JBS (JBSS3) Withdraws From Banco Master Asset Acquisition Talks

Table of Contents

JBS's Official Statement and Reasons for Withdrawal

JBS's official statement regarding the termination of acquisition talks with Banco Master is crucial for understanding the situation. The company's press release, [insert link to press release here if available], should be consulted for the most accurate and up-to-date information. However, initial reports suggest several key reasons for the withdrawal:

-

Valuation Disagreements: Significant discrepancies likely existed between JBS's assessment of the Banco Master assets' worth and the asking price. This is a common cause for deal collapses in M&A activity.

-

Due Diligence Findings: The due diligence process undertaken by JBS may have uncovered unforeseen liabilities or issues that made the acquisition less attractive or financially viable. This could include hidden debts, regulatory hurdles, or operational challenges within Banco Master.

-

Changing Market Conditions: The volatile nature of global financial markets could have influenced JBS's decision. Shifts in interest rates, economic forecasts, or increased risk aversion might have altered JBS's risk tolerance and investment priorities.

Beyond the official reasons, market analysts speculate that unstated factors might also have contributed to the withdrawal. These could include concerns about Banco Master's long-term financial stability or the emergence of more attractive investment opportunities for JBS.

Impact on Banco Master's Restructuring Process

Banco Master is currently grappling with significant financial difficulties, necessitating a comprehensive restructuring process. JBS's withdrawal is a substantial setback, significantly impacting Banco Master's restructuring plans. Key implications include:

-

Delayed Restructuring: The failed acquisition delays Banco Master's progress towards financial stability, potentially lengthening the restructuring timeline.

-

Reduced Asset Value: The inability to secure a sale to JBS likely diminishes the perceived value of Banco Master's assets, making it more challenging to attract alternative buyers.

-

Increased Pressure on Creditors: Banco Master's creditors now face increased uncertainty regarding debt repayment, potentially leading to heightened tensions and negotiations.

The failed acquisition raises the possibility of further complications, including potential bankruptcy proceedings if Banco Master cannot secure alternative funding or a viable restructuring plan. The next steps for Banco Master will be closely watched by investors and creditors alike.

Market Reaction and Investor Sentiment

The news of JBS's withdrawal from the Banco Master acquisition immediately impacted market sentiment. The immediate reaction saw:

-

JBSS3 Stock Price Fluctuation: JBS's (JBSS3) stock price experienced [insert details on stock price movement – e.g., a slight dip or no significant change] following the announcement, reflecting investor sentiment towards the company's strategic decisions.

-

Decreased Investor Confidence (Potentially): Depending on the market reaction, investor confidence in JBS's investment strategy might have been affected, particularly if the withdrawal is perceived as a missed opportunity or a sign of flawed due diligence.

-

Increased Trading Volume: The announcement likely spurred increased trading volume for both JBS and Banco Master stocks as investors reacted to the news and adjusted their portfolios accordingly.

The broader implications for the Brazilian financial market remain to be seen. The event highlights the risks and uncertainties inherent in large-scale acquisitions and the sensitivity of market participants to unexpected developments.

Alternative Acquisition Targets for JBS

JBS's withdrawal from the Banco Master deal opens speculation about potential alternative acquisition targets. Given JBS's past investments and current market conditions, several possibilities exist:

-

Expansion in Existing Markets: JBS might focus on acquiring smaller meatpacking companies or related businesses to consolidate its position in its established markets.

-

Diversification into Complementary Sectors: The company could explore acquisitions in adjacent sectors, such as agricultural technology or food processing, to diversify its revenue streams and enhance its value chain.

-

International Expansion: JBS could target acquisitions in new international markets to expand its geographic reach and tap into new growth opportunities.

Each of these scenarios carries unique benefits and challenges. A thorough analysis of the potential targets' financial health, regulatory environment, and strategic fit with JBS's overall business strategy is essential. The direction JBS chooses will significantly impact its future growth prospects.

Conclusion

JBS's (JBSS3) withdrawal from the Banco Master asset acquisition represents a significant development with implications for both companies and the broader Brazilian financial market. The reasons for the withdrawal, spanning valuation disagreements to changing market conditions, highlight the inherent complexities and risks in M&A activity. Banco Master faces a more challenging restructuring path, while JBS's strategic direction remains open to speculation as it considers alternative acquisition targets.

Call to Action: Stay informed about the evolving situation surrounding JBS (JBSS3) and its future investment strategies. Continue to monitor news and analysis related to JBS (JBSS3) and Banco Master developments for a comprehensive understanding of this dynamic situation. For more in-depth financial news and analysis, visit [link to relevant financial news source].

Featured Posts

-

The Red Carpets Rule Breaking Guests Cnns Perspective

May 18, 2025

The Red Carpets Rule Breaking Guests Cnns Perspective

May 18, 2025 -

Walton Goggins To Host Snl Mocks White Lotus Fan Theories

May 18, 2025

Walton Goggins To Host Snl Mocks White Lotus Fan Theories

May 18, 2025 -

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025 -

Understanding Chat Gpts New Ai Coding Agent A Comprehensive Guide

May 18, 2025

Understanding Chat Gpts New Ai Coding Agent A Comprehensive Guide

May 18, 2025 -

Julia Fox And Bianca Censori A Style Comparison After Kanye West Drama

May 18, 2025

Julia Fox And Bianca Censori A Style Comparison After Kanye West Drama

May 18, 2025

Latest Posts

-

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025 -

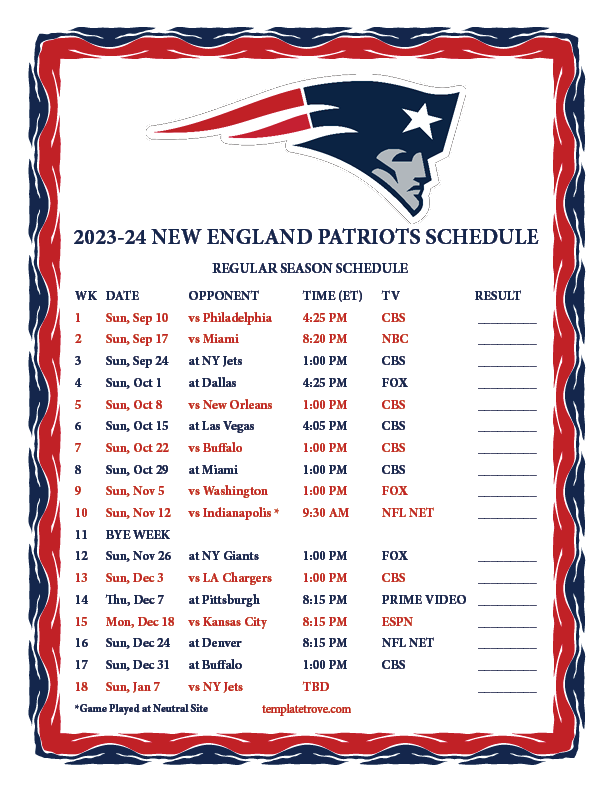

2025 Nfl Draft Expert Assessment Of The New England Patriots

May 18, 2025

2025 Nfl Draft Expert Assessment Of The New England Patriots

May 18, 2025 -

Nfl Analyst Evaluates Patriots Trajectory Following 2025 Draft

May 18, 2025

Nfl Analyst Evaluates Patriots Trajectory Following 2025 Draft

May 18, 2025 -

Jersey Mikes Subs Galesburg Location Menu And More

May 18, 2025

Jersey Mikes Subs Galesburg Location Menu And More

May 18, 2025 -

Will Stephen Miller Become The Next National Security Advisor Analyzing The Possibility

May 18, 2025

Will Stephen Miller Become The Next National Security Advisor Analyzing The Possibility

May 18, 2025