Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's business model centers around providing powerful data analytics platforms to government and commercial clients. Its revenue streams are primarily derived from two key segments: government contracts and commercial partnerships.

Government Contracts

Government contracts form a significant portion of Palantir's revenue. The company provides its Gotham platform to intelligence agencies and defense departments worldwide, assisting them in data integration, analysis, and decision-making.

- Examples of key government contracts: While specific details are often confidential, Palantir has publicly acknowledged significant contracts with various US government agencies and international defense organizations.

- Revenue breakdown from government vs. commercial sectors: Historically, government contracts have constituted a larger portion of Palantir's revenue, although the commercial sector is rapidly growing. Analyzing the exact breakdown requires reviewing Palantir's financial reports.

- Potential risks associated with government reliance: Dependence on government contracts exposes Palantir to the risks associated with changes in defense spending, shifting political priorities, and the potential loss of large contracts due to bidding processes or budgetary constraints. Keywords: government contracts, defense spending, intelligence agencies, data analytics for government.

Commercial Partnerships

Palantir is actively expanding its presence in the commercial sector, offering its Foundry platform to large corporations across various industries. This platform helps businesses integrate and analyze massive datasets to improve operational efficiency, enhance decision-making, and gain a competitive edge.

- Examples of major commercial clients: Palantir has secured partnerships with prominent companies in sectors like finance, healthcare, and manufacturing. Specific client names are often kept confidential due to non-disclosure agreements.

- Types of software solutions offered: Palantir Foundry provides a comprehensive suite of data integration, analytics, and visualization tools tailored to diverse business needs.

- Growth potential in the commercial market: The commercial market presents substantial growth opportunities for Palantir. The increasing volume of data generated by businesses necessitates robust analytics solutions, creating a large addressable market.

- Competitive landscape analysis: Palantir faces competition from established players and emerging startups in the data analytics space. Understanding this competitive landscape is crucial for assessing Palantir's long-term growth potential. Keywords: commercial partnerships, data analytics platform, enterprise software, big data analytics.

Financial Performance and Growth Prospects

Analyzing Palantir's financial performance is essential for evaluating its investment potential. Key metrics provide insights into its past trajectory and potential for future growth.

Revenue Growth and Profitability

Palantir has shown significant revenue growth, although profitability has been a focus area for the company.

- Key financial metrics (revenue, EBITDA, net income): Examining these metrics year-over-year provides a clear picture of Palantir's financial performance and its progress toward profitability.

- Year-over-year growth comparisons: Consistent and accelerating revenue growth indicates a healthy business model and strong market demand.

- Analyst forecasts: Consulting analyst reports provides insights into future revenue and earnings projections. It’s important to note these are estimations.

- Potential catalysts for growth: Expanding its commercial partnerships and developing new data analytics solutions are potential catalysts for future growth. Keywords: revenue growth, profitability, earnings per share, financial performance, market capitalization.

Cash Flow and Debt

Understanding Palantir's cash flow generation and debt levels provides insights into its financial health and sustainability.

- Free cash flow analysis: Positive and growing free cash flow demonstrates the company's ability to generate cash from its operations.

- Debt-to-equity ratio: This ratio reveals the company's leverage and its capacity to manage its debt obligations.

- Liquidity position: A strong liquidity position indicates the company's ability to meet its short-term obligations.

- Discussion of any potential financial risks: High debt levels or insufficient cash flow can present financial risks. Keywords: cash flow, debt, financial health, liquidity, balance sheet.

Risks and Challenges Facing Palantir

Despite its strengths, Palantir faces several risks and challenges that investors should carefully consider.

Competition and Market Saturation

The data analytics market is highly competitive, with both established players and emerging startups vying for market share.

- Key competitors (e.g., Databricks, Snowflake): Analyzing the strengths and weaknesses of key competitors provides a framework for assessing Palantir's competitive position.

- Market share analysis: Tracking Palantir's market share reveals its competitive success and potential for future growth.

- Potential for market saturation: The market for data analytics could become saturated in the future, increasing competition and potentially reducing profitability.

- Strategies to maintain competitive advantage: Palantir must continuously innovate and adapt to maintain its competitive edge. Keywords: competition, market share, competitive landscape, market saturation, disruptive technologies.

Dependence on Large Contracts

Palantir's reliance on large contracts, both government and commercial, presents significant risk.

- Contract renewal risks: The failure to renew large contracts could negatively impact Palantir's revenue and profitability.

- Potential for contract losses: Competitive bidding processes and changes in client priorities can lead to contract losses.

- Diversification strategies: To mitigate risk, Palantir needs to diversify its client base and revenue streams.

- Impact of geopolitical instability: Geopolitical events can affect government contracts and commercial partnerships, creating uncertainty and potential revenue disruptions. Keywords: contract risk, contract renewal, geopolitical risk, diversification.

Valuation and Investment Considerations

Assessing Palantir's valuation is crucial for determining whether the current stock price reflects its intrinsic value and future growth prospects.

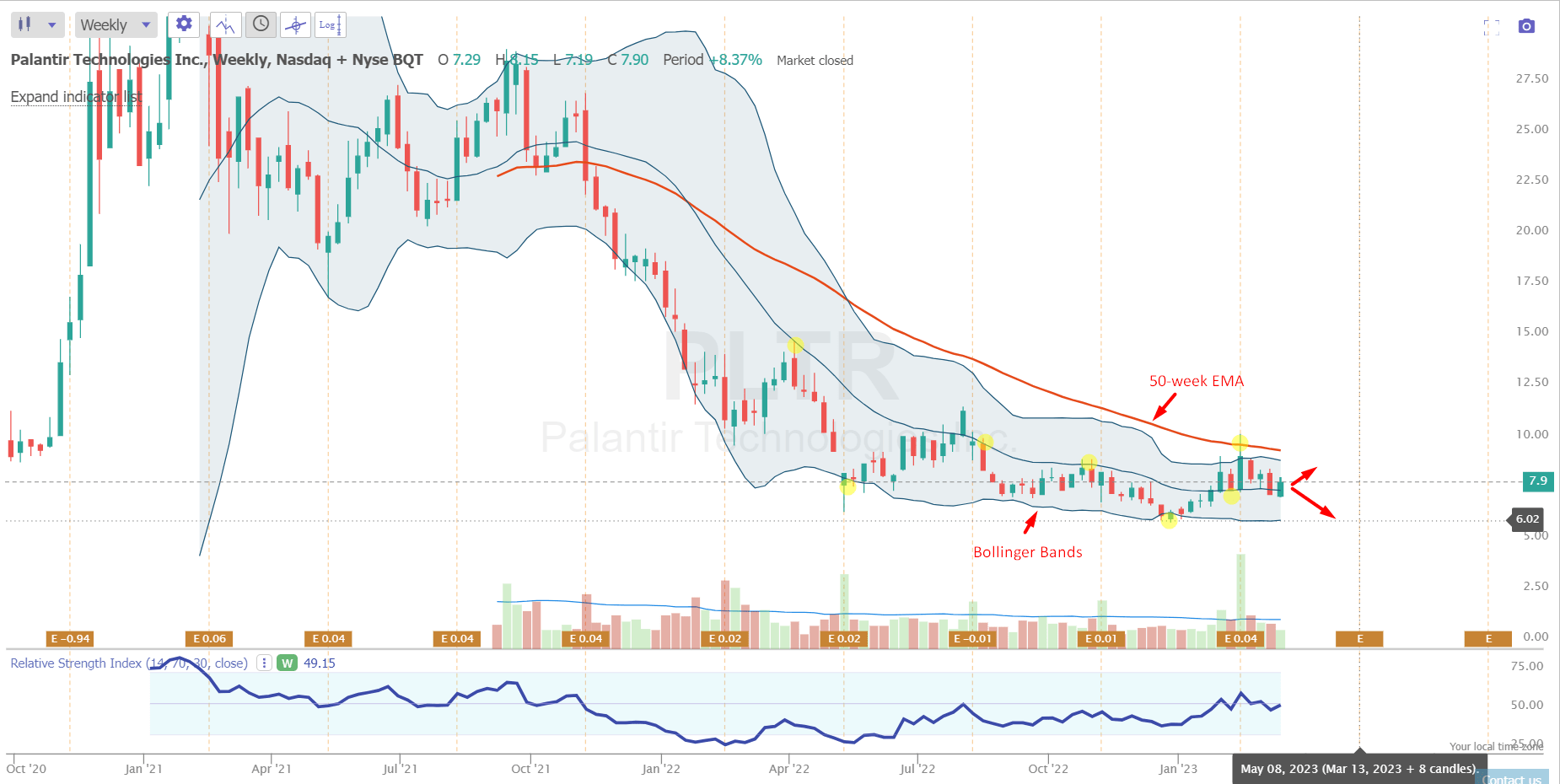

Stock Price Analysis

Several valuation metrics can help assess Palantir's stock price.

- Price-to-sales ratio: This ratio compares the company's market capitalization to its revenue.

- Price-to-earnings ratio: This ratio compares the stock price to the company's earnings per share.

- Market sentiment: Investor sentiment toward Palantir can influence its stock price.

- Analyst ratings: Analyst ratings provide insights into the overall perception of Palantir's investment potential.

- Potential upside and downside scenarios: Considering various scenarios allows for a more comprehensive risk assessment. Keywords: stock price, valuation, price-to-sales ratio, PE ratio, market sentiment, stock forecast.

Buy, Sell, or Hold Recommendation

Based on the analysis presented, it's difficult to give a definitive "buy," "sell," or "hold" recommendation without considering individual investment goals and risk tolerance. A thorough review of the company's financials and an understanding of the risks are key to making an informed decision.

- Strengths and weaknesses of the investment thesis: Carefully weigh the positive and negative aspects of investing in Palantir.

- Potential risks and rewards: Assess the potential for high returns versus the potential for losses.

- Long-term growth potential: Consider Palantir's long-term prospects in the data analytics market. Keywords: buy recommendation, sell recommendation, hold recommendation, investment strategy, risk assessment.

Conclusion

This comprehensive analysis of Palantir Technologies stock provides a nuanced perspective on its investment potential. While the company boasts impressive technology and a growing market presence, investors should carefully weigh the risks, including competition and dependence on large contracts. The decision of whether Palantir is a "buy" depends on individual risk tolerance and investment goals. Consider your personal financial situation and conduct thorough due diligence before investing in Palantir Technologies stock or any other security. Remember, this analysis is for informational purposes only and should not be considered financial advice. Ultimately, the question of whether Palantir stock is a buy for you requires careful consideration of all the factors outlined above. Before making any investment decisions regarding Palantir Technologies stock, consult with a qualified financial advisor.

Featured Posts

-

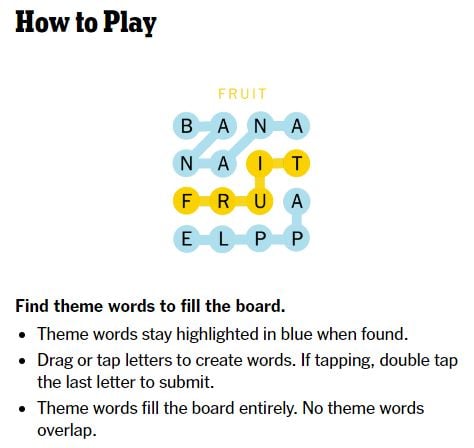

Nyt Strands Today April 6 2025 Clues And Hints

May 10, 2025

Nyt Strands Today April 6 2025 Clues And Hints

May 10, 2025 -

Extreme Price Hike For V Mware At And T Highlights Broadcoms 1 050 Proposal

May 10, 2025

Extreme Price Hike For V Mware At And T Highlights Broadcoms 1 050 Proposal

May 10, 2025 -

Nyt Strands Hints And Answers Tuesday March 4 Game 366

May 10, 2025

Nyt Strands Hints And Answers Tuesday March 4 Game 366

May 10, 2025 -

Stock Market Prediction Identifying 2 Stocks To Beat Palantirs Performance In 3 Years

May 10, 2025

Stock Market Prediction Identifying 2 Stocks To Beat Palantirs Performance In 3 Years

May 10, 2025 -

Ligne 3 De Tram Dijon Le Projet Entre En Concertation

May 10, 2025

Ligne 3 De Tram Dijon Le Projet Entre En Concertation

May 10, 2025