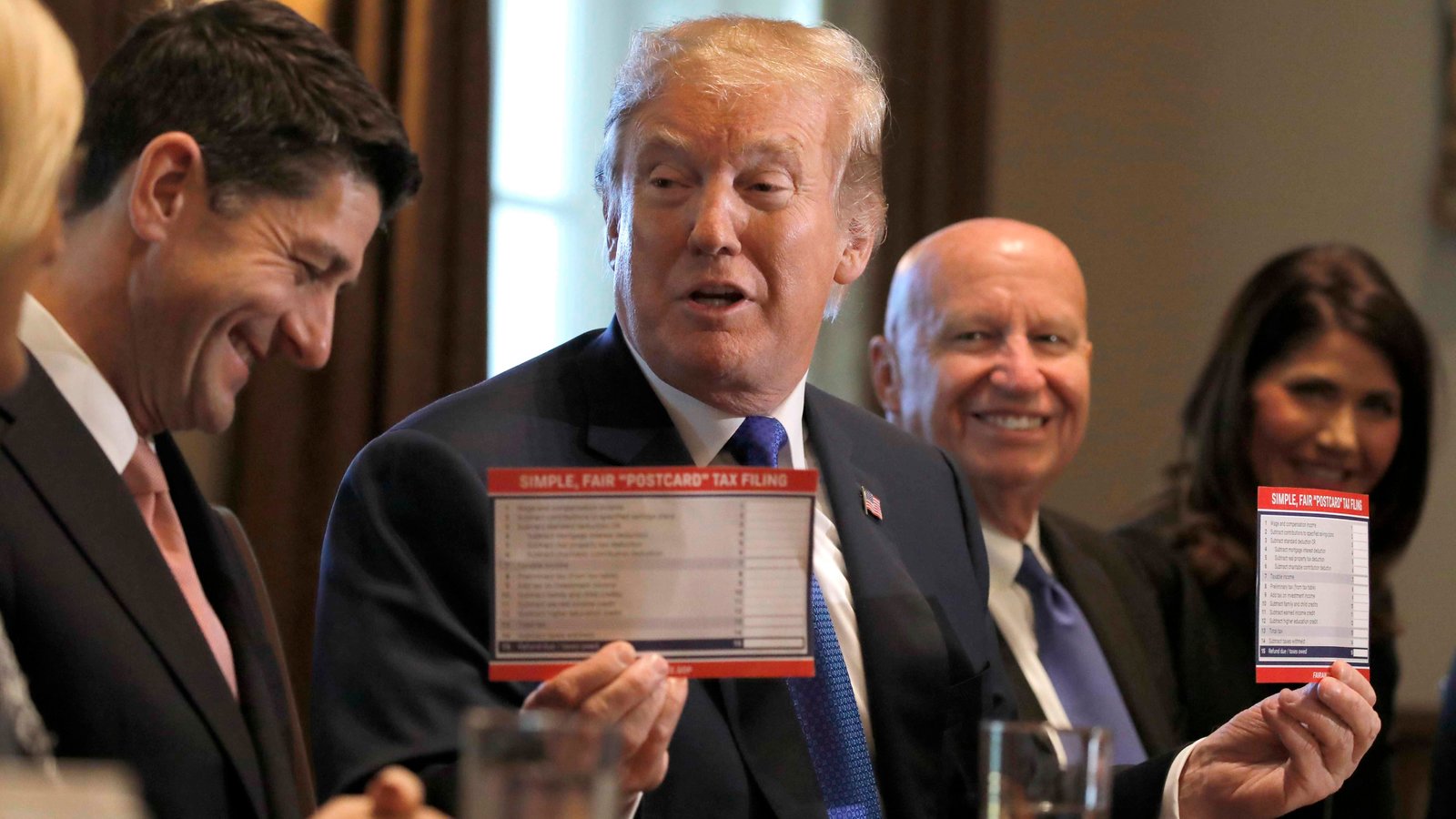

Key Provisions Of The House Republicans' Trump Tax Cut Plan

Table of Contents

The House Republicans' proposed Trump tax cut plan aimed to significantly reshape the US tax code. Understanding its key provisions is crucial for individuals and businesses navigating the American tax system. This article delves into the core elements of this plan, analyzing its potential economic consequences and its lasting impact on American taxpayers. We'll explore the changes to individual income tax rates, corporate tax rates, and other significant provisions, providing clarity on this complex piece of proposed legislation.

Individual Income Tax Rate Reductions

The proposed plan featured substantial reductions in individual income tax rates. This section details the proposed changes and their implications for taxpayers across various income brackets.

Lowering Tax Brackets

The plan proposed lowering the number of individual income tax brackets and reducing the rates within those brackets. This resulted in significant tax savings for many taxpayers, particularly those in higher income brackets.

- Proposed Tax Rates: While the exact proposed rates varied across different versions of the plan, a common theme was a reduction in the top marginal tax rate and a simplification of the overall bracket structure. Specific numbers would need to be referenced from the official proposal documents for accurate representation.

- Tax Savings by Income Level: The proposed cuts resulted in varying degrees of tax savings depending on income. Lower-income individuals generally saw smaller tax reductions compared to higher-income individuals. Detailed analysis comparing pre- and post-cut tax burdens for specific income levels is necessary for a precise understanding of the impact.

Standard Deduction and Exemptions

The plan also included modifications to the standard deduction and personal exemptions. These changes significantly impacted taxpayers' overall tax liability.

- Increased Standard Deduction: The proposed plan significantly increased the standard deduction amount for both single individuals and married couples filing jointly. This change provided tax relief to many taxpayers, particularly those who previously itemized their deductions.

- Elimination of Personal Exemptions: A key aspect of the proposed changes was the elimination of personal exemptions. This change further altered the overall tax burden for families and individuals, depending on their specific circumstances.

Corporate Tax Rate Cuts

The proposed plan included significant reductions in corporate tax rates, aiming to stimulate business investment and economic growth.

Reduction in Corporate Tax Rate

The plan proposed a substantial decrease in the federal corporate tax rate. This measure was intended to improve the competitiveness of American businesses in the global market and encourage domestic investment.

- Proposed Corporate Tax Rate: The proposed rate was significantly lower than the pre-existing rate, aiming to incentivize businesses to expand, hire, and invest. Again, referencing the official proposal is crucial for exact figures.

- Economic Impacts: Proponents argued that this reduction would lead to increased business investment, job creation, and higher corporate profits. However, critics raised concerns about the potential impact on the national debt and the distribution of benefits.

Pass-Through Business Tax Treatment

The plan also addressed the tax treatment of pass-through businesses—entities like S corporations and partnerships—which often include small businesses and self-employed individuals.

- Proposed Changes: The exact details regarding tax treatment for pass-through entities varied across different versions of the plan. However, the overall aim was generally to provide tax relief to small business owners.

- Impact on Small Businesses: The proposed changes sought to reduce the tax burden on small business owners, making it easier for them to invest in their businesses and create jobs. However, the actual impact varied greatly based on the specifics of the business structure and its profitability.

Other Key Provisions

Beyond individual and corporate tax rates, the proposed plan included several other key provisions impacting various aspects of the tax code.

Changes to Itemized Deductions

The plan proposed changes to several itemized deductions, potentially altering the tax benefits for taxpayers who itemize.

- Affected Deductions: The specific itemized deductions affected and the nature of the changes varied across versions of the plan. Some commonly discussed deductions included mortgage interest and state and local taxes (SALT).

- Impact on Taxpayers: These alterations impacted taxpayers who itemize significantly, possibly increasing or decreasing their tax liabilities depending on their specific circumstances and the types of deductions they claimed.

Estate Tax Changes

The proposed plan included changes to the estate tax, affecting high-net-worth individuals and their families.

- Proposed Changes: The plan proposed modifications to the estate tax exemption amount and rates. This would effectively reduce the number of estates subject to the estate tax.

- Impact on High-Net-Worth Individuals: These changes significantly benefited high-net-worth individuals and their families, reducing the estate tax burden upon their death.

Impact on National Debt

A major point of contention surrounding the proposed tax cuts was their potential impact on the national debt.

- Projected Debt Increase: Economic forecasts suggested a substantial increase in the national debt as a result of the tax cuts. The long-term fiscal implications were widely debated.

- Long-Term Fiscal Implications: The long-term impact on the national debt remained a significant concern, prompting debates on fiscal responsibility and sustainable economic policies.

Conclusion

This article outlined the key provisions of the House Republicans' Trump tax cut plan, including significant reductions in individual and corporate income tax rates, adjustments to deductions and exemptions, and potential impacts on the national debt. Understanding these changes is vital for navigating the complexities of the US tax system.

Call to Action: For a deeper understanding of how the House Republicans' Trump Tax Cut Plan might affect your personal finances, consult a tax professional. Further research into the long-term effects of these tax cuts is also recommended. Stay informed about future tax legislation changes impacting the House Republicans' Trump Tax Cut Plan and its potential successors.

Featured Posts

-

Golden Horse Awards Winner Lin Tsan Ting Dies At 94 A Legacy Of Cinematic Excellence

May 13, 2025

Golden Horse Awards Winner Lin Tsan Ting Dies At 94 A Legacy Of Cinematic Excellence

May 13, 2025 -

Confirmation Cassie And Alex Fine Expecting A Third Child Gender Revealed

May 13, 2025

Confirmation Cassie And Alex Fine Expecting A Third Child Gender Revealed

May 13, 2025 -

Sabalenka Defeats Pegula In Miami Open Final

May 13, 2025

Sabalenka Defeats Pegula In Miami Open Final

May 13, 2025 -

Alterya Acquired By Blockchain Leader Chainalysis A Strategic Move In Ai

May 13, 2025

Alterya Acquired By Blockchain Leader Chainalysis A Strategic Move In Ai

May 13, 2025 -

Analyzing The 2025 Cubs Game 25 Who Shone And Who Faltered

May 13, 2025

Analyzing The 2025 Cubs Game 25 Who Shone And Who Faltered

May 13, 2025

Latest Posts

-

The Traitors 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025

The Traitors 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025 -

Zdrada 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu I Materialy Extra

May 14, 2025

Zdrada 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu I Materialy Extra

May 14, 2025 -

Fitzgeralds Hot Streak Powers Giants To Victory

May 14, 2025

Fitzgeralds Hot Streak Powers Giants To Victory

May 14, 2025 -

Dodgers Defeat Diamondbacks 14 11 Ohtanis Crucial Home Run

May 14, 2025

Dodgers Defeat Diamondbacks 14 11 Ohtanis Crucial Home Run

May 14, 2025 -

Dodgers Ohtani 3 Run Homer Fuels Comeback Win Against Diamondbacks

May 14, 2025

Dodgers Ohtani 3 Run Homer Fuels Comeback Win Against Diamondbacks

May 14, 2025