Jeanine Pirro's Stock Market Forecast: A Few Weeks Of Caution?

Table of Contents

Understanding Jeanine Pirro's Market Analysis

Jeanine Pirro's approach to market analysis, while not traditionally rooted in technical indicators, often reflects a keen understanding of broader economic and geopolitical trends. She frequently draws connections between current events and their potential impact on investor sentiment and market performance. While she doesn't publicly release detailed quantitative models, her commentary often reflects a focus on qualitative factors influencing market behavior. To support this analysis, we have referenced recent appearances on her television show and public statements (links to specific videos or transcripts would be included here if available).

- Key Arguments: Pirro's recent statements (insert specific quotes if available, citing sources) suggest concerns regarding [mention specific concerns, e.g., inflation, geopolitical instability, potential recession].

- Economic Indicators: She often highlights [mention specific indicators she mentioned, e.g., rising inflation rates, interest rate hikes by the Federal Reserve, escalating tensions in specific regions].

- Overall Sentiment: Her overall sentiment regarding the near-term market outlook appears to be cautiously bearish, suggesting a need for prudence in investment decisions.

Key Factors Influencing Pirro's Forecast

Several economic factors appear to be contributing to Pirro's cautious outlook on the stock market:

- Inflation Rates: Persistently high inflation erodes purchasing power and can lead to decreased consumer spending, impacting corporate profits and potentially slowing economic growth. This is a major concern reflected in Pirro's analysis.

- Interest Rate Hikes: The Federal Reserve's efforts to curb inflation through interest rate hikes can increase borrowing costs for businesses and consumers, potentially dampening economic activity and impacting stock valuations. Pirro likely weighs this factor heavily in her forecast.

- Geopolitical Risks: Global political instability and uncertainty, including [mention specific geopolitical events relevant to her commentary, e.g., the war in Ukraine, tensions in other regions], contribute to market volatility and investor apprehension, as highlighted by Pirro.

- Recessionary Pressures: The combination of high inflation, rising interest rates, and geopolitical risks increases the likelihood of a recession, a significant factor driving Pirro's cautious forecast.

Alternative Perspectives on the Current Market

It's crucial to acknowledge that not all financial experts share Pirro's cautious outlook. Several prominent analysts offer contrasting viewpoints.

- Differing Opinions: [Name prominent economists or analysts with bullish or neutral views] argue that [summarize their arguments, providing links to their analysis]. They highlight factors such as [mention specific factors supporting their optimistic views, e.g., strong corporate earnings, resilience of the consumer sector, potential for technological innovation].

- Counterarguments: These analysts counter Pirro's concerns by emphasizing [mention counterarguments to Pirro's points, e.g., the potential for inflation to moderate, the adaptability of businesses to changing economic conditions, the long-term growth potential of the market].

Practical Implications for Investors

Considering Jeanine Pirro's stock market forecast and the alternative perspectives, investors should take the following actions:

- Risk Management: Diversification of investment portfolios across various asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Hedging strategies may also be considered.

- Portfolio Adjustments: Based on Pirro's cautionary outlook and the potential for market volatility, investors might consider adjusting their portfolio allocations, potentially shifting towards less volatile assets in the short term.

- Long-Term Strategy: Despite short-term fluctuations, maintaining a long-term investment strategy aligned with individual financial goals remains paramount. Panic selling based on short-term market predictions can be detrimental to long-term wealth creation.

Conclusion: Navigating the Market Based on Jeanine Pirro's Stock Market Forecast

Jeanine Pirro's stock market forecast reflects a cautious outlook driven by concerns about inflation, interest rate hikes, geopolitical risks, and potential recessionary pressures. While her analysis provides valuable insights, it's crucial to consider alternative perspectives and conduct thorough research before making any investment decisions. Remember that market predictions are not guarantees, and a balanced approach incorporating diverse viewpoints is essential for navigating the complexities of the stock market. Stay updated on Jeanine Pirro's stock market forecasts and regularly review your own investment strategies to adapt to the ever-changing economic landscape. Seek professional financial advice before making any significant investment decisions. Learn more about navigating the stock market based on expert predictions to make informed choices for your financial future.

Featured Posts

-

Bao Hanh Tre Em Tai Tien Giang Phai Xu Ly Nghiem Va Ngan Chan Tuong Tu

May 09, 2025

Bao Hanh Tre Em Tai Tien Giang Phai Xu Ly Nghiem Va Ngan Chan Tuong Tu

May 09, 2025 -

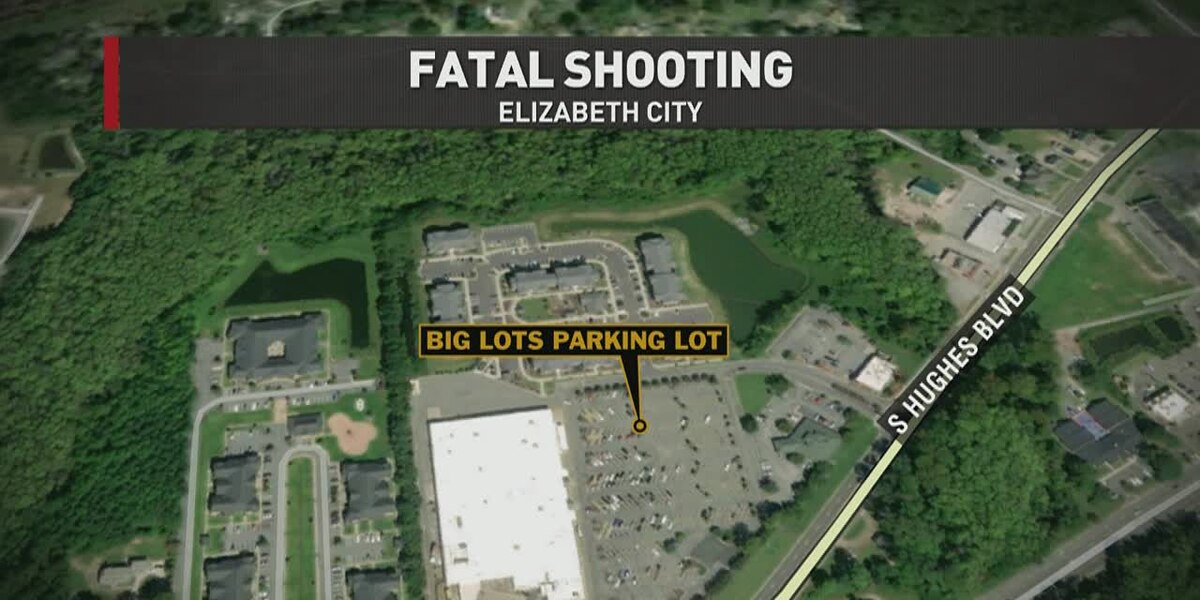

Multiple Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025 -

Lawsons Future Uncertain Colapinto Poised To Seize Red Bull Opportunity

May 09, 2025

Lawsons Future Uncertain Colapinto Poised To Seize Red Bull Opportunity

May 09, 2025 -

Indias Rise In Global Power Outpacing Uk France And Russia

May 09, 2025

Indias Rise In Global Power Outpacing Uk France And Russia

May 09, 2025 -

Woman Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025

Woman Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025