Is Riot Platforms (RIOT) Stock A Buy At 52-Week Lows?

Table of Contents

Riot Platforms (RIOT), a major player in the Bitcoin mining industry, has recently seen its stock price plummet to 52-week lows. This significant drop raises a crucial question for investors: is now the time to buy RIOT stock, or should you steer clear? This in-depth analysis examines the current market conditions, RIOT's financial performance, and future prospects to help you determine if RIOT stock is a worthwhile investment at its current price. We'll consider factors like Bitcoin's price, energy costs, and the company's overall strategic direction. This analysis will help you understand whether Riot Platforms stock is a good investment for your portfolio.

Analyzing Riot Platforms' (RIOT) Current Financial Situation

Revenue and Profitability

Riot Platforms' revenue is primarily generated through Bitcoin mining. Analyzing recent financial reports is crucial to understanding RIOT's profitability. We need to examine revenue streams, profitability margins, and compare current performance to previous quarters and industry averages. Key financial metrics to consider include:

- Revenue: Total revenue generated from Bitcoin mining operations.

- Net Income: The company's profit after all expenses are deducted.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): A measure of profitability that excludes the impact of financing and accounting decisions.

A decline in Bitcoin's price directly impacts RIOT's revenue, as the value of mined Bitcoin decreases. Furthermore, significant cost factors like energy costs and equipment expenses heavily influence profitability margins. Comparing RIOT's performance to competitors like Marathon Digital Holdings (MARA) and Core Scientific (CORZ) provides valuable context.

Debt and Liquidity

Understanding RIOT's debt levels and liquidity is vital for assessing its financial stability. Key metrics to analyze include:

- Debt-to-Equity Ratio: Indicates the proportion of company financing from debt compared to equity. A high ratio suggests higher financial risk.

- Current Ratio: Measures the company's ability to pay its short-term liabilities with its short-term assets. A ratio below 1 suggests potential liquidity issues.

- Cash on Hand: The amount of readily available cash the company possesses.

RIOT's ability to manage its debt and withstand market fluctuations is crucial. High debt levels could pose significant risks, especially during periods of low Bitcoin prices or increased operational costs. A strong cash position, however, would mitigate these risks.

Bitcoin's Price and its Impact on RIOT Stock

Correlation between Bitcoin Price and RIOT Stock

The price of Bitcoin has a strong positive correlation with RIOT's stock performance. When Bitcoin's price rises, RIOT's stock price generally follows suit, and vice versa. A chart illustrating this historical relationship would clearly demonstrate this dependence.

Bitcoin price volatility significantly impacts RIOT's revenue and profitability. A sharp decline in Bitcoin's price can lead to substantial losses, while a surge can boost profits considerably. Analyzing potential future Bitcoin price scenarios – bullish, bearish, or sideways – is crucial to forecasting RIOT's performance.

Bitcoin Mining Difficulty and Hash Rate

Bitcoin mining difficulty and hash rate are key factors influencing RIOT's operations and profitability.

- Mining Difficulty: This refers to the computational difficulty of solving complex mathematical problems to mine Bitcoin. Increased difficulty reduces the likelihood of successfully mining Bitcoin.

- Hash Rate: This represents the computing power dedicated to Bitcoin mining. A higher hash rate increases the chances of mining Bitcoin.

Changes in these factors directly impact RIOT's mining efficiency and, consequently, its earnings. Comparing RIOT's hash rate to its competitors provides insights into its market position and competitiveness.

Future Outlook and Growth Potential for Riot Platforms (RIOT)

Expansion Plans and Strategic Initiatives

Riot Platforms' future growth potential hinges on its expansion plans and strategic initiatives. These include:

- New Mining Facilities: Expanding mining capacity to increase Bitcoin production.

- Technology Upgrades: Investing in more energy-efficient mining equipment to reduce operational costs.

- Strategic Partnerships: Collaborations that could unlock new opportunities and enhance efficiency.

The success of these initiatives will significantly impact RIOT's financial performance. However, risks and challenges associated with expansion, such as securing sufficient energy resources and managing technological complexities, must be carefully considered.

Competitive Landscape and Market Share

RIOT operates in a competitive Bitcoin mining industry. Analyzing its market share and competitive position is crucial. This involves comparing RIOT with other major Bitcoin mining companies, identifying its competitive advantages (e.g., low energy costs, efficient mining operations), and assessing potential for future market share growth. The ability to navigate the competitive landscape and maintain a strong market position will be critical for RIOT's long-term success.

Conclusion

This analysis reveals that Riot Platforms' (RIOT) financial health is intrinsically linked to the price of Bitcoin. While the current 52-week lows present a potential buying opportunity for some investors, it's crucial to acknowledge the significant risks associated with this volatile sector. The company's expansion plans and strategic initiatives offer potential for future growth, but their success is not guaranteed. The high correlation between Bitcoin's price and RIOT's stock price necessitates careful consideration of Bitcoin's price volatility.

Call to Action: Is Riot Platforms (RIOT) stock a buy at 52-week lows? The decision depends on your individual risk tolerance and investment goals. Conduct thorough research, consider consulting a financial advisor, and carefully weigh the potential rewards against the considerable risks before making any investment decisions. Further research into Riot Platforms stock price prediction and the broader Bitcoin mining stocks market can enhance your understanding. Remember, this is not financial advice.

Featured Posts

-

La Position De Macron Sur La Palestine Une Erreur Selon Netanyahu

May 03, 2025

La Position De Macron Sur La Palestine Une Erreur Selon Netanyahu

May 03, 2025 -

Is Milwaukees Rental Market Truly Exclusive And Cutthroat

May 03, 2025

Is Milwaukees Rental Market Truly Exclusive And Cutthroat

May 03, 2025 -

Reform Uk Figure Rupert Lowe Faces Bullying Allegations Police Involved

May 03, 2025

Reform Uk Figure Rupert Lowe Faces Bullying Allegations Police Involved

May 03, 2025 -

England Womens World Cup Final Preview Likely Lineups And Match Prediction

May 03, 2025

England Womens World Cup Final Preview Likely Lineups And Match Prediction

May 03, 2025 -

Tributes Pour In Manchester United Bayern Munich Honour Poppy Atkinson

May 03, 2025

Tributes Pour In Manchester United Bayern Munich Honour Poppy Atkinson

May 03, 2025

Latest Posts

-

Dutch Energy Providers Experiment With Dynamic Pricing Based On Solar Output

May 04, 2025

Dutch Energy Providers Experiment With Dynamic Pricing Based On Solar Output

May 04, 2025 -

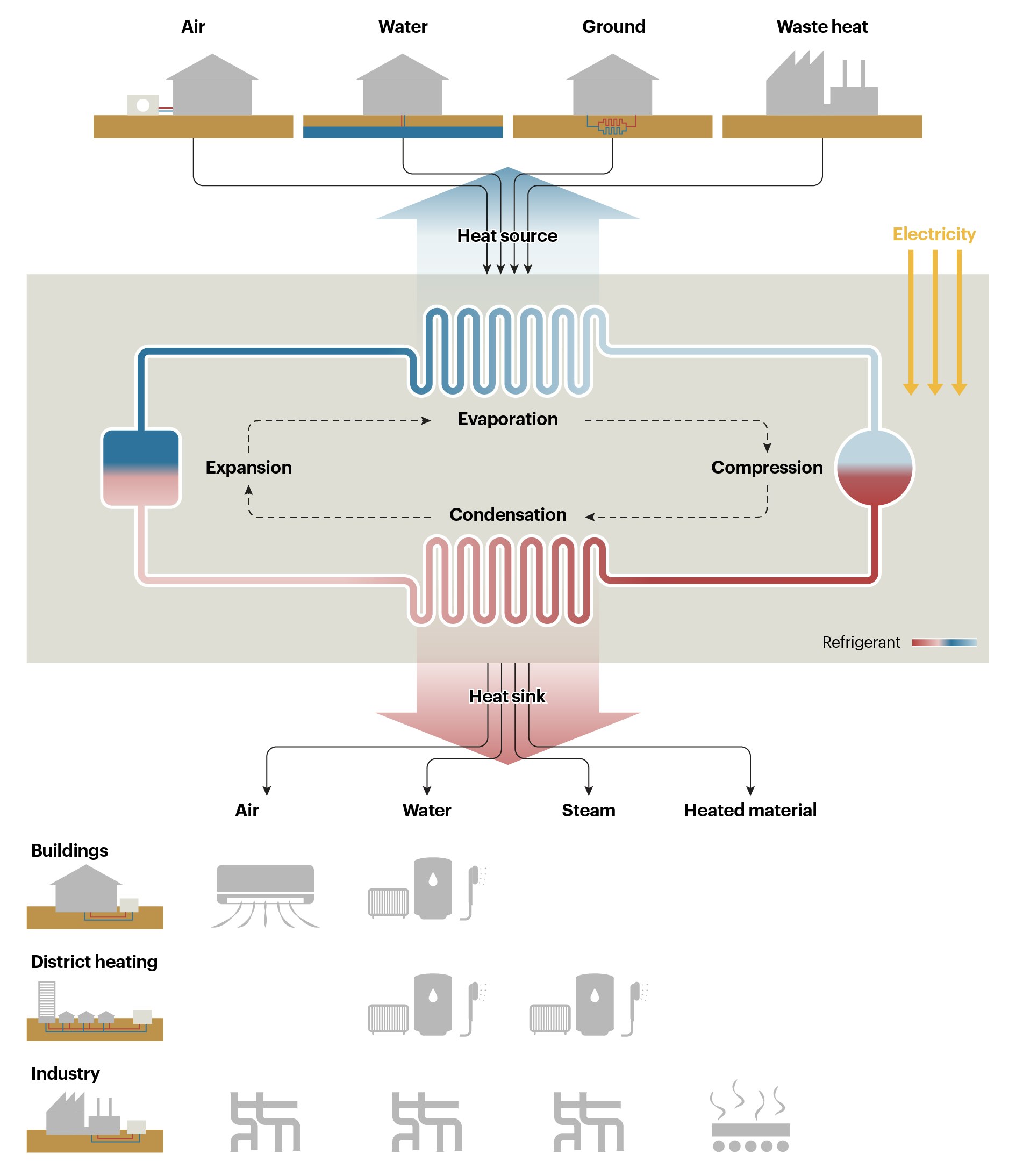

Largest Heat Pump System Launched Innomotics Eneco And Johnson Controls Collaboration

May 04, 2025

Largest Heat Pump System Launched Innomotics Eneco And Johnson Controls Collaboration

May 04, 2025 -

Innomotics Eneco And Johnson Controls Launch Of Europes Largest Heat Pump System

May 04, 2025

Innomotics Eneco And Johnson Controls Launch Of Europes Largest Heat Pump System

May 04, 2025 -

Netherlands Renewable Energy Push Utrechts Giant Heat Pump

May 04, 2025

Netherlands Renewable Energy Push Utrechts Giant Heat Pump

May 04, 2025 -

Utrechts Wastewater Plant Unveils Groundbreaking Heat Pump Technology

May 04, 2025

Utrechts Wastewater Plant Unveils Groundbreaking Heat Pump Technology

May 04, 2025