Jim Cramer On CoreWeave (CRWV): A Contrarian View On AI Infrastructure Leadership

Table of Contents

Cramer's Bullish Arguments for CoreWeave (CRWV)

Cramer's bullish stance on CoreWeave rests on several key pillars, highlighting its strategic positioning and growth potential within the AI infrastructure sector.

CoreWeave's Niche Focus on AI Workloads

CoreWeave differentiates itself by providing cloud computing infrastructure specifically optimized for AI workloads. This niche focus offers a significant competitive advantage. Unlike general-purpose cloud providers, CoreWeave leverages high-performance computing (HPC) resources, particularly NVIDIA GPUs, perfectly tailored for the demanding computational requirements of AI training and inference. This specialized approach allows them to cater to the specific needs of AI clients, delivering superior performance and efficiency.

- AI Training: CoreWeave's infrastructure excels at training large language models and other complex AI algorithms, offering unparalleled speed and scalability.

- AI Inference: Its optimized environment ensures rapid and efficient inference, crucial for real-time AI applications.

- GPU Computing: The extensive use of NVIDIA GPUs provides the raw computing power necessary for handling massive datasets and complex AI models.

Strong Partnerships and Customer Acquisition

CoreWeave's rapid growth is fueled by strategic partnerships and impressive customer acquisition. They've collaborated with key players in the AI industry, securing significant contracts with prominent clients who rely on CoreWeave's services for their AI initiatives. While specific details about all clients may not be publicly available, the consistent revenue growth and high customer acquisition rate demonstrate significant market traction.

- Strategic Partnerships: Collaborations with leading AI software providers enhance the overall value proposition for CoreWeave's clients.

- Customer Acquisition: A consistently high customer acquisition rate signifies strong market demand and a compelling value proposition.

- Revenue Growth: Impressive revenue growth figures substantiate the effectiveness of their business model and market strategy.

Potential for Disruptive Innovation

CoreWeave's innovative approach to cloud computing for AI positions it for disruptive growth. They're not simply replicating existing solutions; they are pushing the boundaries of what's possible. This proactive stance on innovation sets them apart from competitors and paves the way for future expansion into new markets and services.

- Disruptive Technology: CoreWeave continuously explores and implements cutting-edge technologies to enhance its services.

- Cloud Computing Solutions: Their tailored solutions offer a superior alternative to generic cloud platforms for AI-focused businesses.

- AI Solutions: They are constantly developing new tools and services to streamline AI workflows and improve efficiency.

Potential Challenges and Counterarguments to Cramer's View

While Cramer's bullish outlook is compelling, several potential challenges and counterarguments warrant careful consideration.

Competition in the AI Infrastructure Market

The AI infrastructure market is intensely competitive, with major players like AWS, Google Cloud, and Microsoft Azure dominating the landscape. These established giants possess substantial resources and market share, presenting a formidable challenge to CoreWeave's ambitions. CoreWeave's ability to carve out a significant niche and compete effectively against these established players remains a key consideration.

- Competitive Landscape: The market is highly competitive, requiring CoreWeave to continuously innovate and adapt.

- Market Share: Gaining significant market share against established giants will be a significant hurdle.

- Cloud Competition: The intense competition among cloud providers could impact CoreWeave's pricing and profitability.

Financial Risks and Valuation Concerns

Investing in CRWV stock involves inherent financial risks. Analyzing CoreWeave's financial performance, growth prospects, and valuation multiples relative to competitors is crucial. While early growth is encouraging, sustained profitability and a reasonable valuation are essential for long-term investor success.

- Financial Performance: A thorough assessment of CoreWeave's financial statements is vital for evaluating investment risk.

- Stock Valuation: Comparing CoreWeave's valuation to competitors helps determine if the stock is appropriately priced.

- Investment Risk: Investing in a relatively new company always carries a higher degree of risk.

Dependence on Specific Technologies

CoreWeave's reliance on specific hardware and software technologies, particularly NVIDIA GPUs, creates potential risks associated with vendor lock-in and technological obsolescence. Changes in the technology landscape or disruptions in the supply chain could significantly impact CoreWeave's operations and financial performance.

- Technology Risk: Dependence on specific technologies exposes CoreWeave to potential disruptions.

- Vendor Lock-in: The reliance on NVIDIA GPUs could limit CoreWeave's flexibility and adaptability.

- Technological Obsolescence: Rapid technological advancements could render CoreWeave's infrastructure outdated.

Conclusion: Investing in CoreWeave (CRWV) – A Balanced Perspective on AI Infrastructure Leadership

Jim Cramer's bullish outlook on CoreWeave (CRWV) highlights the company's strategic focus on AI workloads, strong partnerships, and potential for disruptive innovation. However, the intense competition, financial risks, and dependence on specific technologies present significant challenges. A balanced perspective is essential. Before making any investment decisions related to CRWV stock, thorough due diligence, including a comprehensive analysis of its financial performance, competitive positioning, and technological risks, is crucial. Conduct further research on CoreWeave (CRWV) and its role in AI infrastructure leadership to make informed investment choices. Only after careful consideration of the opportunities and risks associated with CoreWeave investment should you proceed with a CRWV stock analysis and determine whether it aligns with your investment strategy.

Featured Posts

-

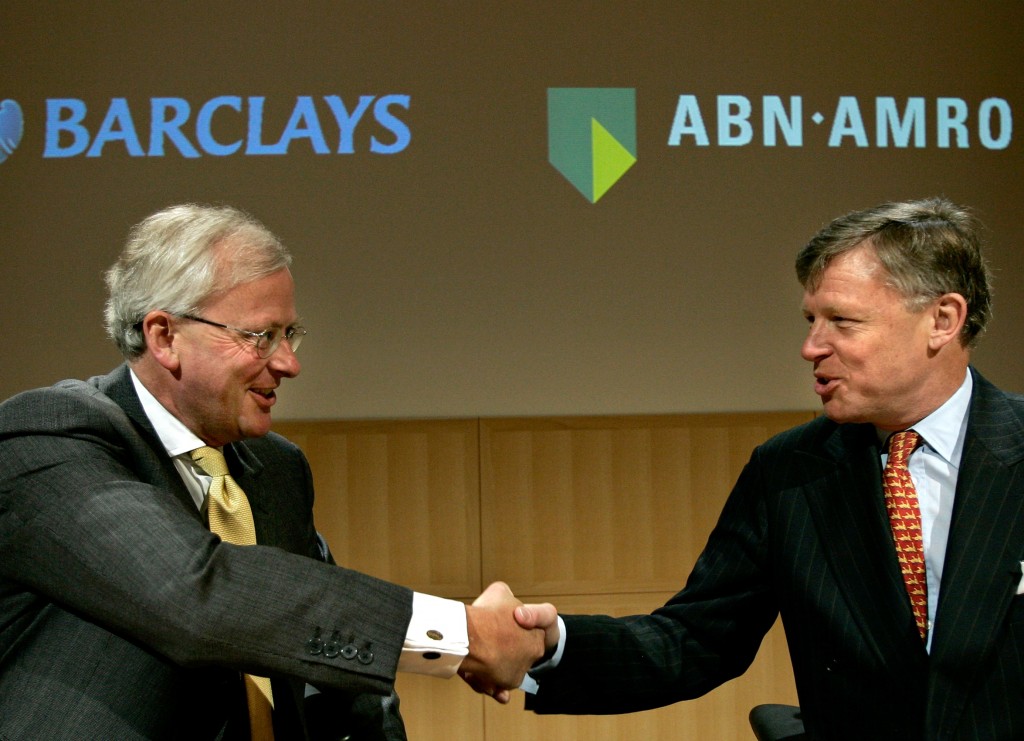

Abn Amro Kamerbrief Certificaten Een Verkoopprogramma Overzicht

May 22, 2025

Abn Amro Kamerbrief Certificaten Een Verkoopprogramma Overzicht

May 22, 2025 -

Switzerland And China A Call For Reasoned Tariff Discussions

May 22, 2025

Switzerland And China A Call For Reasoned Tariff Discussions

May 22, 2025 -

New The Amazing World Of Gumball Trailer Hulu Premiere Date Announced

May 22, 2025

New The Amazing World Of Gumball Trailer Hulu Premiere Date Announced

May 22, 2025 -

A Family Legacy The Traversos And The Cannes Film Festival

May 22, 2025

A Family Legacy The Traversos And The Cannes Film Festival

May 22, 2025 -

Peppa Pigs Mummys Baby Gender Reveal A New Arrival

May 22, 2025

Peppa Pigs Mummys Baby Gender Reveal A New Arrival

May 22, 2025

Latest Posts

-

Asear Aldhhb Fy Qtr Alithnyn 24 Mars 2024

May 23, 2025

Asear Aldhhb Fy Qtr Alithnyn 24 Mars 2024

May 23, 2025 -

Msharkt Ebd Alqadr Fy Hzymt Qtr Amam Alkhwr

May 23, 2025

Msharkt Ebd Alqadr Fy Hzymt Qtr Amam Alkhwr

May 23, 2025 -

Ooredoo And Qtspbf A Winning Partnership Continues

May 23, 2025

Ooredoo And Qtspbf A Winning Partnership Continues

May 23, 2025 -

Akhr Thdyth Lser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars

May 23, 2025

Akhr Thdyth Lser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars

May 23, 2025 -

Khsart Ebd Alqadr Me Qtr Amam Alkhwr Fy Aldwry Alqtry

May 23, 2025

Khsart Ebd Alqadr Me Qtr Amam Alkhwr Fy Aldwry Alqtry

May 23, 2025