Is XRP (Ripple) A Good Buy Under $3? A Comprehensive Guide

Table of Contents

Understanding Ripple and XRP's Technology

Ripple's technology and XRP's role within its ecosystem are key factors influencing its value. Understanding this technology is crucial for assessing its long-term prospects and potential for growth.

Ripple's Payment Solution: RippleNet

RippleNet is Ripple's global payment network designed to facilitate faster, cheaper, and more efficient cross-border transactions for financial institutions. It leverages blockchain technology to streamline the process, significantly reducing the time and costs associated with traditional methods like SWIFT.

- xRapid: Uses XRP as a bridge currency to enable faster and more cost-effective liquidity solutions between different currencies.

- xCurrent: A gross settlement system that provides real-time gross settlement of payments without using XRP.

- xVia: An API-based solution that allows financial institutions to easily connect to RippleNet and process payments.

Key partnerships with major financial institutions globally signify RippleNet's growing adoption and potential for widespread use in the future. This institutional adoption is a significant positive factor for XRP's long-term value. Keywords: RippleNet, xRapid, xCurrent, xVia, cross-border payments, blockchain technology, remittance, financial institutions, institutional adoption.

XRP's Role in RippleNet

XRP plays a crucial role within RippleNet, acting as a bridge currency to facilitate transactions between different fiat currencies. This utility differentiates XRP from many other cryptocurrencies.

- Faster Transactions: XRP enables significantly faster transactions compared to traditional methods.

- Lower Costs: Transactions using XRP are often cheaper due to its efficiency and lower transaction fees.

- Enhanced Liquidity: XRP's liquidity within the RippleNet ecosystem contributes to smoother and more efficient payment processing.

- Scalability: The Ripple network is designed for scalability, able to handle a large volume of transactions.

The unique utility of XRP within the RippleNet ecosystem is a key factor to consider when evaluating its investment potential. Keywords: XRP utility, liquidity, scalability, transaction speed, bridging currencies, XRP function.

Analyzing XRP's Current Market Position

Understanding XRP's current market position is essential for any investment decision. This includes analyzing its price, market capitalization, and the regulatory landscape.

Current Price and Market Capitalization

At the time of writing, XRP's price is [insert current XRP price] with a market capitalization of [insert current market cap]. This places it [insert ranking] in the overall cryptocurrency market. Recent price movements have been influenced by [mention recent news affecting price, e.g., legal developments, market trends]. Comparing XRP's market cap to other major cryptocurrencies like Bitcoin and Ethereum provides context for its relative size and potential for growth. Keywords: XRP market cap, cryptocurrency market, altcoin market, Bitcoin, Ethereum, price volatility, XRP price.

Regulatory Landscape and Legal Challenges

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and future prospects. The SEC alleges that XRP is an unregistered security, while Ripple maintains that it is a utility token.

- SEC's Claims: The SEC argues that XRP sales constitute unregistered securities offerings.

- Ripple's Defense: Ripple contends that XRP is a decentralized digital asset used for payments and not a security.

- Uncertainty and Impact: The outcome of this lawsuit remains uncertain, but it carries significant implications for XRP's price and regulatory status. A negative ruling could severely impact XRP's value, while a positive outcome could lead to substantial price appreciation.

This regulatory uncertainty is a major risk factor to consider. Keywords: SEC lawsuit, Ripple lawsuit, regulatory uncertainty, legal risks, XRP regulation.

Factors to Consider Before Investing in XRP

Before investing in XRP, it's crucial to conduct thorough due diligence and assess the inherent risks.

Risk Assessment

Investing in cryptocurrencies, including XRP, carries significant risk. The market is highly volatile, and prices can fluctuate dramatically in short periods.

- Volatility Risk: XRP's price is subject to sharp increases and decreases, leading to potential substantial losses.

- Regulatory Risk: The outcome of the SEC lawsuit significantly impacts XRP's future.

- Market Risk: The overall cryptocurrency market is prone to crashes and bear markets.

It's crucial to understand and accept these risks before investing in XRP. Keywords: cryptocurrency risk, investment risk, volatility risk, potential losses, due diligence.

Diversification and Investment Strategy

A critical aspect of responsible investing is diversification. Never invest more than you can afford to lose.

- Diversified Portfolio: Spread your investments across different asset classes to mitigate risk.

- Long-Term Perspective: Consider XRP as a long-term investment, rather than a short-term trading opportunity.

- Thorough Research: Always conduct comprehensive research before investing in any cryptocurrency.

Responsible investment practices are paramount to managing risk effectively. Keywords: portfolio diversification, risk management, investment strategy, long-term investment, responsible investing.

Conclusion

Determining whether XRP is a good buy under $3 requires careful consideration of its underlying technology, market position, and the significant risks involved. While RippleNet's potential for widespread adoption and XRP's utility within the ecosystem offer potential benefits, the regulatory uncertainty surrounding the SEC lawsuit presents a considerable challenge. Weigh the potential benefits and risks carefully before deciding if XRP is a good buy under $3 for your investment portfolio. Conduct your own in-depth research to make an informed decision about whether XRP fits your investment strategy. Remember to always prioritize responsible investment practices and diversify your portfolio. Further exploration of XRP and other cryptocurrencies is encouraged before making any investment commitment.

Featured Posts

-

Celtics Mettle Tested Star Studded Homestand Showdown

May 01, 2025

Celtics Mettle Tested Star Studded Homestand Showdown

May 01, 2025 -

Ben Afflecks New Movie Details On A Key Shootout Scene With Gillian Anderson

May 01, 2025

Ben Afflecks New Movie Details On A Key Shootout Scene With Gillian Anderson

May 01, 2025 -

Hdafw Aldwry Alinjlyzy Trtyb Jdyd Bed Hdf Haland Fy Twtnham

May 01, 2025

Hdafw Aldwry Alinjlyzy Trtyb Jdyd Bed Hdf Haland Fy Twtnham

May 01, 2025 -

Are Cruise Complaints A Risk Understanding Potential Consequences

May 01, 2025

Are Cruise Complaints A Risk Understanding Potential Consequences

May 01, 2025 -

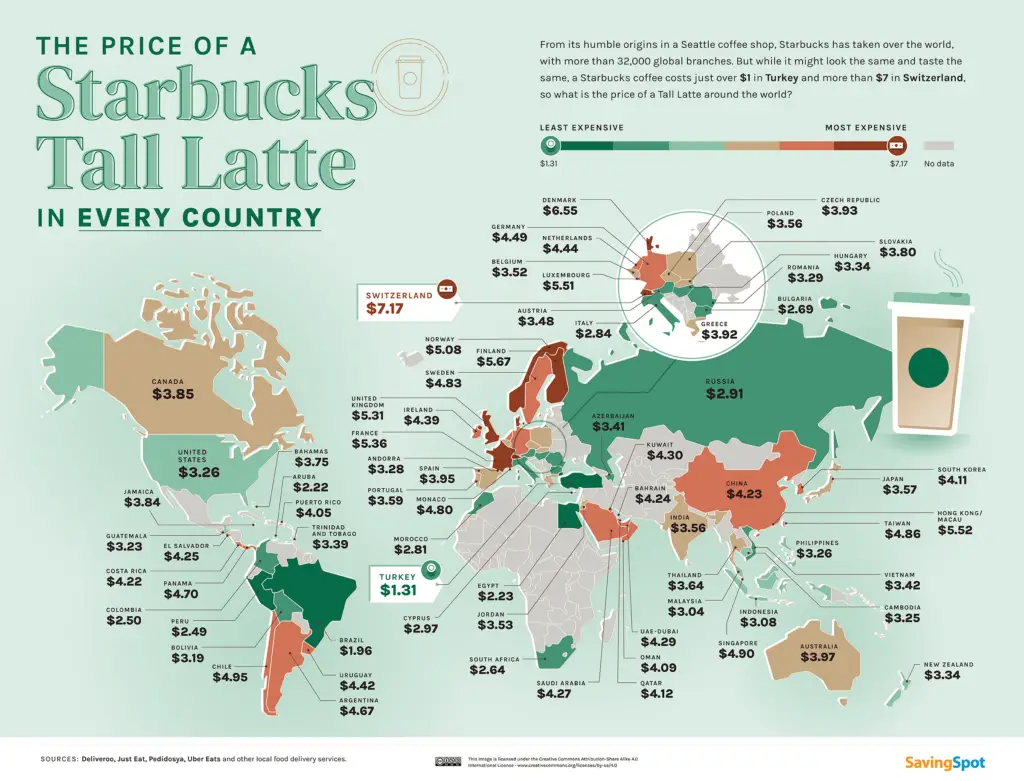

9 Key Differences Target Starbucks Vs Standalone Stores

May 01, 2025

9 Key Differences Target Starbucks Vs Standalone Stores

May 01, 2025