Is This AI Quantum Computing Stock A Smart Investment?

Table of Contents

Understanding the AI Quantum Computing Market

The marriage of AI and quantum computing holds immense potential. AI algorithms can leverage the immense computational power of quantum computers to solve complex problems currently intractable for classical computers. This synergy is expected to revolutionize various sectors. For instance, in drug discovery, quantum computing can simulate molecular interactions with unprecedented accuracy, accelerating the development of new medicines. In materials science, it can help design novel materials with superior properties. Financial modeling will also benefit, allowing for more accurate risk assessment and portfolio optimization.

The current AI quantum computing market is still nascent, but its growth trajectory is impressive. According to a report by [Insert reputable source, e.g., Gartner, IDC], the market is projected to reach [Insert projected market size] by [Insert year], representing a [Insert growth percentage] compound annual growth rate (CAGR).

- Market size and growth projections: [Insert specific data with source citations].

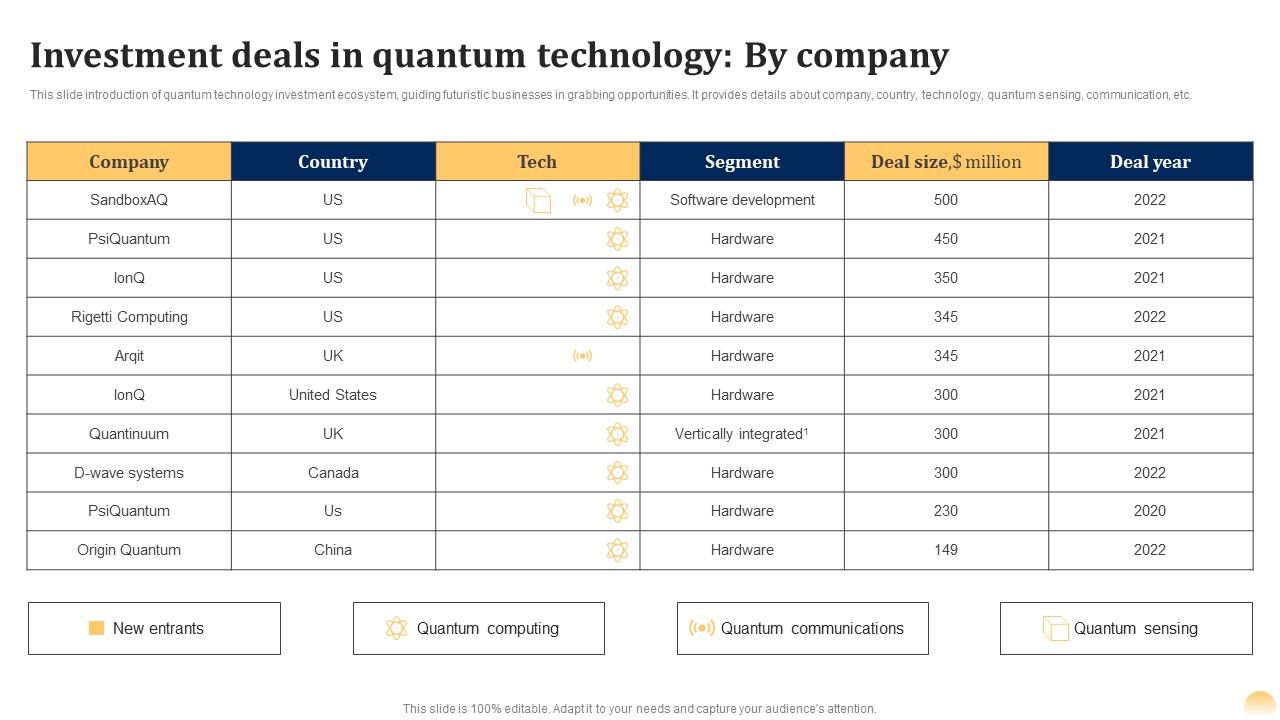

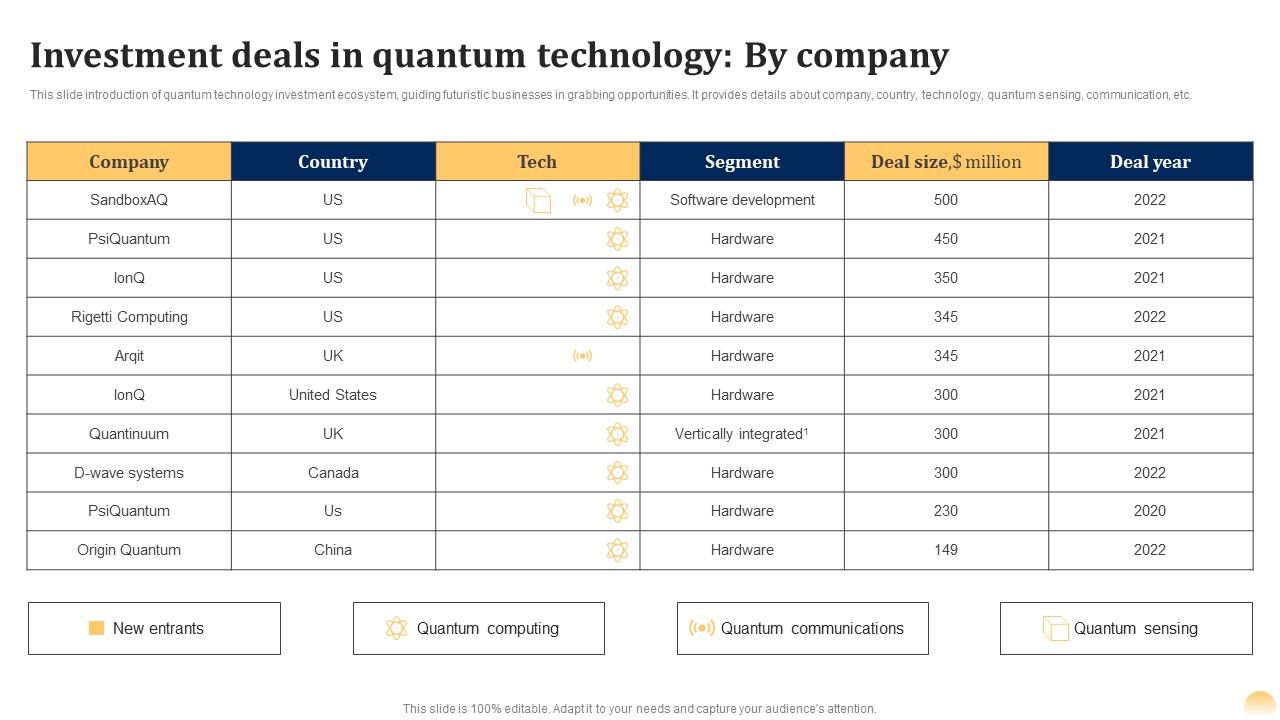

- Key players in the AI quantum computing sector: IBM, Google, Microsoft, IonQ, Rigetti Computing, and numerous startups.

- Potential risks and challenges: Technological hurdles in building stable and scalable quantum computers, regulatory uncertainties surrounding data privacy and security, and the high capital expenditure required for research and development.

Analyzing a Specific AI Quantum Computing Stock: QuantumLeap Corp

Financial Performance and Valuation

QuantumLeap Corp's financial performance reveals a mixed picture. While revenue has shown [Insert growth percentage] growth in the past [Insert time period], the company is currently not profitable, incurring [Insert amount] in losses during the last fiscal year. Its Price-to-Earnings (P/E) ratio is currently [Insert P/E ratio], which is [Insert comparison – high, low, or average] compared to its competitors. Its market capitalization stands at [Insert market capitalization].

- Key financial ratios and their analysis: [Provide details on key ratios like Debt-to-Equity, Current Ratio, etc., with analysis].

- Comparison with competitor companies: [Compare QuantumLeap Corp's key financial metrics with those of its competitors, like IonQ or Rigetti].

- Potential for future growth and profitability: [Analyze the company's potential for future growth based on its technology, market position, and financial projections].

Technological Advancement and Competitive Advantage

QuantumLeap Corp's core technology revolves around [Describe the company's core technology and its specific applications]. The company holds [Insert number] patents related to [Mention specific patent areas], providing it with a degree of intellectual property protection. However, the competitive landscape is intense, with established players and numerous startups vying for market share. QuantumLeap Corp's competitive advantage lies primarily in [Identify specific competitive advantages, e.g., unique algorithm, superior qubit technology, strategic partnerships].

- Description of the company's core technology: [Provide detailed description, focusing on its advantages and limitations].

- Patents and intellectual property analysis: [Summarize the company's key patents and their significance].

- Competitive advantages and disadvantages: [Analyze QuantumLeap Corp's strengths and weaknesses relative to its competitors].

Management Team and Risk Factors

QuantumLeap Corp's management team possesses a strong track record in [Mention relevant fields, e.g., quantum physics, software engineering, business management]. The CEO, [CEO's name], has over [Number] years of experience in [Relevant field]. However, investing in QuantumLeap Corp involves significant risks. These include technological risks (e.g., failure to deliver on technology promises), financial risks (e.g., potential for further losses and dilution of shareholder value), and regulatory risks (e.g., changes in government regulations impacting the industry). Geopolitical instability could also impact the company's operations and valuation.

- Key members of the management team and their background: [Provide brief biographies of key management personnel].

- Major risks (technological, financial, regulatory): [Detail the potential risks and their potential impact].

- Potential impact of geopolitical events: [Discuss potential impacts of geopolitical events on the company's operations and valuation].

Conclusion

Our analysis of QuantumLeap Corp reveals a company with significant potential but also considerable risks. While its technology shows promise, its current financial performance is weak, and the competitive landscape is fiercely competitive. The high-risk, high-reward nature of investing in AI quantum computing necessitates a cautious approach. Based on our assessment, QuantumLeap Corp may not be a smart investment for risk-averse investors. However, for those with a higher tolerance for risk and a long-term horizon, the potential rewards might outweigh the risks. This conclusion is based on the current data; a reevaluation may be necessary as the company's performance and the market evolve. An effective AI quantum computing investment strategy requires careful diversification and thorough due diligence.

Call to Action: Investing in AI quantum computing stocks requires careful consideration of various factors. Before making any decisions, remember to conduct your own thorough research on any AI quantum computing stock that interests you—your future investment success depends on it. Explore additional resources available online to further educate yourself on this complex but potentially lucrative field. Remember to always diversify your investments and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Hidden Hmrc Debt Thousands With Savings Accounts Unaware Of Overpayments

May 20, 2025

Hidden Hmrc Debt Thousands With Savings Accounts Unaware Of Overpayments

May 20, 2025 -

Red Devils Eye Dynamic Premier League Forward Transfer Battle Looms

May 20, 2025

Red Devils Eye Dynamic Premier League Forward Transfer Battle Looms

May 20, 2025 -

The Trump Presidency And Its Impact On Mark Zuckerberg And Meta

May 20, 2025

The Trump Presidency And Its Impact On Mark Zuckerberg And Meta

May 20, 2025 -

Descente De La Brigade De Controle Rapide Bcr Les Marches D Abidjan Sous Haute Surveillance

May 20, 2025

Descente De La Brigade De Controle Rapide Bcr Les Marches D Abidjan Sous Haute Surveillance

May 20, 2025 -

Blue Origin Postpones Launch Technical Glitch Halts Mission

May 20, 2025

Blue Origin Postpones Launch Technical Glitch Halts Mission

May 20, 2025

Latest Posts

-

I Tragodia Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025

I Tragodia Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025 -

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025 -

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Tis Anthropinis Aksias

May 20, 2025

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Tis Anthropinis Aksias

May 20, 2025 -

I Los Antzeles Kai To Endiaferon Gia Ton Giakoymaki

May 20, 2025

I Los Antzeles Kai To Endiaferon Gia Ton Giakoymaki

May 20, 2025 -

Baggelis Giakoymakis I Katarrakosi Tis Aksias Toy Alloy

May 20, 2025

Baggelis Giakoymakis I Katarrakosi Tis Aksias Toy Alloy

May 20, 2025