Is The Canadian Dollar's Rise Against The US Dollar A Temporary Phenomenon?

Table of Contents

The Canadian dollar has recently demonstrated surprising strength against its American counterpart, leaving many wondering: is this a fleeting surge, or a signal of a more permanent shift in the CAD/USD exchange rate? This article delves into the multifaceted factors contributing to the CAD's appreciation against the USD, examining economic indicators, geopolitical influences, and market sentiment to provide a comprehensive analysis. We will explore whether this rise is a temporary blip or a more significant, lasting change in the currency markets.

Economic Factors Influencing the CAD/USD Exchange Rate

Several key economic factors play a crucial role in determining the CAD/USD exchange rate. Understanding these dynamics is essential for interpreting the recent strengthening of the Canadian dollar.

Canadian Interest Rates and Monetary Policy

The Bank of Canada's monetary policy significantly impacts the CAD's value. Interest rate decisions, influenced by inflation and economic growth, directly affect investor sentiment and capital flows.

- Comparison of Canadian and US interest rates: Higher interest rates in Canada relative to the US can attract foreign investment, increasing demand for the CAD and strengthening its value. Conversely, lower rates can weaken the CAD.

- Impact of inflation on interest rate decisions: High inflation typically prompts the Bank of Canada to raise interest rates to curb price increases, which can support the CAD.

- Potential for future rate hikes or cuts: Market expectations regarding future interest rate adjustments also influence the CAD/USD exchange rate. Anticipation of further rate hikes generally strengthens the currency, while expectations of cuts tend to weaken it. Closely monitoring the Bank of Canada's pronouncements on monetary policy is key to understanding the direction of the CAD.

Keywords: Bank of Canada, interest rates, monetary policy, inflation, CAD interest rates, USD interest rates, Canadian inflation, US inflation.

Canadian Economic Growth and Commodity Prices

Canada's resource-based economy makes it particularly susceptible to fluctuations in commodity prices, especially oil. The price of oil and other key Canadian exports significantly influences the CAD's value.

- Impact of oil prices on CAD value: Higher oil prices typically boost the CAD as it increases export revenue and improves Canada's trade balance. Conversely, lower oil prices can weaken the CAD.

- Strength of other Canadian exports: Performance of other export sectors, such as lumber and agricultural products, also plays a role. Stronger exports generally support the CAD.

- GDP growth forecasts and their influence on the CAD/USD exchange rate: Positive GDP growth forecasts usually bolster investor confidence, leading to increased demand for the CAD.

Keywords: commodity prices, oil prices, Canadian economy, GDP growth, exports, resource-based economy, Canadian exports, lumber prices, agricultural exports.

US Economic Performance and the US Dollar

The health of the US economy and the performance of the US dollar (USD) are equally important factors influencing the CAD/USD exchange rate. A strong USD generally puts downward pressure on the CAD.

- US inflation: High US inflation can weaken the USD, potentially benefiting the CAD.

- US interest rate expectations: Similar to Canada, interest rate expectations in the US influence the USD's value and consequently impact the CAD/USD exchange rate.

- US economic growth and potential recessionary risks: A robust US economy tends to strengthen the USD, while recessionary fears can weaken it, potentially leading to CAD appreciation.

Keywords: US economy, US dollar, US inflation, US interest rates, US economic growth, US recession, US economic outlook.

Geopolitical Factors and Market Sentiment

Geopolitical events and overall market sentiment can significantly impact the CAD/USD exchange rate, often overriding short-term economic data.

Global Economic Uncertainty and Safe-Haven Currencies

During times of global economic uncertainty, investors often seek safe-haven currencies like the USD and, to a lesser extent, the CAD. This flight-to-safety can affect the exchange rate regardless of underlying economic fundamentals.

- Examples of geopolitical events affecting exchange rates: Global conflicts, political instability, and unexpected economic crises can trigger shifts in investor sentiment, impacting the CAD/USD pair.

- Investor sentiment towards Canada and the US: Positive sentiment towards Canada's economic stability and political climate can boost the CAD, while negative sentiment can weaken it.

- Flight-to-safety effects: During periods of heightened risk aversion, investors tend to move towards perceived safer assets, often leading to increased demand for the USD, potentially causing the CAD to depreciate.

Keywords: geopolitical risk, safe-haven currency, investor sentiment, global economic uncertainty, risk aversion, global instability.

US-Canada Relations and Trade

The relationship between the US and Canada, particularly in terms of trade, has a substantial impact on the CAD/USD exchange rate.

- Impact of trade disputes or agreements on currency exchange rates: Trade disputes or the renegotiation of trade agreements like the USMCA (formerly NAFTA) can significantly influence investor confidence and currency values.

- NAFTA/USMCA impact: The USMCA, which replaced NAFTA, has had a complex impact on the exchange rate, depending on its perceived effects on trade flows and economic growth in both countries.

Keywords: US-Canada relations, trade agreements, NAFTA, USMCA, bilateral trade, trade relations, North American trade.

Predicting the Future of the CAD/USD Exchange Rate

Forecasting the CAD/USD exchange rate is inherently challenging due to the interplay of numerous complex factors.

Analyst Forecasts and Market Opinions

Financial analysts offer varying forecasts for the CAD/USD exchange rate, often based on their interpretation of economic indicators, geopolitical developments, and market sentiment.

- Quotes from financial analysts: Many financial institutions regularly publish reports and forecasts on the CAD/USD exchange rate, providing insight into market expectations.

- Summaries of market predictions: Consolidating various market predictions allows for a better understanding of the range of potential outcomes for the CAD/USD exchange rate.

- Potential scenarios for the future: It's crucial to consider various scenarios, from continued CAD appreciation to a potential reversal, depending on shifting economic and geopolitical conditions.

Keywords: CAD/USD forecast, exchange rate prediction, market analysis, financial analysts, currency forecast, exchange rate outlook.

Potential Risks and Uncertainties

Numerous unpredictable events can significantly impact the accuracy of any forecast.

- Black swan events: Unforeseen crises or events with low probability but high impact can dramatically alter exchange rate dynamics.

- Unexpected policy changes: Sudden shifts in monetary policy by either the Bank of Canada or the Federal Reserve can cause significant volatility.

- Potential unforeseen global crises: Global economic or geopolitical shocks can substantially influence the CAD/USD exchange rate, defying predictions based on current trends.

Keywords: economic uncertainty, geopolitical risk, market volatility, unforeseen events, black swan events, global crisis.

Conclusion

The recent rise of the Canadian dollar against the US dollar is a multifaceted issue stemming from a complex interplay of economic and geopolitical factors. While the current strength of the CAD may be partly attributed to higher Canadian interest rates, robust commodity prices, and relative economic stability compared to some global uncertainties, predicting the long-term trend remains challenging due to the inherent uncertainties in the global economic landscape. Understanding these interconnected factors is crucial for businesses and individuals involved in international trade and investment.

Call to Action: Stay informed about the ever-evolving dynamics of the Canadian dollar and the US dollar exchange rate to make well-informed decisions. Continue monitoring the Canadian dollar's performance against the US dollar for further insights and analysis. Learn more about [link to further resources about CAD/USD exchange rate].

Featured Posts

-

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025 -

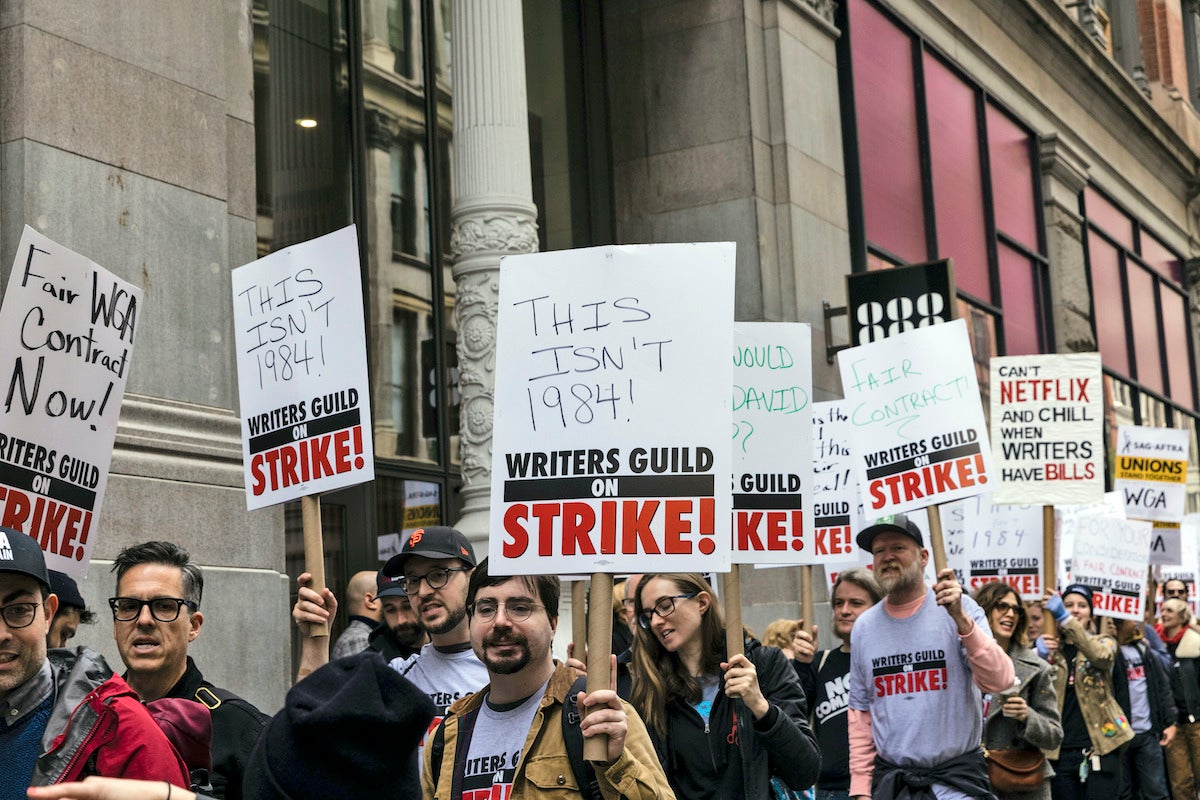

Actors And Writers Strike The Impact On Hollywood Productions

Apr 24, 2025

Actors And Writers Strike The Impact On Hollywood Productions

Apr 24, 2025 -

Liams Fate On The Bold And The Beautiful Will He Survive His Collapse

Apr 24, 2025

Liams Fate On The Bold And The Beautiful Will He Survive His Collapse

Apr 24, 2025 -

Wednesday April 16 Bold And The Beautiful Recap Liam Hope And Bridgets Storylines

Apr 24, 2025

Wednesday April 16 Bold And The Beautiful Recap Liam Hope And Bridgets Storylines

Apr 24, 2025 -

Warriors Hand Hornets Seventh Consecutive Loss

Apr 24, 2025

Warriors Hand Hornets Seventh Consecutive Loss

Apr 24, 2025

Latest Posts

-

Extended Border Controls In The Netherlands Impact Of Reduced Arrests And Asylum Applications

May 12, 2025

Extended Border Controls In The Netherlands Impact Of Reduced Arrests And Asylum Applications

May 12, 2025 -

Netherlands To Maintain Heightened Border Security Despite Falling Asylum Numbers

May 12, 2025

Netherlands To Maintain Heightened Border Security Despite Falling Asylum Numbers

May 12, 2025 -

Faber Retains Position After No Confidence Vote

May 12, 2025

Faber Retains Position After No Confidence Vote

May 12, 2025 -

Asylum Volunteer Royal Honors Fabers Complete Policy Reversal

May 12, 2025

Asylum Volunteer Royal Honors Fabers Complete Policy Reversal

May 12, 2025 -

Potenziale Zur Kostensenkung In Asylunterkuenften Ein Bericht Der Beiraete

May 12, 2025

Potenziale Zur Kostensenkung In Asylunterkuenften Ein Bericht Der Beiraete

May 12, 2025