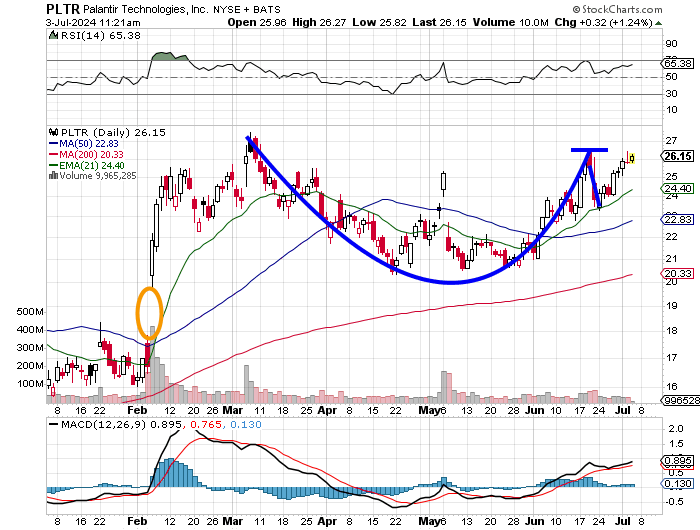

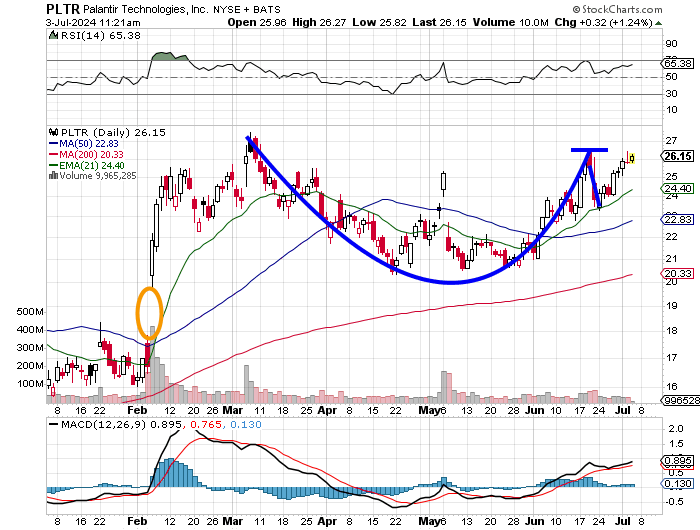

Is Palantir's High Stock Price Justified Despite Past Financial Blowouts?

Table of Contents

Palantir's Recent Financial Performance and Growth Prospects

Palantir, known for its Gotham and Foundry platforms, has experienced significant growth in recent years, fueled by increased demand for its data analytics solutions in both the government and commercial sectors. Analyzing Palantir's recent financial reports reveals a mixed picture. While revenue growth has been impressive, profitability remains a key area of focus.

- Revenue Growth: Palantir has consistently demonstrated strong year-over-year revenue growth, exceeding expectations in several quarters. Specific figures need to be updated with current data for accuracy. For example, [insert actual recent revenue figures and growth percentages from Palantir's financial reports].

- Key Clients and Contracts: Significant contract wins with major government agencies and large commercial enterprises have been crucial to Palantir's growth. [Include specific examples of high-profile contracts and clients, citing sources].

- Profitability and Operating Expenses: While revenue is increasing, Palantir's profitability margins need scrutiny. High operating expenses, particularly in research and development, impact profit margins. [Include details regarding operating margins and R&D spending].

- Future Growth Projections: Analysts' predictions for Palantir's future growth vary widely. Some project continued strong expansion, while others express caution regarding the sustainability of its current growth trajectory. [Include details and citations on analyst forecasts].

The sustainability of this growth hinges on continued success in winning new contracts, expanding its commercial customer base, and effectively managing operating expenses. The potential for increased competition and economic downturns represents significant risk factors.

The Impact of Government Contracts on Palantir's Valuation

Government contracts form a substantial portion of Palantir's revenue. This dependence, however, presents both opportunities and risks.

- Revenue Dependence: [Insert percentage of revenue derived from government contracts based on Palantir’s financial statements]. This high reliance makes Palantir vulnerable to changes in government spending and policy.

- Geopolitical Landscape: Global political instability and shifting government priorities can directly impact contract renewals and future awards. [Discuss current geopolitical events and their potential effect on Palantir's government contracts].

- Contract Wins and Losses: The competitive bidding process for government contracts is inherently uncertain. Losing a significant contract could significantly impact Palantir's financial performance.

- Comparison to Competitors: Unlike some competitors focusing primarily on the commercial sector, Palantir's significant government business is a unique aspect of its business model. This reliance, while generating substantial revenue, also introduces greater volatility.

The extent to which this reliance on government contracts justifies Palantir's current high stock price is a key question for investors.

Comparison to Competitors in the Big Data Analytics Market

To gauge Palantir's valuation, it's crucial to compare it to its competitors in the rapidly growing big data analytics market.

- Competitive Landscape: Key competitors include companies like Databricks, Snowflake, and others. [Create a table comparing Palantir's key financial metrics – revenue, market capitalization, profit margins – against its main competitors].

- Competitive Advantages and Disadvantages: Palantir’s strengths lie in its advanced analytics capabilities and strong relationships with government agencies. However, its higher pricing and less extensive platform capabilities compared to some competitors represent potential weaknesses.

- Market Trends: The big data analytics market is experiencing rapid growth, driven by increasing data volumes and the need for sophisticated analytics solutions. However, increased competition could put pressure on pricing and margins.

By comparing Palantir's performance and valuation to its peers, investors can better assess whether its current stock price is justified relative to its market position and growth prospects.

Addressing Past Financial Blowouts and Investor Sentiment

Palantir’s journey hasn't been without its setbacks. Past financial difficulties significantly impacted investor sentiment.

- Past Financial Setbacks: [Discuss specific examples of past financial challenges faced by Palantir, such as periods of losses or slower-than-expected growth].

- Reasons for Setbacks: Analyze the factors contributing to these setbacks, such as aggressive expansion strategies, challenges in scaling operations, or difficulties in penetrating certain markets.

- Improved Financial Management: Assess the steps Palantir has taken to address past shortcomings, such as improving operational efficiency, strengthening its financial management team, or refining its strategic focus.

- Shifting Investor Perception: Analyze how investor sentiment towards Palantir has evolved over time in light of improved financial performance and strategic initiatives.

Whether the market has fully factored in these past issues in its current valuation of Palantir's stock remains a critical question.

Conclusion: Is Palantir's High Stock Price Ultimately Justified?

The justification of Palantir's high stock price is a complex issue. While its recent financial performance demonstrates growth and significant contract wins, the reliance on government contracts, competition from other big data analytics firms, and the legacy of past financial challenges introduce significant uncertainties. The company's future growth trajectory, profitability margins, and ability to navigate the evolving big data landscape will all be critical determinants of its long-term valuation.

Before investing in Palantir, carefully consider the complexities surrounding Palantir's high stock price and its future growth prospects. Conduct thorough due diligence and stay informed about the company's financial performance to make informed decisions.

Featured Posts

-

Who Wants To Be A Millionaire Easy Question Stumps Contestant See If You Can Do Better

May 07, 2025

Who Wants To Be A Millionaire Easy Question Stumps Contestant See If You Can Do Better

May 07, 2025 -

The Cool Girl Vibe Rihannas Engagement Ring And Red Shoe Choice

May 07, 2025

The Cool Girl Vibe Rihannas Engagement Ring And Red Shoe Choice

May 07, 2025 -

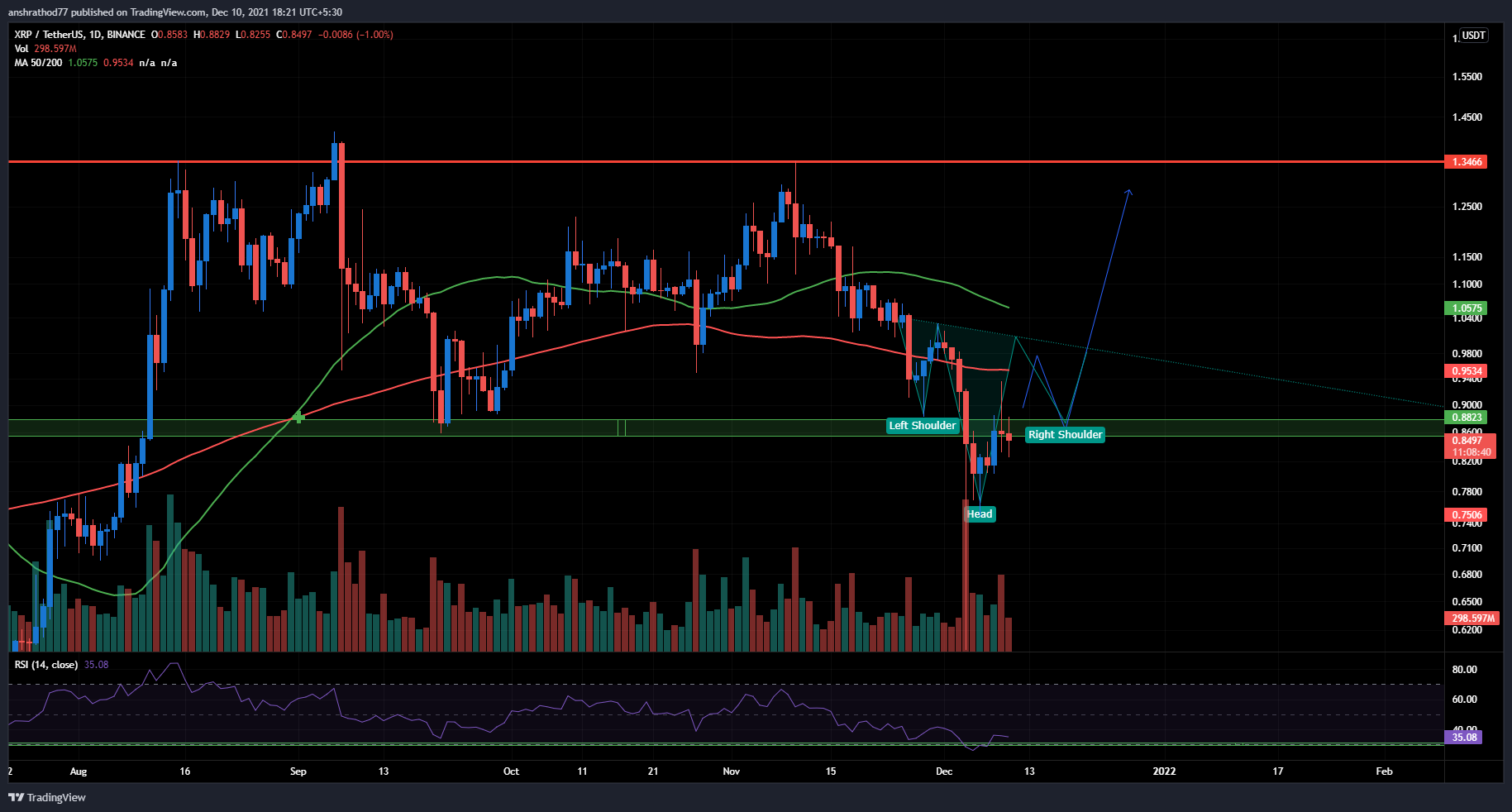

Should You Buy Xrp After Its 400 Increase A Detailed Look

May 07, 2025

Should You Buy Xrp After Its 400 Increase A Detailed Look

May 07, 2025 -

Keanu Reeves John Wick 5 Everything We Know So Far

May 07, 2025

Keanu Reeves John Wick 5 Everything We Know So Far

May 07, 2025 -

Ortega Verlaat Scream 7 De Officiele Verklaring

May 07, 2025

Ortega Verlaat Scream 7 De Officiele Verklaring

May 07, 2025

Latest Posts

-

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025 -

What To Do When Your Crucial Dwp Letter Goes Missing

May 08, 2025

What To Do When Your Crucial Dwp Letter Goes Missing

May 08, 2025 -

Dwp Communication Breakdown The High Cost Of Missing Mail

May 08, 2025

Dwp Communication Breakdown The High Cost Of Missing Mail

May 08, 2025 -

Is This Confirmation Jayson Tatum Ella Mai And A New Baby In A Commercial

May 08, 2025

Is This Confirmation Jayson Tatum Ella Mai And A New Baby In A Commercial

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025