Is XRP (Ripple) A Smart Investment For Long-Term Financial Security?

Table of Contents

Understanding XRP and its Technology

XRP is a digital asset designed to facilitate fast and inexpensive cross-border payments. Unlike Bitcoin or Ethereum, which rely on proof-of-work consensus mechanisms, XRP operates on a unique consensus mechanism, offering faster transaction speeds and significantly lower energy consumption. Ripple, the company behind XRP, aims to revolutionize global financial transactions by providing a faster, cheaper, and more efficient alternative to traditional banking systems.

- XRP's Role as a Bridge Currency: XRP acts as a bridge currency, enabling seamless conversion between different fiat currencies and cryptocurrencies, facilitating faster and cheaper international transactions. This unique functionality sets it apart from many other cryptocurrencies.

- Key Partnerships and Collaborations: Ripple has forged strategic partnerships with numerous financial institutions worldwide, including major banks and payment providers. This institutional adoption is a significant factor driving potential long-term growth.

- Transaction Speed and Fees: Compared to Bitcoin and Ethereum, XRP boasts considerably faster transaction speeds and significantly lower fees. This efficiency makes it attractive for high-volume transactions and everyday use cases. This improved scalability is a key advantage in the cryptocurrency landscape.

Analyzing XRP's Market Performance and Price Prediction

XRP's price history is marked by periods of significant volatility, influenced by various factors. The SEC lawsuit against Ripple significantly impacted XRP's price, creating uncertainty and volatility in the market. However, the ongoing legal battle's eventual resolution could significantly affect its future trajectory.

- Historical Price Analysis: Examining XRP's historical price charts reveals periods of both substantial gains and significant losses. Understanding these fluctuations is crucial for assessing its potential for long-term growth. [Insert chart visualizing XRP's historical price performance here].

- Influencing Factors: Factors impacting XRP's price include regulatory developments (the outcome of the SEC lawsuit is paramount), the rate of adoption by financial institutions, and overall market sentiment towards cryptocurrencies.

- XRP Price Predictions: Various analysts offer XRP price predictions, but it's crucial to remember that these are speculative and should not be taken as financial advice. The future price of XRP remains highly uncertain. Potential future catalysts, such as increased regulatory clarity and wider institutional adoption, could positively impact the price.

Assessing the Risks Associated with XRP Investment

Investing in XRP, like any cryptocurrency, carries significant risks. The cryptocurrency market is notoriously volatile, and XRP's price can fluctuate dramatically in short periods.

- Volatility: The inherent volatility of the cryptocurrency market poses substantial risk. Sudden price drops can lead to significant losses.

- Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies, particularly XRP in light of the ongoing SEC lawsuit, introduces additional risk. Unfavorable regulatory decisions could significantly negatively impact XRP's price and future prospects.

- Diversification: Investing in a single cryptocurrency is inherently risky. Diversification is essential for mitigating risk. A well-diversified portfolio spread across different asset classes, including traditional investments and other cryptocurrencies, reduces overall risk exposure.

Developing a Long-Term XRP Investment Strategy

A successful long-term XRP investment strategy requires a clear understanding of your financial goals and risk tolerance.

- Financial Goals and Risk Tolerance: Define your investment goals and assess your risk tolerance before investing in XRP or any other cryptocurrency. Understand that higher potential returns often come with higher risks.

- Dollar-Cost Averaging (DCA): DCA, a strategy of investing a fixed amount of money at regular intervals regardless of price, can mitigate the impact of market volatility. This reduces the risk of investing a lump sum at a market peak.

- Portfolio Diversification: Diversify your investments to mitigate risk. Consider investing in other asset classes like stocks, bonds, and real estate alongside XRP. Remember to only invest what you can afford to lose.

Conclusion

Investing in XRP (Ripple) for long-term financial security presents both potential opportunities and substantial risks. While its technology and potential for widespread adoption are attractive, the inherent volatility of the cryptocurrency market and regulatory uncertainties cannot be ignored. The success of any XRP investment strategy heavily depends on thorough research, a realistic understanding of your risk tolerance, and a well-diversified investment portfolio. Conduct your own thorough research before making any investment decisions about XRP and remember that building a diversified investment portfolio is crucial for managing your long-term financial security effectively. Don't treat this article as financial advice; consult a financial professional before making any investment decisions.

Featured Posts

-

Descubra 8 Filmes Incriveis Com Isabela Merced A Dina De The Last Of Us

May 07, 2025

Descubra 8 Filmes Incriveis Com Isabela Merced A Dina De The Last Of Us

May 07, 2025 -

Warriors Vs Hornets Basketball Game How To Watch On March 3rd

May 07, 2025

Warriors Vs Hornets Basketball Game How To Watch On March 3rd

May 07, 2025 -

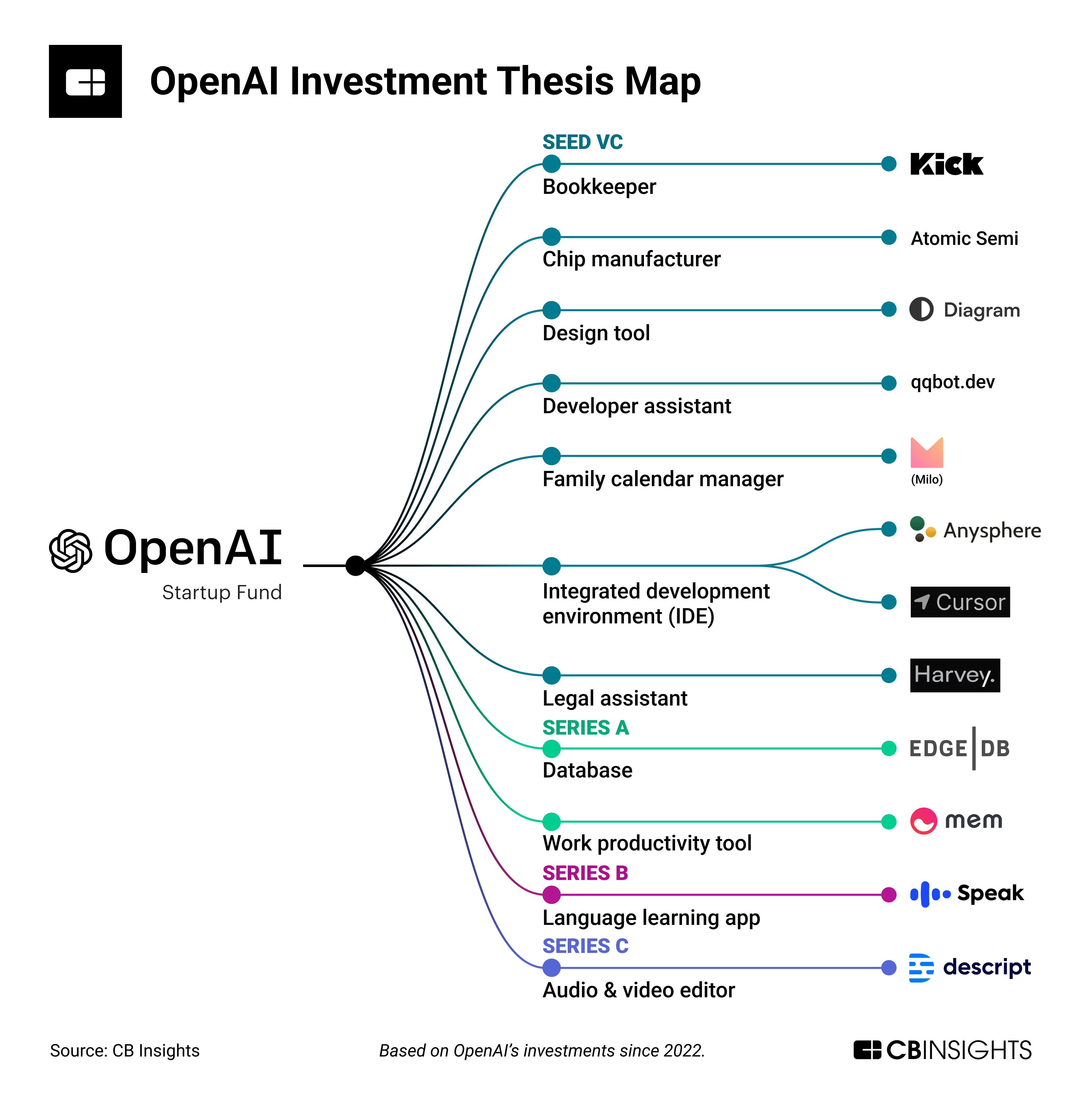

Nonprofit Control Ensured Open Ais Commitment To Responsible Ai

May 07, 2025

Nonprofit Control Ensured Open Ais Commitment To Responsible Ai

May 07, 2025 -

Yes Bank Potential Minority Stake Acquisition By Smfg

May 07, 2025

Yes Bank Potential Minority Stake Acquisition By Smfg

May 07, 2025 -

Kyle Harrison And Carson Whisenhunt The Future Of The San Francisco Giants

May 07, 2025

Kyle Harrison And Carson Whisenhunt The Future Of The San Francisco Giants

May 07, 2025

Latest Posts

-

Duesen Kripto Piyasasinda Yatirimci Davranislari Satislar Artti

May 08, 2025

Duesen Kripto Piyasasinda Yatirimci Davranislari Satislar Artti

May 08, 2025 -

Kripto Para Yatirimlarinda Gerileme Ve Satislar

May 08, 2025

Kripto Para Yatirimlarinda Gerileme Ve Satislar

May 08, 2025 -

Sermaye Piyasasi Kurulu Ndan Kripto Duezenlemesi Platformlar Icin Yeni Sartlar

May 08, 2025

Sermaye Piyasasi Kurulu Ndan Kripto Duezenlemesi Platformlar Icin Yeni Sartlar

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

Kripto Duesuesue Satis Baskisinin Ardindaki Nedenler

May 08, 2025

Kripto Duesuesue Satis Baskisinin Ardindaki Nedenler

May 08, 2025