Is The Recent Bitcoin Rebound Sustainable? Experts Weigh In

Table of Contents

Analyzing the Drivers of the Recent Bitcoin Price Increase

Several factors contribute to the recent Bitcoin price increase, creating a complex picture that requires careful analysis before making any investment decisions. Understanding these drivers is key to assessing the sustainability of this Bitcoin rebound.

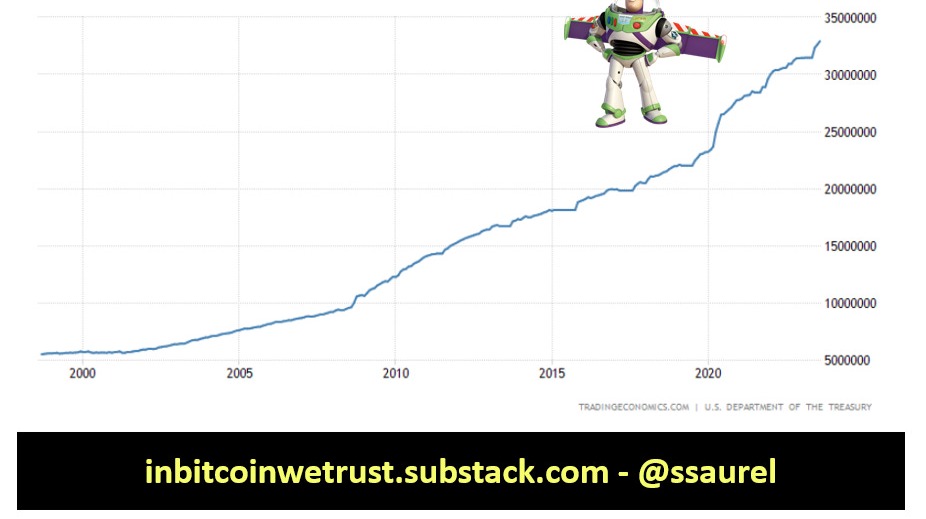

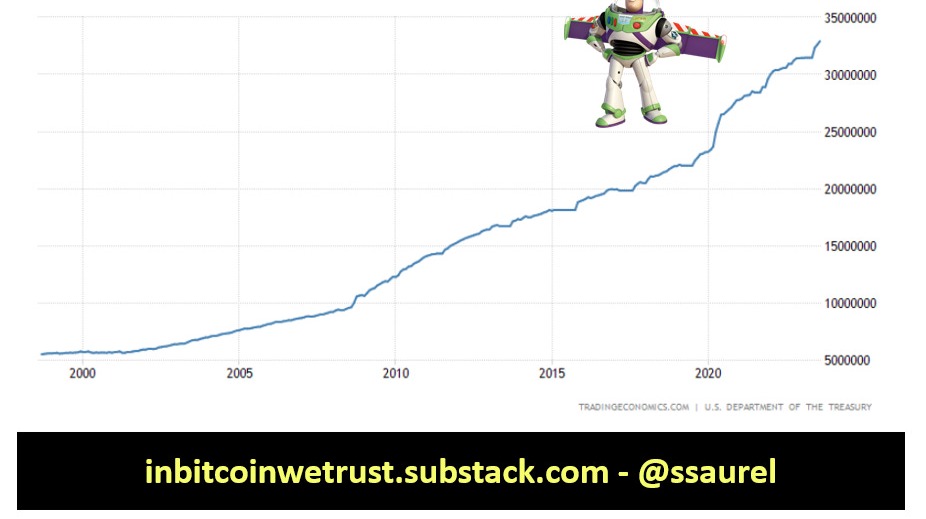

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin's price. Several key factors are at play:

-

Increased Institutional Investment: Large institutional investors, such as hedge funds and corporations, are increasingly viewing Bitcoin as a hedge against inflation and a diversification tool within their portfolios. This influx of capital significantly influences market dynamics. The growing acceptance of Bitcoin as a legitimate asset class fuels this trend.

-

Positive Regulatory Developments: More favorable regulatory frameworks in certain jurisdictions are boosting investor confidence. Clearer guidelines and a reduction in regulatory uncertainty can lead to increased institutional adoption and overall market stability, potentially supporting a sustained Bitcoin rebound.

-

Growing Adoption by Businesses and Corporations: The increasing number of businesses accepting Bitcoin as a form of payment is driving demand and expanding its use cases beyond speculation. This broader acceptance solidifies Bitcoin's position as a viable alternative currency and store of value.

-

Global Economic Uncertainty: Paradoxically, global economic uncertainty can also fuel a Bitcoin rebound. Investors may seek refuge in Bitcoin as a less correlated asset during times of market volatility and inflation, driving up demand. However, rising interest rates could also negatively impact Bitcoin's price as investors seek higher returns in traditional markets.

Technical Analysis

Technical analysis provides another perspective on the Bitcoin rebound. Examining chart patterns and indicators helps to predict potential future price movements.

-

Chart Patterns: Analyzing chart patterns such as head and shoulders, double tops/bottoms, and flags can provide insights into potential price reversals or continuations. A sustained breakout above key resistance levels could indicate a continuation of the upward trend.

-

Support and Resistance Levels: Identifying key support and resistance levels is crucial. The ability of Bitcoin's price to hold above crucial support levels suggests stronger underlying strength and potential for continued upward momentum. Conversely, failure to break through significant resistance levels might indicate a weakening rebound.

-

Technical Indicators: Moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands provide valuable insights into momentum, overbought/oversold conditions, and potential trend reversals. These indicators can help determine if the current Bitcoin rebound is sustainable.

Expert Opinions on Bitcoin's Future Price Trajectory

Expert opinions on Bitcoin's future are varied, reflecting the inherent volatility and uncertainty in the cryptocurrency market.

Bullish Predictions

Some analysts remain bullish on Bitcoin's prospects, citing various catalysts for further price increases:

-

Halving Events: The upcoming Bitcoin halving event, which reduces the rate of new Bitcoin creation, historically leads to increased scarcity and potential price appreciation. This event is often cited as a major driver for future bullish cycles.

-

ETF Approval: The potential approval of a Bitcoin exchange-traded fund (ETF) in major markets would likely increase institutional investment and liquidity, potentially fueling a significant price increase.

-

Long-Term Adoption: Many believe in Bitcoin's long-term potential as a decentralized digital currency and store of value, predicting continued growth and adoption over the coming years.

Bearish Concerns

However, several experts express concerns about the sustainability of the recent Bitcoin rebound:

-

Regulatory Uncertainty: Regulatory crackdowns or inconsistent regulations across different jurisdictions pose a significant risk to Bitcoin's price stability. Increased regulatory scrutiny could negatively impact investor sentiment and market growth.

-

Market Manipulation: The possibility of market manipulation and wash trading remains a concern, potentially distorting price discovery and creating artificial price swings.

-

Macroeconomic Headwinds: A global economic slowdown or a significant correction in the stock market could negatively impact Bitcoin's price, as investors may move their capital into safer assets.

Assessing the Risks and Rewards of Investing in Bitcoin During a Rebound

Investing in Bitcoin during a rebound presents both significant potential rewards and considerable risks.

Risk Mitigation Strategies

To mitigate potential losses, investors should consider:

-

Diversification: Diversify your cryptocurrency portfolio to reduce risk. Don't put all your eggs in one basket.

-

Stop-Loss Orders: Utilize stop-loss orders to automatically sell your Bitcoin if the price drops below a predetermined level, limiting potential losses.

-

Thorough Research: Conduct thorough research and only invest what you can afford to lose. Understand the risks involved before investing in cryptocurrencies.

-

Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations, to reduce the impact of market volatility.

Potential Rewards

Despite the risks, the potential rewards of investing in Bitcoin during a rebound can be substantial:

-

Significant Returns: Bitcoin has historically shown periods of rapid price appreciation, offering the potential for substantial returns on investment.

-

Long-Term Growth Potential: Many analysts believe in the long-term growth potential of the cryptocurrency market, suggesting Bitcoin could continue to appreciate in value over time.

-

Early Adoption: Early adoption of promising cryptocurrencies can lead to significantly higher returns compared to later entry points.

Conclusion

The recent Bitcoin rebound presents both opportunities and challenges for investors. While positive macroeconomic factors and technical indicators suggest potential for further growth, significant risks and uncertainties remain. Expert opinions are divided, highlighting the need for cautious optimism and thorough due diligence. Understanding the factors influencing the Bitcoin rebound is crucial for making informed investment decisions. Continue your research on the Bitcoin rebound and explore other resources to develop a comprehensive understanding of this dynamic market. Remember to invest responsibly and only allocate capital you can afford to lose.

Featured Posts

-

185 Cryptocurrency Return Predicted By Van Eck Is It Worth The Investment

May 08, 2025

185 Cryptocurrency Return Predicted By Van Eck Is It Worth The Investment

May 08, 2025 -

Pakistan Super League 10 Tickets On Sale Now

May 08, 2025

Pakistan Super League 10 Tickets On Sale Now

May 08, 2025 -

Rogue And Gambit A New Weapon A Poignant Tribute

May 08, 2025

Rogue And Gambit A New Weapon A Poignant Tribute

May 08, 2025 -

Arsenal Protiv Ps Zh Polnaya Statistika Evrokubkovykh Vstrech

May 08, 2025

Arsenal Protiv Ps Zh Polnaya Statistika Evrokubkovykh Vstrech

May 08, 2025 -

Post Fire La Landlords Face Backlash Over Alleged Rent Increases

May 08, 2025

Post Fire La Landlords Face Backlash Over Alleged Rent Increases

May 08, 2025