Iwi Asset Growth: Top 10 Reach $8.2 Billion, Report Finds

Table of Contents

Key Drivers of Iwi Asset Growth

The dramatic increase in iwi wealth is a result of several interconnected factors, showcasing the effectiveness of long-term strategic planning and resource management.

Strategic Investments and Diversification

Strategic investment diversification has been a cornerstone of iwi asset growth. Rather than relying on single income streams, iwi have built diversified portfolios that mitigate risk and maximize returns. This involves investing across a range of sectors, including:

- Forestry: Long-term investments in sustainably managed forests provide consistent income streams and capital appreciation.

- Aquaculture: Sustainable aquaculture operations, often incorporating traditional Māori knowledge, offer significant economic potential.

- Tourism: Leveraging unique cultural experiences and natural resources, iwi are creating thriving tourism ventures.

- Property: Strategic land acquisitions and property development generate substantial income and contribute to community infrastructure.

Successful iwi investments demonstrate the power of long-term vision. For example, [insert example of a successful iwi investment in a specific sector and its return]. Effective strategies include:

- Long-term vision: Planning for multiple generations, ensuring sustainable wealth creation.

- Risk management: Diversifying investments to mitigate potential losses.

- Strategic partnerships: Collaborating with external experts and businesses to maximize returns and expertise. This often involves joint ventures with private sector entities.

These strategies highlight the sophisticated approach iwi are taking to iwi investment strategies and portfolio management, leading to remarkable financial success.

Treaty Settlements and Resource Ownership

Treaty settlements have played a crucial role in providing iwi with the capital necessary to invest and grow their assets. The financial redress received through these settlements has been strategically deployed to build strong economic foundations. Furthermore, the return of ancestral lands and the securing of resource ownership rights (e.g., water rights) have created significant ongoing income streams. The value of these settlements and resource ownership is substantial and continues to contribute to iwi economic empowerment. Quantifying this impact requires careful analysis of individual settlements, however, the overall impact is demonstrably significant. For example, [insert data or example illustrating the financial impact of a specific Treaty settlement].

Effective Governance and Management

The success of iwi asset growth is inextricably linked to strong governance structures and skilled management teams. Iwi governance is crucial in ensuring responsible and transparent management of assets. Iwi trusts and other governance bodies play a vital role in:

- Developing and implementing investment strategies.

- Monitoring performance and managing risk.

- Ensuring accountability and transparency in financial reporting.

- Prioritizing sustainable development and long-term growth.

Best practices in iwi governance include robust financial reporting, independent audits, and the incorporation of traditional Māori values into decision-making processes. These practices reflect a commitment to corporate governance best practices, adapted to suit the unique context of iwi.

Impact of Iwi Asset Growth on Communities

The growth in iwi assets is not merely a financial success; it is having a transformative impact on iwi communities across Aotearoa.

Social and Economic Development

The increased iwi wealth is being channeled into initiatives that improve social and economic outcomes:

- Education: Funding scholarships, educational programs, and initiatives to improve educational attainment.

- Health: Investing in healthcare services, promoting wellbeing, and addressing health disparities.

- Infrastructure: Developing community infrastructure, including housing, roads, and other essential services.

- Employment: Creating employment opportunities within iwi-owned businesses and ventures.

These investments are crucial for building thriving and resilient communities. For example, [insert example of a community development project funded by iwi assets]. The impact is tangible, contributing to measurable improvements in iwi wellbeing.

Cultural Preservation and Revitalization

Increased iwi asset growth is also enabling significant investments in preserving and revitalizing Māori culture and language:

- Funding for cultural preservation initiatives, such as the restoration of historical sites and the preservation of taonga (treasures).

- Support for language revitalization programs, promoting the use and teaching of te reo Māori (the Māori language).

- Investing in cultural centers and other initiatives that celebrate and share Māori heritage.

These investments are not just about preserving the past but about ensuring the vibrancy of Māori culture for future generations. The connection between Māori culture and iwi identity is vital for wellbeing, and this investment is critical to maintaining that connection.

Challenges and Future Outlook for Iwi Asset Growth

Despite the remarkable progress, challenges remain:

- Economic downturns: The global economy can impact investment returns, requiring robust risk management strategies.

- Regulatory changes: Changes in government policies and regulations can affect investment opportunities.

- Skill development: Ongoing investment in skills development is essential to maintain strong management and governance capabilities.

However, the future outlook for iwi asset growth remains positive. Continued strategic investment, effective governance, and a commitment to sustainable development will be key factors in ensuring continued success. New opportunities exist in areas such as renewable energy and technology, promising further growth and diversification.

Conclusion: Understanding and Leveraging Iwi Asset Growth

The significant growth of iwi assets, driven by strategic investments, Treaty settlements, and effective governance, is transforming iwi communities and contributing significantly to Māori economic empowerment and cultural revitalization. This success underscores the importance of iwi asset growth as a vital factor in building strong and prosperous communities. To learn more about the strategies driving iwi asset growth and how you can contribute to this positive trend, explore resources from organizations such as [insert relevant organizations or websites]. Understanding and supporting this progress is crucial for the future of Aotearoa New Zealand.

Featured Posts

-

Nonnas Italian Kitchen Vince Vaughns Exciting New Culinary Venture

May 14, 2025

Nonnas Italian Kitchen Vince Vaughns Exciting New Culinary Venture

May 14, 2025 -

Recruiting Expats Canadas Economic Opportunity Amidst Us Challenges

May 14, 2025

Recruiting Expats Canadas Economic Opportunity Amidst Us Challenges

May 14, 2025 -

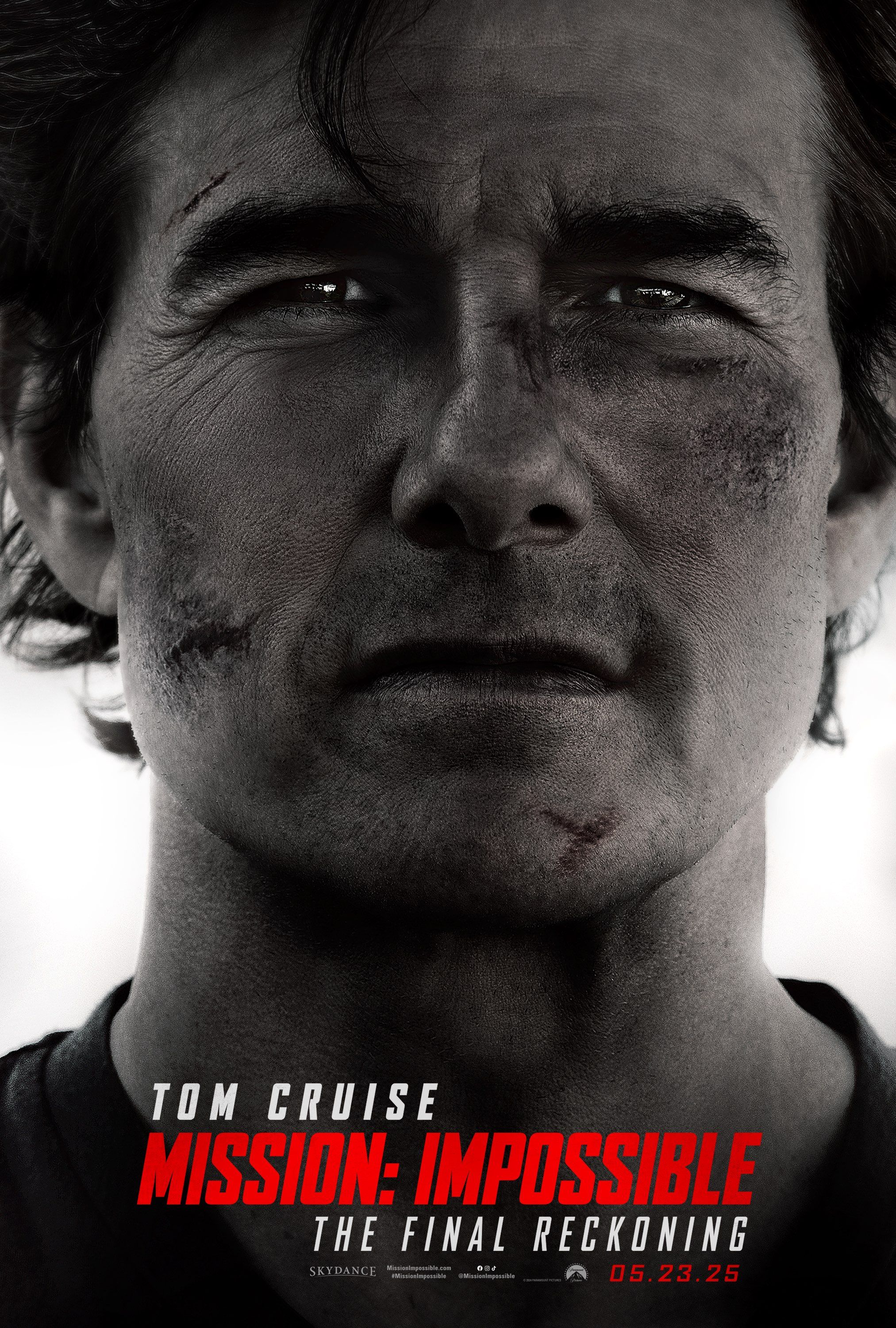

Tom Cruises High Altitude Stunt In Mission Impossible Dead Reckoning Part One

May 14, 2025

Tom Cruises High Altitude Stunt In Mission Impossible Dead Reckoning Part One

May 14, 2025 -

Pokemon Tcg Pocket Charizard Ex A2b 010 Deck Strategies And Counter Plays

May 14, 2025

Pokemon Tcg Pocket Charizard Ex A2b 010 Deck Strategies And Counter Plays

May 14, 2025 -

Ohtanis Power Surge 6 Run 9th Fuels Dodgers Comeback

May 14, 2025

Ohtanis Power Surge 6 Run 9th Fuels Dodgers Comeback

May 14, 2025