Is The Bitcoin Rebound Sustainable? A Look At Market Indicators

Table of Contents

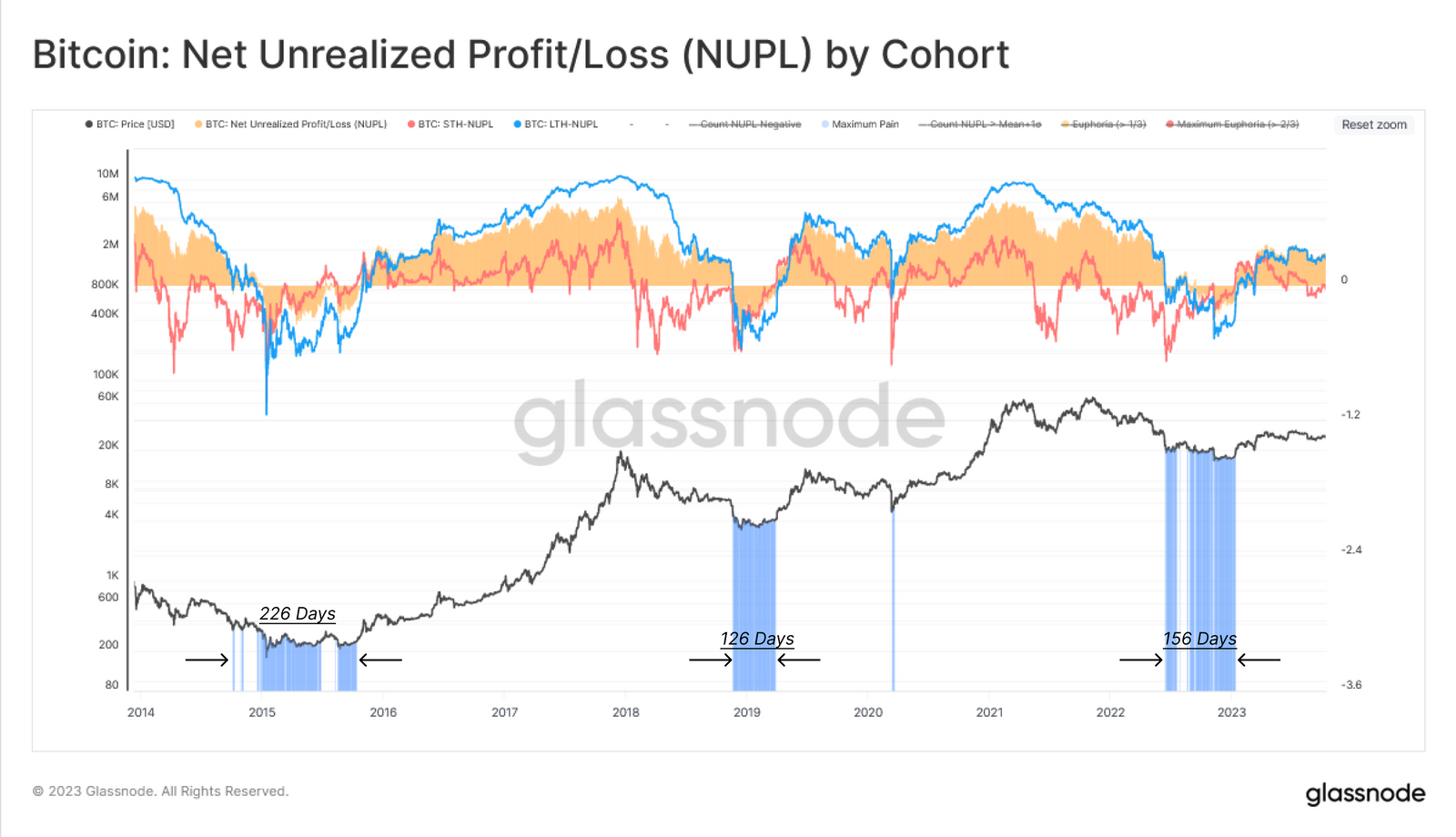

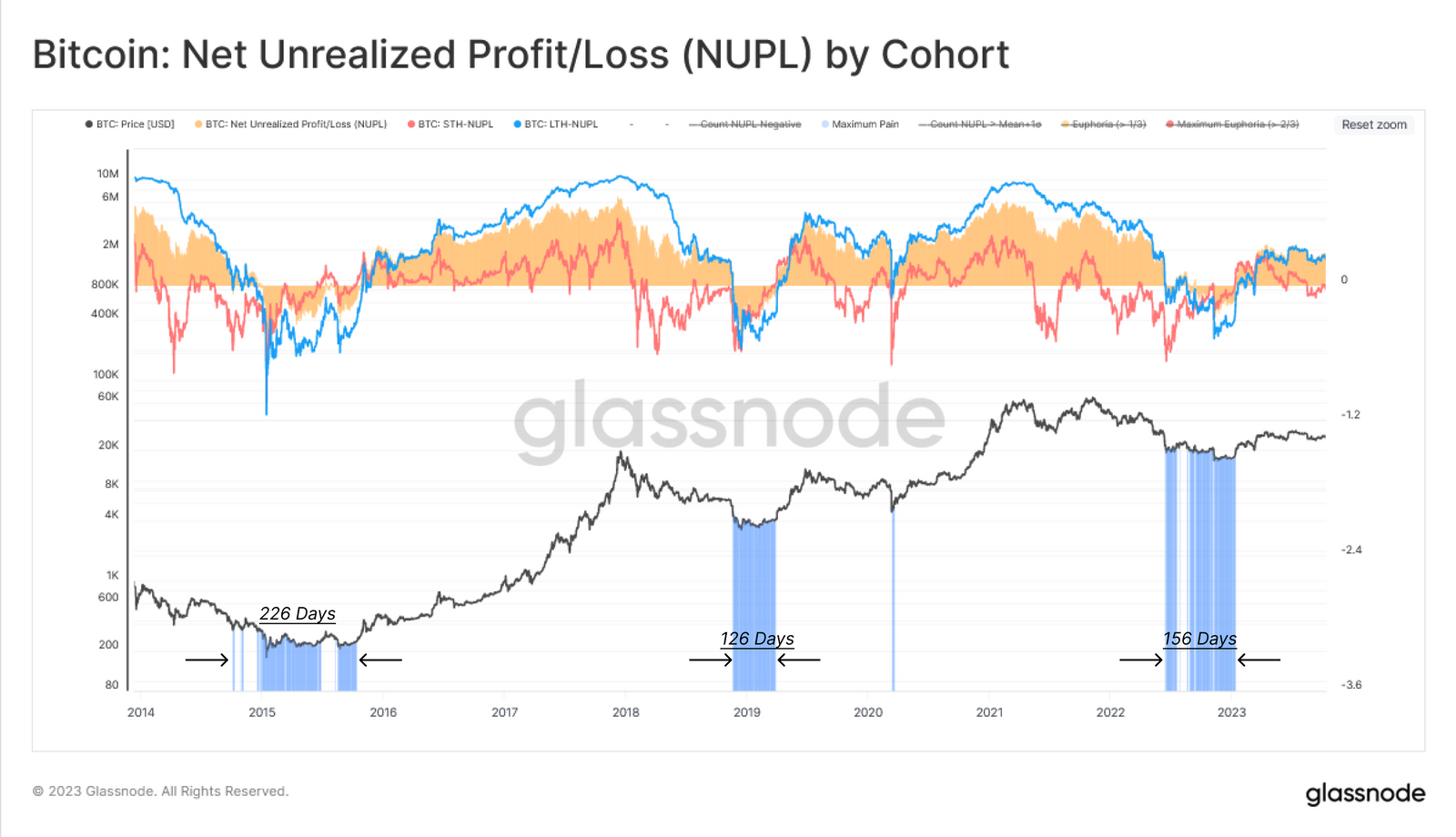

Analyzing On-Chain Metrics

Examining on-chain metrics provides a direct look at Bitcoin's network activity and investor sentiment, offering valuable insights into the sustainability of the current rebound. These metrics, derived directly from the Bitcoin blockchain, offer a transparent and objective view of the cryptocurrency's health.

Transaction Volume and Fees

High transaction volumes and increased fees are often indicative of heightened activity and increased demand for Bitcoin. This suggests a potential strengthening of the market and a more sustainable price increase.

- Relationship with Bitcoin Price: Historically, periods of high transaction volume have coincided with Bitcoin price increases, although correlation doesn't equal causation. Increased demand often pushes prices higher.

- Network Congestion: Very high transaction volumes can lead to network congestion, increasing transaction fees and potentially slowing down transactions. This can be a double-edged sword; while signaling high demand, it might also discourage some users.

- Recent Fee Trends: Monitoring recent fee trends is essential. A consistent rise in fees, alongside increasing transaction volume, points towards a healthy and growing network. Conversely, a sharp decline in fees might signal waning interest.

Active Addresses and New Addresses

The number of active and new Bitcoin addresses provides a crucial indicator of user adoption and participation in the network. An increase suggests growing interest and potential for future growth.

- Significance of Active Addresses: Active addresses represent the number of unique addresses engaging in transactions within a specific timeframe. A sustained increase indicates a larger user base actively participating in the Bitcoin ecosystem.

- Role of New Addresses: The number of new addresses created suggests new users joining the network. A consistent influx of new addresses indicates growing adoption and potential for long-term price support.

- Data Visualization: Analyzing charts and graphs showing the trends in active and new addresses helps visualize the growth trajectory of the Bitcoin network and its correlation with price movements.

Miner Behavior and Hash Rate

Miner activity and the network's hash rate are vital indicators of Bitcoin's security and overall health. A robust hash rate indicates a secure and resilient network, bolstering confidence in Bitcoin's long-term sustainability.

- Hash Rate Definition and Importance: The hash rate represents the computational power dedicated to securing the Bitcoin network. A higher hash rate generally means a more secure and resistant network.

- Miner Revenue and Impact on Bitcoin Price: Miners' profitability is directly tied to the Bitcoin price. Higher Bitcoin prices incentivize more mining activity, increasing the hash rate and further securing the network, creating a positive feedback loop.

- Mining Difficulty Adjustments: Bitcoin's mining difficulty adjusts automatically to maintain a consistent block generation time. These adjustments reflect the overall hash rate and can influence miner profitability and, indirectly, Bitcoin's price.

Assessing Macroeconomic Factors

Global economic trends and regulatory developments significantly impact Bitcoin's price. Understanding these factors is critical in assessing the long-term sustainability of any Bitcoin rebound.

Inflation and Monetary Policy

High inflation often pushes investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. This increased demand can support price increases.

- Relationship between Inflation and Bitcoin Price: Historically, periods of high inflation have seen increased interest in Bitcoin, as investors seek to preserve their purchasing power.

- Role of Central Bank Policies: Central bank policies, such as interest rate hikes or quantitative easing, can influence inflation and consequently impact investor sentiment toward Bitcoin.

- Other Inflation Hedges: It's important to compare Bitcoin's performance against other traditional inflation hedges, such as gold or real estate, to gauge its relative effectiveness.

Regulatory Landscape and Institutional Adoption

Positive regulatory developments and increasing institutional investment significantly influence Bitcoin's price and perception in the market.

- Regulatory Changes Impacting Bitcoin: Favorable regulatory frameworks in different jurisdictions can encourage institutional adoption and increase investor confidence.

- Role of Institutional Investors: Large-scale investments from institutional players like MicroStrategy signal growing acceptance and legitimacy, supporting price increases.

- Potential for Future Regulations: The evolving regulatory landscape remains a significant factor. Negative regulatory developments can trigger price drops, highlighting the importance of staying informed.

Global Economic Uncertainty

Periods of global economic uncertainty, such as geopolitical instability or economic downturns, can increase demand for safe-haven assets, potentially boosting Bitcoin's price.

- Impact of Geopolitical Events: Major geopolitical events can drive investors toward Bitcoin as a perceived safe haven, temporarily increasing demand.

- "Safe-Haven" Asset Narrative: Bitcoin's proponents often highlight its decentralized nature as a key advantage during times of economic turmoil.

- Other Safe-Haven Assets: Comparing Bitcoin's performance against traditional safe-haven assets, such as gold, during periods of uncertainty provides valuable context.

Gauging Market Sentiment and Technical Analysis

Analyzing market sentiment and employing technical indicators provides additional insights into potential price movements and the sustainability of the Bitcoin rebound.

Social Media Sentiment and News Coverage

Analyzing social media trends and news coverage offers a gauge of public opinion on Bitcoin, although it's crucial to approach this data with caution.

- Sentiment Analysis Tools: Various tools can analyze social media posts to gauge overall sentiment towards Bitcoin.

- Impact of News Coverage: Positive news coverage can boost investor confidence and increase demand, while negative news can have the opposite effect.

- Biases in Social Media Sentiment: It's important to recognize potential biases and manipulation within social media discussions regarding Bitcoin.

Technical Indicators (e.g., Moving Averages, RSI)

Technical analysis tools, like moving averages and the Relative Strength Index (RSI), can help identify potential support and resistance levels and predict future price movements.

- Explanation of Key Indicators: Moving averages smooth out price fluctuations, helping identify trends, while RSI measures the momentum of price changes.

- Charts and Graphs: Visual representations of these indicators alongside price charts can help identify potential entry and exit points for trading.

- Limitations of Technical Analysis: Technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Whale Activity and Large Transactions

Tracking large Bitcoin transactions can reveal insights into potential market manipulation or significant investments by large holders ("whales").

- Influence of Large Investors: Large transactions by whales can influence market price volatility, sometimes creating significant short-term price swings.

- Impact of Large Transactions: Significant buy or sell orders by whales can trigger cascading effects on the market.

- Potential for Manipulation: While not always indicative of manipulation, large transactions warrant careful scrutiny, as they can artificially inflate or deflate prices.

Conclusion

This analysis of on-chain metrics, macroeconomic factors, and market sentiment suggests that the sustainability of the current Bitcoin rebound is complex and depends on various interacting forces. While positive indicators exist, such as increasing transaction volume and institutional adoption, caution remains warranted given the inherent volatility of the cryptocurrency market. The regulatory landscape and global economic conditions continue to play significant roles.

Call to Action: Understanding the factors influencing Bitcoin's price is crucial for informed investment decisions. Continue your research on the Bitcoin rebound and its sustainability by exploring further market indicators and staying updated on the latest news and developments in the cryptocurrency space. Consider diversifying your portfolio to mitigate risks associated with Bitcoin investment. Remember that thorough research and understanding of the market are essential before any Bitcoin investment.

Featured Posts

-

Bondi Announces Historic Fentanyl Seizure Impact On The Opioid Epidemic

May 09, 2025

Bondi Announces Historic Fentanyl Seizure Impact On The Opioid Epidemic

May 09, 2025 -

David Beckham The Unmatched Greatest Of All Time

May 09, 2025

David Beckham The Unmatched Greatest Of All Time

May 09, 2025 -

High Potential Finale A Surprise Reunion After 7 Years

May 09, 2025

High Potential Finale A Surprise Reunion After 7 Years

May 09, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Neden

May 09, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Neden

May 09, 2025 -

Formacioni Me I Mire I Gjysmefinaleve Te Liges Se Kampioneve Dominimi I Psg Se

May 09, 2025

Formacioni Me I Mire I Gjysmefinaleve Te Liges Se Kampioneve Dominimi I Psg Se

May 09, 2025