Is This Hot New SPAC Stock The Next MicroStrategy? Investor Analysis

Table of Contents

The MicroStrategy Model: Bitcoin as a Core Asset

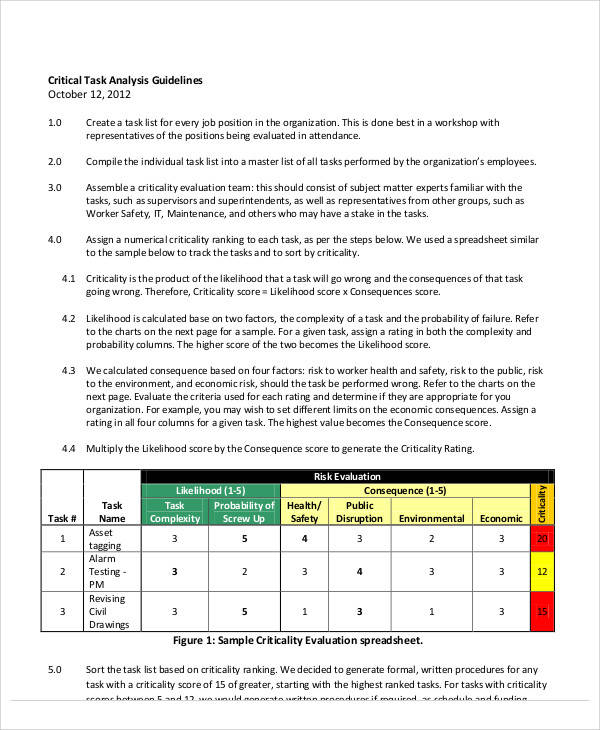

MicroStrategy's bold strategy of accumulating Bitcoin as a core asset has become a case study in cryptocurrency investment. Their significant investment, starting in August 2020, has seen their Bitcoin holdings fluctuate dramatically alongside the cryptocurrency's price. This demonstrates both the potential rewards and significant risks inherent in such a strategy.

-

Significant increase in MicroStrategy's stock price correlated with Bitcoin's rise: MicroStrategy's stock price has, at times, moved in tandem with Bitcoin's price, showcasing the direct impact of the cryptocurrency's performance on the company's valuation. This correlation highlights the inherent volatility of this investment strategy.

-

Long-term strategic vision of Bitcoin adoption: MicroStrategy's CEO, Michael Saylor, has publicly championed Bitcoin as a hedge against inflation and a store of value, demonstrating a long-term belief in the cryptocurrency's potential. This long-term vision is a key factor in their strategy.

-

Potential for significant losses if Bitcoin's price falls: Conversely, a sharp decline in Bitcoin's price would significantly impact MicroStrategy's balance sheet and potentially lead to substantial losses. This risk needs careful consideration by potential investors.

-

Impact on MicroStrategy's balance sheet and financial statements: The substantial Bitcoin holdings significantly influence MicroStrategy's financial statements, requiring investors to understand the accounting treatment of these assets and their impact on the company's overall financial health.

Analyzing the New SPAC: Key Factors to Consider

Before jumping into this hot new SPAC, a thorough analysis of the target company and the merger terms is crucial. This involves examining several key aspects to determine its potential for success and the associated risks.

-

Details on the target company's revenue model and potential for growth: Understanding the target company's business model, revenue streams, and future growth prospects is paramount. Is it solely reliant on Bitcoin's price, or does it have diversified revenue streams?

-

Background and track record of the SPAC's sponsors and management team: Investigating the experience and reputation of the SPAC's sponsors and management team provides insights into their ability to execute the merger and manage the post-merger entity effectively. A strong team is vital for success.

-

Comparison of the SPAC's valuation to similar publicly traded companies: Comparing the SPAC's valuation to those of comparable companies in the Bitcoin or fintech industry helps determine whether the proposed merger price is reasonable and reflects the target company's true potential.

-

Analysis of the risks associated with the merger and the Bitcoin investment: Identifying and assessing potential risks associated with the merger process, including regulatory hurdles and potential delays, is critical. Understanding the risks of a Bitcoin-centric investment remains paramount.

-

Mention any potential regulatory hurdles: The regulatory landscape surrounding cryptocurrencies is constantly evolving. Any potential regulatory changes could significantly impact the target company's operations and valuation.

Market Sentiment and Bitcoin's Future Price

The current market sentiment towards Bitcoin is a significant factor influencing the SPAC's potential. Bitcoin's price is notoriously volatile, influenced by various factors.

-

Current Bitcoin price and market capitalization: The current market price and overall capitalization of Bitcoin provide a snapshot of the market's current perception of the cryptocurrency.

-

Recent news and events impacting Bitcoin's price: News related to regulatory changes, institutional adoption, and technological advancements can significantly influence Bitcoin's price. Keeping abreast of these factors is vital.

-

Analysis of various price prediction models: While predicting Bitcoin's future price is inherently uncertain, analyzing various price prediction models and expert opinions can offer potential scenarios and inform investment decisions.

-

Impact of macroeconomic factors on Bitcoin's price: Macroeconomic factors, such as inflation, interest rates, and global economic conditions, can also affect Bitcoin's price. Understanding these dynamics is crucial.

Risk Assessment and Investment Strategy

Investing in this SPAC, and by extension Bitcoin, carries inherent risks. Understanding and mitigating these risks is crucial for informed decision-making.

-

Specific risks related to the SPAC merger process: SPAC mergers can sometimes fail to materialize, resulting in losses for investors.

-

Potential downsides of investing in a Bitcoin-focused company: The volatility of Bitcoin's price exposes investors to significant potential losses.

-

Importance of due diligence before investing in any SPAC: Thorough due diligence is essential before investing in any SPAC, including scrutinizing the target company's financials and the merger terms.

-

Strategies for managing risk, including portfolio diversification: Diversification across different asset classes can help mitigate the risks associated with investing in a single, volatile asset like Bitcoin. A well-diversified portfolio is recommended.

Conclusion

This analysis highlights the potential for this new SPAC to mirror MicroStrategy's success by capitalizing on the growing interest in Bitcoin. However, it's crucial to acknowledge the significant risks associated with investing in both Bitcoin and SPACs. The volatility of Bitcoin's price and the uncertainties inherent in SPAC mergers necessitate a cautious approach. Before investing in this SPAC stock, conduct thorough due diligence, understand the risks involved, and consider whether this investment aligns with your individual risk tolerance and investment strategy. This analysis is for informational purposes only and should not be considered financial advice. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025 -

Penny Pritzkers Influence Examining Her Impact On Harvard And Beyond

May 08, 2025

Penny Pritzkers Influence Examining Her Impact On Harvard And Beyond

May 08, 2025 -

The Impact Of High Xrp Supply On Etf Performance And Institutional Investment

May 08, 2025

The Impact Of High Xrp Supply On Etf Performance And Institutional Investment

May 08, 2025 -

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025 -

Unexpected Take Rogue One Actor On Fan Favorite Character

May 08, 2025

Unexpected Take Rogue One Actor On Fan Favorite Character

May 08, 2025