significantly impact revenue.

- Successful expansion in the commercial sector. Competition is fierce, and failure to attract and retain commercial clients could hamper growth.

- Successful product innovation and timely product launches. Delayed launches or poorly received products could derail the growth trajectory.

Comparing to Historical Performance

Analyzing Palantir's past performance provides context for the 40% projection:

- Historical Revenue Growth: Palantir has demonstrated periods of strong revenue growth, but also periods of slower growth or even decline. A careful examination of these historical trends is essential.

- Factors Affecting Past Performance: Understanding what contributed to past successes and setbacks provides valuable insights into the reliability of the 40% projection.

- Consistency: The consistency of revenue growth is key in evaluating the realism of the projection.

Industry Benchmarks and Competitor Analysis

Comparing Palantir to its competitors provides a broader perspective:

- Key Competitors: Companies like Microsoft, AWS, and other data analytics firms are key competitors.

- Growth Trajectories: Analyzing the growth trajectories of these competitors helps assess whether Palantir's 40% projection is achievable in a competitive landscape.

- Competitive Advantages: Palantir's unique technology and focus on specific niche markets provide certain competitive advantages.

Assessing the Risks and Rewards of Investing in Palantir Stock

Investing in Palantir stock carries both significant risks and potential rewards:

Financial Health and Valuation

A detailed look at Palantir's financial statements is critical:

- Key Financial Ratios: Analyzing key ratios like the Price-to-Earnings (P/E) ratio and debt-to-equity ratio offers insights into Palantir's financial health and valuation.

- Overvalued or Undervalued: Determining whether Palantir is currently overvalued or undervalued relative to its peers and future growth prospects is paramount for any investment decision.

Market Volatility and Macroeconomic Factors

External factors significantly influence Palantir's stock price:

- Interest Rates and Inflation: Changes in interest rates and inflation impact investor sentiment toward growth stocks like Palantir.

- Geopolitical Events: Global events can significantly influence investor confidence and market volatility.

- Market Sentiment: Overall market sentiment towards the tech sector affects Palantir's stock price.

Management Team and Corporate Governance

The quality of Palantir's leadership and corporate governance is important:

- Experience and Expertise: The experience and track record of Palantir's management team influence investor confidence.

- Corporate Culture and Ethical Standards: A strong corporate culture and ethical standards contribute to long-term sustainability.

Conclusion: Should You Buy Palantir Stock in 2024?

Deciding whether to buy Palantir stock in 2024 requires careful consideration of the 40% growth projection, the inherent risks, and your personal investment goals and risk tolerance. While the potential rewards are significant, driven by strong government contracts and expansion into the commercial sector, the path is not without its challenges. The ambitious growth projection requires significant success across various fronts, and market volatility and competitive pressures pose substantial risks. Before making any investment decision, thorough due diligence is essential. Consider consulting a financial advisor to ensure that a Palantir stock buy aligns with your broader investment strategy and risk appetite. Conduct your own thorough research and consider diversifying your portfolio to mitigate potential losses. Only then can you make an informed decision about whether Palantir stock is the right investment for you in 2024.

Featured Posts

-

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Nationals

May 10, 2025

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Nationals

May 10, 2025 -

Book Cover Design Exploring The Medieval Tale Of Merlin And Arthur

May 10, 2025

Book Cover Design Exploring The Medieval Tale Of Merlin And Arthur

May 10, 2025 -

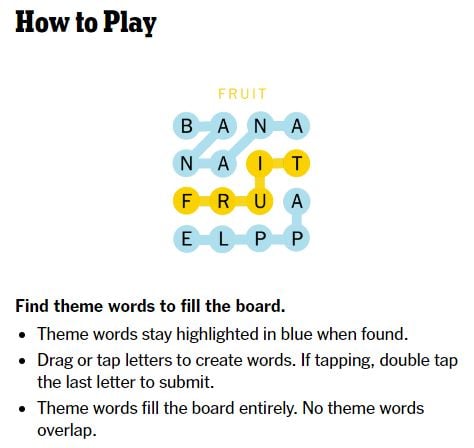

Nyt Strands Today April 6 2025 Clues And Hints

May 10, 2025

Nyt Strands Today April 6 2025 Clues And Hints

May 10, 2025 -

Edmonton Oilers Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025

Edmonton Oilers Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Guide

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Guide

May 10, 2025