Is Riot Platforms Stock A Buy At 52-Week Lows? A Detailed Analysis

Table of Contents

Riot Platforms' Business Model and Financial Performance

Riot Platforms' core business revolves around Bitcoin mining. The company operates large-scale mining facilities, utilizing sophisticated hardware to solve complex cryptographic problems and earn Bitcoin rewards. Revenue is primarily generated from the production and subsequent sale of mined Bitcoin. Analyzing Riot's recent financial reports is crucial for understanding its financial health and potential for future growth.

- Key Financial Metrics: Investors should carefully examine Riot Platforms' revenue growth, profit margins, and debt levels. Tracking these metrics over time provides insight into the company's operational efficiency and financial stability. A declining profit margin, for instance, could signal challenges in managing operating costs.

- Comparison to Competitors: Benchmarking Riot Platforms against competitors like Marathon Digital Holdings and Core Scientific is essential. Comparing mining efficiency (measured in Bitcoin mined per terahash per second), energy consumption, and overall profitability offers valuable context.

- Mining Efficiency and Energy Consumption: The efficiency of Riot's mining operations significantly impacts its profitability. Lower energy costs and advanced mining hardware contribute to higher margins. Analyzing their energy consumption and strategies for procuring sustainable energy sources is crucial.

Market Analysis and Industry Trends

The cryptocurrency market, particularly Bitcoin's price, significantly influences Riot Platforms' stock price. Bitcoin's inherent volatility creates both opportunities and risks for investors. Understanding broader industry trends is equally important.

- Bitcoin's Price Prediction and Correlation: While predicting Bitcoin's price is inherently speculative, analyzing historical price movements and market sentiment can provide insights into potential future price fluctuations and their impact on Riot Platforms' stock. A strong correlation between Bitcoin's price and Riot's stock price is expected.

- Impact of Regulatory Changes: Regulatory changes concerning Bitcoin mining and cryptocurrency trading can significantly impact Riot's operations and profitability. Changes in tax policies, licensing requirements, or environmental regulations could all affect the company’s bottom line.

- Technological Advancements: The Bitcoin mining industry is constantly evolving. Advancements in mining hardware, such as the introduction of more energy-efficient ASICs (Application-Specific Integrated Circuits), can impact the competitiveness and profitability of Riot Platforms.

Risk Assessment and Investment Considerations

Investing in Riot Platforms stock carries inherent risks. Understanding these risks and assessing your personal risk tolerance is paramount before making any investment decisions.

- Bitcoin Price Fluctuations: The most significant risk is the volatility of Bitcoin's price. A sharp decline in Bitcoin's value can directly impact Riot Platforms' revenue and profitability, leading to a substantial decrease in its stock price.

- Regulatory Risks: Regulatory uncertainty remains a significant concern. Changes in government regulations regarding cryptocurrency mining could severely impact Riot Platforms' operations.

- Competitive Landscape: The Bitcoin mining industry is competitive. New entrants and established players constantly vie for market share. Assessing the competitive landscape and identifying potential threats is critical.

Valuation and Comparison to Peers

A thorough valuation analysis is necessary to determine whether Riot Platforms' current stock price accurately reflects its intrinsic value.

- Key Valuation Metrics: Analyzing key valuation metrics like the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and market capitalization provides insights into Riot Platforms' valuation relative to its peers and historical performance.

- Comparison with Peers: Comparing Riot Platforms' valuation metrics to those of similar publicly traded Bitcoin mining companies helps assess its relative attractiveness as an investment.

- Discounted Cash Flow Analysis: A discounted cash flow (DCF) analysis, while complex, can provide a more comprehensive valuation, projecting future cash flows and discounting them to present value.

Conclusion: Is Riot Platforms Stock a Buy at 52-Week Lows? A Final Verdict

Based on our analysis, investing in Riot Platforms stock at its current 52-week lows presents a mixed outlook. While the company benefits from the potential long-term growth of the Bitcoin mining industry and possesses a relatively established position within it, significant risks associated with Bitcoin's price volatility and regulatory uncertainty remain. The current low price might represent a buying opportunity for those with a high risk tolerance and a long-term investment horizon. However, a thorough due diligence process, considering factors outlined above and potentially including a DCF analysis, is crucial.

Therefore, the recommendation is a cautious buy, contingent upon a comprehensive risk assessment and a thorough understanding of the inherent volatility of the cryptocurrency market. Remember that this is not financial advice. Conduct your own in-depth research and consider consulting a financial advisor before making any investment decisions regarding Riot Platforms stock or any other cryptocurrency-related investment.

Featured Posts

-

Aventure Cycliste 8000 Km A Travers L Europe Pour Trois Jeunes Du Bocage Ornais

May 02, 2025

Aventure Cycliste 8000 Km A Travers L Europe Pour Trois Jeunes Du Bocage Ornais

May 02, 2025 -

Daisy May Cooper Faces 30 000 Lawsuit Over House Paint Colour

May 02, 2025

Daisy May Cooper Faces 30 000 Lawsuit Over House Paint Colour

May 02, 2025 -

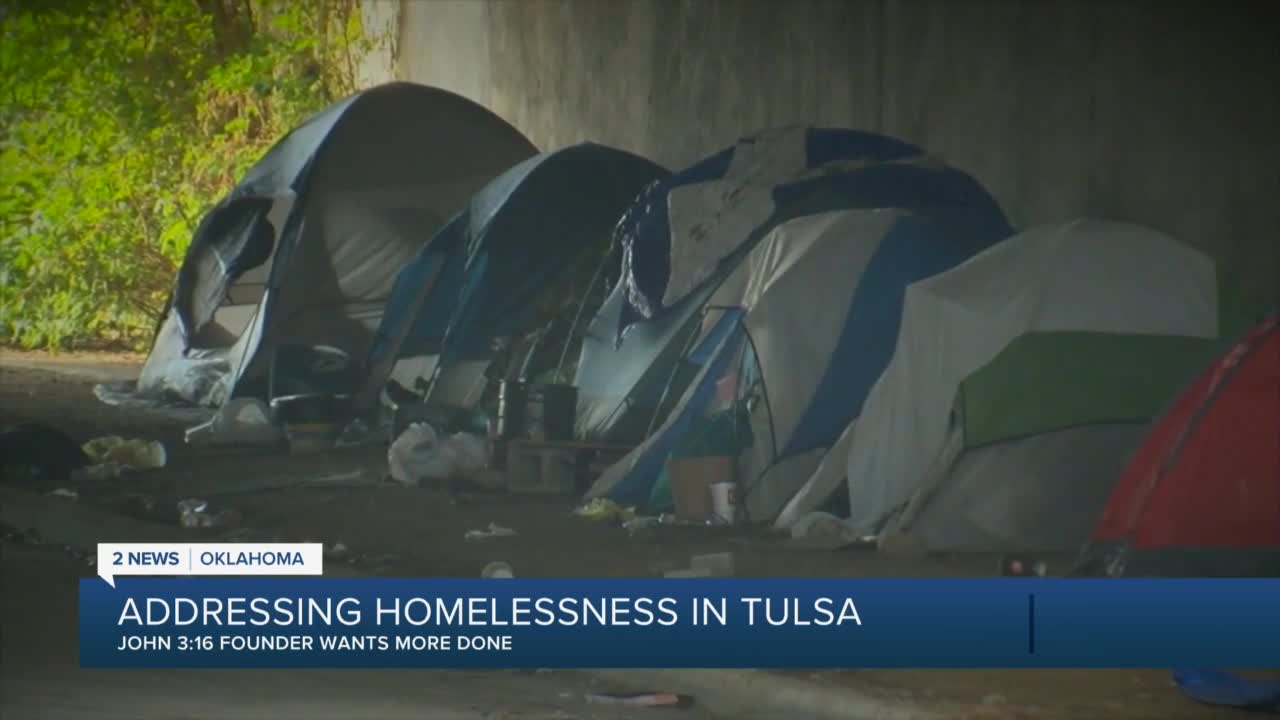

Tulsas Growing Homeless Population A Frontline Report From The Tulsa Day Center

May 02, 2025

Tulsas Growing Homeless Population A Frontline Report From The Tulsa Day Center

May 02, 2025 -

2 6

May 02, 2025

2 6

May 02, 2025 -

Kampen Eist Recht Op Stroomnetaansluiting Kort Geding Tegen Enexis

May 02, 2025

Kampen Eist Recht Op Stroomnetaansluiting Kort Geding Tegen Enexis

May 02, 2025