Jim Cramer's Take On CoreWeave (CRWV): A Scrappy Company's Success

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV):

Unfortunately, at the time of writing, publicly available information regarding Jim Cramer's specific comments on CoreWeave (CRWV) is limited. A thorough search of his "Mad Money" transcripts, social media (tweets), and other media appearances reveals no direct mention of the company. This absence of commentary doesn't necessarily reflect negatively on CoreWeave; it simply highlights that the company may be relatively new to his radar or that he hasn't yet publicly addressed its prospects. The lack of explicit commentary from Cramer means we need to rely on our own analysis of CRWV to assess its investment potential. This will involve carefully examining its business model, financial performance, and competitive landscape. Keywords used in this section: Jim Cramer CoreWeave, Cramer CRWV, Mad Money CoreWeave.

CoreWeave's Business Model and Competitive Advantages:

CoreWeave's business model revolves around providing GPU-accelerated cloud computing services. It distinguishes itself by leveraging repurposed GPUs, offering a cost-effective solution compared to competitors using solely brand-new hardware. This focus on efficiency allows CoreWeave to cater to specific niche markets, particularly those demanding high-performance computing power, such as AI, machine learning, and high-frequency trading.

Its main competitors include giants like AWS, Google Cloud, and Azure. However, CoreWeave differentiates itself through:

- Cost efficiency: Utilizing repurposed GPUs lowers infrastructure costs, translating to more competitive pricing for clients.

- Specialized expertise: CoreWeave possesses deep expertise in GPU-accelerated computing, enabling it to offer tailored solutions for demanding applications.

- Scalability: The company's cloud infrastructure is designed for rapid scaling to meet the fluctuating needs of its clients.

CoreWeave’s growth strategy involves:

- Strategic Partnerships: Collaborations with leading technology providers to expand its reach and enhance its offerings.

- Expansion into new markets: Targeting new industries and customer segments that require high-performance computing.

- Continuous innovation: Investing in research and development to stay ahead of the curve in GPU technology and cloud computing.

Bullet points:

- Advantages of repurposed GPUs: Lower capital expenditure, reduced environmental impact, and competitive pricing.

- Key partnerships: (This section needs to be filled in with real-world examples if available from CoreWeave's investor relations materials or news releases.)

- Target customer segments: AI/ML developers, financial institutions, scientific research organizations, gaming companies.

Keywords: CoreWeave business model, CRWV competitive advantage, GPU cloud computing, AI cloud computing.

CoreWeave's Financial Performance and Future Outlook:

(This section requires detailed financial data from CoreWeave's public filings and news releases. Replace the bracketed information with actual figures.)

Analyzing CoreWeave's recent financial performance requires a look at key metrics such as revenue growth, profitability margins, and customer acquisition costs. [Insert data on revenue growth rates, profitability margins (if available), and other relevant financial metrics]. Recent funding rounds and investments [insert details on funding rounds and investments] indicate investor confidence in the company's growth potential.

Bullet points:

- Key financial metrics: [Insert actual data on revenue growth, profitability margins, etc.]

- Recent investments or funding rounds: [Insert details on recent funding rounds and their amounts]

- Potential threats to the company's success: Increased competition, fluctuations in GPU prices, potential economic downturns affecting client spending.

Keywords: CoreWeave financials, CRWV stock performance, CoreWeave growth projections, CRWV investment.

Is CoreWeave (CRWV) a Good Investment? Considering Jim Cramer's Perspective and Beyond:

While we lack direct insight into Jim Cramer's opinion on CoreWeave, our analysis suggests the company possesses significant potential. Its innovative business model, focus on high-growth markets, and strong financial backing paint a positive picture. However, investors should remember that the technology sector is volatile, and even promising companies face risks. Potential challenges include increasing competition, the need for continuous innovation, and the general economic climate.

Therefore, a decision on whether CoreWeave (CRWV) is a "good investment" hinges on individual risk tolerance and investment goals. It's crucial to conduct thorough due diligence, considering factors beyond Jim Cramer's (currently unavailable) perspective.

Keywords: CoreWeave investment, CRWV buy or sell, CoreWeave stock analysis, CoreWeave future.

Conclusion: CoreWeave (CRWV) – A Verdict on its Future Success

While Jim Cramer hasn't yet publicly commented on CoreWeave, our analysis reveals a company with a strong foundation built on a disruptive business model and a focus on a high-growth market. CoreWeave's strengths include its cost-effective approach to GPU-accelerated computing and its targeted approach to specific niche markets. However, the competitive landscape and inherent risks within the tech sector demand careful consideration. The company's long-term success will depend on its ability to maintain innovation, secure strategic partnerships, and navigate the challenges of a rapidly evolving technological environment. Whether CoreWeave aligns with your long-term investment goals is a decision only you can make after conducting thorough research.

Call to action: Before making any investment decisions regarding CoreWeave (CRWV) stock, conduct thorough research and consider consulting a financial advisor. We encourage you to leave a comment below and share your perspective on CoreWeave’s future prospects. Let's discuss! Keywords: CoreWeave stock outlook, CRWV future prospects, invest in CoreWeave.

Featured Posts

-

Wtt Chennai Arunas Unexpected Early Defeat

May 22, 2025

Wtt Chennai Arunas Unexpected Early Defeat

May 22, 2025 -

Vanja Mijatovic Demantira Glasine O Razvodu Puna Istina

May 22, 2025

Vanja Mijatovic Demantira Glasine O Razvodu Puna Istina

May 22, 2025 -

Fastest Across Australia Man Achieves Unprecedented Foot Race

May 22, 2025

Fastest Across Australia Man Achieves Unprecedented Foot Race

May 22, 2025 -

Athena Calderones Milestone Birthday A Roman Extravaganza

May 22, 2025

Athena Calderones Milestone Birthday A Roman Extravaganza

May 22, 2025 -

Solve Nyt Wordle 1357 March 7 Clues And Answer

May 22, 2025

Solve Nyt Wordle 1357 March 7 Clues And Answer

May 22, 2025

Latest Posts

-

03 2025 Onlayn Rezultati Ta Rozklad Matchiv Ligi Natsiy

May 22, 2025

03 2025 Onlayn Rezultati Ta Rozklad Matchiv Ligi Natsiy

May 22, 2025 -

Kosova Ne Ligen B Perspektiva Te Reja Per Futbollin Kosovar

May 22, 2025

Kosova Ne Ligen B Perspektiva Te Reja Per Futbollin Kosovar

May 22, 2025 -

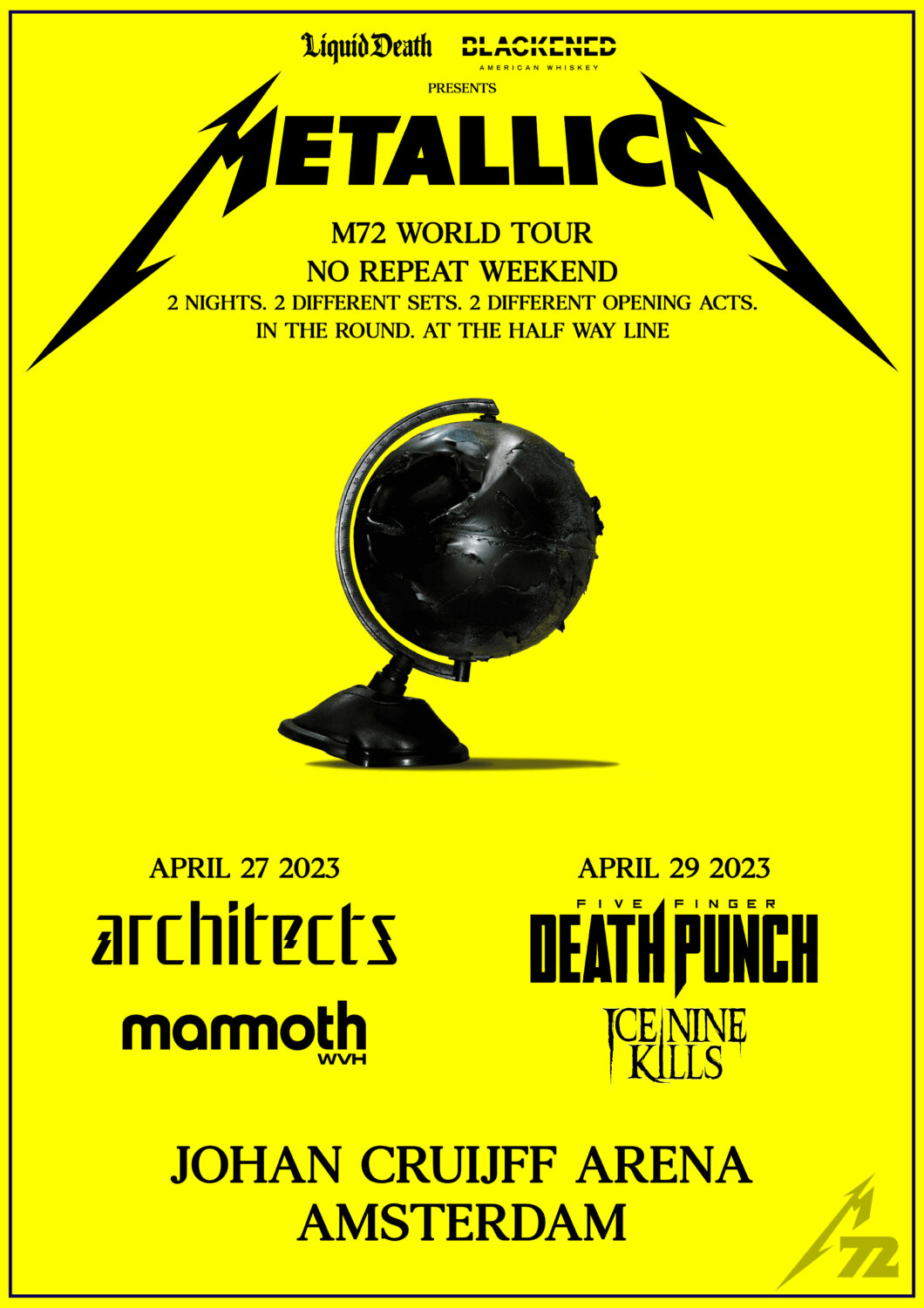

Metallicas M72 World Tour 2026 Uk And European Dates Announced

May 22, 2025

Metallicas M72 World Tour 2026 Uk And European Dates Announced

May 22, 2025 -

Liga Natsiy Match Tsentr 20 03 2025 Rezultati Ta Rozklad

May 22, 2025

Liga Natsiy Match Tsentr 20 03 2025 Rezultati Ta Rozklad

May 22, 2025 -

Ligja E Kombeve Suksesi I Kosoves Dhe Rruga Drejt Liges A

May 22, 2025

Ligja E Kombeve Suksesi I Kosoves Dhe Rruga Drejt Liges A

May 22, 2025