Klarna's $1 Billion Funding Round And Imminent IPO

Table of Contents

The Significance of Klarna's $1 Billion Funding Round

Klarna's $1 billion funding round represents a monumental vote of confidence in its business model and future prospects. This substantial investment significantly increases Klarna's valuation, solidifying its position as a leader in the global BNPL market. The funding round attracted a range of prominent investors, each motivated by Klarna's impressive growth trajectory and market dominance. Their participation underscores the immense potential of the BNPL sector and Klarna's ability to capitalize on it.

The infusion of capital will be strategically utilized to fuel several key initiatives:

- Aggressive Market Expansion: Klarna plans to leverage the funds to expand into new geographical markets, further solidifying its global presence and reaching a wider customer base. This includes penetrating underserved regions and strengthening its position in existing markets.

- Technological Advancements: A substantial portion of the funding will be dedicated to enhancing Klarna's technological infrastructure. This includes improving its payment processing capabilities, developing innovative features, and strengthening its data security measures. This investment in technology ensures Klarna remains ahead of the curve and competitive in the fast-paced BNPL landscape.

- Robust Marketing Campaigns: To increase brand awareness and customer acquisition, Klarna will allocate resources towards targeted marketing campaigns. These initiatives aim to attract new users and solidify its position as the go-to BNPL provider.

Bullet Points:

- Increased market capitalization, boosting investor confidence.

- Strengthened financial position, allowing for strategic investments.

- Fuel for aggressive expansion strategies into new markets.

- Significant investment in technology and innovation to maintain a competitive edge.

Klarna's IPO Preparations and Expectations

The successful funding round paves the way for Klarna's highly anticipated IPO. While a precise date remains unannounced, market speculation points towards an IPO sometime in the near future. The expected valuation at IPO is substantial, reflecting Klarna's impressive growth and market leadership. However, the actual valuation will depend on various factors, including prevailing market conditions and investor sentiment.

The IPO process presents both opportunities and challenges:

- Market Conditions: The overall economic climate and investor appetite for technology stocks will significantly influence the IPO's success. A strong market will likely result in a higher valuation, while volatility could negatively impact the outcome.

- Regulatory Hurdles: The BNPL sector faces increasing regulatory scrutiny globally. Navigating these regulatory complexities will be crucial for Klarna's successful IPO. Compliance with evolving regulations is paramount to ensuring a smooth transition to public trading.

- Competition: The BNPL market is becoming increasingly competitive. The presence of established players and new entrants poses a constant challenge. Klarna's ability to maintain its competitive advantage will be essential for long-term success post-IPO.

Bullet Points:

- IPO timeline remains under wraps, but speculation is rife.

- Estimated valuation at IPO is expected to be substantial.

- Market conditions and investor interest will play a significant role.

- Potential regulatory hurdles need careful navigation.

Klarna's Position in the Growing BNPL Market

The Buy Now Pay Later market is experiencing explosive growth, driven by increasing consumer adoption and the convenience of its services. Klarna holds a significant market share, owing to its early entry into the market, strong brand recognition, and innovative features. However, its dominance isn't without challenges:

- Intense Competition: Several other major players are vying for market share. Competition is fierce, requiring Klarna to constantly innovate and adapt to stay ahead.

- Regulatory Scrutiny: Governments worldwide are increasingly scrutinizing the BNPL sector, particularly concerning consumer protection and responsible lending practices. Adapting to and complying with evolving regulations is critical.

Bullet Points:

- Market size and growth projections are exceptionally positive.

- Klarna's market share remains substantial, but competition is increasing.

- Key competitors include PayPal, Affirm, and Afterpay, each with unique strengths.

- Regulatory considerations and potential impacts on business models are significant.

Conclusion: The Future of Klarna Post-IPO

Klarna's recent $1 billion funding round and imminent IPO mark a pivotal moment for both the company and the BNPL industry. The funding significantly strengthens Klarna's position, fueling expansion, technological advancements, and marketing initiatives. The upcoming IPO promises to be a landmark event, potentially reshaping the financial technology landscape. The success of the IPO will hinge on navigating market conditions, regulatory hurdles, and intense competition. However, given Klarna's established market presence and innovative spirit, its future prospects appear bright.

Stay tuned for updates on Klarna's IPO and the evolving Buy Now Pay Later landscape. Subscribe to our newsletter for the latest insights!

Featured Posts

-

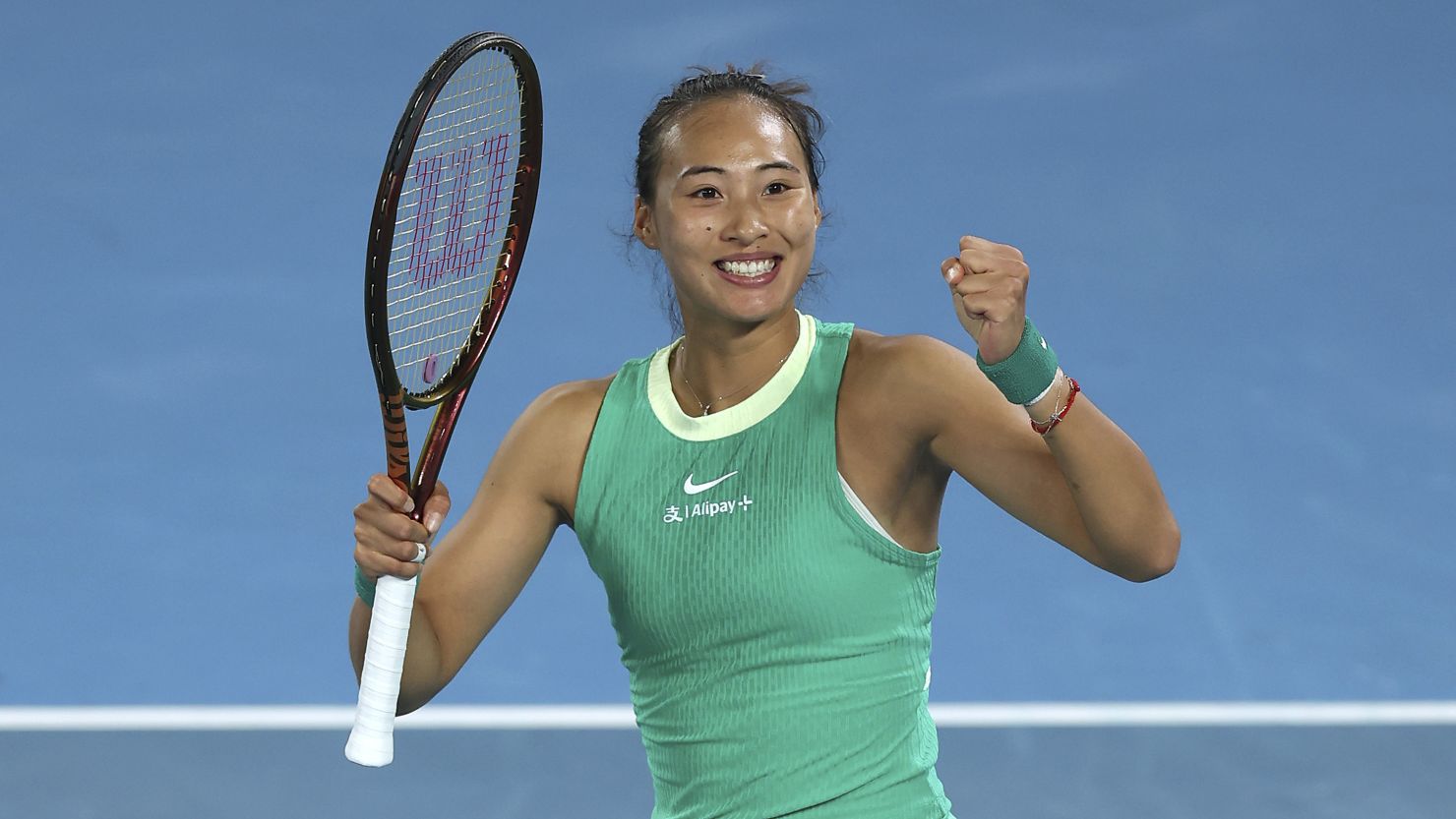

Zheng Qinwens Madrid Open Upset Loss To Potapova

May 14, 2025

Zheng Qinwens Madrid Open Upset Loss To Potapova

May 14, 2025 -

Pokemon Go Raids April 2025 Boss Lineup And Strategies

May 14, 2025

Pokemon Go Raids April 2025 Boss Lineup And Strategies

May 14, 2025 -

Uruguays Jose Mujica A Legacy Remembered After His Death At 89

May 14, 2025

Uruguays Jose Mujica A Legacy Remembered After His Death At 89

May 14, 2025 -

Borussia Dortmund Leading The Race To Sign Jobe Bellingham

May 14, 2025

Borussia Dortmund Leading The Race To Sign Jobe Bellingham

May 14, 2025 -

Dont Hate The Playaz A Deeper Look Into Hip Hop Culture

May 14, 2025

Dont Hate The Playaz A Deeper Look Into Hip Hop Culture

May 14, 2025