Kering Shares Plunge 6% Following Disappointing Q1 Earnings

Table of Contents

Weak Q1 Earnings: A Detailed Breakdown

Kering's Q1 2024 earnings revealed a concerning picture, with several key brands underperforming expectations. This section provides a detailed breakdown of the financial results and potential contributing factors.

Revenue Decline in Key Brands:

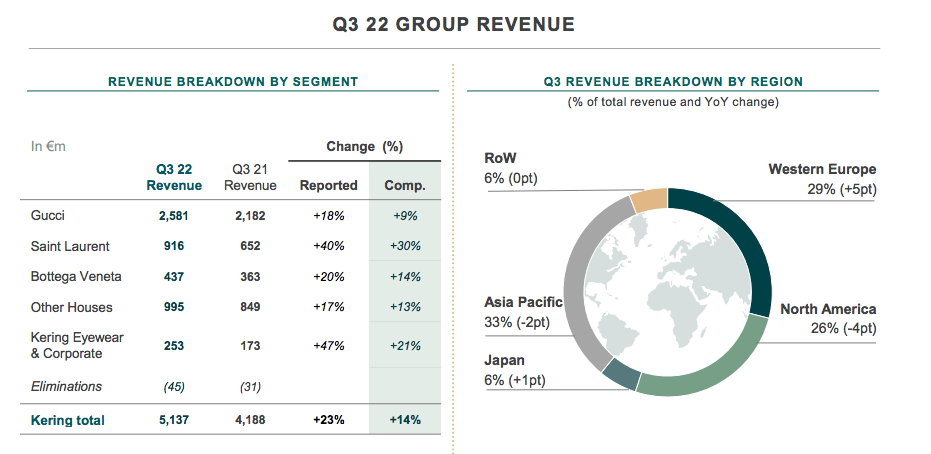

Gucci, a major revenue driver for Kering, experienced a significant revenue decline compared to the same period last year and initial market forecasts. While precise figures are pending full report release, early estimates suggest a percentage drop in the double digits. Similarly, Yves Saint Laurent also reported weaker-than-expected sales, impacting the overall group performance.

- Underperforming Product Categories: Reports suggest that specific product lines within both Gucci and Yves Saint Laurent underperformed, possibly indicating a need for a refreshed product strategy. Details on these specific categories are awaited.

- Contributing Factors: Several factors likely contributed to this revenue decline, including persistent supply chain disruptions, shifts in consumer spending patterns, and increased competition within the luxury market.

Impact of Macroeconomic Factors:

The global economic landscape played a significant role in Kering's disappointing results. The ongoing impact of inflation, persistent recessionary fears in key markets, and ongoing geopolitical instability have all contributed to reduced consumer spending, particularly in the luxury goods sector.

- Reduced Consumer Spending: High inflation and economic uncertainty have led to a decrease in discretionary spending, impacting the demand for luxury goods.

- Competitor Performance: While Kering underperformed, comparing its Q1 performance to competitors in the luxury sector will provide a more nuanced understanding of the overall market trends.

Profit Margin Squeeze:

Beyond the revenue decline, Kering also faced a squeeze on its profit margins. Rising production costs, driven by inflation and supply chain issues, alongside increased price competition, significantly impacted profitability.

- Operating and Net Income: The company is expected to report declines in both operating income and net income compared to Q1 of the previous year. Specific data will be revealed in the full earnings report.

- Impact of Rising Costs: Increased raw material costs, labor expenses, and logistical challenges all contributed to a reduction in profitability.

Market Reaction and Investor Sentiment

The announcement of Kering's disappointing Q1 earnings triggered a swift and negative reaction in the stock market.

Immediate Stock Market Impact:

The 6% share plunge was immediate and significant, reflecting investors' concerns about the company's future prospects. Trading volume also increased substantially, indicating high market activity in response to the news.

- Stock Price Volatility: Kering's stock price exhibited significant volatility following the earnings release, indicating uncertainty among investors.

- Analyst Comments: Initial analyst comments reflected concern over the weaker-than-expected results and their implications for future growth.

Investor Concerns and Future Outlook:

Investors' concerns primarily revolve around the sustainability of Kering's growth trajectory and the impact on future dividend payouts. The Q1 results raise questions about the company's ability to navigate the challenging macroeconomic environment.

- Implications for Growth: The disappointing Q1 results cast doubt on the company's ability to meet previously stated financial targets for the year.

- Rating Agency Downgrades: There is potential for rating agencies or analyst firms to issue downgrades of Kering's credit rating, depending on the severity and persistence of the underperformance.

Kering's Response and Strategic Adjustments

In response to the disappointing Q1 results, Kering's management is likely to outline strategic adjustments aimed at improving the company's performance.

Management Commentary:

Kering's management will likely release an official statement addressing the Q1 results, explaining the factors contributing to the underperformance and outlining their plans to address the challenges.

- Strategic Initiatives: The company may announce new product launches, refined marketing strategies, and cost-cutting measures to improve profitability and regain market share.

Future Guidance and Expectations:

Kering will likely provide revised financial guidance for the remainder of the year, reflecting the impact of the weaker Q1 performance. This guidance will provide insight into the company's expectations for future growth and profitability.

- Strategies for Improvement: The company will likely highlight its strategies for regaining market share, improving operational efficiency, and bolstering its brand image.

Conclusion: Analyzing the Kering Shares Plunge and Looking Ahead

The 6% plunge in Kering shares following the release of disappointing Q1 earnings is a significant event that reflects a combination of factors. Weak revenue across key brands, the impact of macroeconomic factors on consumer spending, and pressure on profit margins all contributed to the negative results. The market reaction highlights investor concern about the company's future performance and the sustainability of growth within the luxury goods sector. Kering's response and future strategic adjustments will be crucial in determining whether the company can recover and regain investor confidence. Stay informed on the evolving situation with Kering shares and continue monitoring the luxury goods market for further updates on the company's performance and strategic adjustments. For more information, refer to Kering's investor relations page and reputable financial news sources. Keywords: Kering stock, Kering financial performance.

Featured Posts

-

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025 -

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025 -

Update On Royal Philips 2025 Annual General Meeting Of Shareholders

May 24, 2025

Update On Royal Philips 2025 Annual General Meeting Of Shareholders

May 24, 2025 -

89 Svadeb V Krasivuyu Datu Kharkovschina Bet Rekordy

May 24, 2025

89 Svadeb V Krasivuyu Datu Kharkovschina Bet Rekordy

May 24, 2025 -

French Cac 40 Index Friday Losses Offset By Weekly Stability March 7 2025

May 24, 2025

French Cac 40 Index Friday Losses Offset By Weekly Stability March 7 2025

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025