Kering Stock Drops After Weak First Quarter Results

Table of Contents

Disappointing Sales Figures Across Key Brands

Kering's Q1 earnings revealed a concerning slowdown in sales growth across its key brands, significantly impacting the Kering stock price. The luxury goods market, known for its volatility, showed signs of softening, directly affecting Kering's bottom line.

-

Gucci sales: Gucci, traditionally a major revenue driver for Kering, reported a less-than-stellar performance. While exact figures will vary depending on the official release, reports indicate sales growth significantly below expectations, perhaps only in the low single digits percentage wise, compared to previous years' double-digit growth. This slowdown suggests a potential saturation of the market or a need for a refreshed brand strategy.

-

Yves Saint Laurent (YSL) sales: YSL, while exhibiting stronger performance than Gucci, still fell short of projected targets. Although the brand maintained positive growth, it was considerably less than anticipated, signaling a broader trend of slower growth within the luxury sector.

-

Balenciaga sales: The controversial headlines surrounding Balenciaga in late 2022 and early 2023 appear to have had a lingering negative impact on sales. Despite the brand's enduring popularity, the Q1 results demonstrated a notable sales slowdown, highlighting the vulnerability of luxury brands to reputational damage.

The combined underperformance of these key brands contributed significantly to the overall revenue decrease reported by Kering, creating a negative impact on Kering stock performance.

Impact of External Factors on Kering's Performance

Kering's Q1 struggles weren't solely due to internal factors. Several external macroeconomic headwinds played a significant role, affecting consumer spending and impacting the luxury goods market:

-

Global economic slowdown and inflation: Rising inflation rates and fears of a global recession led to decreased consumer confidence, particularly within the higher-income brackets that frequently purchase luxury goods. This reduced demand directly impacted Kering's sales figures.

-

Supply chain disruptions: Lingering supply chain issues, exacerbated by geopolitical instability, continued to affect the production and timely delivery of Kering's products. This further constrained sales and added pressure to profit margins.

-

Geopolitical instability: The ongoing war in Ukraine and other geopolitical uncertainties contributed to a climate of economic anxiety, influencing consumer spending patterns and impacting the luxury goods market's overall health. Luxury purchases often represent discretionary spending, highly sensitive to economic downturns and uncertainty.

Investor Reaction and Market Analysis

The underwhelming Q1 results triggered a significant negative reaction in the market. Kering's stock price experienced a sharp decline, with the percentage drop varying depending on the specific trading day.

-

Stock price drop: Following the announcement, the Kering stock price fell considerably, reflecting investor concern about the company's short-term prospects. This drop underscores the market's sensitivity to performance within the luxury sector.

-

Investor sentiment: Investor sentiment turned decidedly negative, with many expressing concern over the sustainability of Kering's growth trajectory. This contributed to the selling pressure on Kering stock.

-

Analyst predictions: Analysts offered mixed predictions, with some expressing cautious optimism for a recovery in later quarters, while others indicated a need for a more substantial strategic overhaul to revive growth. The uncertainty further fueled the volatility of the Kering stock price.

-

Market capitalization: The stock price drop directly impacted Kering's overall market capitalization, highlighting the financial implications of the disappointing Q1 results.

Kering's Response and Future Outlook

Kering acknowledged the challenges presented by the weak Q1 results and outlined initial plans to address the issues and restore confidence amongst investors.

-

Company strategy: Kering's response included a focus on reinforcing its brand strategies, emphasizing product innovation, and enhancing customer experience. The company acknowledged the need to adapt to evolving consumer preferences in the luxury market.

-

Growth plans: The company highlighted its longer-term growth potential and reaffirmed its commitment to sustainable growth strategies. Specific details on medium-term plans were promised in upcoming investor calls.

-

Cost-cutting measures: While not explicitly detailed, Kering hinted at streamlining operations and implementing cost-cutting measures to improve profitability in the face of economic challenges.

-

Future projections: While future projections remain uncertain, Kering expressed confidence in its ability to navigate the current challenges and achieve sustainable growth. However, investors will be closely monitoring subsequent quarters' performance to assess the effectiveness of Kering's strategies.

Conclusion

The Kering stock drop following its disappointing first-quarter results reflects a confluence of factors: underperforming sales across key brands, the influence of external economic headwinds, and the resulting negative investor sentiment. The company’s response signals a focus on addressing these issues strategically. However, the success of Kering's recovery strategy and its impact on the Kering stock price will depend on its ability to navigate the complexities of the luxury market and adapt to changing consumer behaviors. Stay informed on the latest developments concerning Kering stock and the luxury goods market. Monitor Kering's performance closely to assess its recovery strategy and the long-term impact on the Kering stock price. Consider diversifying your investment portfolio to mitigate risks associated with single-stock investments in volatile markets like the luxury goods sector. Keep up-to-date with Kering stock news and analysis to make informed investment decisions.

Featured Posts

-

Porsche 956 Nin Tavan Sergisi Teknik Aciklamalar

May 25, 2025

Porsche 956 Nin Tavan Sergisi Teknik Aciklamalar

May 25, 2025 -

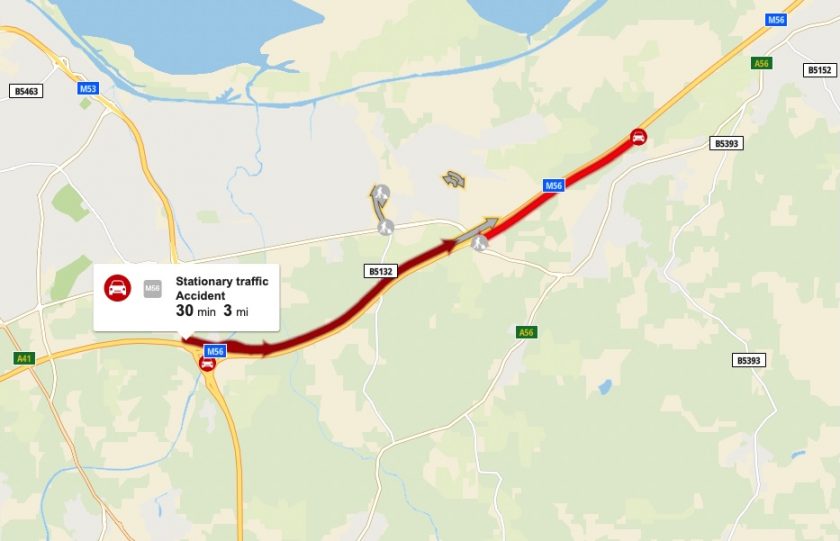

Severe Delays On M56 Collision Impacts Cheshire And Deeside Drivers

May 25, 2025

Severe Delays On M56 Collision Impacts Cheshire And Deeside Drivers

May 25, 2025 -

Collaboration And Growth Take Center Stage At Best Of Bangladesh In Europes 2nd Edition

May 25, 2025

Collaboration And Growth Take Center Stage At Best Of Bangladesh In Europes 2nd Edition

May 25, 2025 -

Under 1m Country Properties A Buyers Guide To Location And Value

May 25, 2025

Under 1m Country Properties A Buyers Guide To Location And Value

May 25, 2025 -

Borsa Europea Attenzione Fed Piazza Affari E Banche In Difficolta

May 25, 2025

Borsa Europea Attenzione Fed Piazza Affari E Banche In Difficolta

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025