JBS Abandoning Banco Master Assets Acquisition: JBSS3 Implications

Table of Contents

Reasons for JBS Abandoning the Banco Master Acquisition

Several factors likely contributed to JBS's decision to abandon the Banco Master acquisition. Analyzing these factors provides crucial insight into the challenges faced in large-scale mergers and acquisitions within the agricultural and financial sectors.

Valuation Discrepancies

Significant disagreements on valuation were likely a primary reason for the deal's collapse. The process of due diligence revealed stark differences in how JBS and Banco Master valued the assets involved.

- Disagreements on Asset Values: JBS's internal valuation might have differed substantially from Banco Master's, particularly concerning key operational assets, real estate, and intangible assets like brand recognition.

- Overlooked Liabilities: Unforeseen liabilities or contingent liabilities associated with Banco Master's operations could have surfaced during due diligence, rendering the acquisition less attractive or financially risky for JBS.

- Differing Growth Projections: Discrepancies in projected future growth and profitability of Banco Master's assets might have led to irreconcilable differences in the perceived value of the acquisition. JBS may have anticipated lower returns than initially projected.

The detailed due diligence process, including independent valuations and legal reviews, likely exposed these valuation discrepancies, ultimately leading to the deal's termination. Reports from financial news outlets would be needed here to cite specific examples if available.

Regulatory Hurdles

Navigating the regulatory landscape is often a significant challenge in large acquisitions. The JBS Banco Master Acquisition might have been hindered by various regulatory hurdles.

- Antitrust Concerns: Regulatory bodies may have raised concerns about potential monopolistic practices resulting from the merger, particularly regarding market share within specific sectors of the agricultural or financial markets.

- Environmental Regulations: Banco Master's operations might have faced scrutiny regarding environmental compliance. Stringent environmental regulations could have posed significant challenges and potential liabilities for JBS.

- Governmental Approvals: The acquisition may have required approvals from several governmental bodies, and delays or outright rejections could have contributed to the decision to abandon the deal.

These regulatory obstacles could have significantly impacted the timeline and profitability of the acquisition, leading JBS to conclude that the potential risks outweighed the benefits.

Market Conditions

Prevailing market conditions played a significant role in JBS's decision. The rapidly changing economic climate can significantly impact investment decisions.

- Interest Rate Shifts: Rising interest rates increase borrowing costs, making acquisitions more expensive and potentially less attractive.

- Inflationary Pressures: High inflation erodes profitability and increases uncertainty, leading companies to reconsider large investments.

- Economic Uncertainty: General economic uncertainty and recessionary fears may have led JBS to reassess its risk appetite and prioritize preserving capital.

These macroeconomic factors likely contributed to JBS's decision to withdraw from the acquisition, as the perceived risks increased while the potential returns decreased.

Impact on JBSS3 Stock Performance

The abandonment of the Banco Master acquisition has immediate and long-term implications for JBSS3.

Short-Term Market Reaction

The news of the acquisition's failure likely triggered a negative short-term market reaction.

- Stock Price Fluctuations: We would expect to see a decrease in JBSS3's stock price immediately following the announcement. (Specific data from financial news sources would be needed here.)

- Investor Sentiment: Investor confidence in JBS might have been negatively impacted, leading to a sell-off.

- Trading Volume Changes: Increased trading volume would likely be observed as investors reacted to the news and adjusted their portfolios.

The immediate market reaction would reflect investor sentiment and the perceived impact of the failed acquisition on JBS's future performance.

Long-Term Implications for Investors

The long-term implications for JBSS3 investors depend on JBS's ability to adapt and implement successful alternative strategies.

- Future Growth Prospects: The failure of the acquisition might impact JBS's future growth prospects if it was considered a key element of their growth strategy.

- Dividend Payouts: JBS may need to reassess dividend payouts if the acquisition's failure impacts their financial performance.

- Overall Financial Stability: The impact on JBS's overall financial stability needs to be assessed; the failed acquisition might free up resources for other investments or require cost-cutting measures.

Investors need to carefully analyze JBS's revised strategic plan and future announcements to assess the long-term risks and opportunities.

JBS's Future Strategies and Alternative Investments

The failed JBS Banco Master Acquisition necessitates a recalibration of JBS's strategic direction.

Potential Acquisition Targets

JBS will likely seek alternative acquisition targets that align with their long-term goals.

- Strategic Sectors: JBS might explore acquisitions within complementary sectors of the agricultural industry or potentially other related industries.

- Synergistic Targets: The focus will likely shift towards identifying companies that offer stronger synergies and a lower risk profile.

Organic Growth Initiatives

JBS might prioritize organic growth strategies to compensate for the missed opportunity.

- R&D Investment: Increased investment in research and development could lead to innovation and new product lines.

- Operational Efficiency: Improving operational efficiency through technological upgrades and streamlined processes could enhance profitability.

- Market Expansion: Focus on expanding into new markets or strengthening existing market positions could drive growth.

These organic growth initiatives will be crucial in offsetting the negative impact of the failed Banco Master acquisition.

Conclusion

The abandonment of the JBS Banco Master acquisition presents a complex situation with significant implications for JBSS3. While the short-term market reaction might be negative, the long-term impact will depend on JBS's ability to adapt and pursue alternative strategies. Investors should closely monitor JBS's future announcements and carefully assess their investment strategies in light of this development. Understanding the reasons behind the acquisition's failure, along with JBS's future plans, is crucial for informed decision-making regarding the JBS Banco Master Acquisition and the outlook for JBSS3. Stay informed on further developments surrounding the JBS Banco Master Acquisition to make the best investment choices.

Featured Posts

-

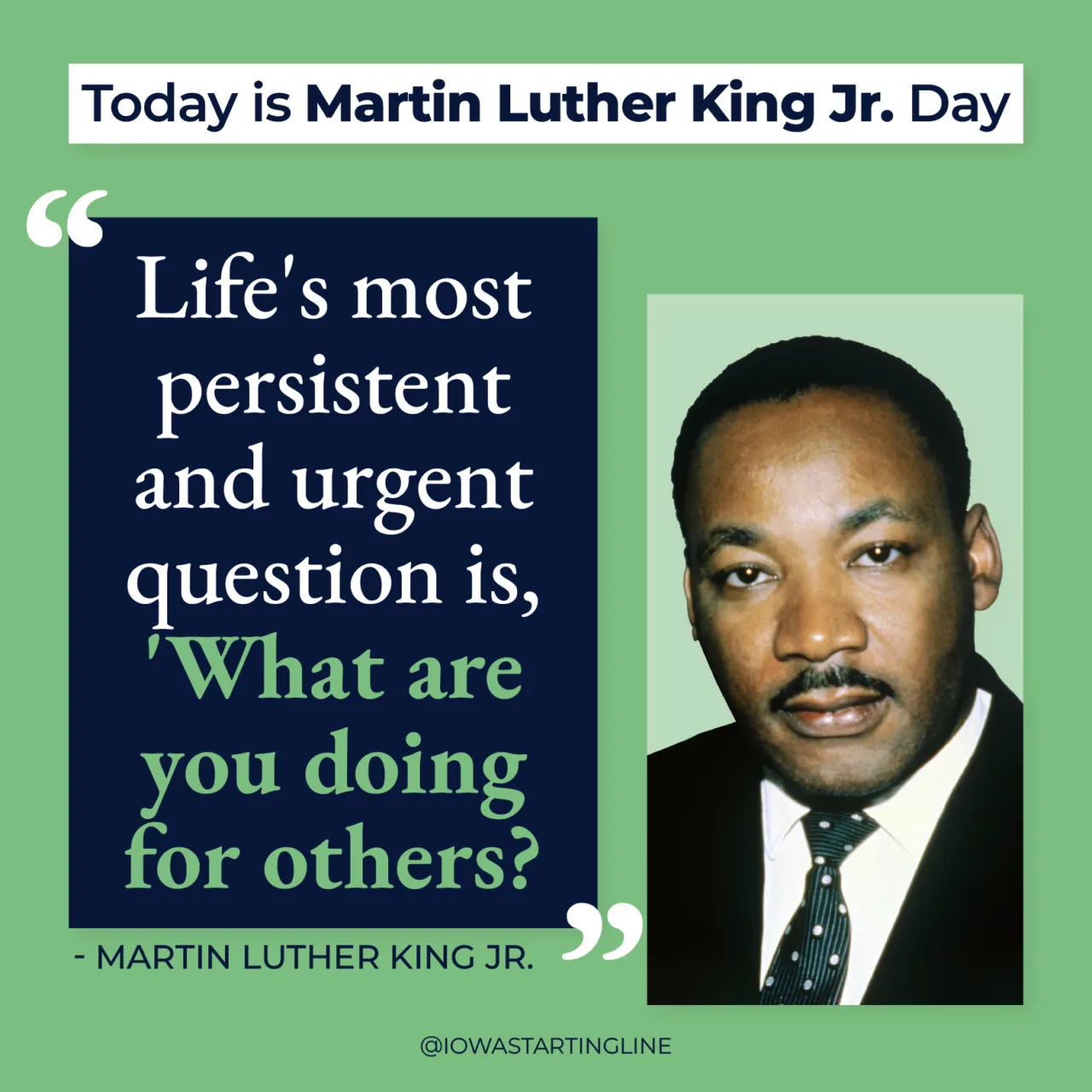

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025 -

Hong Kong Dining Roucous Cheese Omakase A Comprehensive Review

May 18, 2025

Hong Kong Dining Roucous Cheese Omakase A Comprehensive Review

May 18, 2025 -

Public Offering Voyager Technologies Targets Space Defense Market

May 18, 2025

Public Offering Voyager Technologies Targets Space Defense Market

May 18, 2025 -

Moncada And Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025

Moncada And Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025 -

Trumps Middle East Policy A Shift In Power Dynamics Between Arab States And Israel

May 18, 2025

Trumps Middle East Policy A Shift In Power Dynamics Between Arab States And Israel

May 18, 2025

Latest Posts

-

Confortos Path To Success Following In Hernandezs Footsteps

May 18, 2025

Confortos Path To Success Following In Hernandezs Footsteps

May 18, 2025 -

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025 -

Pete Crow Reports Cubs Clinch Series With Armstrongs Two Homer Performance

May 18, 2025

Pete Crow Reports Cubs Clinch Series With Armstrongs Two Homer Performance

May 18, 2025 -

Dodgers Vs Cubs Armstrongs Two Home Runs Decide Series

May 18, 2025

Dodgers Vs Cubs Armstrongs Two Home Runs Decide Series

May 18, 2025 -

Confortos Dodgers Debut Mirroring Hernandezs Impact

May 18, 2025

Confortos Dodgers Debut Mirroring Hernandezs Impact

May 18, 2025