Kato's Firm Position: No Weaponizing US Treasuries In Trade

Table of Contents

The Risks of Weaponizing US Treasuries

The potential consequences of weaponizing US Treasuries are far-reaching and profoundly destabilizing for the global economy. Such actions represent a dangerous form of financial warfare with potentially devastating repercussions.

Destabilization of Global Financial Markets

- Mass selling of Treasuries: A sudden, large-scale dumping of US Treasuries onto the market would create significant volatility and uncertainty. This could trigger a sharp decline in their value, impacting global interest rates and investor confidence.

- Ripple effect on other economies: The interconnected nature of global finance means that the shockwaves from such an event would ripple outwards, affecting economies worldwide. Emerging markets, particularly, are vulnerable to such instability.

- Contagion effect: The initial market disruption could easily trigger a contagion effect, leading to a broader financial crisis. Investor panic could cause a liquidity crunch and a cascade of defaults.

The interconnectedness of global financial markets means that actions taken in one area, such as a mass selloff of US Treasuries, will inevitably have far-reaching consequences. The 1997-98 Asian financial crisis serves as a stark reminder of how quickly a localized crisis can escalate into a global one, underscoring the need for caution and responsible stewardship of financial assets.

Erosion of Trust in the US Dollar

- Damage to the US dollar's reputation: The weaponization of US Treasuries would severely damage the reputation of the US dollar as a safe haven asset and a reliable store of value.

- Loss of confidence in US financial institutions: This would lead to a loss of confidence in the stability and reliability of the US financial system as a whole.

- Potential for capital flight: Investors might seek safer alternatives, leading to significant capital flight from the US and a weakening of the dollar.

This loss of confidence could lead to a long-term decline in the dollar's global dominance, potentially triggering a shift towards alternative reserve currencies like the Euro or the Chinese Yuan, with significant implications for US global economic influence.

Escalation of Trade Conflicts

- Retaliatory actions: The weaponization of US Treasuries would almost certainly provoke retaliatory actions from other countries, potentially escalating into a full-blown trade war.

- Diplomatic fallout: Such actions could severely damage diplomatic relationships and undermine efforts towards international cooperation.

- Global economic slowdown: A protracted trade war fueled by financial warfare would undoubtedly lead to a significant global economic slowdown, harming businesses and consumers worldwide.

The use of financial weapons in trade disputes bypasses diplomatic channels and exacerbates tensions, making peaceful resolutions significantly more difficult to achieve.

Kato's Position and Rationale

[Kato's Name/Title/Organization] has consistently and firmly opposed the weaponization of US Treasuries in international trade disputes. This position is rooted in a deep understanding of the potential risks and a commitment to fostering stable and predictable global trade.

Commitment to Stable International Trade

- Public statements against weaponization: Kato has publicly stated [insert Kato's statements or official declarations].

- Rationale emphasizing stable trade: The rationale behind this position centers on the understanding that stable and predictable trade relationships are crucial for global economic prosperity.

- Legal and ethical considerations: Weaponizing financial assets raises serious legal and ethical concerns, potentially violating international norms and agreements.

[Include quotes from Kato supporting this stance, if available]. The broader implication is the preservation of a rules-based international order that relies on cooperation and mutually beneficial agreements, rather than coercive tactics.

Advocating for Alternative Dispute Resolution

- Proposals for alternative solutions: Kato advocates for alternative methods of resolving trade disputes, including diplomacy, negotiation, and arbitration.

- Emphasis on international cooperation: This approach emphasizes the importance of international cooperation and the constructive engagement of international organizations.

- Initiatives for peaceful trade relations: Kato's involvement in [mention any initiatives or organizations Kato is involved in] highlights a commitment to peaceful trade relations.

Alternative dispute resolution mechanisms offer a path towards resolving trade disagreements without resorting to destabilizing financial warfare.

The Importance of Maintaining a Stable Financial System

Maintaining a stable global financial system is paramount for global economic prosperity and stability. Weaponizing US Treasuries would pose a significant threat to this stability.

Global Economic Interdependence

- Interconnectedness and systemic failure: The interconnectedness of the global economy means that a disruption in one area can quickly spread, potentially leading to systemic failure.

- Impact on developing countries: Developing countries are particularly vulnerable to financial shocks, and weaponizing Treasuries could exacerbate their economic challenges.

- Undermining global growth: Destabilizing financial markets through weaponization would ultimately undermine global economic growth and prosperity.

The global economy relies on a stable and predictable financial system. Any action that threatens this system carries immense risks.

The Role of International Institutions

- IMF, World Bank, and WTO: International organizations like the IMF, World Bank, and WTO play critical roles in promoting stability and resolving trade disputes peacefully.

- Kato's involvement (if applicable): [Mention Kato's involvement in these organizations, if applicable].

- Mitigating risks: These institutions can play a crucial role in mitigating the risks associated with the weaponization of financial assets by fostering dialogue, facilitating negotiations, and providing technical assistance.

These organizations offer frameworks for international cooperation and provide avenues for resolving disputes constructively, avoiding the need for potentially devastating financial actions.

Conclusion

Kato's firm position against weaponizing US Treasuries highlights the critical need for responsible and stable international trade practices. The potential consequences of using financial assets as weapons in trade disputes are severe, ranging from market destabilization to the erosion of trust in the US dollar and the escalation of global conflicts. Kato's advocacy for alternative dispute resolution mechanisms and commitment to a stable global financial system offer a far more constructive and responsible approach. By prioritizing diplomacy and cooperation, we can build a more secure and prosperous future for global trade. Let's reject the weaponization of US Treasuries and embrace responsible strategies for international trade.

Featured Posts

-

Highly Anticipated Pacheco And Mbilli To Face Off In May

May 05, 2025

Highly Anticipated Pacheco And Mbilli To Face Off In May

May 05, 2025 -

Nelson Dongs A 390 000 Apo Main Event Victory

May 05, 2025

Nelson Dongs A 390 000 Apo Main Event Victory

May 05, 2025 -

Nhl Playoffs First Round What You Need To Know

May 05, 2025

Nhl Playoffs First Round What You Need To Know

May 05, 2025 -

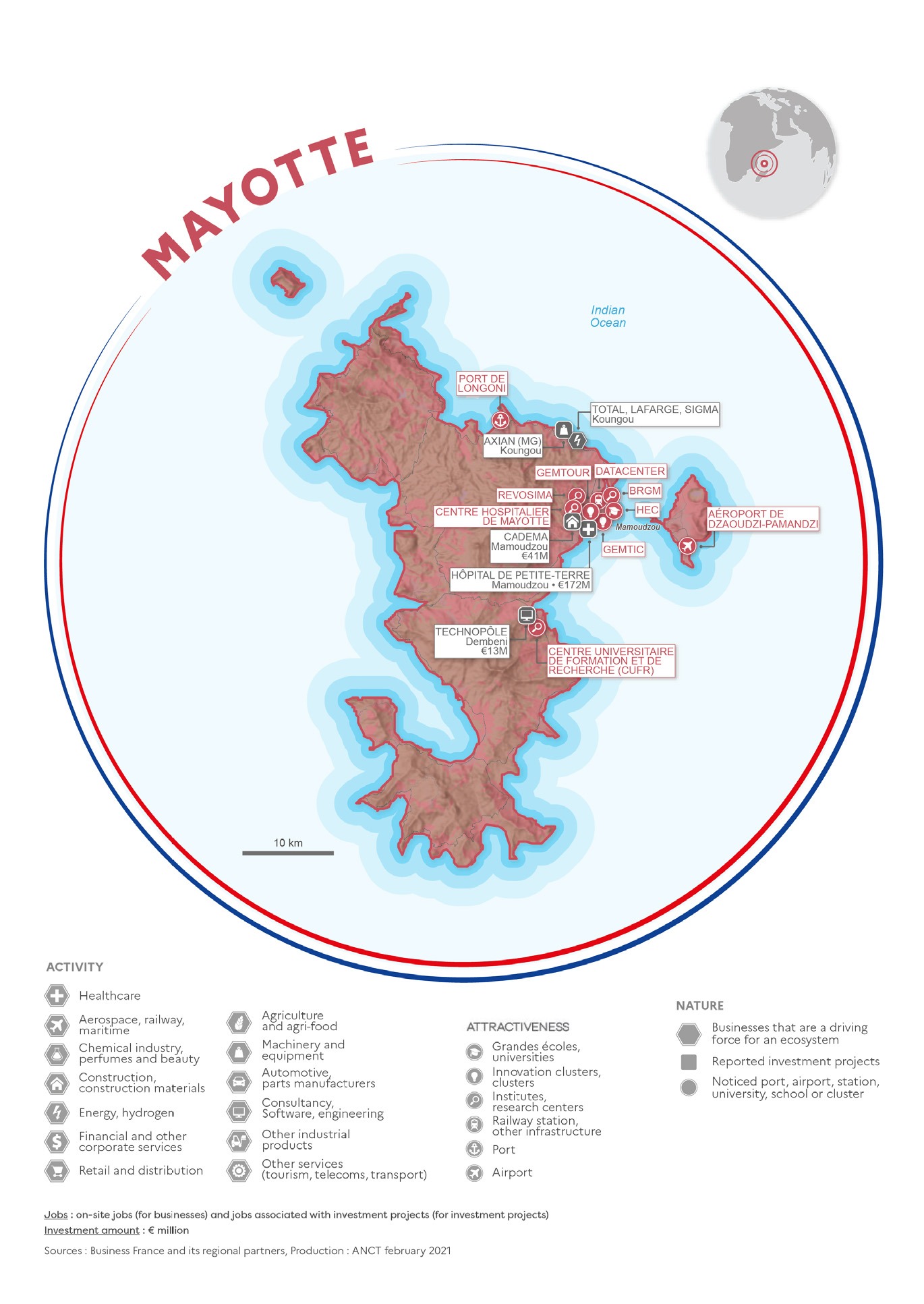

Mayotte And France A History Of Colonial Arrogance

May 05, 2025

Mayotte And France A History Of Colonial Arrogance

May 05, 2025 -

Nba World Weighs In Fan Reactions To Russell Westbrooks Play

May 05, 2025

Nba World Weighs In Fan Reactions To Russell Westbrooks Play

May 05, 2025

Latest Posts

-

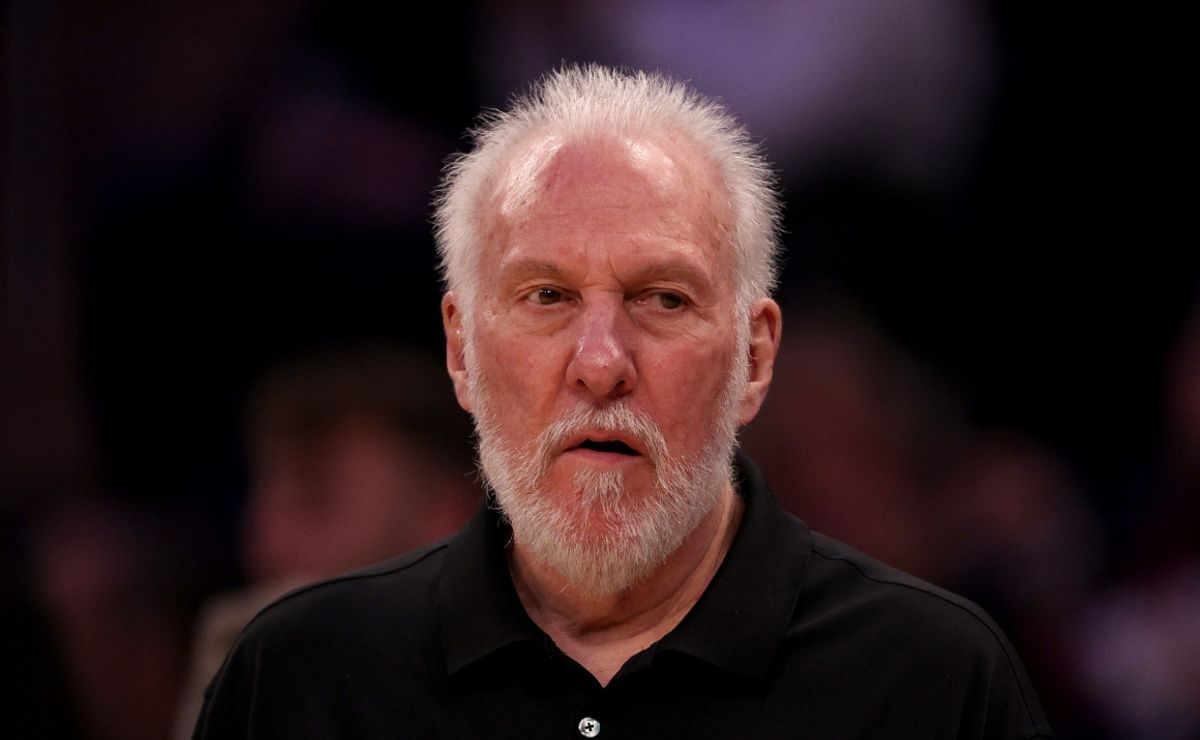

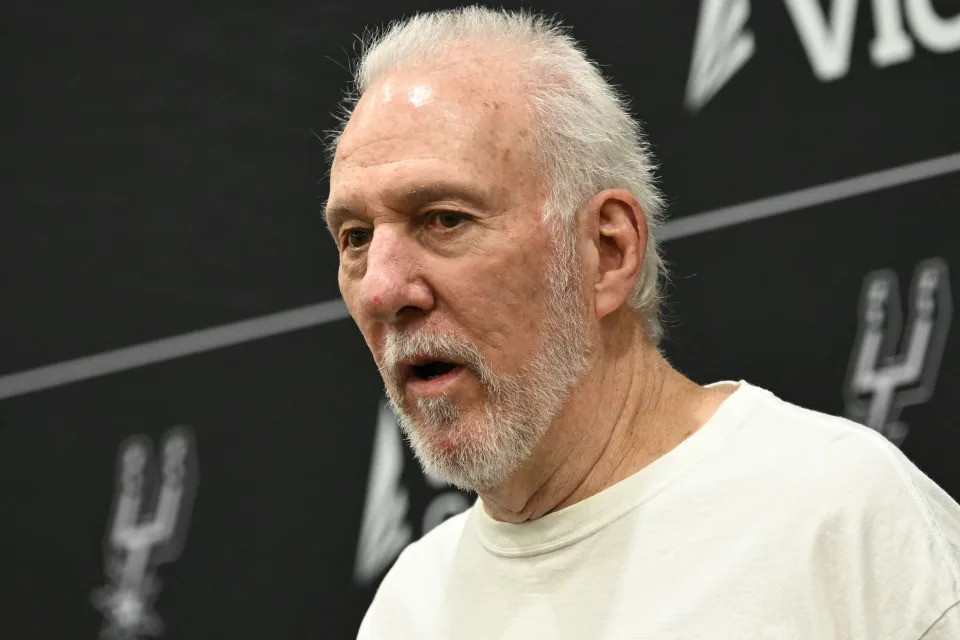

Gregg Popovichs Future With The Spurs The Decision Is In

May 06, 2025

Gregg Popovichs Future With The Spurs The Decision Is In

May 06, 2025 -

Spurs Coach Gregg Popovich Espn Predicts Absence For Remainder Of Season

May 06, 2025

Spurs Coach Gregg Popovich Espn Predicts Absence For Remainder Of Season

May 06, 2025 -

Decision Made Gregg Popovichs Spurs Future Revealed

May 06, 2025

Decision Made Gregg Popovichs Spurs Future Revealed

May 06, 2025 -

Espn Gregg Popovichs Absence Expected To Continue Through The Spurs Season

May 06, 2025

Espn Gregg Popovichs Absence Expected To Continue Through The Spurs Season

May 06, 2025 -

Popovichs Spurs Return Uncertain Espn Report Casts Doubt On This Season

May 06, 2025

Popovichs Spurs Return Uncertain Espn Report Casts Doubt On This Season

May 06, 2025