Is Palantir Stock A Good Buy Before Its May 5th Earnings?

Table of Contents

Palantir's Recent Performance and Growth Trajectory

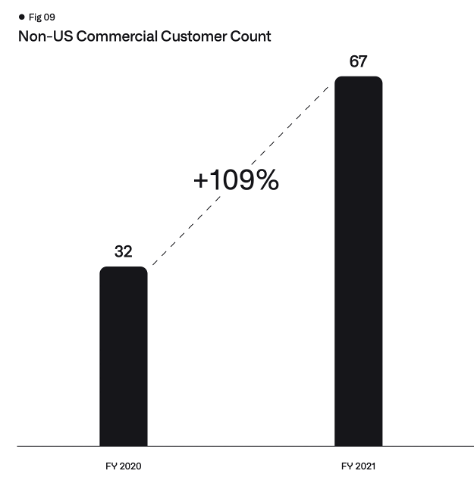

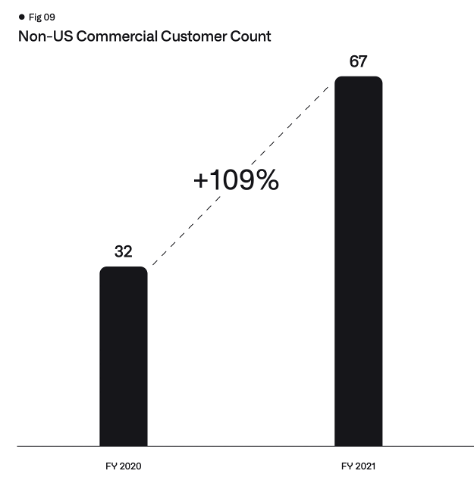

Analyzing Palantir's recent financial reports is vital for assessing its growth trajectory and potential future performance. Key performance indicators (KPIs) like revenue growth, operating income, and customer acquisition provide valuable insights into the company's health. Palantir operates in both the government and commercial sectors, and understanding its progress in each is crucial for a comprehensive evaluation.

-

Revenue growth in Q4 2022 and projections for Q1 2023: Examining the recent quarterly reports reveals the pace of revenue expansion, offering clues about the company's momentum heading into the May 5th earnings announcement. Significant growth could signal a positive outlook, while slower growth might raise concerns.

-

Growth in government contracts vs. commercial contracts: Palantir's revenue stream is split between government and commercial contracts. Assessing the growth rate in each sector helps to understand its diversification and risk profile. A balanced portfolio across both sectors generally suggests greater stability.

-

Expansion into new markets and technological advancements: Innovation is key in the tech sector. Analyzing Palantir's expansion into new markets and its investment in research and development (R&D) provides a glimpse into its future growth potential. New product launches and partnerships could signify strong growth drivers.

-

Key partnerships and collaborations: Strategic alliances with other companies can significantly impact Palantir's reach and capabilities. Analyzing these partnerships helps in evaluating the company's potential for future growth. Strong partnerships can lead to increased market share and revenue. These factors are all crucial aspects of assessing Palantir revenue and Palantir growth. The PLTR financial performance needs to be assessed holistically to get a comprehensive picture.

Analyst Expectations and Price Targets for Palantir Stock

Understanding analyst expectations is another critical step in evaluating Palantir stock. Financial analysts offer price targets and ratings that reflect their collective assessment of the company's future performance. While not a guarantee, this consensus can influence market sentiment and stock price movement.

-

Average price target for PLTR stock: The average price target among analysts provides a benchmark for potential future stock value.

-

Range of price targets from different analysts: Different analysts may have varying price targets, reflecting the diversity of opinions and perspectives. A wide range indicates higher uncertainty.

-

Potential upside and downside scenarios: It's essential to consider both the best-case and worst-case scenarios based on analyst forecasts. Understanding the potential range of outcomes is crucial for managing risk.

-

Impact of earnings beat or miss on stock price: The market's reaction to the earnings report will significantly impact the stock price. Exceeding expectations generally leads to price increases, while falling short can cause declines. This is a key aspect of the Palantir stock forecast. Wall Street outlook often heavily influences short-term price fluctuations. Understanding the Palantir price target and PLTR analyst ratings helps in gauging the market's expectations.

Risks and Potential Downsides of Investing in Palantir Stock

Despite its potential, investing in Palantir stock carries inherent risks. A balanced assessment necessitates acknowledging these potential downsides.

-

Competition from other big data analytics companies: Palantir operates in a competitive market with other established players. Intense competition could put pressure on margins and revenue growth.

-

Reliance on government contracts and their impact: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's financial performance. This is a key aspect of the government contract risk.

-

Market volatility and its effect on tech stocks: The tech sector is known for its volatility. Market downturns can significantly impact even the strongest companies. Understanding the inherent tech stock volatility is crucial.

-

Potential for slower-than-expected growth: While Palantir shows promise, there's always a risk that its growth might not meet expectations, leading to stock price declines. This risk is an important aspect of Palantir risk and PLTR risks.

Factors to Consider Before Buying Palantir Stock Before Earnings

Before making any investment decisions, it's crucial to consider your personal circumstances and risk tolerance.

-

Your personal risk tolerance and investment goals: Investing in Palantir stock involves risk. Your risk tolerance should align with your investment goals and overall financial situation.

-

Your investment horizon (short-term vs. long-term): Your investment timeframe is a crucial factor. Short-term investors might be more sensitive to market fluctuations, while long-term investors can ride out short-term volatility.

-

Portfolio diversification and asset allocation: Diversifying your portfolio across different asset classes reduces overall risk. Don't put all your eggs in one basket. This is a key aspect of Palantir investment strategy.

-

Importance of due diligence and independent research: Before investing in any stock, conducting thorough research and seeking professional advice is essential. This is key for any PLTR investment.

Conclusion: Should You Buy Palantir Stock Before its May 5th Earnings?

Investing in Palantir stock before its May 5th earnings presents both opportunities and risks. While the company shows potential for growth, the inherent volatility of the tech market and its reliance on government contracts introduce considerable uncertainty. Thorough analysis of Palantir's recent performance, analyst expectations, and inherent risks is crucial. Remember to consider your own risk tolerance and investment horizon before making any investment decisions. Conduct your own due diligence and make an informed decision regarding whether Palantir stock is a good buy for you before the May 5th earnings announcement. This comprehensive Palantir stock analysis should help you make an informed Palantir investment decision. Remember that the May 5th earnings impact will be significant, so careful consideration is key for anyone thinking about investing in Palantir.

Featured Posts

-

New Spring Collection Elizabeth Stewart Partners With Lilysilk

May 10, 2025

New Spring Collection Elizabeth Stewart Partners With Lilysilk

May 10, 2025 -

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 10, 2025

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 10, 2025 -

Pley Off Vegas Golden Nayts Obygryvaet Minnesotu V Overtayme

May 10, 2025

Pley Off Vegas Golden Nayts Obygryvaet Minnesotu V Overtayme

May 10, 2025 -

Understanding The Celebrity Antiques Road Trip Format And Its Appeal

May 10, 2025

Understanding The Celebrity Antiques Road Trip Format And Its Appeal

May 10, 2025 -

Nyt Strands Saturday Puzzle April 12 2025 Clues Theme And Solution Help

May 10, 2025

Nyt Strands Saturday Puzzle April 12 2025 Clues Theme And Solution Help

May 10, 2025