Is XRP (Ripple) A Good Investment Under $3?

Table of Contents

The price of XRP, Ripple's native cryptocurrency, has seen significant fluctuations. Currently trading under $3, many investors are questioning whether it presents a worthwhile investment opportunity. This article provides a comprehensive analysis of the key factors to consider before investing in XRP at this price point, offering a balanced perspective on its potential and inherent risks.

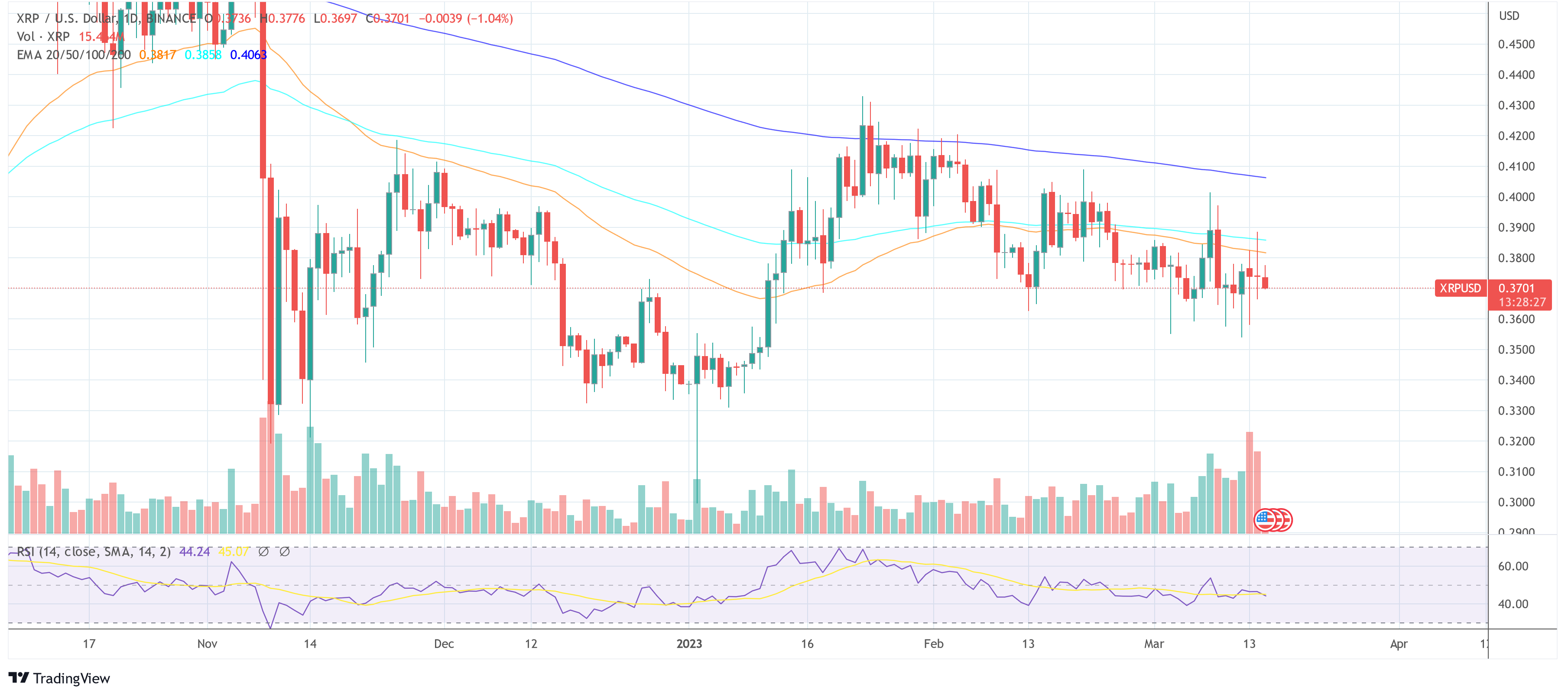

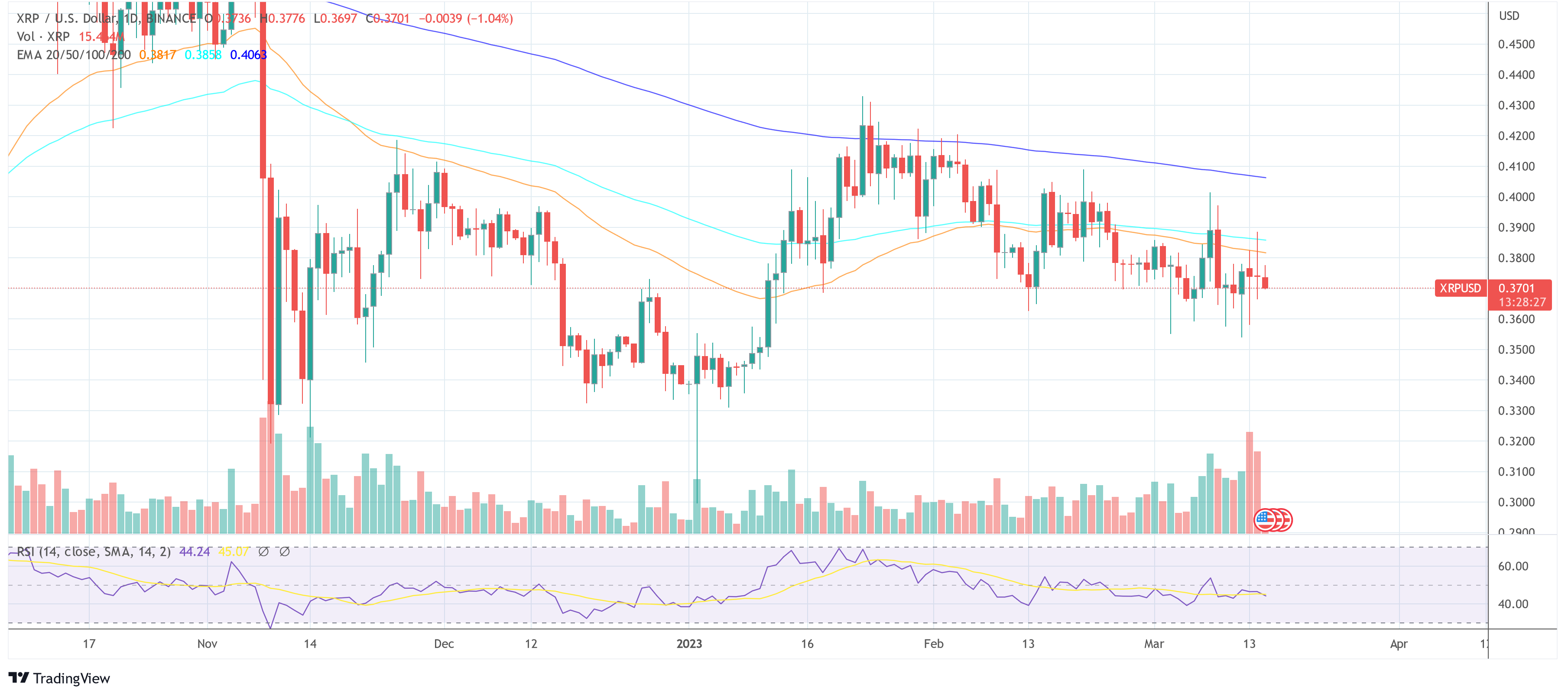

XRP's Current Market Position and Recent Performance

XRP's current market position is a crucial factor in determining its investment viability. Analyzing its price, market capitalization, and recent performance against other major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) is essential. Currently, XRP holds a position among the top cryptocurrencies by market cap, but its ranking fluctuates. Recent price movements have shown considerable volatility, influenced by various factors.

- XRP's trading volume and liquidity: High trading volume generally indicates strong market interest and liquidity, making it easier to buy and sell XRP. However, this can also fluctuate significantly.

- Influence of regulatory developments on XRP price: The ongoing SEC lawsuit and regulatory uncertainty surrounding XRP have a considerable impact on its price volatility. Positive regulatory developments could lead to substantial price increases, while negative news can cause sharp declines.

- Adoption rate among financial institutions: RippleNet's adoption by financial institutions is a key driver for XRP's value. Increased adoption translates to higher demand and potentially higher prices.

Ripple's Technology and Use Cases

Ripple's technology, primarily its RippleNet platform, plays a crucial role in XRP's potential. RippleNet facilitates cross-border payments, offering a faster, cheaper, and more efficient alternative to traditional methods. XRP acts as a bridge currency within this network, facilitating seamless transactions.

Beyond cross-border payments, XRP's potential use cases are expanding. Its speed and efficiency make it suitable for various financial applications.

- Speed and efficiency of XRP transactions: XRP transactions are significantly faster and cheaper than many other cryptocurrencies, offering a clear advantage in payment processing.

- Scalability of the XRP Ledger: The XRP Ledger is designed for high scalability, capable of handling a large number of transactions per second.

- Energy consumption compared to Proof-of-Work cryptocurrencies: Unlike Bitcoin, XRP uses a consensus mechanism that requires significantly less energy, making it a more environmentally friendly option.

- Partnerships and collaborations with financial institutions: Ripple's strategic partnerships with major banks and financial institutions demonstrate its growing adoption and acceptance within the traditional finance sector.

Regulatory Landscape and Legal Challenges

The ongoing SEC lawsuit against Ripple is a major factor influencing XRP's price and future prospects. The uncertainty surrounding the outcome significantly impacts investor confidence. Understanding the potential implications is vital before making an investment decision.

- Potential outcomes of the SEC lawsuit: A favorable ruling could lead to a significant price surge, while an unfavorable outcome could result in substantial losses.

- Impact of regulatory clarity (or lack thereof) on XRP's price: Clear regulatory frameworks across different jurisdictions would provide much-needed stability and could attract more institutional investment.

- Regulatory landscape in different jurisdictions: The regulatory landscape varies considerably across countries, impacting XRP's availability and trading conditions.

Future Price Predictions and Investment Potential

Predicting the future price of XRP is challenging, but analyzing predictions from reputable sources and considering potential catalysts for price growth is essential. Increased adoption, regulatory clarity, and technological advancements can all drive price increases.

However, it's crucial to acknowledge the inherent risks of investing in cryptocurrencies. The market is highly volatile, and unpredictable events can significantly impact prices.

- Factors influencing XRP's future price: Market sentiment, regulatory changes, technological developments, and adoption rates are all significant factors.

- Long-term vs. short-term investment strategies: Long-term investors might be more tolerant of short-term volatility, while short-term traders require a different approach.

- Risk tolerance and diversification: Diversifying your investment portfolio across different asset classes can help mitigate the risk associated with investing in XRP.

Conclusion

Investing in XRP under $3 presents both exciting opportunities and considerable risks. Ripple's technology and potential use cases are compelling, but the ongoing legal battle and regulatory uncertainty significantly affect its future trajectory. The potential for growth must be carefully weighed against the substantial risks involved. Before making any investment decisions regarding XRP, conduct thorough research, assess your risk tolerance, and consider seeking advice from a qualified financial advisor. Is XRP a good investment for you under $3? Only you can answer that question after carefully considering the factors discussed above.

Featured Posts

-

2024 Nfl Draft Panthers 8th Pick Holds Key To Continued Success

May 01, 2025

2024 Nfl Draft Panthers 8th Pick Holds Key To Continued Success

May 01, 2025 -

Compare Top Rated Us Cruise Lines

May 01, 2025

Compare Top Rated Us Cruise Lines

May 01, 2025 -

Luto En El Futbol Argentino Fallece Joven Promesa De Afa

May 01, 2025

Luto En El Futbol Argentino Fallece Joven Promesa De Afa

May 01, 2025 -

Channel 4 And Michael Sheen Face Accusations Of Misappropriating Funds

May 01, 2025

Channel 4 And Michael Sheen Face Accusations Of Misappropriating Funds

May 01, 2025 -

Daly Late Show Englands Six Nations Victory Over France

May 01, 2025

Daly Late Show Englands Six Nations Victory Over France

May 01, 2025