Jerome Powell On Tariffs: A Threat To The Fed's Goals

Table of Contents

Tariffs and Inflation: A Complex Relationship

Tariffs, essentially taxes on imported goods, create a complex relationship with inflation. The primary mechanism is cost-push inflation: when tariffs increase the price of imported goods, these higher costs are passed on to consumers. This leads to a rise in the overall price level, impacting the Federal Reserve's ability to maintain its inflation targets. The impact is far-reaching; it's not just about the direct price increase of the imported good itself.

- Increased import costs directly translate to higher prices for consumers: Everything from clothing and electronics to raw materials used in manufacturing becomes more expensive. This directly impacts consumer spending power and can lead to a decrease in overall demand.

- Supply chain disruptions caused by tariffs exacerbate inflationary pressures: Tariffs can disrupt established supply chains, leading to shortages and further price increases. Businesses may be forced to seek more expensive alternatives, adding to inflationary pressures.

- The Fed's mandate to maintain price stability is directly challenged by tariff-induced inflation: When inflation rises unexpectedly due to tariffs, the Fed is forced to react, often through measures that can have unintended consequences for economic growth.

- Examples of specific goods affected by tariffs and resulting price increases: Specific examples, such as steel and aluminum tariffs impacting the automotive and construction industries, clearly demonstrate how tariff-induced inflation ripples through the economy. These ripple effects can be substantial and long-lasting.

The Impact of Tariffs on Economic Growth

Beyond inflation, tariffs significantly impact economic growth. The uncertainty created by trade wars discourages business investment and reduces overall confidence. Businesses hesitate to commit to long-term projects when facing volatile trade policies, hindering expansion and job creation.

- Trade uncertainty makes businesses hesitant to invest in expansion or new projects: This uncertainty reduces capital expenditures and slows overall investment, a crucial driver of economic growth.

- Reduced consumer spending due to higher prices dampens economic activity: As consumers face higher prices due to tariffs, their disposable income shrinks, leading to reduced spending and slower economic growth.

- The overall impact on GDP growth can be significant, hindering the Fed's mandate for full employment: Slower economic growth directly translates to fewer job opportunities, further complicating the Fed's goal of maximum employment.

- Potential negative effects on specific sectors of the economy: Certain sectors, particularly those heavily reliant on imported goods or components, are disproportionately affected, potentially leading to job losses and economic hardship.

The Fed's Dilemma: Navigating Monetary Policy in a Tariff-Driven Environment

The Federal Reserve faces a significant challenge when trying to manage monetary policy in the face of tariff-induced economic shocks. The traditional tools—adjusting interest rates—become less effective when dealing with supply-side issues like those stemming from tariffs.

- Raising interest rates to combat inflation risks slowing economic growth further: Hiking interest rates to curb inflation could stifle already weakened economic activity, creating a difficult trade-off for policymakers.

- Lowering interest rates to stimulate growth might exacerbate inflation: Conversely, lowering interest rates to spur growth might fuel inflation even further, complicating the situation.

- The Fed’s ability to fine-tune the economy is hampered by external factors like tariffs: The Fed's ability to accurately predict and respond to economic fluctuations is significantly diminished by the unpredictability of tariff policies.

- Potential unconventional monetary policy responses: The Fed might consider unconventional measures, though their effectiveness in addressing supply-side issues remains debated. This further highlights the complexity of the situation.

Conclusion

In conclusion, Jerome Powell's concerns regarding tariffs are well-founded. Tariffs pose a significant threat to the Federal Reserve's ability to achieve its dual mandate of price stability and maximum employment. They fuel inflation, hinder economic growth, and severely limit the effectiveness of traditional monetary policy tools. Understanding the complexities of Jerome Powell on tariffs and their impact on the Fed's goals is crucial for navigating the current economic landscape. We encourage readers to further investigate this critical issue by exploring resources from the Federal Reserve website and reputable economic news outlets to gain a deeper understanding of the ongoing debate surrounding tariffs and their far-reaching consequences for the U.S. economy. The implications of Jerome Powell on tariffs are far-reaching and require careful consideration.

Featured Posts

-

Meta Israels 2024 Holocaust Remembrance Day Instagram Project

May 26, 2025

Meta Israels 2024 Holocaust Remembrance Day Instagram Project

May 26, 2025 -

Popular Southern Vacation Spot Rebuts Claims Of Poor Safety Following Shooting

May 26, 2025

Popular Southern Vacation Spot Rebuts Claims Of Poor Safety Following Shooting

May 26, 2025 -

Naomi Kempbell 55 Rokiv Fotosesiyi Ta Kar Yera

May 26, 2025

Naomi Kempbell 55 Rokiv Fotosesiyi Ta Kar Yera

May 26, 2025 -

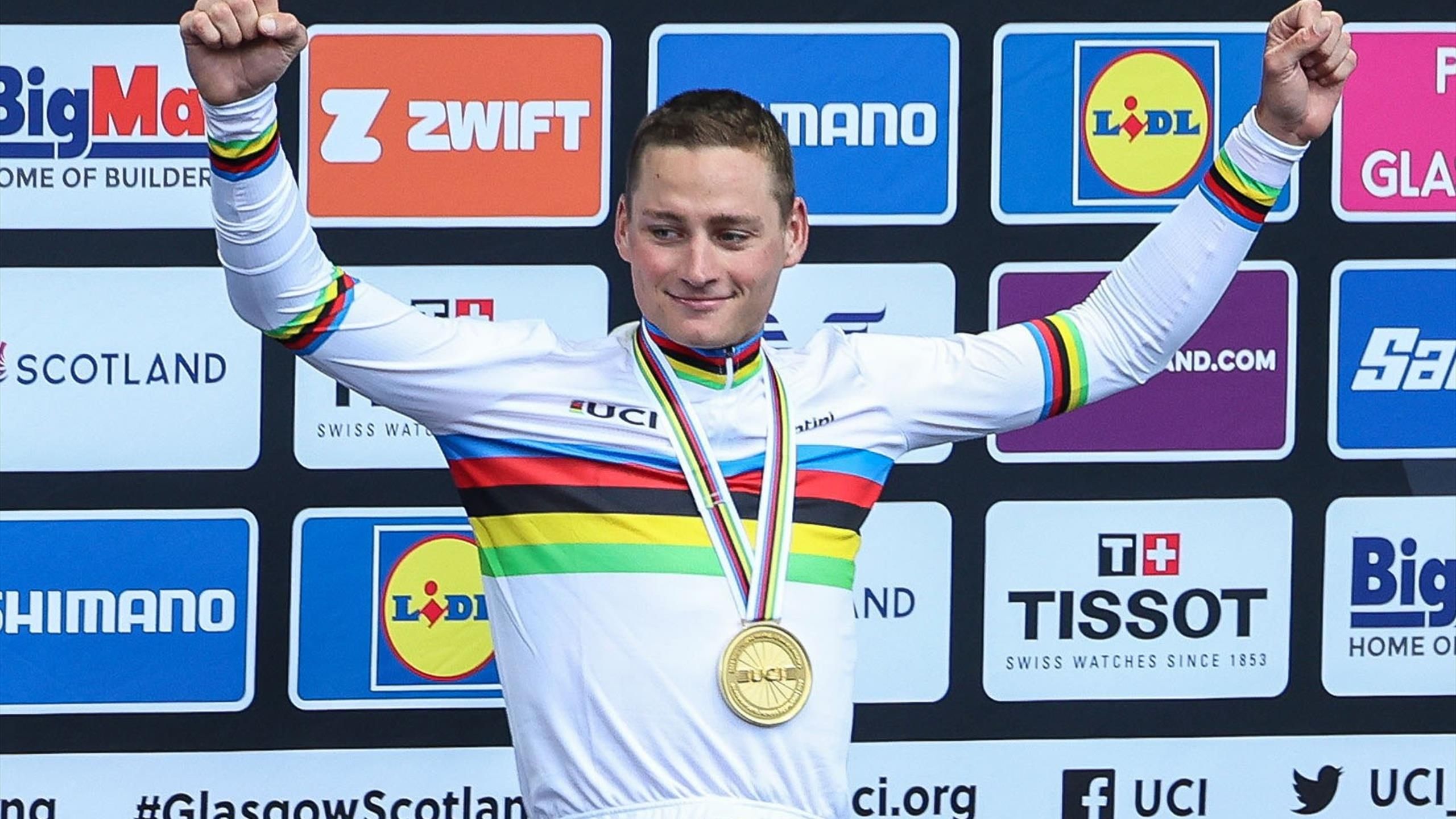

Tour Of Flanders Pogacars Solo Ride Denies Van Der Poel Historic Win

May 26, 2025

Tour Of Flanders Pogacars Solo Ride Denies Van Der Poel Historic Win

May 26, 2025 -

This Dad Rowed To Raise 2 2 Million For His Sons Treatment A True Story Of Dedication

May 26, 2025

This Dad Rowed To Raise 2 2 Million For His Sons Treatment A True Story Of Dedication

May 26, 2025

Latest Posts

-

South Seattle Drive By Shooting Leaves Child Injured

May 29, 2025

South Seattle Drive By Shooting Leaves Child Injured

May 29, 2025 -

50 Jarige Man Overleden Bij Schietincident In Venlo

May 29, 2025

50 Jarige Man Overleden Bij Schietincident In Venlo

May 29, 2025 -

8 Year Old Girl Injured In South Seattle Drive By Shooting

May 29, 2025

8 Year Old Girl Injured In South Seattle Drive By Shooting

May 29, 2025 -

Schietincident Prinsenstraat Venlo Getuigenoproep

May 29, 2025

Schietincident Prinsenstraat Venlo Getuigenoproep

May 29, 2025 -

Seattle Cid Shooting Man Suffers Double Gunshot Wound

May 29, 2025

Seattle Cid Shooting Man Suffers Double Gunshot Wound

May 29, 2025